Netflix has mastered the art of keeping us glued to our screens, driving a record-breaking year in 2024. The streaming giant is evolving rapidly. Ad-supported plans, password-sharing crackdowns, and live sports are shaping its next growth phase. With shares up over 1700% in the last decade, the question is, can Netflix’s winning formula continue delivering blockbuster returns? Let’s find out.

- It was a record 2024 for Netflix, adding 40 million new subscribers for the year, with net profit rising by 61%. Netflix is proving it can keep scaling, raise prices, and still pull in more users.

- Netflix’s 2025 outlook is strong as it scales live sports, expands its ad-supported tier, and raises prices. However, competition and consumer spending pose challenges.

- Analysts are positive on Netflix. According to Bloomberg’s Analyst Recommendations, it boasts 45 buy ratings, 17 hold ratings, and 2 sell ratings. With an average price target of USD$1049.24, that implies a 10% upside.

View Netflix Stock

The Basics

Netflix, once a DVD-by-mail pioneer, is now the undisputed online streaming king. It’s amassed over 300 million subscribers in over 190 countries. It has made itself a one-stop shop for entertainment. It was originally known for its series, movies, and documentaries, but it is now making big moves in live sports and gaming. The business makes its money with three simple plans: Standard with Ads, Standard, and Premium. Netflix’s ad tier, introduced in late 2022, aims to capture cost-conscious viewers and has now created another revenue stream through advertising. This tier has been a hit with consumers. In Q4 2024, Netflix said 55% of sign-ups in ad-tier-supported countries went to the advertising plans.

So, what has led Netflix to become the streaming king?

- Content as an Asset: Netflix owns many of its originals outright, which provides long-term value. Unlike some competitors, Netflix doesn’t rely as heavily on licensing deals, meaning fewer costs down the line as its library ages. They have established themselves as a media company and generated whole new series’ based on binge-watching.

- Data-Driven Decisions: Netflix spends $17 billion annually on content but leverages viewership data from its vast user base to invest strategically. Every decision Netflix makes, whether it’s greenlighting a show, personalising your homepage, or deciding release schedules, is driven by an immense trove of viewer data. This analytical approach reduces risk and boosts engagement, making content investments more efficient.

- Global Appeal, Local Touch: Netflix invests heavily in local-language content, with breakout hits like Money Heist (Spain) and Squid Game (South Korea) showing its ability to capture markets beyond the most well-known markets. These hit shows often cost less than large-scale Hollywood productions yet deliver outsized subscriber growth and have been key to its international success.

- Diversifying Revenue Beyond Subscriptions:Though subscription revenue still accounts for over 90% of Netflix’s income, the introduction of its ad-supported tier marks a significant shift. This tier is designed to capture a broader audience while opening doors to high-margin advertising revenue, which could become a multi-billion-dollar business in the coming years.

And for shareholders? They’ve reaped the rewards. In 2024, shares jumped 83%, taking Netflix’s 10-year return to over 1700%.

Fun Fact: Netflix once offered to sell itself to Blockbuster for $50 million in 2000, but Blockbuster turned the deal down. Today, Netflix’s market value exceeds $150 billion, while Blockbuster has just one store left in the world.

Past performance is not an indication of future results.

Competitor Diagnosis

Netflix is the leader in streaming, which means it faces fierce competition from major players like Disney+, Amazon Prime Video, and Apple TV. Evolving content trends have intensified the battle for subscribers, particularly as the industry shifts focus from growth at all costs to profitability. Sports continues to be a bigger part of the content pie more than ever. Get that right, and you’re onto a winner, just like Netflix has proved.

- Disney+: Leveraging its legacy franchises like Marvel, Star Wars, and Pixar, Disney+ appeals to a broad audience, particularly families. International expansion and bundled offers (Hulu and ESPN+) give it a strong pricing advantage.

- Amazon Prime Video: With a vast content library and the backing of Amazon’s billion-dollar balance sheet, Prime Video excels through its bundled Prime memberships that offer more than just streaming. Its investment in live sports, including the NFL, makes it a unique challenger.

- Apple TV+: Known for its premium content, Apple TV+ has become a force in the streaming market by focusing on quality over quantity. Its close integration with Apple’s ecosystem and its bundling through Apple One offer further value for its users.

Where these competitors succeed is that they offer more than just streaming. Whether that’s delivery through Amazon or Cloud Storage through Apple, arguably, consumers are getting more value. But, most importantly, the content is clearly not as good, giving Netflix the upper hand, given their scale, innovation, and relentless content investment, driving engagement and retention rates. However, staying ahead will require navigating growing competition while maintaining profitability. As rivals scale their platforms, Netflix has no time to rest on its laurels. Investors should also be aware that continued price hikes from Netflix may test consumers’ limits. Although its new ad-supported tier is a success, prices are already rising, which could cause price-conscious consumers to switch off.

Financial Health Check

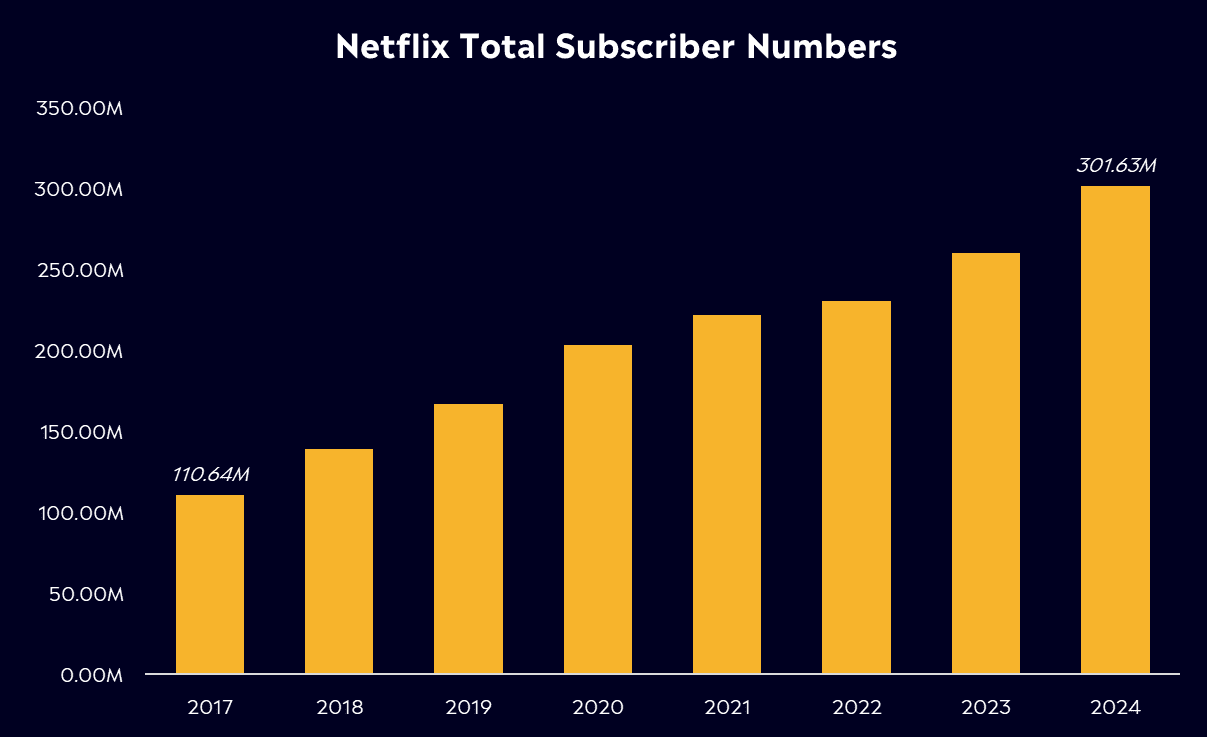

Netflix’s Q4 earnings were handed down earlier this week, and they were an absolute home run. The company added a record-breaking 18.91 million new subscribers in the quarter, bringing its global total to 301.63 million. That historic quarter capped off a record year for Netflix, adding 41 million subscribers in 2024. Their content slate throughout the year has driven new users to the platform, from local-language productions like Squid Game 2, which attracted 67 million viewers on the week of its release. To live sports, such as Mike Tyson vs Jake Paul, which drew 108 million live viewers worldwide, the highest number in the history of live-streamed sports.

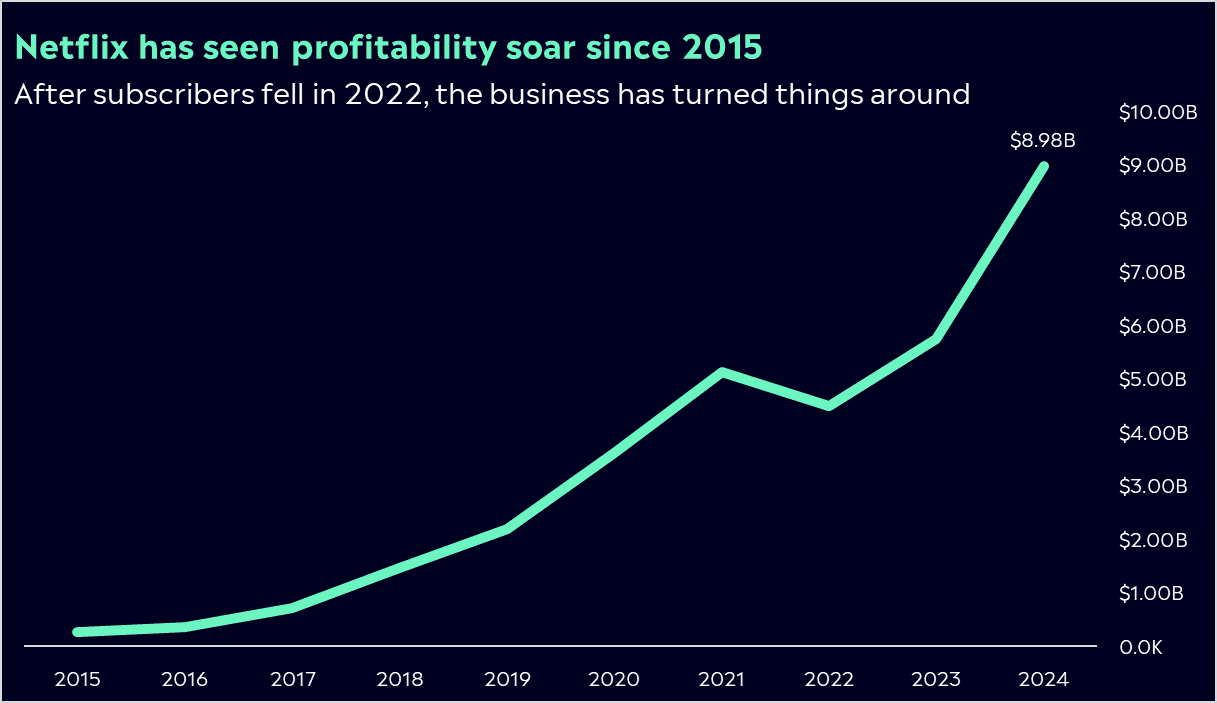

Revenue rose to USD$10.25 billion in the quarter, up 16% year over year, while operating margin for the full year rose to 26.7%, up from 20.6% last year, demonstrating its ability to scale effectively even as it invests heavily in new content and initiatives like live sports. This saw net profit jump 61% to $8.7 billion in 2024. Netflix also announced a $15 billion share buyback programme. This marks the largest buyback in the company’s history and highlights its robust cash flow and financial confidence. To top off the result, it also raised its full-year revenue and operating margin guidance for 2025.

Investors’ focus, though, now shifts from subscriber numbers to financial metrics. This will be the last time Netflix reports quarterly subscriber numbers. We look to double-digit revenue growth, widening margins, expanding free cash flow and long-term profitability as the focus for investors. Ongoing live sports are set to keep driving users and its advertising segment in 2025. If its content lineup keeps delivering, that justifies price increases, meaning that Netflix’s growth won’t be slowing down anytime soon.

Past performance is not an indication of future results.

Buy, Hold or Sell?

Netflix’s content breadth makes it a standout right now. They promised better content in 2025, which should drive engagement and growth. With pricing power and a growing advertising revenue model, this creates a solid long-term runway for Netflix. With shares rallying in the last year, it’s now trading at 36x forward earnings, making the stock slightly pricey. Its impressive profitability must stay high with a lot of optimism already priced into shares. Nonetheless, Netflix is proving it can keep scaling, raise prices, and still pull in more users. That won’t come easily, though, with its formidable competitors likely to put up a fight. Plus, if US interest rates don’t budge, consumers may feel the need to tighten their belts, and a Netflix subscription could be first off the list, especially if prices keep rising.

Analysts still believe there is further upside for Netflix shares. According to Bloomberg’s Analyst Recommendations, it boasts 45 buy ratings, 17 hold ratings, and 2 sell ratings. With an average price target of USD$1049.24, that implies a 10% upside. While Netflix’s valuation might seem steep, its ability to evolve and remain the go-to platform for millions sets it apart. The continued rollout of new revenue streams, such as the ad-supported tier and its focus on live sports and localised content, gives Netflix a competitive edge in driving future growth.

View Netflix Stock

Data Accurate as of 23/01/2025

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.