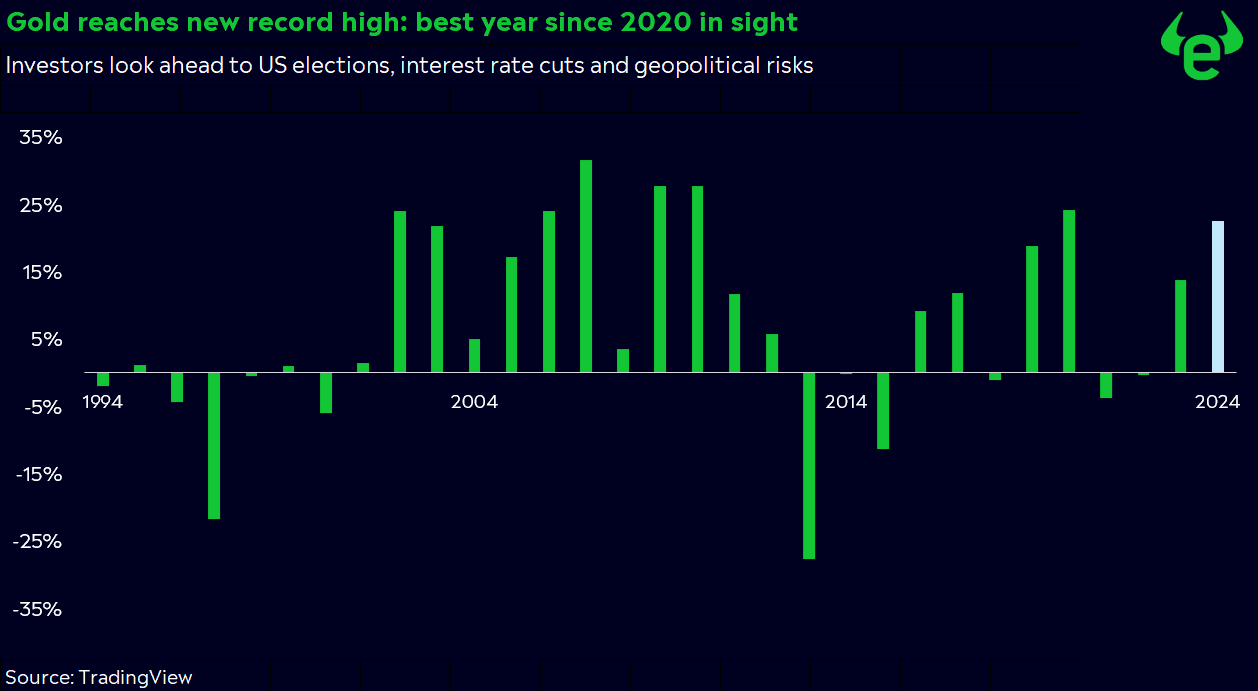

Gold has outperformed Wall Street this year and is on track for its best year since 2020. If the rally continues through the end of the year, it could become the strongest year in 14 years. However, nothing is certain in the stock market — some risks could still derail the precious metal’s impressive performance.

US Elections & Rate Cuts

For gold traders, the remaining months of the year promise to be particularly exciting. The upcoming US elections in November create significant uncertainty, with an unpredictable outcome and ample room for speculation. Donald Trump and Kamala Harris are in a tight race. At the same time, aggressive bets on interest rate cuts are bringing gold into the spotlight, as a loosening of monetary policy makes the metal more attractive. July’s US inflation data, showing a drop in consumer prices from 3.0% to 2.9%, have reinforced the position of gold bulls. Additionally, escalating geopolitical tensions, such as the Middle East conflict and the Ukraine war, are increasing demand for gold as a safe haven. Gold serves not only as a stable store of value over long periods but also as a crucial diversification tool that makes any portfolio more resilient.

Trump’s Impact on Gold

No one can say for certain whether Trump will become US President again. However, the markets are better prepared this time than in 2016, which could lead to less volatility — though investor demand for safety might still increase. Trump’s stringent immigration policies, risky tariff strategies with looming trade wars with China, and repeated threats to withdraw from NATO remain significant risks. The strong link between interest rates and bond yields underscores gold’s importance: declining interest rates or the prospect of rate cuts put pressure on bond yields and enhance gold’s appeal as a safe haven. Since late April, the yield on the 10-year US Treasury bond has fallen from 4.7% to 3.9%. This development weakens the dollar, making gold cheaper. The EUR/USD exchange rate has risen by 3.4% since May, surpassing 1.10. Markets expect credit costs to be reduced by 2 percentage points by mid-2025, which will keep gold attractive in the medium term.

Gold’s Rally: Can It Last?

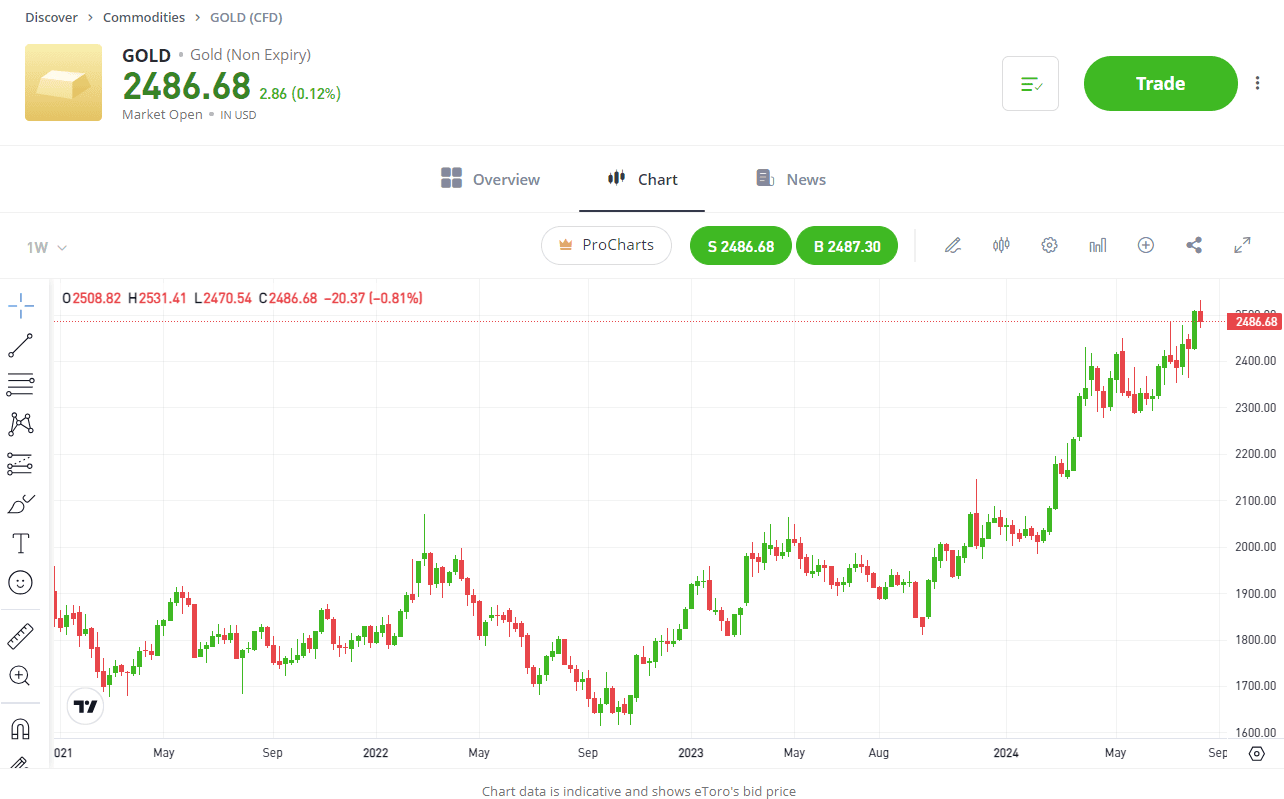

Gold has clearly outperformed Wall Street this year and is on track for its best performance since 2020. With a gain of 21.5%, the precious metal is currently performing strongly and reached a new record high of $2,510 just last week. In contrast, the S&P 500 has only seen a 16.5% increase since the beginning of the year. On the weekly chart, it took Gold four attempts to sustainably break through the May high of $2,450. If the rally continues through the end of the year, 2024 could be the most successful year for gold in 14 years — provided it surpasses the 24.2% gain from 2020. Additionally, the RSI on the weekly chart indicates that Gold is not yet overbought, suggesting further upside potential.

Bitcoin vs. Gold

Bitcoin, often dubbed “digital gold,” poses a direct challenge to traditional gold investments. Especially younger, tech-savvy investors might prefer Bitcoin, potentially dampening a rally in gold. Despite its relative novelty and lower market capitalization ($1.2 trillion versus $15.5 trillion for gold), the crypto market offers potentially higher returns. However, this lower market capitalization also makes the crypto market more susceptible to significant price swings and higher risks. For commodity investors seeking alternatives, silver might present an attractive option. The current silver price is 11% below its recent peak and 40% below its all-time high. The rising silver-gold ratio indicates an expensive gold price relative to silver, which, as a more economically sensitive metal, could benefit from an economic recovery.

The Jackson Hole

Gold remains well-positioned in the medium-term. However, an unexpected resurgence in inflation could pose challenges, potentially forcing the Fed to slow down its rate cuts. Notably, central banks have significantly reduced their gold purchases in the second quarter, with China halting its gold buys for the past three months — likely due to high prices. Market attention is now turning to upcoming events: the Fed’s Minutes on Wednesday and the central bank symposium in Jackson Hole on Friday and Saturday. This year’s theme — “Reassessment of Monetary Policy Effectiveness and Transmission” — promises intense discussions and could provide clearer insights into the future monetary policy paths of the Fed and other central banks.

View Gold on eToro

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.