The first half of the year has come to an end, and the S&P500 has continued to take out new record highs along the way. The ASX200, however, has stalled slightly, falling in Q2 as investors digest the prospect of higher for long rates. Nvidia reached a record USD$3 trillion in market cap and briefly passed Apple and Microsoft to become the largest stock in the world as spending on AI continued.

The Federal Reserve has remained cautious throughout 2024; however, softening data puts a rate cut on the cards in Q3, which would provide stocks with a tailwind alongside continued earnings growth.

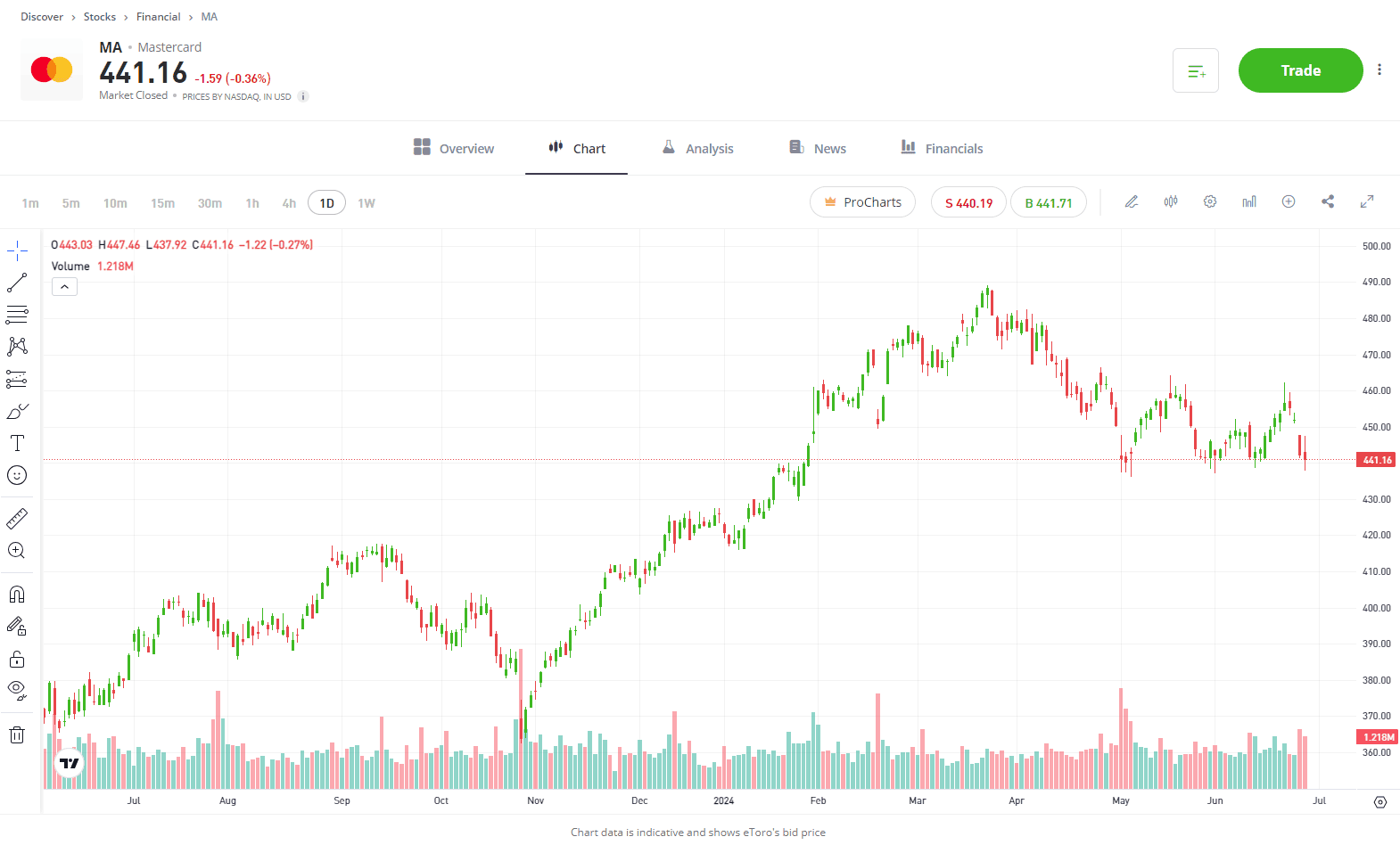

Stock #1: Mastercard (MA)

Sector: Financials

The digitisation of money has been a real win for Mastercard over recent years, with the emergence of contactless payments and the slow removal of cash from society. It may not be liked by all, but it serves as a tailwind for Mastercard moving forward. The bulk of Mastercard’s revenue comes from core consumer payments, which is driven by spending, with the business doubling its merchant locations in the last five years. They look set to deliver revenue growth of 16% for the full year 2024, led by healthy US consumer spending and strength in overseas volume. They have a healthy cash flow, which enables Mastercard to pursue M&A opportunities in an ever-growing fintech space while still being able to deliver a decent dividend with a yield of around 0.6%. With a strong summer season in the Northern Hemisphere ahead, a beat on earnings this quarter alongside strong guidance could be on the cards.

View Mastercard

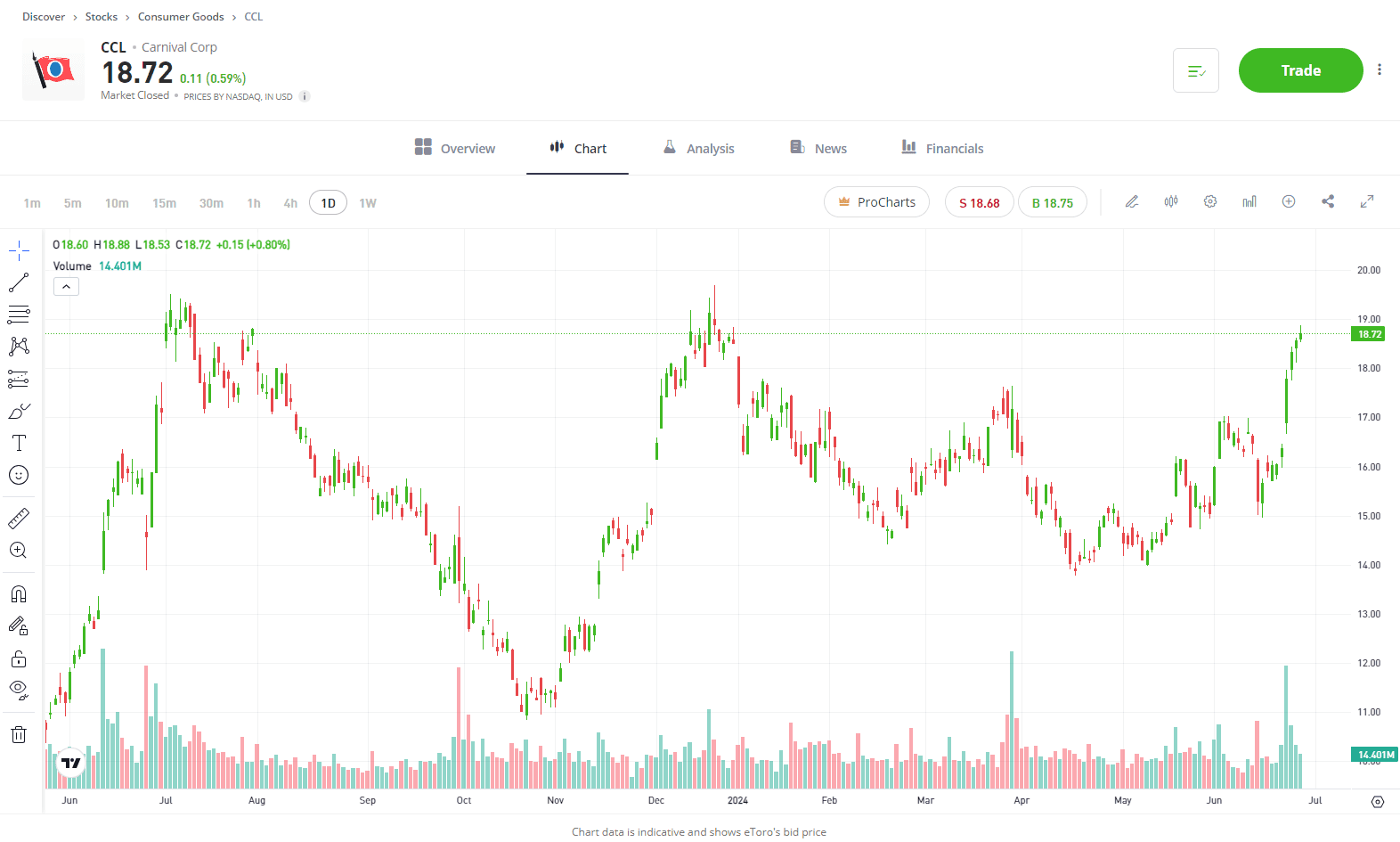

Stock #2: Carnival (CCL)

The travel industry was one of the worst affected sectors during the pandemic as the world came to a halt. But, fast-forward to 2024, travel stocks have got their mojo back. Carnival Corp is among one of the big benefactors as cruise demand bounces back above pre-pandemic levels. Carnival impressed with its Q2 earnings last month, reporting record revenues and operating income as well as all-time highs in customer deposits and booking levels. Management also provided a strong outlook for the rest of the year, triggering a round of broker upgrades from analysts. The business is also reducing its large debt position it accrued during the pandemic, and if it can keep doing that while delivering on earnings, the future looks bright for Carnival Corp.

View Carnival Corp

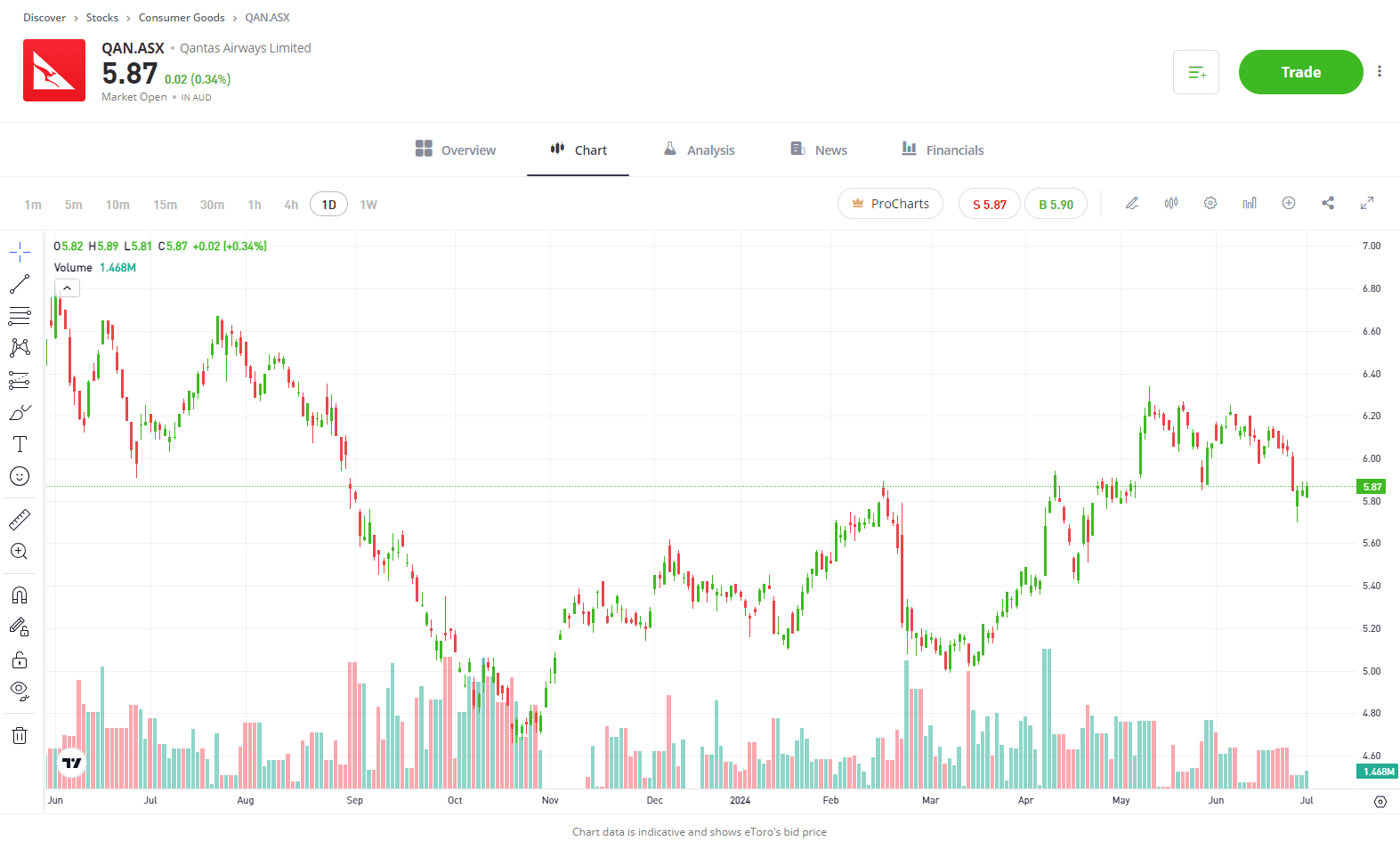

Stock #3: Qantas (QAN)

It’s been a mixed 12 months for Qantas as Vanessa Hudson looks to repair the tarnished reputation. They’re spending more i to try and rebuild consumers trust, looking to improve customer service, fewer flight delays and offering more reward seats. For now, Qantas is making steps in the right direction with its new look board and CEO looking to turn its fortunes around. Alan Joyce was unable to find the right balance between pleasing shareholders and keeping customers happy. Shares have fallen around 5% in the last 12 months, and its valuation has fallen with earnings set to fall slightly for the full year vs last year, now trading at a discount to its 5-year average. However, earnings are set to rise by more than 10% in 2025, back above pre-pandemic levels, and analysts are positive. The business has 13 buy ratings, 3 holds and 0 sells, with an average price target of AUD$7.07 a share, signalling 20% upside from current levels.

View Qantas

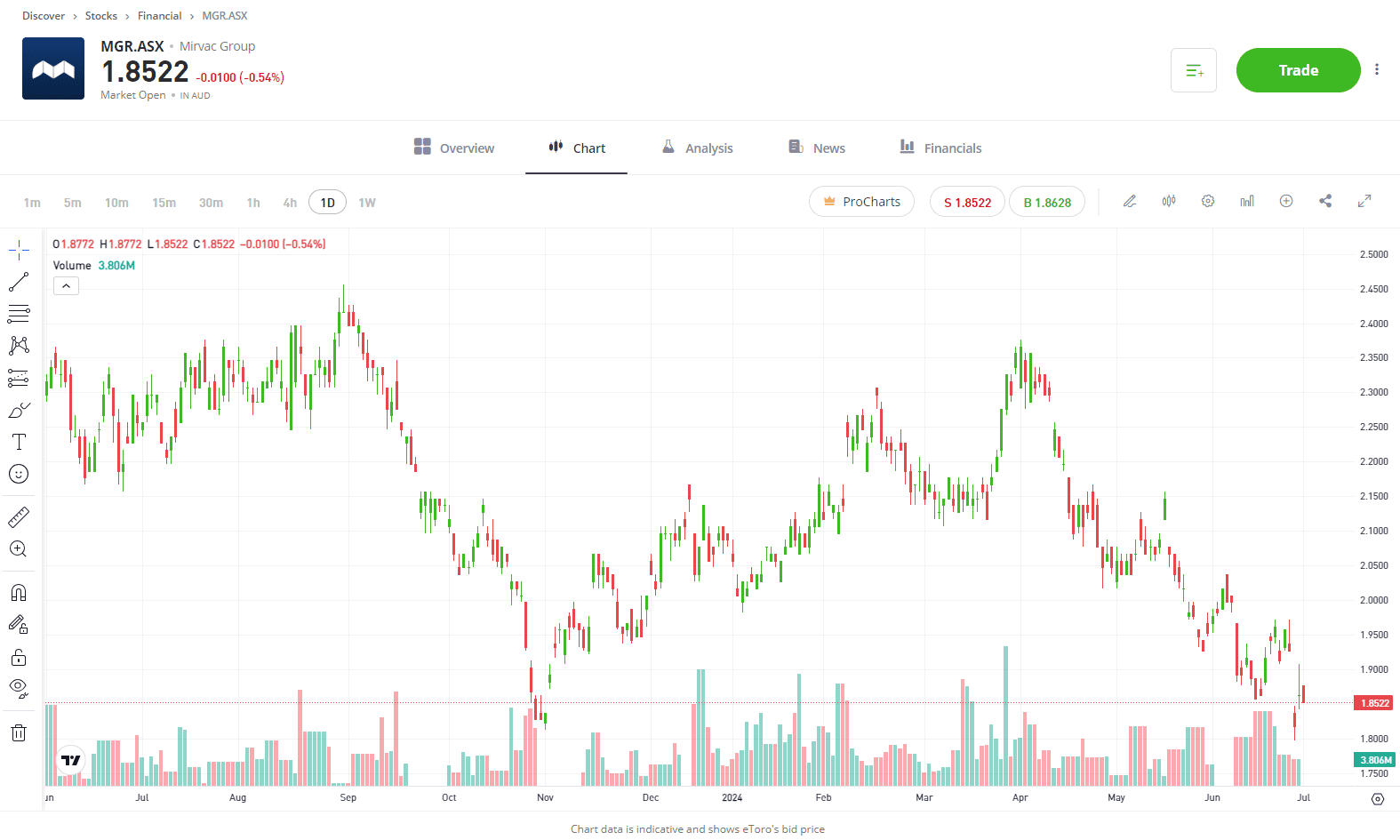

Stock #4: Mirvac (MGR)

After recently hitting a 52-week low, Mirvac Group is getting the seal of approval from analysts. The leading development and management property group has seen brokers upgrade their price targets in the last week. Bloomberg’s Analyst Recommendations now show 6 buys, 4 holds and 0 sells, with an average price target of AUD$2.25, signalling over 20% upside from Friday’s close. The recent positivity comes after Mirvac maintained its full-year earnings forecast amid a challenging environment for the real estate market, with interest rates remaining elevated. Analysts see value in the business after recent weakness, with shares trading at 13.5x forward earnings while also paying out a healthy dividend yield of around 5%.

View Mirvac

Disclaimer: eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.