Investing in this market is challenging, I get it. Navigating the kind of uncertainty we’re seeing, with markets whipsawing day to day is no easy feat. Right now, the two largest economies are going head to head, and the blows in this economic fight are landing on the rest of the world, but particularly on us here in Australia. Trump is looking to strong-arm nations and it’s quite clearly having a severe impact on global markets. Volatility is going to stay. Trump’s last trade war came in waves. Each escalation triggered a sharp sell-off and surge in volatility, and each truce or trade deal sparked relief rallies. In this scenario, though, we’re seeing Trump pick a fight with every nation, more than initially expected. That’s having a ripple effect globally, ramping up recession fears and knocking earnings expectations, which combined are sending stocks lower. However, those relief rallies are big. Wednesday’s rally on Wall Street was one of the largest one-day moves in history.

For investors, it’s about cutting through the noise, filtering through the market reaction and finding the opportunities that will appear in this market. This week, I look at four stocks that can help to weather the tariff storm. All four of the stocks are dividend-paying stocks. These businesses operate in essential sectors, have global scale or local supply chains, and possess the kind of brand strength or innovation that makes them less vulnerable to external shocks. In volatile markets, dividend payers also offer something precious: stability. They are typically mature, financially sound, and continue to reward shareholders even when markets pull back.

- The global economy might be uncertain, but investing in quality businesses with resilient earnings can be the smartest move in shaky times.

- Dividend-paying stocks are regaining appeal. They offer regular income, solid cash flows and a degree of stability when broader market volatility picks up.

- These aren’t high-flying tech names, from supermarkets to soft drinks, but they’re dependable companies, perfect for investors who want returns without riding the rollercoaster.

Stock #1: Coca Cola (KO)

Coca-Cola, we all know it even if we don’t all drink it. This is a company that has been through it all: wars, recessions, pandemics, and, yes, trade wars too. Its strength lies in the global scale of its operations and the local nature of its production. While it sells in over 200 countries, much of its manufacturing and bottling happens locally, insulating it from cross-border tariffs and supply chain shocks.

Coke’s products are staples. Whether the economy is booming or contracting, consumers tend to keep buying soft drinks, making demand relatively stable and perfect for investors looking to ride out volatility. This isn’t to say that Coca-Cola doesn’t go through tough periods, but it’s an investment you can count on over the long term.

Warren Buffett has owned the stock since 1988 and still makes up just over 10% of his Berkshire Hathaway portfolio. He famously stated, “When we own portions of outstanding businesses with outstanding managements, our favourite holding period is forever,” which he applied to Coca-Cola, indicating his long-term investment strategy and belief in the company’s strength.

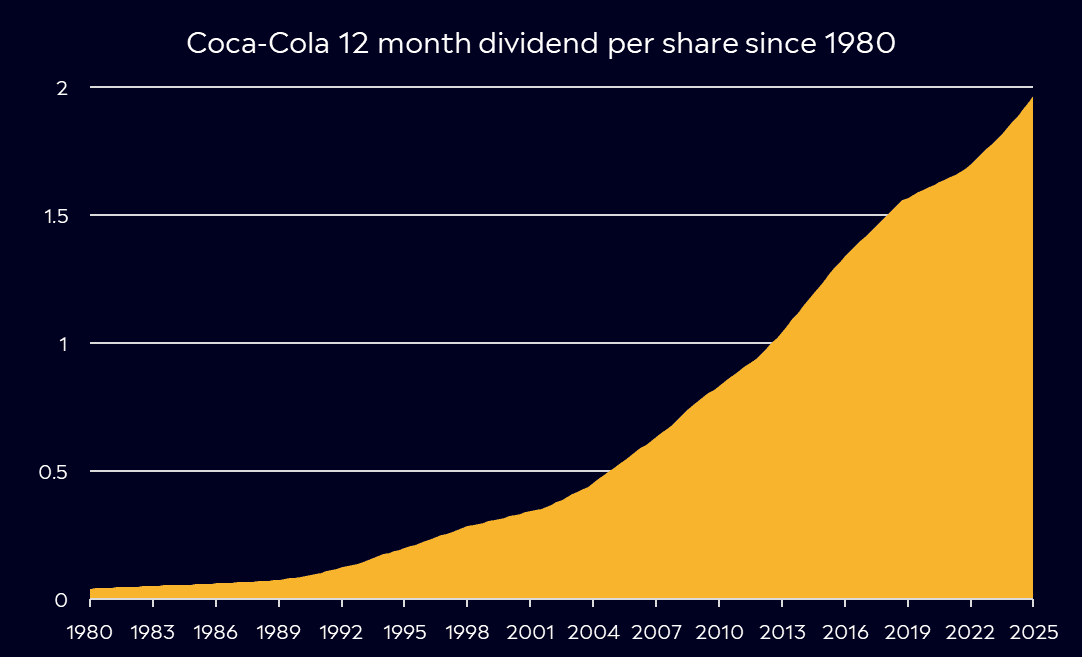

What’s impressive about Coca-Cola is the fact it’s increased its annual dividend for 63 consecutive years, ranking it as a ‘Dividend King’. It’s also doubled its dividend since 2012 and Coca-Cola currently pays around a 3% dividend yield.

The business commands around 45% of the carbonated soft drink market, and it owns five of the world’s top 10 brands (including Sprite and Fanta), which gives it a huge competitive edge over its rivals. Solid gross margins and continued sales helped drive profits 16% higher in 2024, with net income at USD$12.4 billion. Its strong pricing power and low-capital-intensive business model have let the business continuously generate high levels of free cash flow, enabling it to continue its high dividend payout ratio.

According to Bloomberg’s Analyst Recommendations, Coca-Cola has 28 buy ratings, 3 holds, and 1 sell, with an average price target of USD$75.41 signalling a potential upside of 6.6% from its last closing price. So far in 2025, shares are up 14% (including dividends), while the S&P 500 has fallen by 10.4%

Fun Fact: Coca-Cola is one of the most universally recognised brands in the world, it’s estimated that 94% of the world’s population can identify its logo. It’s sold in every country on Earth except for two: North Korea and Cuba.

Explore Coca-Cola

Stock #2: Coles (COL:ASX)

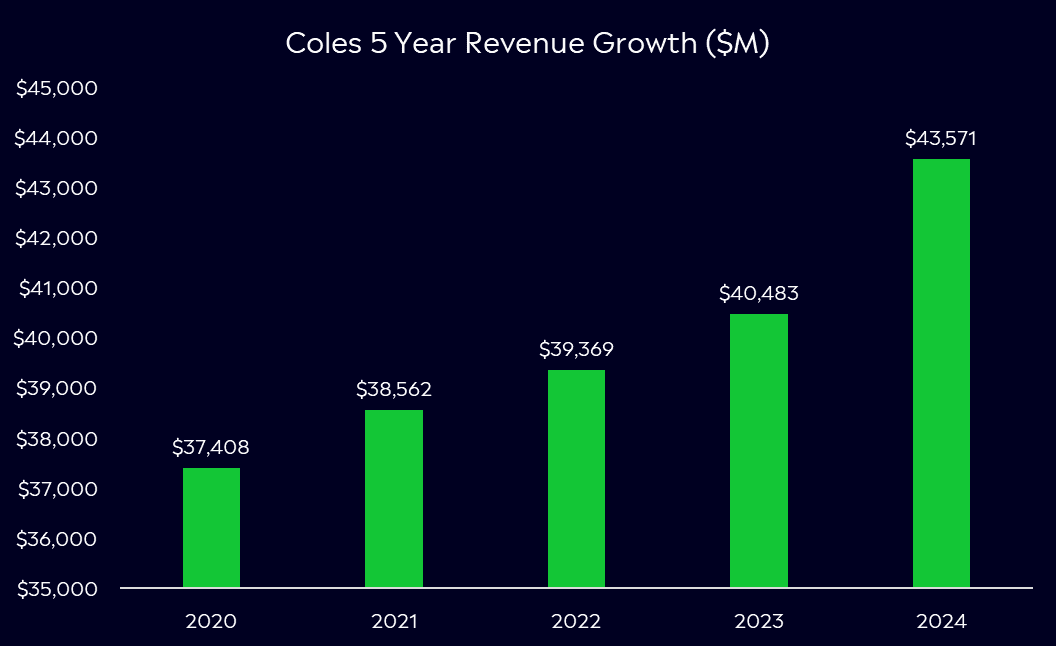

As one of Australia’s two major supermarket chains, Coles sits at the heart of the country’s consumer economy, offering the kind of stable, essential goods that people keep buying, no matter the headlines. In an environment clouded by trade tensions and recession risk, Coles stands out as a defensive play. Its locally focused supply chain reduces exposure to global tariffs and logistics disruption, and its core offering groceries, is about as non-discretionary as it gets.

Competition remains fierce, particularly from Woolworths, which has a larger market share, while Aldi and Costco are also gaining market share. However, Coles’ tech investments in automation and supply chain efficiency (like its partnership with Ocado for robotic fulfilment centres) are helping it maintain margins and improve productivity over time.

Importantly, Coles just had a regulatory cloud lifted. The ACCC recently closed its investigation into the supermarket’s pricing practices without further action, a welcome relief for investors and a chance for Coles to shift focus back to operations and consumer engagement.

In its 1H results in February, Coles saw its group sales climb 3.7% to AU$23 billion and supermarkets’ revenue jump 4.3% for the first half of FY25. The company’s underlying profit increased by 6.4% to $666 million, allowing shareholders to enjoy a fully franked interim dividend of 37 cents per share, up 2.8% from last year. Even with ongoing cost-of-living pressures affecting consumers, Coles’ disciplined approach and growing market share have positioned it well for long-term growth.

According to Bloomberg’s Analyst Recommendations, Coles has 8 buy ratings, 7 holds, and 3 sells, with an average price target of AUD$20.60, signalling a potential upside of 1% from its last closing price. So far in 2025, shares have rallied more than 14% (including dividends). It’s currently paying a healthy dividend yield of around 4%.

Fun Fact: Coles serves more than 21 million customers every week — that’s nearly the entire population of Australia walking through its doors or shopping online every single week.

Explore Coles

Stock #3: Philip Morris International (PM)

Philip Morris might not be a company you’ve all heard of, but it’s a classic example of a business that holds up well in volatile markets. Why? Because it sells a product that, while controversial, tends to see very steady demand regardless of economic conditions.

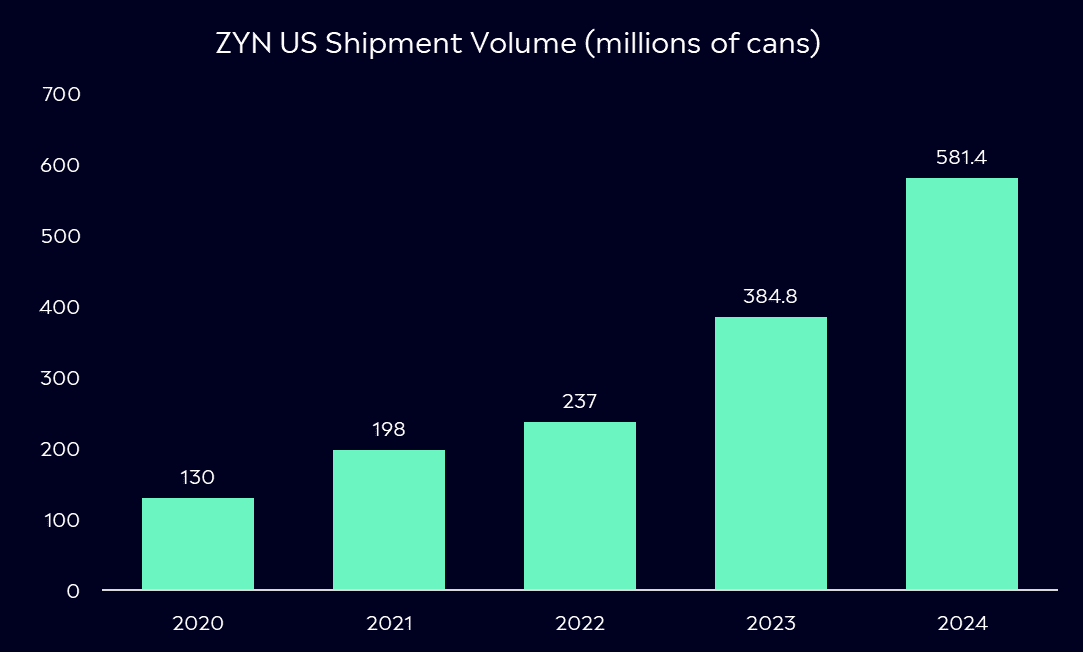

They’re a global producer of tobacco and smoke-free products. They are responsible for six of the world’s top 15 international tobacco brands, including Marlboro, the world’s best-selling international cigarette. With cigarette volumes declining, the company has now shifted its focus to the production of various alternative, smoke-free products, such as e-vapes, nicotine pouches, and other electronic devices. It acquired Swedish Match, a manufacturer of ZYN nicotine pouches, in 2022. This acquisition looks set to be fruitful, with shipments growing 346% since 2020, and over 40% in 2024, helping to grow profits by almost 10% for the year.

The firm has 39 production facilities worldwide, serving around 150 million customers across over 175 markets. Its regional manufacturing strategy makes Philip Morris resilient in a tariff-driven world. Its products are largely made and sold within the same region, minimising exposure to global trade disruptions.

Thanks to its strong cash flow and consistent payout, the company has long been a dividend investor favourite. Its free cash flow climbed 36% in 2024 to USD$10.7 billion, and its current dividend yield is an attractive 3.5%. The company has raised its dividend every year for 16 years, which is no small feat in an industry facing regulation and change.

According to Bloomberg’s Analyst Recommendations, Philip Morris has 17 buy ratings, 3 holds, and 1 sell, with an average price target of USD$155.22, signalling a potential upside of 2.7% from its last closing price. It’s been a stellar 2025 for Philip Morris, with shares soaring 27% (including dividends), making it one of the top performers on the S&P500 this year.

Fun Fact: Philip Morris employs more than 70,000 people, including over 1500 research and development scientists, engineers, and technicians who work on the design and development of smoke-free products.

Explore Philip Morris

Stock #4: AGL Energy (AGL:ASX)

AGL Energy is one of Australia’s largest energy companies, providing energy, gas and other services to wholesale, business, and residential customers across the country. It provides essential services, making it a staple in times like this.

What makes AGL particularly interesting right now is its transition story. Once heavily coal-dependent, the company is in the midst of a multi-year transformation, transitioning away from fossil fuels to focus more on renewable energy. While that journey hasn’t been smooth, with leadership changes, activist pressure, and plant closures, the worst appears to be behind it.

AGL is aiming to exit coal by 2035, invest in renewable capacity, and modernise its retail offering. That direction gives investors a rare mix of defensive income today and future-facing growth. It owns significant energy generation assets, including gas peaking plants and the country’s largest battery under construction, the Liddell Battery, which will support grid stability and energy storage needs. The biggest tailwind for AGL remains the recovery in wholesale electricity prices, which could significantly boost earnings moving forward.

Recently, though, it has felt the effect of lower customer pricing and heightened competition from the likes of Origin Energy. Net profit in 1H25, reported in February, fell 7% to AUD$373 million, but they lowered net debt and reaffirmed their full-year guidance. It’s currently paying an impressive 5.37% dividend yield, up almost 20% from a year ago.

According to Bloomberg’s Analyst Recommendations, AGL Energy has 5 buy ratings, 6 holds, and 0 sells, with an average price target of AUD$12.41, signalling a potential upside of 20.4% from its last closing price. Shares are down -5.9% this year (including dividends), but despite being lower, they have outperformed the ASX200, which is down 7.6%.

Fun Fact: AGL stands for Australian Gas Light Company and was founded in 1837, making it one of Australia’s oldest listed companies. It helped light Sydney’s first gas streetlamps.

Explore AGL

In a market rattled by uncertainty and tariff tension, investors are seeking quality, consistency, and resilience. Coca-Cola, Coles, Philip Morris, and AGL Energy all offer unique defensive strengths and reliable dividends. They may not be the flashiest names in the market, but in turbulent times, they’re the kind of stocks that help keep portfolios steady…and sometimes, boring is brilliant.

*Data Accurate as of 04/04/2025

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.