Bitcoin is above $70,000 and earnings are getting into full swing. The Daily Breakdown takes a look at the markets.

Tuesday’s TLDR

What’s happening?

We’re in a period where trillions of dollars worth of market cap — there’s $12 trillion in mega-cap tech this week alone — are reporting earnings in the next few days. As a result, there will be a lot of headlines and information flooding through the investment world.

McDonald’s and Pfizer reported earnings this morning, alongside financial and fintech faves like SoFi and PayPal. They’re joined by Royal Caribbean, JetBlue, Crocs, and others.

Tonight, we’ll hear from Advanced Micro Devices, Alphabet, Snap, Chipotle, Visa, First Solar, and Reddit, among others.

Remember to stay grounded; be realistic and keep some perspective.

The S&P 500 has climbed in 10 of the last 12 weeks, is up 22.2% year to date, and has hit 47 new all-time highs so far this year. Remember, sometimes we can have a little turbulence when stocks are flying higher. That’s not a bearish call, just being realistic after a big rally into a busy calendar.

There’s a big difference between confidence and arrogance — and when we behave like the latter, the market often serves up a dish of humble pie.

Want to receive these insights straight to your inbox?

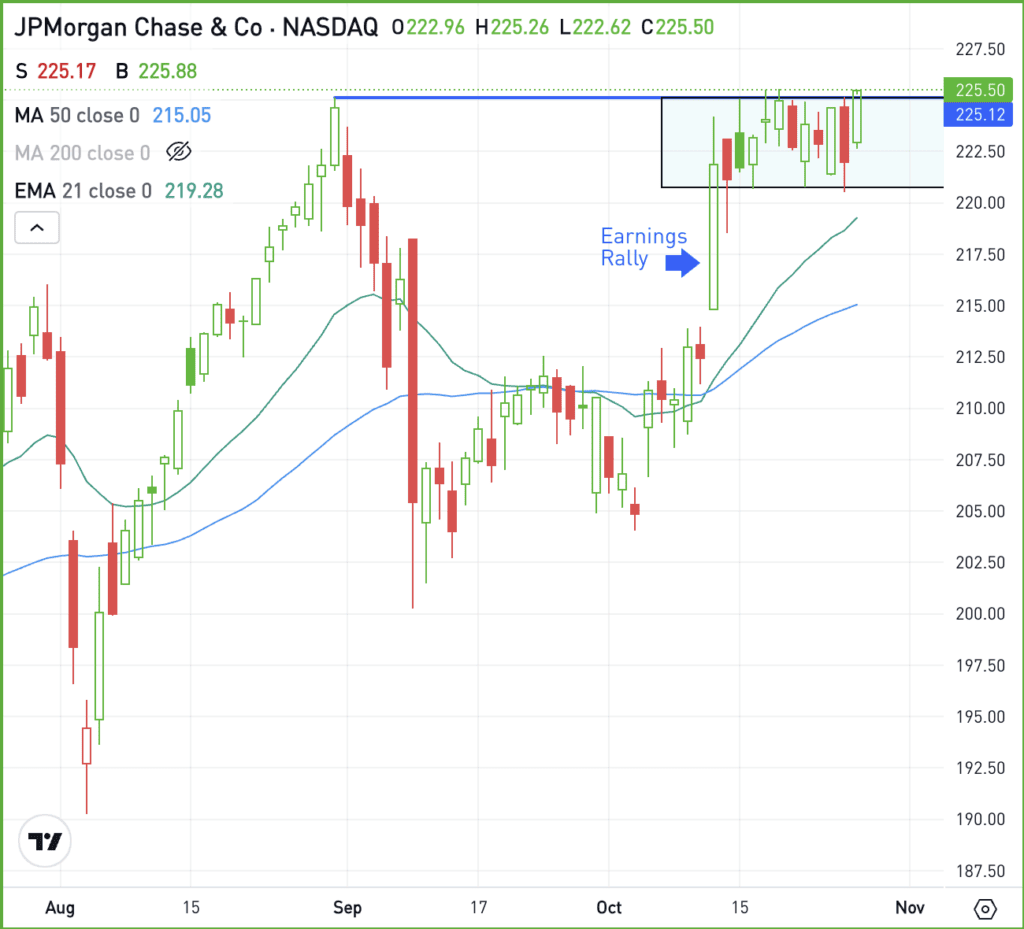

The setup — JPMorgan

JPMorgan is the largest US bank and has helped lead the financial sector to a stellar performance so far in 2024.

It had a strong reaction to its earnings report earlier this month, with the stock rallying back to the $220s. Lately, resistance has been in play around $225.

If JPM can close above this level, it could trigger a breakout and open up new highs for the stock. However, if this level remains resistance and can’t be broken, shares may spend more time consolidating or may even pullback.

Options

Investors who believe shares will break out — or those who are waiting for the potential breakout to happen first — can participate with calls or call spreads. If speculating on the breakout rather than waiting for it to happen first, consider using adequate time until expiration.

For investors who would rather speculate on resistance holding, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

BTC – As Bitcoin gains steam, so too is investor optimism that it will be able to hit all-time highs. On Monday, Bitcoin briefly cleared the $70,000 level. On Tuesday, it’s pushing above this figure with some momentum. Can it get to new highs?

MCD – After falling 7.6% last week due to an E. coli outbreak, McDonald’s is down about 2.5% in pre-market trading on Tuesday after reporting its Q3 results. Earnings of $3.23 a share beat expectations of $3.20 a share, while revenue of $6.87 billion grew 2.7% year over year and inched by expectations. However, global comp-store sales declined year over year.

PYPL – PayPal stock has been on fire lately, up in 12 of the last 13 weeks and up more than 40% during that stretch coming into earnings. Shares are down slightly this morning after the firm beat on earnings estimates ($1.20 a share vs. estimates of $1.07 a share), but missed on revenue expectations ($7.8 billion vs. estimates of $7.89 billion).

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.