The Daily Breakdown takes a closer look at PayPal’s earnings, and also looks at how using options around earnings can be beneficial.

Tuesday’s TLDR

- Big day of earnings kicks off.

- More than one-third of S&P 500 will report this week.

- Taking a technical look at PayPal after earnings.

What’s happening?

The earnings continue to pour in.

Companies like SoFi, PayPal, Pfizer, and Procter & Gamble reported this morning. Tonight we’ll hear from others, like Advanced Micro Devices, Starbucks, Microsoft, Pinterest, First Solar, and others.

Earnings can be a tough environment for investors. The outsized moves and binary nature of these events can make it difficult to predict the outcome. That’s one reason why options can play such an interesting role.

Admittedly, using options around earnings is difficult. First, implied volatility is elevated, making the options more expensive. Second, these options can easily become worthless if the stock fails to move far enough in the desired direction.

Yes, that’s right — even if the stock has a bullish reaction, it doesn’t mean that a call option will necessarily profit.

So why use options?

When traders buy options — like buying a call, a put, or a spread — they know their maximum risk. So even though an options position can become worthless, knowing the most that an investor can lose is a very valuable risk management tool.

For instance, if I’m bullish on a stock and want to buy common shares ahead of earnings, I could be on the hook for massive losses if the reaction is terrible. Seeing a 15% to 20% loss (or more) can happen. Depending on the stock, that could equate to hundreds or thousands of dollars.

Getting it wrong with options may result in a 100% loss. But say that option only costs $50. Or $150. Either way, I know that that’s the most I will lose regardless of how bad the outcome is. And if the outcome is really good for my position, the options can benefit in a big way.

Options aren’t perfect, but traders who use them often know their maximum risk — and that’s a really valuable tool going into situations where the outcome is unknown.

For those looking to learn more about options, consider visiting the eToro Academy and consider joining our Learn & Earn Challenge, where you can take courses, pass quizzes, and earn up to $18 in rewards. Terms and conditions apply.

Want to receive these insights straight to your inbox?

The setup — PYPL

PayPal reported its quarterly results this morning, beating earnings and revenue expectations. It was a solid report and the stock is rallying on the news.

Will it maintain those gains?

Unfortunately, the stock has had a difficult time doing that. While many stocks have recovered from their bear-market losses, PayPal isn’t one of them. Shares are still down 81% from the all-time high.

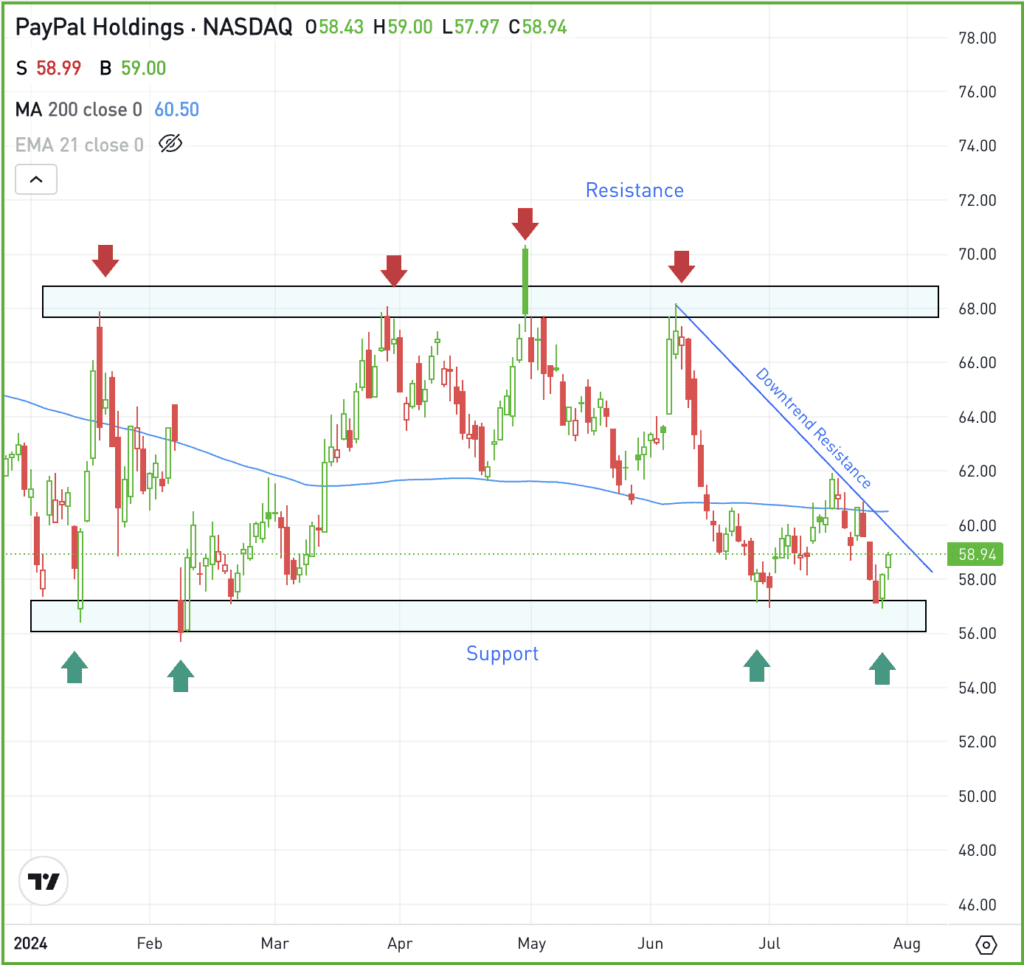

Shares have been stuck between $57 and $67 for most of this year, bouncing between support and resistance. While the stock is clearing downtrend resistance (noted on the chart) in pre-market trading, the $67 to $68 zone is a far larger resistance level at the moment.

If the bullish reaction continues, look to see how PYPL handles this zone — does it act as resistance again or does the stock finally break out?

If the gains reverse, look to see how shares handle a retest of support around $57.

What Wall Street is watching

MCD — People are eating less McDonald’s, noted by the first decline in comp-store sales since the end of 2020. McDonald’s also missed analysts’ estimates for earnings and revenue. While revenue was flat year over year, net income dropped 12%, although the company’s recent “$5 Meal Deal” promotion is expected to impact Q3 earnings more significantly.

BABA — Shares of Alibaba jumped in Hong Kong after announcing a new strategy to generate more service fees from merchants. The company will introduce a 0.6% software service fee on confirmed transactions for vendors on Tmall and Taobao. Smaller vendors might be exempt from this fee.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.