As a trusted, intuitive and accessible brand in Crypto, where better to grow your cryptoassets holdings just by holding them than on eToro?

Using eToro’s dedicated staking services, you can sit back and watch your holdings grow in number. It’s that simple.

What is staking?

Staking is a process that allows you to hold supported cryptoassets, and automatically gain rewards of more of the same asset. It’s a similar kind of mechanism to the way in which one might earn interest on money.

All you need to do is own the cryptoasset in question, and choose to stake them here. If you do not wish to stake your cryptoassets, you can opt-out directly from your eToro investment account.

You can learn more about the staking process in the “What is Staking?” FAQ below.

How you benefit

If you hold any of the cryptoassets that are supported by eToro’s staking services in your region (see the table below), you can receive staking rewards in the supported cryptoasset on a monthly basis.

Here’s the deal: your staked cryptoassets are always yours. At eToro, we take the responsibility of handling the entire staking process for our users, ensuring top-notch security and efficiency.

We go the extra mile to safeguard your cryptoassets, shielding them from any additional risks. We spare you the complexities of staking on your own, and in return, we retain a portion of the yield as a fee, covering operational, technical, and legal expenses.

Supported Cryptoassets and Staking Rewards

Listed below are the reward percentages per Club tier of the monthly staking yield.

| Cryptoasset | Non-Club (Bronze) | Silver | Gold | Platinum | Platinum+ | Diamond | Cryptoasset intro days |

|---|---|---|---|---|---|---|---|

| Ethereum (ETH)*** | 45% | 55% | 65% | 75% | 85% | 90% | 7 (rewards begin day 8) |

| Solana (SOL) | 45% | 55% | 65% | 75% | 85% | 90% | 7 (rewards begin day 8) |

| Cardano (ADA) | 45% | 55% | 65% | 75% | 85% | 90% | 9 (rewards begin day 10) |

| Tron (TRX)* | 45% | 55% | 65% | 75% | 85% | 90% | 7 (rewards begin day 8) |

| Near Protocol (NEAR) | 45% | 55% | 65% | 75% | 85% | 90% | 7 (rewards begin day 8) |

| Polygon (POL) | 45% | 55% | 65% | 75% | 85% | 90% | 7 (rewards begin day 8) |

| Polkadot (DOT)** | 45% | 55% | 65% | 75% | 85% | 90% | 7 (rewards begin day 8) |

| Cosmos (ATOM)** | 45% | 55% | 65% | 75% | 85% | 90% | 7 (rewards begin day 8) |

** Staking for DOT and ATOM will not be available to clients in the UK under FCA regulations until further notice.

*** Important!

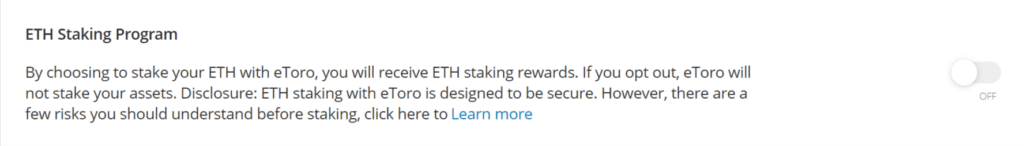

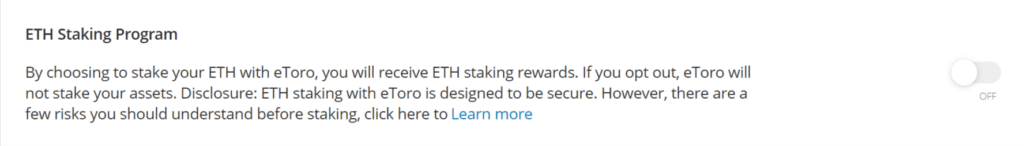

In order to stake your ETH holdings, you need to proactively opt in to the service.

In your investment portfolio, go to Settings > Trading > Stake ETH, and move the button to the ON position.

Who can receive staking rewards?

If you hold any of the cryptoassets that are supported by eToro’s staking services in your region within your eToro investment portfolio, then you are eligible to receive staking rewards.

As shown in the table above, positions need to have been open for a certain number of days, which varies according to the blockchain network of the cryptoasset in question.

Who can’t receive staking rewards?

Germany and the US: eToro staking services are not available in these countries.

UAE: For eToro ME users staking is only available for Cardano (ADA), Solana (SOL), Polygon (POL) and Ethereum (ETH).

Important note: eToro’s staking service does not include cryptoassets held using CFDs or short positions.

Important: The rewards percentage is indicative, and subject to client eligibility, and/or regulatory limitations.

FAQ

- How does the monthly distribution of rewards work?

-

eToro prides itself on being consistently transparent towards its users. It is therefore essential that we explain precisely how we calculate the monthly entitlement regarding the distribution of rewards for all users.

- A daily snapshot of each user’s holdings is taken each day at 00:00 GMT.

This shows each user’s eligible staking units for all of their open positions. See also the FAQ “What are the eligible staking units?”.

- At the end of each month, the total of all the month’s snapshots are divided according to the number of days in the month, producing an average daily amount.

- The average daily amount is the basic amount on which the calculations are made to get the individual user’s monthly reward. The monthly yield percentage per cryptoasset is calculated, and then the applicable Club member percentage (see table above) is added to the calculation.

The amount of a reward must be of a value that is no less than 1 USD.

See the FAQ “How is the monthly yield per cryptoasset calculated?” below.

- How do I opt out of staking my assets?*

-

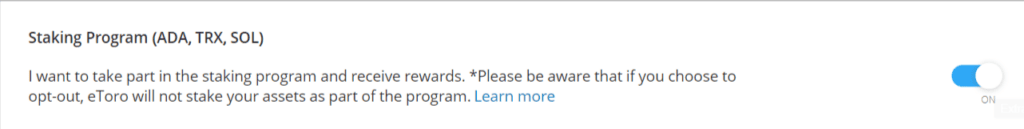

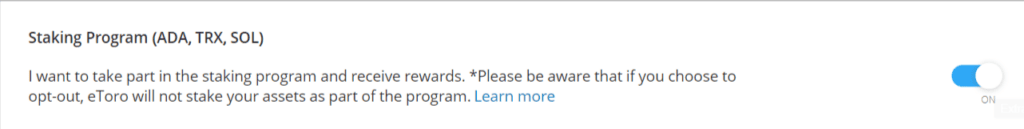

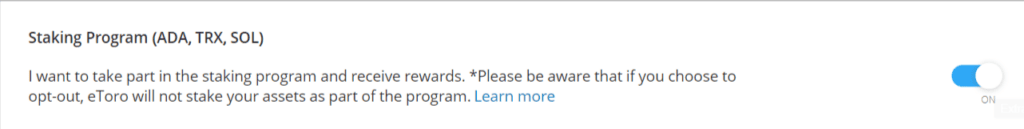

Staking ADA, TRX, Near Protocol (NEAR), Polygon (POL), SOL, DOT & ATOM

eToro offers users the ability to opt out of staking their assets as they choose. To opt out of staking your assets, this is what you need to do:

1. Go to your eToro investment portfolio.

2. Go to Settings > Trading > Crypto Staking Program.

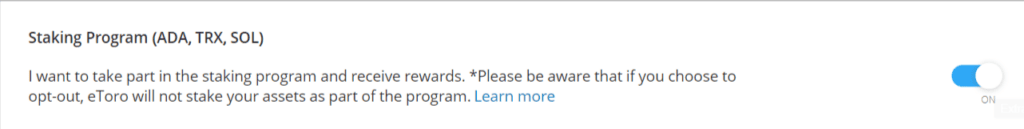

3. Move the button to the OFF position. (See image below.)

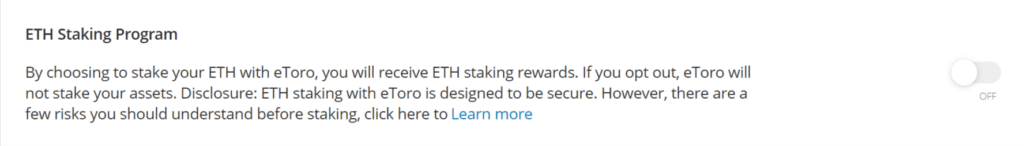

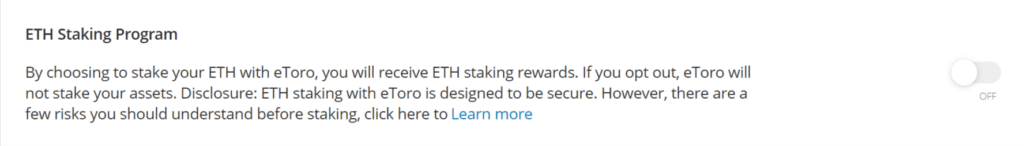

Opting in or out of staking ETH

In order to stake your ETH holdings, you need to proactively opt in to the service, although you can opt out at any stage following this. In your investment portfolio, go to Settings > Trading > Stake ETH, and move the button to the ON position to opt in, or the OFF position to opt out.

* Note: Opt-in/out refers to the entire staking process.

- How does eToro’s staking services process work?

-

Eligible eToro users receive the staking rewards that they have earned each month directly and automatically, with absolutely no action required on their part. Each user also receives an individual monthly email, explaining how much in staking rewards they received that month, and how it was calculated for each of the supported staked cryptoassets.

eToro offers users the ability to opt in or out* of staking their assets as they choose. To opt out of staking your assets, this is what you need to do:

1. Go to your eToro investment portfolio.

2. Go to Settings > Trading > Crypto Staking Program.

3. Move the button to the ON or OFF position as required. (See image below.)

To stake ETH, you need to proactively opt in. Go to Settings > Trading > Stake ETH, and move the button to the ON position.

* Note: Opt in/out refers to the entire staking process. An opt in/out toggle button exists for ADA, TRX and SOL, and an additional button for ETH.

- What is staking?

-

Staking is a process that allows rewards to be earned by holders of a specific coin.

Staking derives from the PoS (Proof-of-stake) mechanism, used by a distributed blockchain network, where blockchain miners can mine or validate block transactions according to how many coins they have. The more coins they hold, the more mining power they have. Staking rewards are shared with users who own the cryptoassets (like eToro and our clients) and who delegate their voting rights to staking pools. The more validations that are delegated to a staking pool, the higher chance of being elected to produce the next block, and the more rewards likely to be received.

- Which coins are supported?

-

eToro currently supports staking for Cardano (ADA), Solana (SOL), Ethereum (ETH), Near Protocol (NEAR), Polygon (POL), Tron (TRX)**, Polkadot (DOT) & Cosmos (ATOM) and is working on plans to support more cryptoassets in the future.

For eToro users in the UAE (eToro ME users) staking is only available for Cardano (ADA), Solana (SOL), Near Protocol (NEAR), Polygon (POL), Polkadot (DOT) & Cosmos (ATOM) and Ethereum (ETH). - Do I receive the entire staking amount?

-

eToro staking rewards are among the most generous in the market, from a minimum of 45% of the staking yield. eToro retains a percentage of the yield as a fee, as well as to cover the various operational, technical, and legal costs involved.

- Why are you keeping a percentage of the staking amount?

-

eToro takes great care to protect our users’ cryptoassets against exposure to any additional risks, sparing them the hassle and complication of staking on their own. Consequently, eToro retains a percentage of the yield to cover the various operational, technical, and legal costs involved.

- Why aren’t all coins supported on the eToro platform receiving staking?

-

eToro currently supports staking for Cardano (ADA), Solana (SOL), Ethereum (ETH), Near Protocol (NEAR), Polygon (POL), and Tron** (TRX), Polkadot (DOT) & Cosmos (ATOM) and is working on plans to support more cryptoassets in the future.

For eToro users in the UAE (eToro ME users) staking is only available for Cardano (ADA), Solana (SOL), Near Protocol (NEAR), Polygon (POL), Polkadot (DOT), Cosmos (ATOM) and Ethereum (ETH). - What if I don’t want to receive staking rewards?

-

If you hold any of the stakable assets and do not wish to stake them,

,you can opt-out of staking your assets directly from your eToro investment account.Here is what you need to do:

1. Go to your eToro investment portfolio.

2. Go to Settings > Trading > Crypto Staking Program.

3. Move the button to the ON or OFF position as required. (See image below.)

Note: Opt in/out refers to the entire staking process. An opt in/out toggle button exists for ADA, TRX and SOL.

For Ethereum, you have to proactively opt in to enjoy staking services. Go to Settings > Trading > Stake ETH, and move the button to the ON position.

- When will I receive the staking rewards?

-

Staking rewards will be distributed for a specific month within 14 days into the following month. No action is required on the part of the user.

- How long do I have to be holding the coins to receive the staking?

-

A user is eligible for a staking reward if they have held an open position of the staked cryptoasset for a certain period of time. The time period for when a user becomes eligible differs per cryptoasset; according to the blockchain of the specific cryptoasset, and how long it takes for it to be included in the staking pool.

– For Cardano, the position must have been open for at least 9 days (cryptoasset intro days), with users becoming eligible from day ten.

– For Solana, Near Protocol, Polygon, Tron, Polkadot, and Cosmos the position must have been open for at least 7 days (cryptoasset intro days), with users becoming eligible from day 8**

– For Ethereum, first you have to opt in. After this, the position must have been open for at least 7 days (cryptoasset intro days), with users becoming eligible from day 8.

For eToro users in the UAE (eToro ME users) staking is only available for Cardano (ADA), Solana (SOL), Near Protocol (NEAR), Polygon (POL), Polkadot (DOT), Cosmos (ATOM) and Ethereum (ETH).

- Does staking apply to coins held in the eToro trading platform or the Wallet?

-

Staking applies to cryptoassets held in the eToro trading platform only.

- How are rewards shared with users?

-

Rewards are distributed automatically. An email with full details will be sent, including a table that specifies the amount for which the reward is calculated, the aggregated monthly yield, and the total reward given. The email will also link to a dedicated Staking web page, which will explain the formula for eligibility calculation, interest rates, and other related information.

Note: There will be indication on users’ account statements or their history regarding staking rewards.

- When are rewards distributed each month?

-

Staking rewards will be distributed for a specific month within 14 days of the following month. No action is required on the part of the user.

- Why does eToro keep a certain amount of the reward amount?

-

eToro takes great care to protect our users’ cryptoassets against exposure to any additional risks, sparing them the hassle and complication of staking on their own. Consequently, eToro retains a percentage of the yield to cover the various operational, technical, and legal costs involved.

- How do I know if I am eligible to receive staking rewards?

-

A user is eligible for a staking reward if they have held an open position of the staked cryptoasset for a certain period of time. The time period for when a user becomes eligible differs per cryptoasset; according to the blockchain of the specific cryptoasset, and how long it takes for it to be included in the staking pool.

– For Cardano, the position must have been open for at least 9 days (cryptoasset intro days), with users becoming eligible from day ten.

– For Solana, Near Protocol, Polygon, Tron, Polkadot, and Cosmos the position must have been open for at least 7 days (cryptoasset intro days), with users becoming eligible from day 8**

For Ethereum, first you have to opt in. After this, the position must have been open for at least 7 days (cryptoasset intro days), with users becoming eligible from day 8.

For eToro users in the UAE (eToro ME users) staking is only available for Cardano (ADA), Solana (SOL), Near Protocol (NEAR), Polygon (POL), Polkadot (DOT), Cosmos (ATOM) and Ethereum (ETH).

**If you do not want to stake your assets: in your investment account, go to Settings > Trading > Crypto Staking Program, and move the button to the OFF position as required. (See image below.)

- In which currency the clients will get their reward?

-

Rewards will be shared in the same cryptoasset that was staked; for example, the rewards on the ADA staking will be given in ADA.

- How does eToro calculate the eligibility of a reward (what is the formula)?

-

Here is how the staking rewards are calculated:

1. A daily snapshot of each user’s holdings is taken each day at 00:00 GMT.

This shows each user’s eligible staking units (see “What are the eligible staking units?) for all of their open positions.

2. At the end of each month, the total of all the month’s snapshots are divided according to the number of days in the month, producing an average daily amount.

3. The average daily amount is the basic amount on which the calculations are made to get the individual user’s monthly reward. The monthly yield percentage (see “ How is the monthly yield per cryptoasset calculated?”) is calculated, and then the applicable Club member percentage is calculated on that.

Example

Dave, a Diamond eToro Club member, bought 500 units of ADA on September 1. Then he bought an additional 100 units on September 8, which he closed on September 25.

A. September’s ADA Staking Units

Breakdown calculation – September 1 position:

The position was open for 29 days in September (30 days minus first day)

– First we disregard the initial nine intro days, leaving 20 eligible days. (29 days of open position minus nine intro days = 20 days)

– We multiply Dave’s 500 ADA units from this position by 20 days. (500 ADA units x 20 = 10,000)

Breakdown calculation – September 8 position:

The position was open for 17 days in September (25 days minus eight)

– First we disregard the first nine intro days, leaving eight eligible days.

– We multiply Dave’s 100 ADA units from this position by eight days. (100 ADA units x 8 = 800)

B. Calculable cryptoassets

At the end of September, we calculate the sum of all eligible staking units:

800 + 10,000 = 10,800 ADA units

Average Daily Position Per Client: 10,800 divided by 30 days in September = 360

C. Final Staking Reward

For the month of September, the calculation yield for Cardano was 5%

360 ADA units x 5% = 18 ADA units

Dave is a Diamond Club member, so he gets 90% of the staking yield.

(90% of 18 ADA units = 16.2)

Total – Dave’s staking reward for the month of September was 16.2 ADA units

- What is the minimum amount that a reward can be?

-

The amount of a reward must be of a value that is more than 1 USD.

- Is staking profitable?

-

Staking allows users who own and hold supported cryptoassets to earn rewards of more of these cryptoassets just for holding them, meaning that users grow their holding in much the same way as they would earn interest on money.

- Is staking crypto safe?

-

Staking with eToro is simple, secure and hassle-free. The staked cryptoassets remain the property of the eToro users; in turn, eToro users entrust eToro to execute the entire staking procedure for them, securely and effectively. eToro takes great care to protect our users’ cryptoassets against exposure to any additional risks, sparing them the hassle and complication of staking on their own. Consequently, eToro retains a percentage of the yield to cover the various operational, technical, and legal costs involved.

- Can you stake Bitcoin?

-

No. Staking derives from the PoS (Proof-of-Stake) mechanism, used by a distributed blockchain network, where blockchain miners can mine or validate block transactions according to how many coins they have. The more coins they hold, the more mining power they have. You cannot stake Bitcoin, since Bitcoin miners employ a Proof of Work (PoW) mechanism, on which staking is not possible.

- Which coins can I stake?

-

eToro currently supports staking for Cardano (ADA), Solana (SOL), Near Protocol (NEAR), Polygon (POL), Ethereum (ETH) and Tron** (TRX), Polkadot (DOT) & Cosmos (ATOM) and is working on plans to support more cryptoassets in the future.

For eToro users in the UAE (eToro ME users) staking is only available for Cardano (ADA), Solana (SOL), Near Protocol (NEAR), Polygon (POL), Polkadot (DOT), Cosmos (ATOM) and Ethereum (ETH). - How do you start coin staking?

-

To begin staking, a user needs to purchase and own one or more of the supported cryptoassets. The user then needs to hold the open position of the staked cryptoasset for a certain period of time. The time period for when a user becomes eligible differs per cryptoasset; according to the blockchain of the specific cryptoasset, and how long it takes for it to be included in the staking pool.

- What are the eligible staking units?

-

Each day of the month, a daily “snapshot” of each user’s holdings is taken at 00:00 GMT. These are multiplied by the number of days in the month, and the result is the number of eligible staking units for a user in a specific month.

- How is the monthly yield per cryptoasset calculated?

-

To calculate the monthly yield per cryptoasset eToro divides the total number of new coins (AKA the total sum of the reward) for the month by the total average daily amount of all eligible staking users.

Example

In the month of September 500,000 ADA coins were received on eToro as the staking reward.

For the same month, the total average daily amount of ADA held by eligible staking users was 10,000,000 ADA coins.

Therefore, the calculation will be 500,000 divided by 10,000,000, resulting in a monthly yield of 5%.

- How does eToro support staking on a leveraged position?

-

Open crypto positions with leverage are only eligible for staking on the part of the position held with the non-leveraged value (i.e. bought with the user’s own money).

If money is added to the position in order to lower the leverage, the amount of crypto on which staking is eligible increases, but this extra amount requires the same number of intro days to become eligible as it would if the extra money represented a new position.

If money is removed from the position, thereby increasing the leveraged value, the eligible staking amount decreases immediately.

- Earnings Compound: Will staking earnings (rewards) also be used as part of the input amount for the next staking reward calculation?

-

Yes. The staking reward calculations for one month (e.g. October) will include staking reward percentages earned in the previous month (e.g. September). The rewards will be calculated according to the number of intro days of the specific cryptoasset. For example, Cardano has nine intro days, with calculations beginning on the tenth day of holding the asset.

- Do I need to do anything to stake my assets?

-

eToro offers staking services for Cardano (ADA), Tron (TRX), Near Protocol (NEAR), Polygon (POL), Solana (SOL), Ethereum (ETH), Polkadot (DOT) & Cosmos (ATOM).

If you hold open positions in Cardano (ADA), Tron (TRX), Near Protocol (NEAR), Polygon (POL), Solana (SOL), Polkadot (DOT) & Cosmos (ATOM) your assets are automatically staked, with no action required on your part.**

To stake your Ethereum (ETH) positions, you need to proactively opt in. Go to Settings > Trading > Stake ETH, and move the button to the ON position.

**If you do not want to stake your assets: in your investment account, go to Settings > Trading > Crypto Staking Program, and move the button to the OFF position as required. (See image below.)