This week, Rio Tinto shares jumped as China’s recent bumper stimulus rollout sparked a rally in iron ore prices on optimism that demand for commodities would grow. We’ll dive into the factors driving Rio Tinto’s performance, from its heavy reliance on China to its promising long-term future in copper. But as the world’s second-largest economy continues to face challenges in the short term, will Rio Tinto’s rally fade, or will shares enjoy some time in the sun? Let’s find out.

- Copper demand is forecast to increase 3-4x by 2030, and Rio is heavily investing in copper exploration, which could drive long-term growth.

- The company maintained its 8% dividend yield, a key attraction for income-focused investors, while competitors like BHP have reduced dividends.

- Rio Tinto Ltd has 11 buy ratings, 4 holds, and 0 sells, with an average price target of AUD$131.07, signalling a 6.7% upside.

View Rio Tinto

The Basics

Rio Tinto is one of the world’s largest mining companies. It is known primarily for its iron ore production, which accounts for over 60% of its revenue. The company also mines aluminium, copper, and other industrial metals. With a market capitalisation of over AUD$160 billion, Rio Tinto is a key player in global commodity markets. Rio operates mines and projects across six continents, with major operations in Australia, North America, and Mongolia.

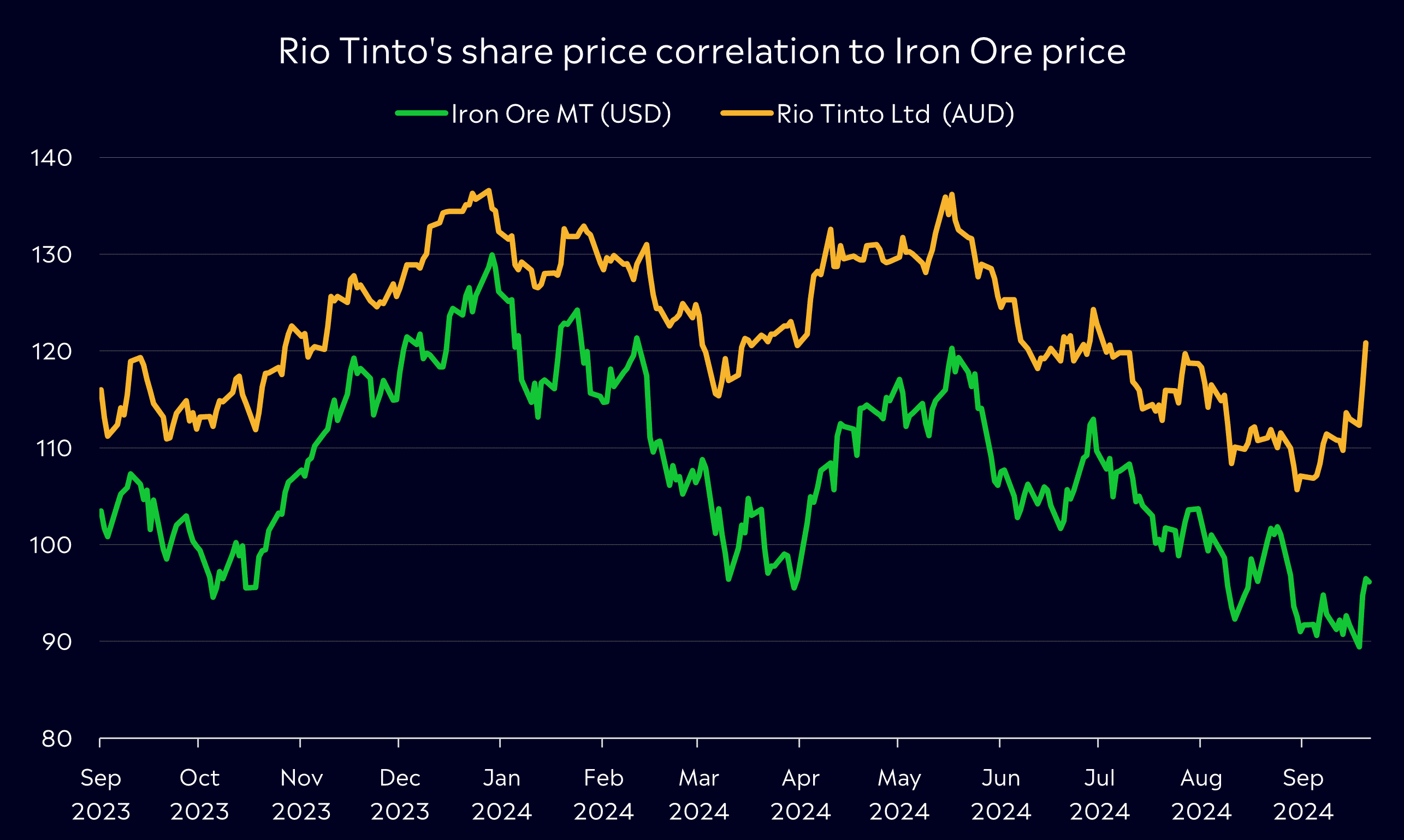

Rio Tinto’s largest customer, China, has been grappling with economic weakness in 2024, driven by a faltering property market, declining exports, and sluggish growth. This weakness has weighed iron ore, a critical commodity for construction and infrastructure through steel. With that, Iron ore prices faced downward pressure, dropping from USD$129 per ton earlier this year to below $90 earlier this month. Rio Tinto’s share price is highly correlated with the iron ore price, given how much money it makes from the commodity.

However, a recent rollout of new stimulus measures in China has lifted iron ore prices and boosted mining stocks, including Rio Tinto, with shares up 8.5% in the past week. Policymakers in China have cut the key short-term interest rate, lowered mortgage rates on existing housing loans and said they would help banks boost lending to consumers. While this provides short-term relief to prices, previous measures have had limited impact, but this larger rollout may be what is needed to help China.

Fun Fact: Rio Tinto’s name comes from the “Red River” (or Río Tinto in Spanish), a river in southwestern Spain that has mined copper, silver, and other minerals for over 5,000 years!

Competitor Diagnosis

Rio Tinto faces significant competition from other major mining companies, particularly BHP, Vale, Glencore, Anglo American, and Fortescue Metals Group. These companies also produce iron ore and copper and are major players in the global commodities market.

Despite the competition, Rio Tinto maintains a strong market position due to its efficient operations, high-quality assets, and significant investments in technology and sustainability initiatives. For example, its focus on low-carbon mining and the development of automated operations gives it a competitive edge. Rio’s status as one of the world’s lowest-cost iron ore producers also aids the business, allowing it to maintain strong margins and navigate current market volatility more effectively.

Rio Tinto is diversifying its portfolio by increasing investments in copper and other minerals essential for renewable energy technologies. This shift not only mitigates risk but positions the business to benefit from the growing demand for metals critical to a sustainable future. However, it still has work to do. Compared to BHP, Rio Tinto still relies on iron ore for 71% of its EBITDA, compared to just 65% for BHP.

Financial Health Check

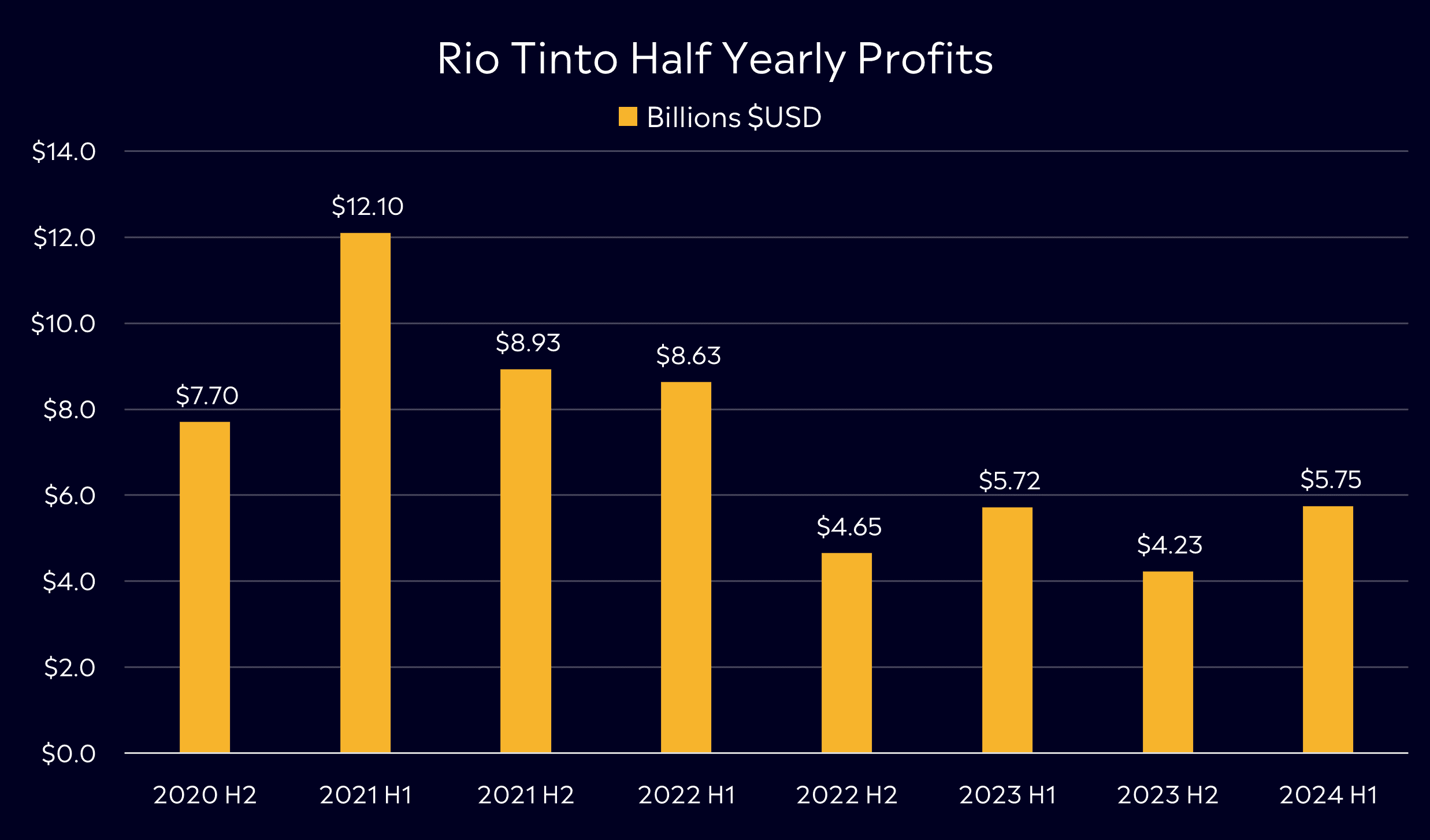

Despite the recent rally, Rio Tinto shares are still down 9.7% YTD, reflecting China’s economic struggles in 2024. However, Rio’s financials remained resilient in its latest half-year results, with underlying earnings of $5.8 billion, a slight increase from the prior year. This stability highlights Rio’s ability to navigate challenging market conditions. However, profits have fallen substantially since the iron ore boom following the pandemic, when prices spiked by over USD$200 per ton.

A significant positive from its result was that its dividend remained intact, a key attraction for many investors. This was the opposite of rival BHP, which slashed its dividend as profits fell. The stock currently provides a dividend yield of around 8%, making it attractive for income-focused investors. That dividend may be under pressure, though, if commodity prices don’t sustain their recent rally.

Looking ahead, Rio’s copper division—which generated around 16% of revenue in H1 2024—offers growth potential. Copper demand is forecast to increase 3-4x by 2030, driven by artificial intelligence, electric vehicles and renewable energy projects. Rio has been focusing on exploration rather than acquisitions, investing heavily in copper projects in recent years, which will continue to play an essential role in the company’s earnings moving forward, with a shortage of the asset expected in the coming years.

Buy, Hold or Sell?

The recent jump in Rio Tinto’s share price reflects the optimism ahead. However, it won’t all be one way. Commodity prices will remain volatile in the short term and that remains a key risk for revenue and profitability. A lot of that weighs on the world’s second-largest economy, China. The recent measures policymakers have rolled out need to help drive infrastructure spending and boost the ailing property market. Capital allocation also remains an important factor in the mining space, either through M&A or exploration projects. Both can cost billions and if not executed correctly, they can have detrimental effects on the share price.

Analysts are optimistic, given China’s latest stimulus package. According to Bloomberg’s Analyst Recommendations, Rio Tinto Ltd. has 11 buy ratings, 4 holds, and 0 sells, with an average price target of AUD$131.07, signalling a 6.7% upside.

Rio Tinto has long-term potential, particularly in copper. But the short term also seems promising right now. This, combined with its high dividend, makes it an appealing option for investors, especially if China’s rebound shifts into gear.

View Rio Tinto

*Data Accurate as of 26/09/2024

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.