You’ve more than likely heard of the diabetes drug Ozempic that has been hailed as a miracle weight loss treatment.. Well, that drug is produced by Novo Nordisk, a Danish healthcare company founded over 90 years ago that is now one of Europe’s largest companies. The drugmaker has been riding high on the success of Ozempic and other weight loss drugs. But, shares have come under pressure in the last 6 months with question marks over the trajectory of the weight loss market and some disappointing results from emerging drug trials. So, does this small setback open an opportunity or is the weight loss boom slimming down? Let’s find out.

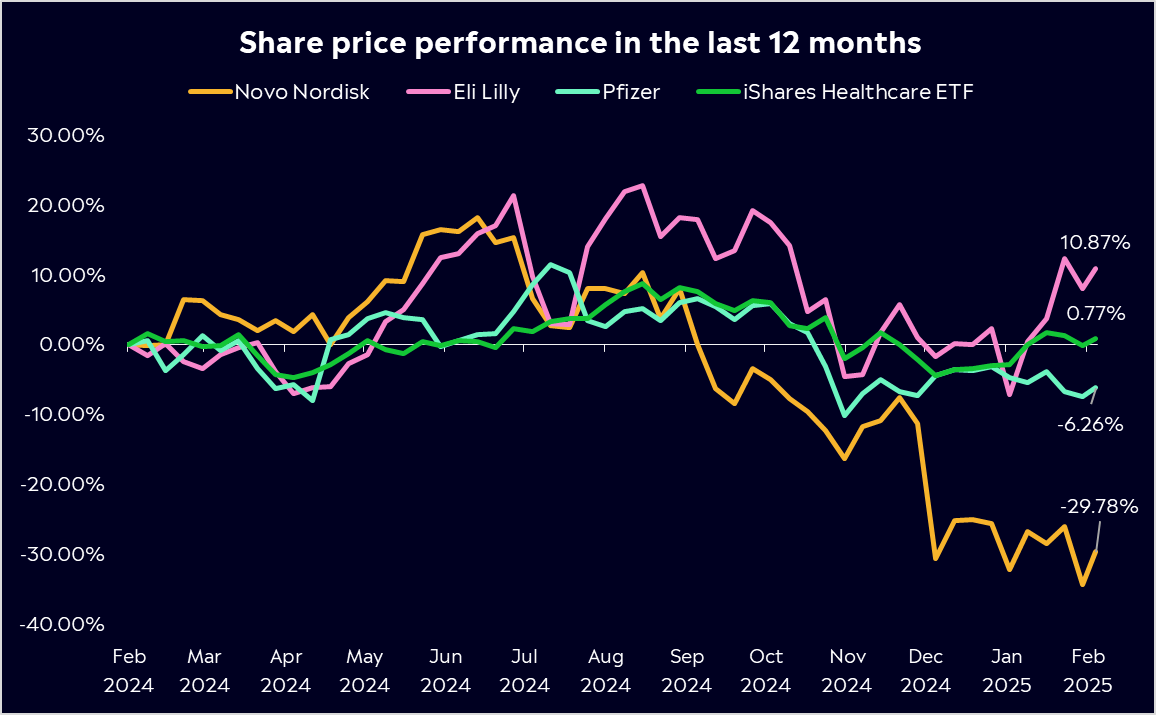

- Shares have tumbled 30% in the last 12 months amid trial disappointments, but strong 2024 results and a valuation reset could present a compelling entry point for investors.

- The obesity drug market is projected to reach $130 billion by 2030, opening up a huge opportunity for Novo as Ozempic and Wegovy continue to drive strong revenue growth.

- Analysts see strong upside potential for Novo Nordisk. According to Bloomberg’s Analyst Recommendations, it boasts 23 buy ratings, 9 hold ratings, and 2 sell ratings, with an average price target implying a potential 37.5% upside.

Explore Novo Nordisk

The Basics

Novo Nordisk is a pharmaceutical powerhouse that has been shaping the diabetes and obesity treatment landscape for over a century. At the heart of Novo Nordisk’s success is its dominance in GLP-1 drugs—a class of drugs that help regulate blood sugar and appetite.

The company’s flagship products, Ozempic (for type 2 diabetes) and Wegovy (for weight loss), have transformed the industry. These drugs have driven explosive growth. Demand for effective weight-loss treatments is soaring. Wegovy has become a game-changer, with supply struggling to keep up with demand in multiple regions. Ozempic, although used for diabetes, has also been in high demand for its effectiveness in weight loss given its ability to suppress appetite.

As life expectancy rises, so does the prevalence of diabetes. Novo Nordisk dominates this space with insulin products and GLP-1 drugs that offer more effective long-term management.

The business is also expanding its use cases for products. Just like Ozempic has been cross used into weight loss, its Wegovy treatment has an expanding use case as well. Novo just received approval to market its weight-loss drug as a treatment for heart disease in Australia, opening up an entirely new revenue stream for the drug.

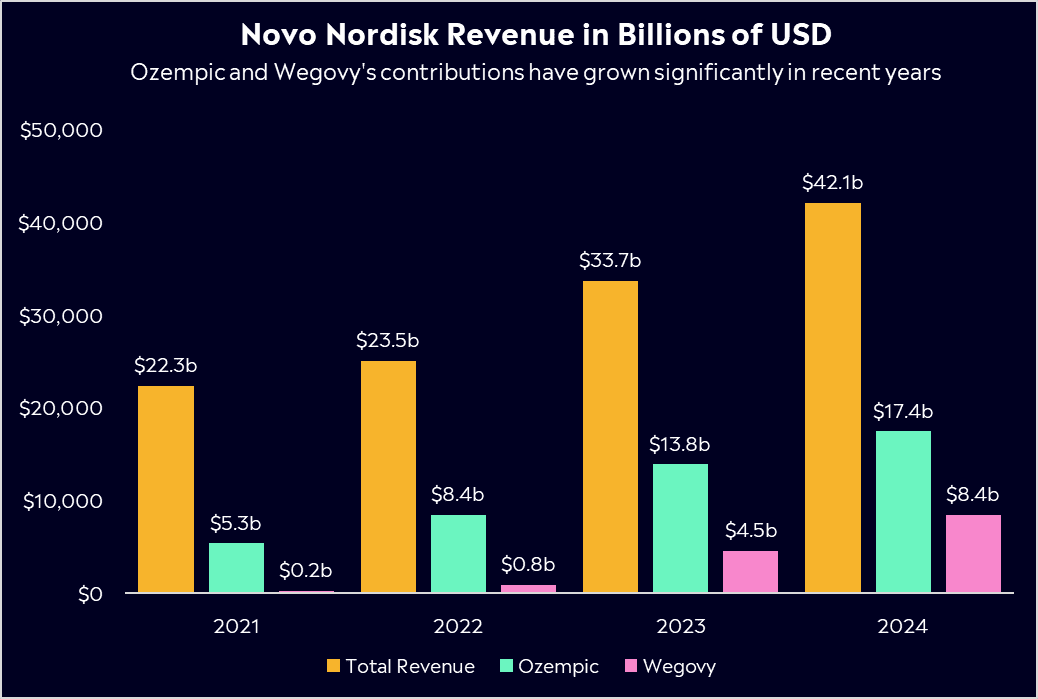

Ozempic remains Novo Nordisk’s money maker, but Wegovy saw 85% revenue growth in 2024, set to grow by 55% in 2025, chasing the tail of Ozempic. Beyond these blockbusters, Novo Nordisk is doubling down on innovation with promising next-generation weight-loss drugs. ‘Amycretin’ and ‘CagriSema’ are two new drugs that are in the trial phase right now. These drugs could be key to sustaining Novo’s dominance in the rapidly expanding obesity treatment market.

Fun Fact: Novo Nordisk goes toe to toe with LVMH as Europe’s most valuable company, briefly surpassing LVMH in early 2025. as demand for its weight-loss drugs skyrocketed. Its market cap at the peak of its shares in 2024 even eclipsed Denmark’s entire GDP!

Past performance is not an indication of future results.

Competitor Diagnosis

The weight-loss drug market is projected to be worth USD 130 billion by 2030, which would require annualized growth of around 50% from where it stands today. This rapid expansion has made the sector highly attractive, with healthcare and biotech firms racing to develop the next breakthrough treatment. While it’s difficult to predict whether the market will reach these targets or which company will emerge as the dominant player, one thing is clear: there is enormous potential in this space.

Novo’s biggest competitor right now is Eli Lilly (NYSE: LLY), which has aggressively expanded its weight-loss and diabetes offerings. Its GLP-1 drug Zepbound (tirzepatide) and diabetes treatment Mounjaro have been rapidly gaining traction, with Zepbound recently securing FDA approval for weight loss. Some studies suggest that Zepbound may be more effective than Wegovy or Ozempic in terms of weight reduction. Eli Lilly’s key competitive advantage lies in its diverse portfolio, which includes Alzheimer’s, eczema, and cancer treatments, allowing it to weather industry shifts better than single-focus competitors.

Although Novo Nordisk and Eli Lilly currently dominate the space, other major players are entering the game. Companies like Pfizer (NYSE: PFE) and Amgen (NASDAQ: AMGN) are developing next-generation weight-loss drugs that could shake up the competitive landscape. Pfizer, in particular, is working on its own weight-loss treatments, which could apply pressure on both Novo and Eli Lilly as the market expands.

With the market growing rapidly, smaller biotech firms are also developing new obesity treatments that could challenge Novo’s dominance. Companies like Altimmune (NASDAQ: ALT) and Viking Therapeutics (NASDAQ: VKTX) are working on alternative GLP-1 formulations, aiming for better efficacy, fewer side effects, or different delivery methods, which could disrupt the current standard of treatment.

Past performance is not an indication of future results.

Financial Health Check

Novo Nordisk ended 2024 on a strong note, reporting USD$42 billion in revenue. Sales have grown 25% year over year and have doubled since 2021, while operating income reached USD$18.6 billion, also up 25% from the previous year. The company’s explosive expansion continues to be fueled by its GLP-1 blockbusters Ozempic and Wegovy.

GLP-1 diabetes treatments now account for over 50% of total sales, but it is the obesity drug Wegovy that is attracting the most investor attention. With sales now making up 20% of total revenue, concerns about Wegovy’s growth slowing have eased. Management’s 2025 guidance remains strong, forecasting 19-27% operating income growth, driven by continued demand for GLP-1 treatments. However, Novo Nordisk still faces pricing pressures on insulin and slower growth in its rare-disease segment, making obesity and diabetes treatments the company’s primary growth engine.

While quarterly results will continue to impact share price movements, R&D breakthroughs may be the key catalyst for 2025. The mixed reaction to CagriSema’s trial results in December and the positive momentum from Amycretin’s Phase II data in January illustrate how clinical developments are shaping investor sentiment. If Novo can continue to innovate in the obesity market, its share price may be driven more by pipeline advancements than short-term earnings growth in 2025.

It’s worth noting that President Donald Trump’s rollout of widespread tariffs could pose a threat. With approximately 60% of Novo Nordisk’s sales of diabetes and weight-loss medications derived from the U.S. market, the company’s largest and most important market could face headwinds. However, Novo Nordisk already operates production facilities in North Carolina for its blockbuster drugs Wegovy and Ozempic and recently announced plans for further expansion. Since production is already occurring on U.S. soil, the impact of tariffs may be muted.

Buy, Hold or Sell?

Within the last 12 months, shares have fallen by around 30%. Much of this weakness has followed the announcement of trial results for their next-generation weight-loss drug, CagriSema. Although the results showed a good weight-loss profile, some investors had hoped for even better data. Despite those results, Novo Nordisk isn’t a one-trick pony, and it recently received more promising Phase II data for its new drug, Amycretin. It’s a potential next-generation weight-loss drug that has shown superior efficacy compared to Novo’s blockbuster Wegovy, raising hopes for its potential to become the next golden egg. While the latest study won’t impact Novo’s short-term earnings, it strengthens its long-term position in the increasingly competitive weight-loss market.

From a valuation perspective, that has changed significantly, with shares now trading at a very modest 22x forward earnings. That’s lower than its five-year average of 31x and far below its peak of 43x back in June. For comparison, Eli Lilly currently trades at 37x. So, although Novo’s valuation is on the high end, it’s certainly not unreasonable, especially for a company with such a strong growth profile. Given the valuation and recent weakness in shares, analysts see strong upside potential for Novo Nordisk. According to Bloomberg’s Analyst Recommendations, it boasts 23 buy ratings, 9 hold ratings, and 2 sell ratings, with an average price target of DKK 821, implying a potential 37.5% upside. Although Novo’s long-term earnings outlook has faced some resistance, the outlook is far from ruined. As a first-mover with Wegovy and a promising R&D pipeline, Novo is well-positioned to remain a significant player in the rapidly growing weight-loss market.

Explore Novo Nordisk

*Data Accurate as of 06/02/2025

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.