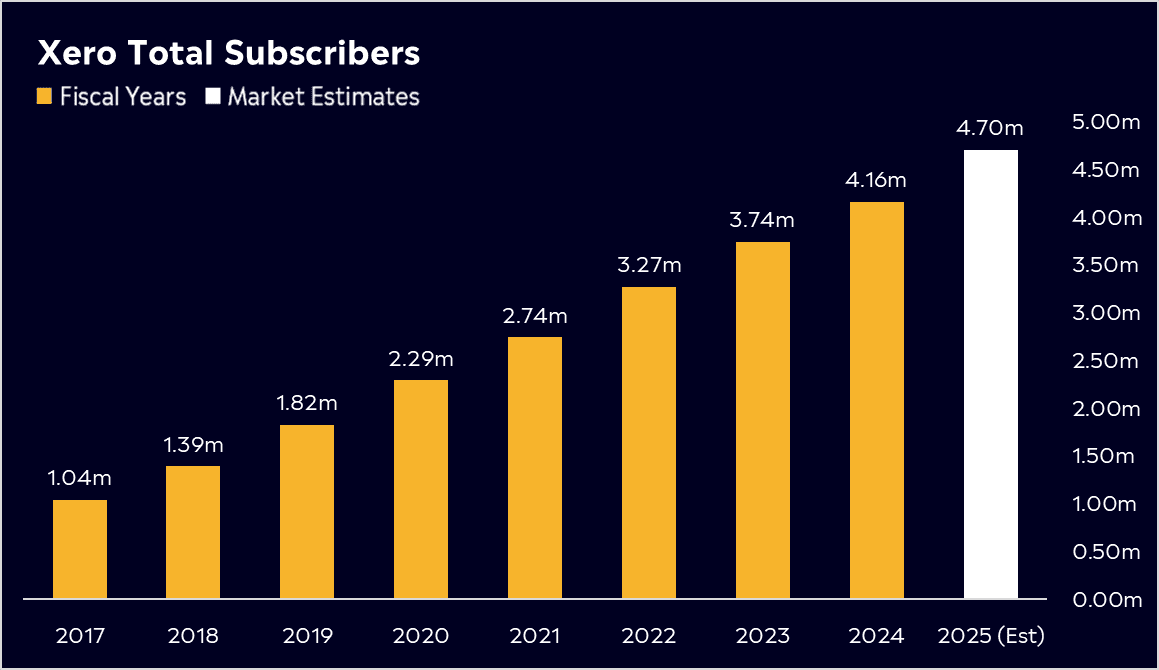

- Xero has almost doubled its subscriber base in the last four years and is moving from strength to strength, focusing on further growth in the US.

- Recent full-year results beat expectations, with profitability accelerating 270% year over year as gross margins expanded. Shares have risen more than 20% in the last 12 months.

- Expectations are high, and that’s clear with a steep valuation. But, Xero has 14 buy ratings, 3 holds, and 1 sell according to Bloomberg.

View Xero

The basics

Xero is a leading ASX-listed technology company that offers cloud-based accounting software. Founded in New Zealand in 2006, Xero connects small business owners with their numbers, their bank, and their advisors anytime, essentially eliminating messy paper or Excel documents. This has enabled businesses to simplify their everyday admin and automate day-to-day tasks, helping Xero become one of the fastest-growing SaaS companies globally.

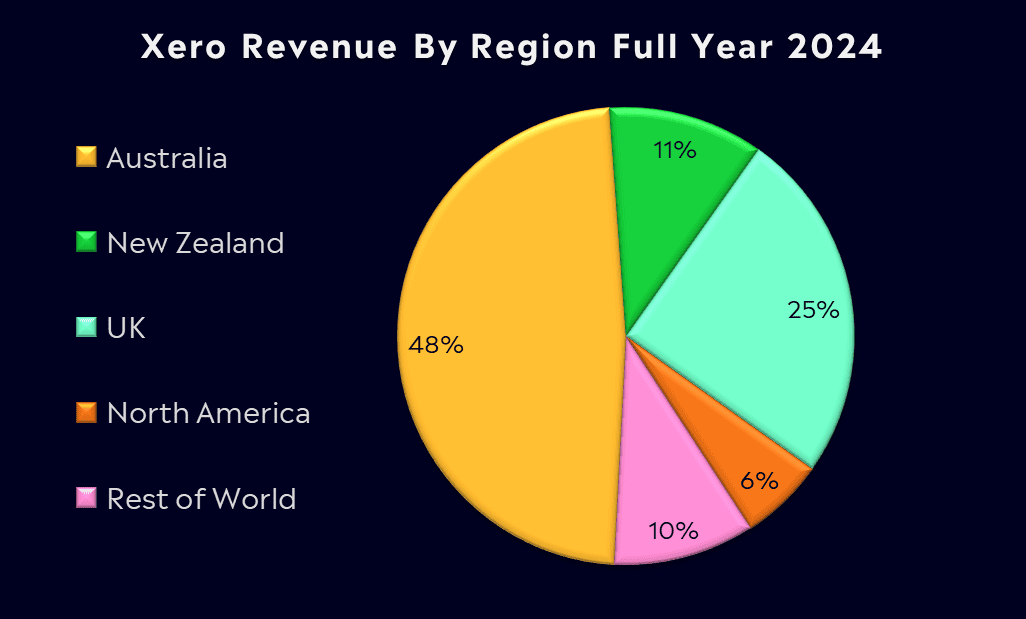

After years of solid growth, Xero now has 4.16 million subscribers globally. Subscribers are how Xero makes its money, and the revenue is split worldwide. The bulk of the revenue comes from Australia, making up 48% of revenue, while the rest comes from key international markets such as the UK and North America. International growth is key for Xero, with a strong footing established in Australia and New Zealand.

Competitor Diagnosis

Xero has a high-quality, scalable product, but the accounting software space is highly competitive, with big names that include the likes of, Oracle, Intuit and Sage. North America has been the tough nut to crack for Xero despite spending millions there in recent years, with QuickBooks, owned by Intuit, the clear leader.

There is a huge addressable market for Xero in the US, but Intuit is around ten times bigger than Xero, meaning it has the financial power to outspend against competitors on marketing.

Xero has made efforts to improve its products and services by including AI in its software, an important step to keep up with competitors. CEO Sukhinder Singh Cassidy has said her focus is still on the US, and given that she only joined in November 2022, strategy shifts can take a few years to bear fruit.

Financial Health Check

Within the last year, Xero has gone from being a loss making business to profitability. In its recent full-year results, the company reported net income of NZD$174.6 million vs NZ$113.5 million net loss last year. This result was better than expected, and was helped by improving gross margins with improvements to efficiency and cost increases that are now bearing fruit.

Two other important areas were annualised monthly recurring revenue that saw growth of 26% year over year, while average revenue per user climbed by 14%. Growth in these areas helped drive revenue to NZD$1.7 billion, up 22% year over year. We’re starting to see the early signs of what’s ahead for Xero, and it looks promising.

Importantly, free cash flow also saw a big jump to NZD$342.1 million, allowing the business to continue investing in its international expansion.

Buy, Hold or Sell?

Xero’s full-year results show they continue to move in the right direction, and that is reflected in the range of broker upgrades in recent weeks. CEO Sukhinder Singh Cassidy has been laying the groundwork for these results over the last 18 months. According to Bloomberg’s Analyst Recommendations, Xero has 14 buy ratings, 3 holds, and 1 sell, with an average price target of $149.78.

However, expectations are high. The business’s valuation is steep, trading at 10x price to sales and 82x forward price-to-earnings, leaving little room for error. But, so far, Xero has delivered.

Xero is competing in a large addressable market with quality software, proven by its sublime retention rate at 99%. There is a huge opportunity globally if Xero can execute its global expansion strategy in the right way, especially if it can keep growing profits at a solid pace.

View Xero

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.