The travel industry was one of the worst affected sectors during the pandemic as the world came to a halt. But, fast-forward to 2024, travel stocks have got their mojo back. Carnival Corp is among one of the big benefactors as cruise demand bounces back above pre-pandemic levels. With summer holidays on the horizon in the Northern Hemisphere and strong travel demand, should this stock be on your watchlist? Let’s find out.

- Cruising demand is bouncing back and in a big way. The wave of travel spending is still growing, giving Carnival a strong runway for growth.

- Carnival delivered record first-quarter revenue in its most recent earnings, and booking volumes hit an all-time high.

- Analysts see good times ahead for Carnival Corp, with an average price target of USD$21.43, signalling a 28% upside from current levels.

View Carnival

The basics

Carnival Corporation (CCL) is the largest cruise company in the world. It operates eight cruise brands, and its 91 ships visit over 700 ports worldwide. Carnival has made several acquisitions over the years to build an impressive lineup of brands, including P&O Cruises, Holland America Line, and Costa.

The business has four main revenue segments. North America and Australia (NAA) account for around 67% of revenue, and Europe and Asia (EA) account for 30%. The remaining 3% comes from Cruise Support and Tour & Other.

The business is dual-listed on the NYSE and London Stock Exchange, trading under the ticker CCL. Given the pandemic’s disastrous impact on the travel industry, shares remain well below their long-term average of USD$29 despite all-time high booking volumes.

A fun fact: Carnival rewards investors with an onboard credit to spend when cruising if they own a minimum of 100 shares.

Competitor Diagnosis

The cruising industry is highly competitive, and although Carnival is the biggest, it faces stiff competition. Not only does Carnival face competition from other cruise liners, such as Royal Caribbean Group (RCL) and Norwegian Cruise Line (NCLH), but it also competes with other travel businesses, resorts, and theme parks, such as Booking.com (BKNG), Marriott International (MAR), Walt Disney (DIS), and Las Vegas Sands (LVS).

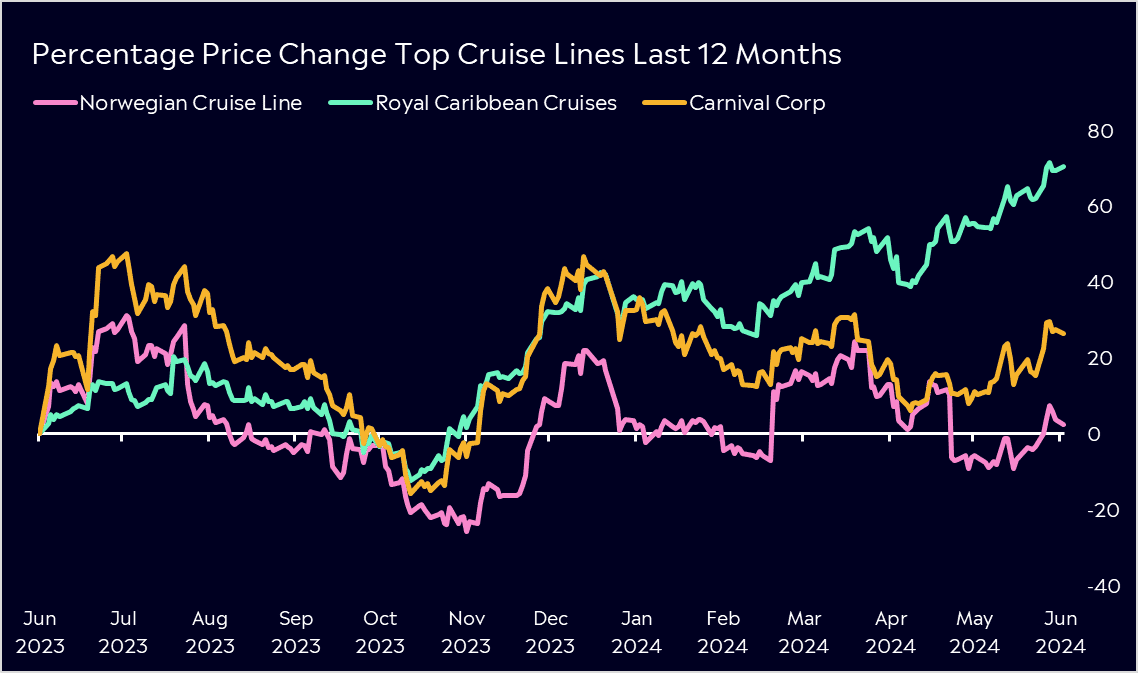

Royal Caribbean is Carnival’s biggest competitor at sea, and both these businesses are constantly introducing new ships, destinations, and onboard features to attract customers. Royal Caribbean’s share price has been on a tear in the last year, rising by over 70%, well outperforming Carnival’s share price in that time, with RCL’s earnings rebounding rapidly.

Carnival is opening its second private beach destination to rival Royal Caribbean’s new private island, CocoCay, in the Bahamas. Such investment is critical to continuing to attract travellers to the cruise industry, keeping RCL at bay, and competing with land-based alternatives.

Financial Health Check

Carnival has had a challenging financial period. Throughout the pandemic, it amassed a large debt position, with total debt sitting at around USD$28 billion at the end of 2023. However, in Q1 2024, first-quarter revenues hit record levels at USD$5.4 billion, and bookings continued to grow. Consumers were not only booking cruises but also spending more onboard, with onboard revenue rising by 18% in Q1 2024 compared to the same period in 2019.

The business generated USD$2.1 billion in free cash flow for 2023, positioning it to continue reducing its debt. If the company can continue to see growth in free cash flow over the next few years as profitability grows again, Carnival can reduce its debt positioning, providing a solid tailwind for the stock. Any reduction in interest rates from the Federal Reserve will also help Carnival’s leveraged position. But, this high leverage is certainly something for investors to take into account when investing.

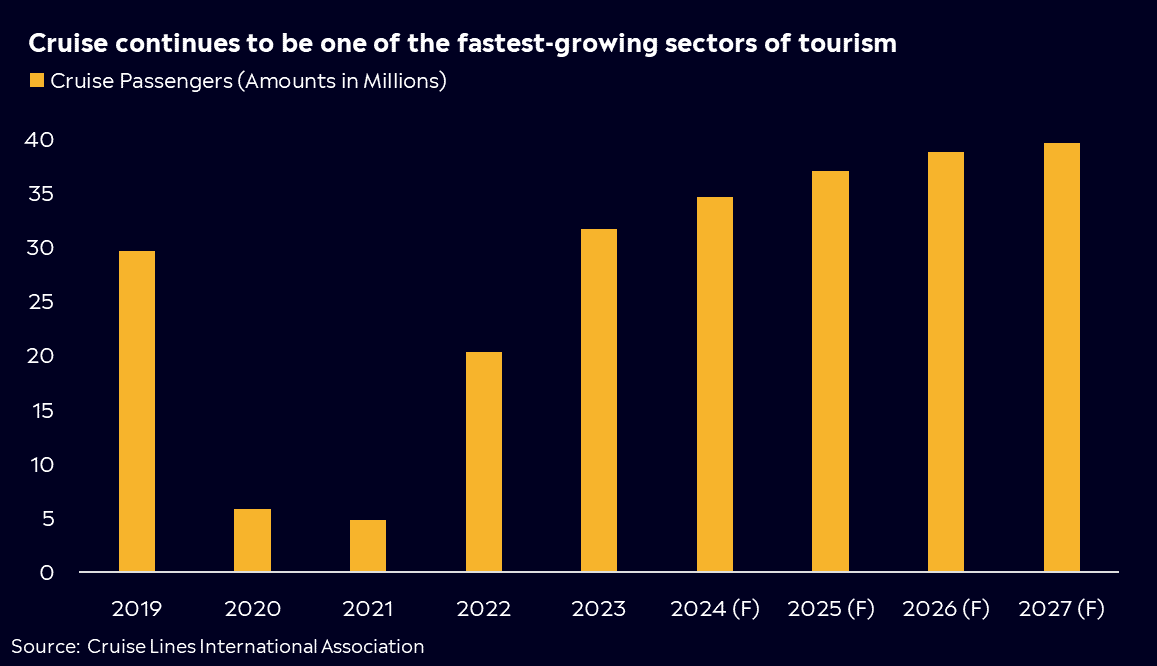

Importantly, Carnival is attracting more first-time passengers which will keep driving revenue. During its first-quarter earnings call, Carnival Cruise Line noted a healthy mix of “new-to-cruise” passengers in its 2025 bookings to date, with younger travellers now coming on board, with cruise remaining one of the fastest-growing sectors of tourism. This will be a crucial area to watch heading into its Q2 earnings report, which is set to be handed down towards the end of June.

Buy, Hold or Sell?

The cruise industry is set to continue growing as travel demand remains strong. The business currently trades at a modest valuation of 15x forward earnings, pricing in the risks of a high-leverage position and the potential for an economic slowdown.

There may be room for shares to move higher after lagging behind Caribbean Cruises on performance over the last two years. According to Bloomberg’s Analyst Recommendations, Carnival has 21 buy ratings, 3 holds, and 2 sells, with an average price target of USD$21.43.

It won’t all be plain sailing for Carnival Corp in the future, but if it continues to deliver on earnings as it has done in recent times, grow its free cash flow to reduce its debt positioning and keep passengers coming back, a brighter future might be on the horizon for Carnival shares.

View Carnival

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.