Abercrombie & Fitch might not be a stock you’d think to add to your portfolio if you hadn’t checked in on the company in the last five years, but that will have certainly changed now. Once a logo-heavy apparel business, Abercrombie & Fitch, also the owner of Hollister, has embarked on a significant turnaround in the last ten years. Abercrombie has not only redefined its image but also delivered impressive financial results, with its share price skyrocketing by over 800% in the last two years alone. As the company continues to innovate and expand, can it sustain its growth, or will it find itself out of style? Let’s find out.

- CEO Fran Horowitz’s leadership has sparked a remarkable turnaround, with Abercrombie outperforming rivals and the biggest tech giants alike.

- Despite a recent sell-off, Abercrombie’s double-digit revenue growth and strong fundamentals signal potential upside for investors.

- Abercrombie & Fitch has 5 buy ratings, 5 holds, and 0 sells, with an average price target of USD$186.29, signalling a 33% upside.

View Abercrombie

The Basics

Abercrombie and Fitch is a leading, global specialty apparel and accessories retailer for men, women and kids. The business has significantly transformed in recent years, shifting from its former image of flashy, logo-centric clothing, once dubbed as ‘America’s most hated brand’ to a more inclusive, fashion-forward brand. This strategic change has revitalised the brand, attracted a broader customer base, including millennials and Gen Z, and led to significant share price growth.

It all changed for Abercrombie when Fran Horowitz, the president of A&F’s well-known Hollister brand, took over as the company’s CEO in 2017. If you ever shopped at a Hollister or Abercrombie store years ago, you may have needed a torch to get around. Under Horowitz’s guidance, she literally turned the lights back on and made stores more appealing. They even streamlined their footprint, closing down poor-performing stores, with the store count falling by over 100 stores since 2017.

Beyond overhauling its stores and improving its product lines, another crucial aspect of Abercrombie’s success has been its marketing shift. They are drawing new customers and increasing transactions from existing ones. A big part of that success has come from working with influencers and affiliates to communicate its rebrand and market its styles. Its ‘influencer program’ has been a hit with Gen Z who are avid users of social media.

For years, Hollister was the key driver of growth and revenue, but that has changed in recent years, with Abercrombie overtaking Hollister as the most significant revenue contributor for the brand, seeing 27% growth in the full fiscal year 2024 to USD$2.2 billion.

Competitor Diagnosis

Abercrombie & Fitch operates in the highly competitive retail apparel industry, where it faces direct competition from other established brands targeting similar demographics. One of its main competitors is American Eagle Outfitters, which has a robust e-commerce platform and omnichannel capabilities that have helped it maintain a solid market presence, similar to Abercrombie’s recent digital focus.

Another significant competitor is H&M, the global fast-fashion retailer known for offering trendy apparel at affordable prices. H&M’s business model of rapid design-to-retail turnaround allows it to respond quickly to fashion trends, attracting a broad customer base that includes budget-conscious consumers. Abercrombie & Fitch distinguishes itself by emphasising higher quality and a more curated shopping experience, but H&M’s extensive global footprint and competitive pricing present a constant challenge. Zara, owned by the large Spanish fashion brand Inditex, also offers Abercrombie a run for its money, adapting to emerging trends and staying relevant.

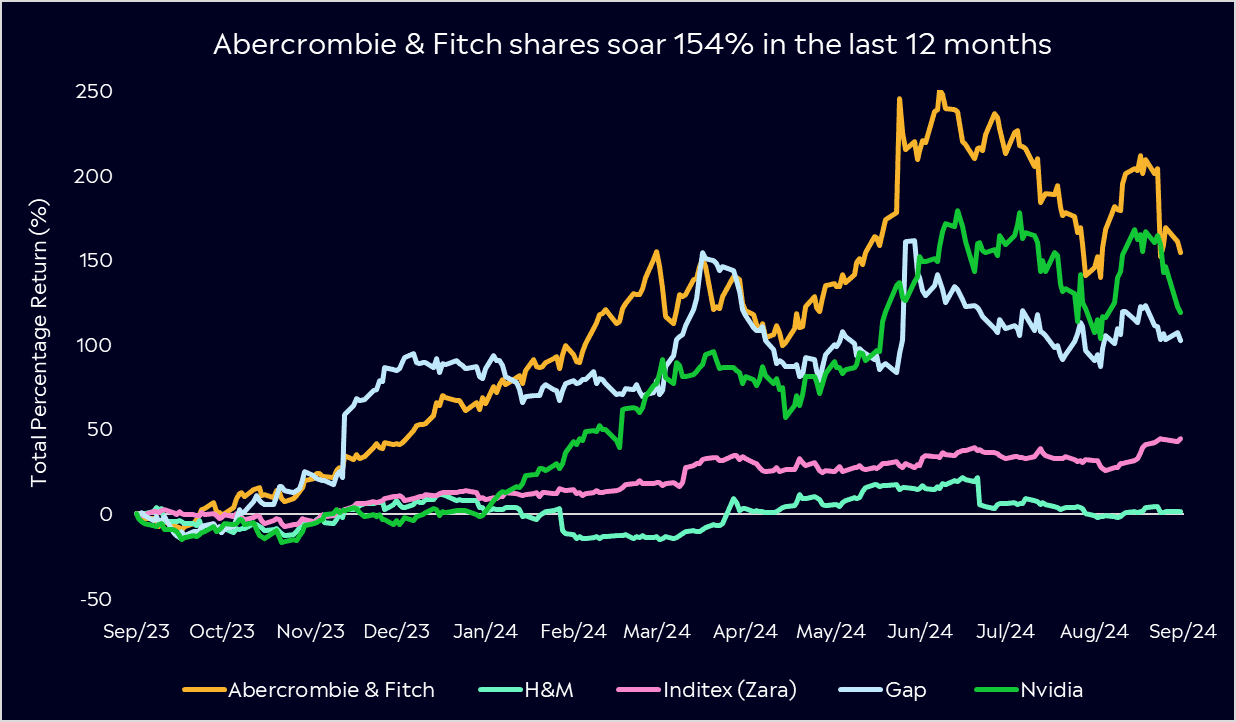

Abercrombie & Fitch distinguishes itself from the competition with an enhanced digital presence, a focus on quality and inclusivity, and strong market campaigns. These are formidable competitors, but Abercrombie & Fitch’s shares have well outperformed these rivals in recent years. This is because they have successfully redefined its brand to resonate with today’s youth culture. By offering trendy, distinctive clothing that sets itself apart from fast-fashion, A&F has become a go-to choice for young people looking to express their style.

Financial Health Check

Abercrombie & Fitch shares have had an undeniably stellar run. In the last two years, shares have gained over 800%, even outperforming Nvidia within the last twelve months, with shares gaining 154%. In that time, the S&P500 Consumer Durables & Apparel Index has only returned 8.7%. A fashion retailer founded in 1892, outperforming Wall Street’s AI darling, who would have thought it?

One of the reasons we are highlighting Abercrombie & Fitch is because of its solid result in the second quarter, but shares sank after the result, similar to that of the high-flying Nvidia. Abercrombie beat expectations and upped its guidance for the full year, but that outlook failed to reach investors lofty expectations after such a strong run. Shares have fallen by 20% in the last three months.

Revenue grew 21% in the quarter to $1.13 billion, ahead of estimates. This growth was spread across both brands, with sales for Abercrombie up 26% and Hollister up 17%, while profit jumped 134% for the quarter. The business continues to see double-digit growth, which looks set to continue. On the balance sheet front, the business ended the second quarter with USD$738M in cash, a great war chest for any challenging times, it repurchased USD$15 million on shares and reiterated its capex guidance of USD$170 million, investing in digital advancements and 20 new store openings by year-end.

Its guidance was what the market was disappointed with, but for us, the market overreacted. It likely focused on CEO Frank Horowitz’s comments that the “business is operating in an uncertain environment”, striking a cautious tone. But, Abercrombie & Fitch expects net sales to rise 12% to 13% for the full year, up from its prior outlook for “about 10%” growth. However, the market overlooked that Horowitz also commented that she was thrilled with the business’s start to August and saw continued growth across regions and brands.

Buy, Hold or Sell?

Abercrombie & Fitch has seen one of the strongest turnarounds in retail history and has some of the best comparable sales in the industry. Of course, there are risks. These come in the view that sales may slow if the business is unable to hit the fashion trends in a competitive market and if they can’t meet the lofty expectations the market expects after such strong growth.

However, the stock is trading at 14x forward earnings, slightly higher than that of competitor American Eagle, but Abercrombie offers a much more appealing growth story moving forward with double-digit revenue and earnings growth and rising margins. Its valuation, combined with the recent pullback, may represent an attractive entry for investors.

With its recent sell-off, analysts are optimistic and have signalled solid upside for shares. According to Bloomberg’s Analyst Recommendations, Abercrombie & Fitch has 5 buy ratings, 5 holds, and 0 sells, with an average price target of USD$186.29, signalling a 33% upside.

Abercrombie & Fitch’s strategic transformation has positioned it well for continued growth. With strong fundamentals, a successful digital strategy, and a focus on sustainability, Abercrombie & Fitch presents a compelling case for long-term investment.

View Abercrombie

*Data Accurate as of 05/09/2024

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.