As part of your overarching investment strategy, you may be interested in acquiring stocks that deliver regular dividends. Investing in dividend stocks may provide a passive income stream that can be spent, saved or reinvested as you wish. It is important to remember, however, that the dividends paid to shareholders can vary from period to period and that past performance does not guarantee future results.

There are a number of considerations when choosing ASX dividend stocks, and you will want to ensure any investment decision aligns with your risk tolerance and long-term investment goals.

Alongside completing your due diligence, you should always thoroughly research any potential dividend stock you want to invest in. To help you get a broader picture of what to look out for, here are four interesting Australian dividend stocks that you might want to invest in this year:

Let us dive into these four ASX dividend stocks, their recent performance, the dividends you can expect to earn over the financial year, as well as other considerations that may influence your decision of whether to add them to your portfolio or not.

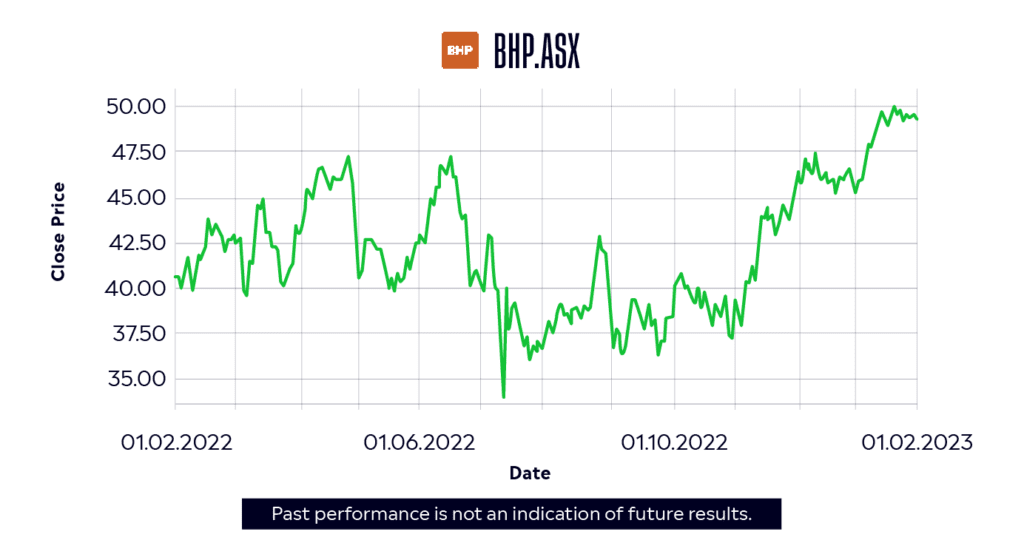

BHP Group (BHP.ASX)

- The BHP Group (Broken Hill Proprietary Company Limited) is a global resources company engaged in mineral exploration across mining coal, iron ore, gold, titanium, nickel and petroleum products.

- One of the largest operations in Australia, the BHP Group has more than 80,000 staff across the country as of 2022, and its products are sold all around the world.

- The mining giant is well recognised on the stock market for giving shareholders generous dividends in recent years.

- In FY2022, BHP Group declared a fully franked full-year dividend of $4.75 per share. Based on BHP’s share price at that time, it ended up being a 12% dividend yield.

- While Morgans analysts are predicting the fully franked dividend for FY2023 will be slightly smaller, it is still expected to hit double digits at around a 10.5% dividend yield.

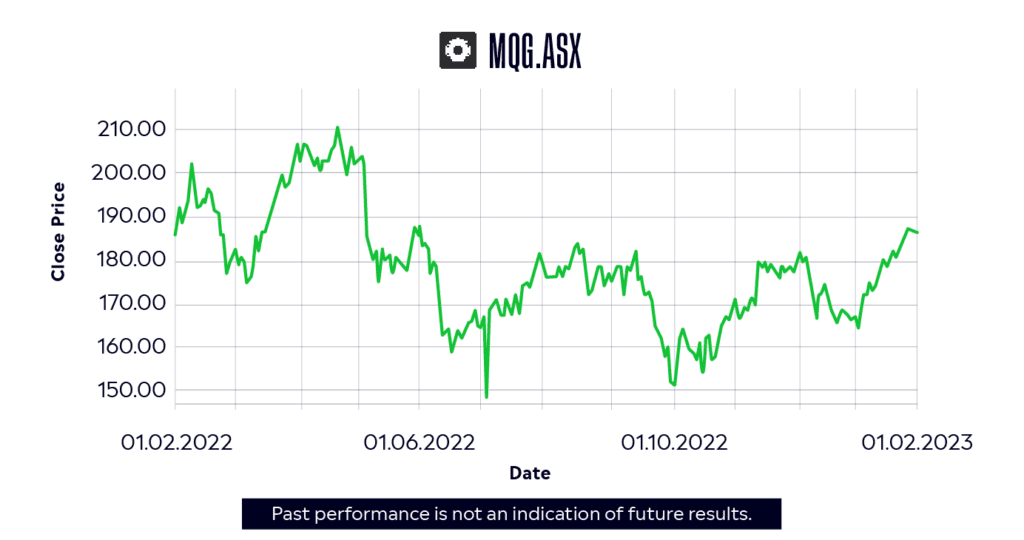

Macquarie Group (MQG.ASX)

- Macquarie Group is a multinational independent investment bank that acts as a holding company for its subsidiaries across banking and financial services, asset management and corporate asset finance.

- As of 2022, the Group operates across 33 markets and employs more than 17,000 staff. The business is split across four key divisions: Macquarie Capital, Macquarie Asset Management, Banking and Financial Services, and Commodities and Global Markets.

- Despite the share price falling throughout much of 2022 – over 17% as of mid-December 2022 – Macquarie Group announced a $2.3 billion profit for the first-half of FY2023.

- For the six months ending 30 September 2022, Macquarie Group raised its interim dividend to $3 per share (40% franked).

- For long-term holders, Macquarie Group may work in your favour as the company is expected to experience some short-term turbulence but an earnings recovery in 2024.

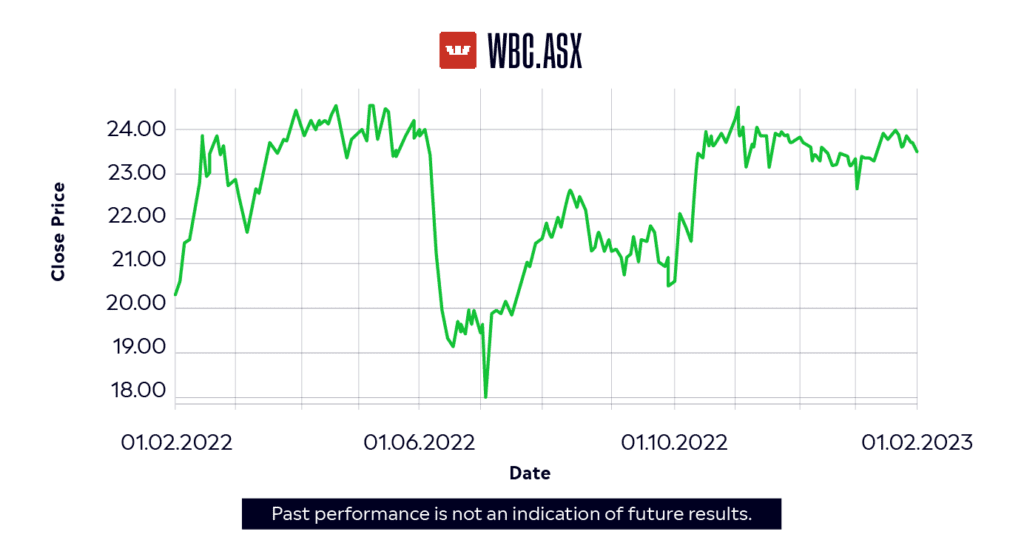

Westpac Banking Corporation (WBC.ASX)

- Westpac Banking Corporation has a history spanning more than two centuries. As Australia’s first bank and oldest company, it remains one of the ‘Big Four’ banks.

- Employing more than 40,000 staff across six divisions, Westpac Banking Corporation also includes an extensive network of subsidiaries, including St. George, Bank of Melbourne, RAMS, BankSA, and BT.

- With interest rates rising for eight consecutive months throughout 2022, Westpac – among other banks and lenders – is tipped to generate strong earnings growth in the coming months and years.

- If predictions for consistent earnings growth come to pass, it could translate to even higher dividend yields for shareholders.

- Goldman Sachs analysts anticipate fully franked dividends per share to reach $1.48 in FY2023 and $1.60 cents in FY2024 – yields of approximately 6.3% and 6.75%, respectively.

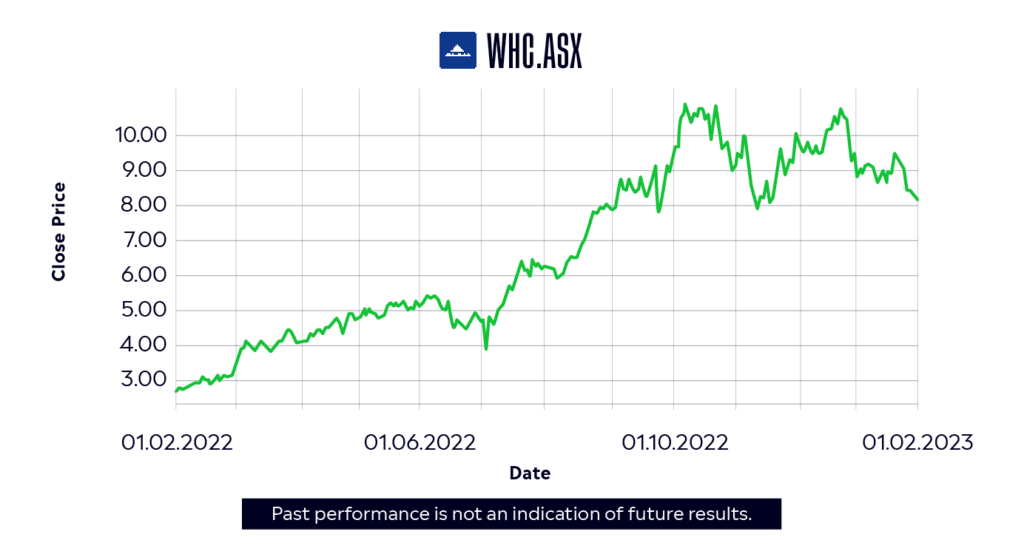

Whitehaven Coal (WHC.ASX)

- Whitehaven Coal is a mining organisation focused on developing and managing coal mines across Australia. The company has both open-cut and underground mining operations.

- The company operates four mines in the Gunnedah Basin, maintains washing plants and processing facilities, and has offices in Sydney, Newcastle and Tokyo.

- One of the strongest performers on the ASX in 2022, the share price has surged more than 323% in the year to 16 December 2022.

- Revenue grew 216% year-on-year, while the company announced a net profit of $1.95 billion. This revenue growth has resulted in substantial dividend growth, with shareholders in FY2022 receiving the largest payout in the company’s history at 40 cents per share.

- Morgans analysts forecast dividends to jump to $1 per share in FY2023 before settling at around 64 cents per share in FY2024.

Depending on your individual approach, there may be benefits when investing in ASX dividend stocks such as these. As with any decision, make sure you factor in your risk tolerance, your long-term goals, as well as your own research on each Australian dividend stock.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments. This material has been prepared without taking any particular recipient’s investment objectives or financial situation into account, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.