Just a few weeks ago, a global IT outage caused widespread chaos, and the company at the centre of it was CrowdStrike. Shares have sunk by more than 40% over the last month following the incident as investors digest the repercussions of the outage. However, CrowdStrike is the leader in a cybersecurity sector that continues to grow, with businesses increasingly relying on robust endpoint security solutions. We’ll explore the details of what happened, its impact and what investors should consider. So, can CrowdStrike navigate the murky waters and keep its growth story intact, or are there more challenges ahead? Let’s find out.

- CrowdStrike has been thrust into the limelight following the global outage, potentially losing some customers’ faith and, therefore, opening the door for competitors to pounce.

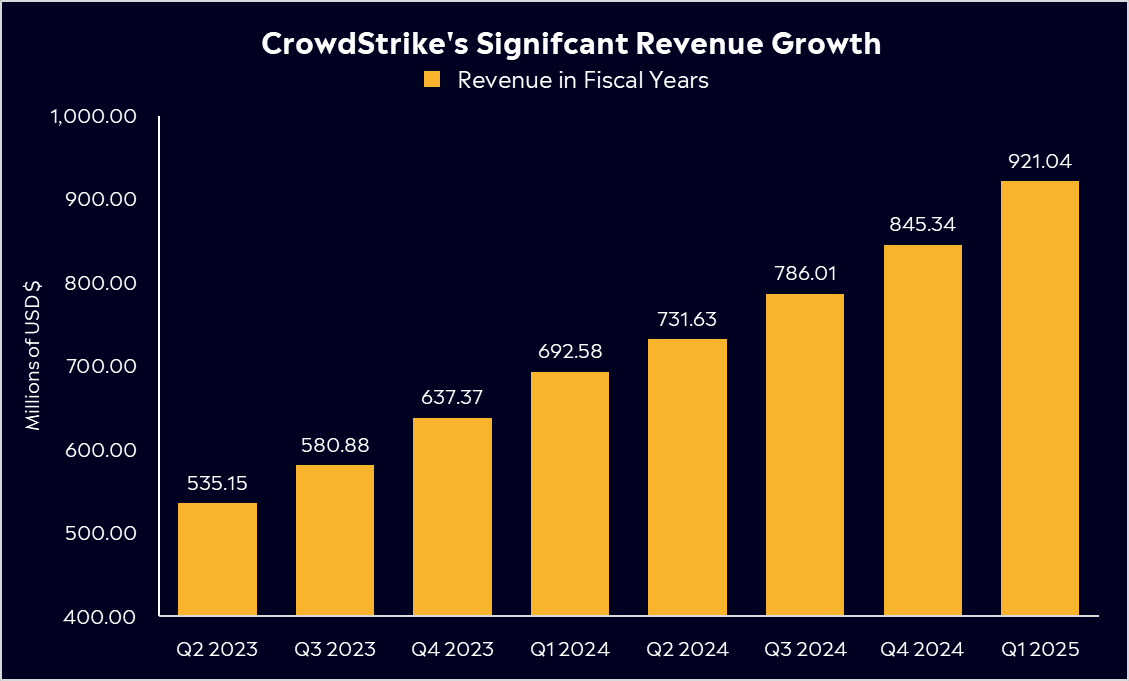

- The business is the leader in cybersecurity and has been growing at a solid rate, with 33% revenue growth last quarter, strong profitability and solid margins.

- Analysts are still bullish, with 40 buy ratings, 10 holds, 1 sell, and an average price target representing over 50% upside for the stock.

View CrowdStrike

The Basics

If you weren’t aware of CrowdStrike a few weeks ago, you probably are now. They’re the cybersecurity firm at the forefront of arguably one of the biggest IT outages in history. CrowdStrike’s ‘Falcon’ platform provides critical endpoint cybersecurity used by major institutions to protect their networks and data. The company is well-established, serving over 298 Fortune 500 companies, and was added to the S&P500 in June.

However, that reputation has taken a pretty hefty dent. In July, a faulty product update caused ‘The Blue Screen of Death’ on Microsoft Windows, rendering devices unusable. It caused havoc globally for airlines, hospitals, governments, banks, broadcasters, and many more industries. While most businesses have since recovered from the outage, there will be repercussions for CrowdStrike.

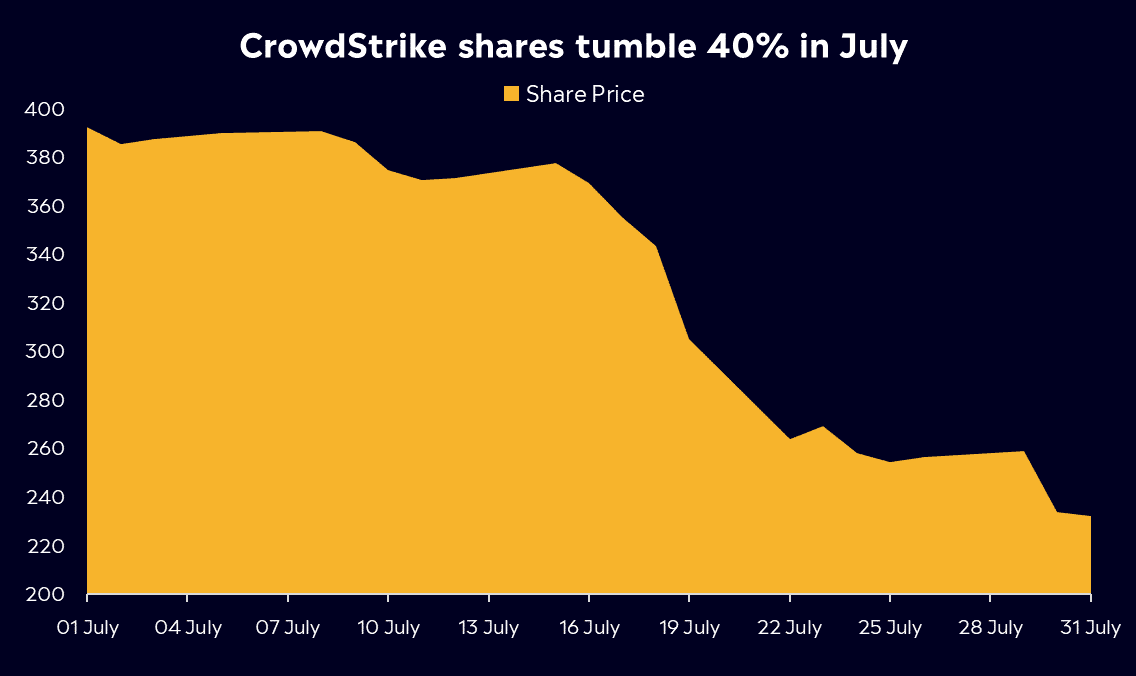

Given the scale of the outage and the unknown severity it may have on the business, shares have been in significant decline. In July, CrowdStrike’s share price fell by more than 40%, making it the worst performer on the S&P500 in that same period.

However, what still stands is how reliant these businesses are on CrowdStrike’s platform. As companies migrate to the cloud and execute digital transformations, endpoint security becomes more significant. Enterprise IT spending on these products is growing, and this outage shows why it is so crucial. Although most consumers may see this outage as a concern or a reason to stay away from CrowdStrike, others will see this as an opportunity. As the saying goes, “Lightning never strikes in the same place twice.”

*Past performance is not an indication of future results.

Competitor Diagnosis

CrowdStrike’s competitors will have been licking their lips following their global mishap, with the view that any new potential CrowdStrike customers would be looking elsewhere. Shares of competitors like Sentinel One and Cisco have risen since the incident. Its main rival, Palo Alto Networks, had been losing ground to CrowdStrike but might benefit from the current situation.

Fortune 500 businesses are expected to face $5.4 billion in costs due to the outage, which could prompt increased scrutiny of cybersecurity providers. Competitors may leverage this opportunity to attract new customers. So, although CrowdStrike may lose some market share to competitors, I would expect to see a boost in cybersecurity spending from enterprises, given the chaos that ensued.

A loss of trust is arguably the cardinal sin in cybersecurity. However, CrowdStrike has established itself within the cybersecurity space, and a change of platform for huge businesses would be time-consuming and costly.

CrowdStrike’s platform is used by the biggest companies in the world because it’s the best. Therefore, if customers were to leave, they’d be leaving for an inferior solution, which should help to limit customer churn. Its superiority is clear in the business’s retention rates, which are more than impressive. Its net revenue retention rate, which measures the average growth of customer spending over time, was 119%, and its net retention rate, customers who stay on the platform, was 98% for Fiscal Year 2024.

Financial Health Check

CrowdStrike’s recent earnings report was strong, with revenue rising 33% year-over-year to USD $921 million and full-year guidance upgraded. Revenue growth has been on an absolute tear in recent years, up by 35% last year and far exceeding that in previous years. Its margins also stand out, with gross margins at around 78%, which look set to grow further thanks to AI integration and scale.

However, this financial strength might be overshadowed for now. The upcoming quarterly report, due August 27th, will be critical and the next two quarters are going to be tricky. The outage likely impacted new bookings, with new customers hesitant to sign deals and sales teams focusing on existing business. The challenge now is navigating potential lawsuits with Delta Air Lines already announcing it is seeking damages.

The positive aspect is CrowdStrike’s quick and transparent response, which should help mitigate some damage and financial impact. Investors might consider a ‘sit and wait’ approach, evaluating the next earnings call. A strong performance could boost the stock, while a weak response may create a potential lower entry point for investors. Much of the bad news might already be priced in, and CEO George Kurtz’s proactive response offers confidence that the growth story remains intact.

*Past performance is not an indication of future results.

Buy, Hold or Sell?

So, what does this mean for you as an investor? As we’ve already mentioned above, there are plenty of factors to consider, including the financial impact and potential loss of business from this incident. The brand damage that this will have caused at a critical period for the cyber security space, and if customers will go through the difficulty of moving to inferior software? Its valuation also remains lofty, trading at 54x forward earnings, which may be justified by the industry’s growth and the firm’s strong development.

That said, analysts are still extremely bullish. The recent weakness has seen some price target downgrades, but its return potential has also increased significantly. According to Bloomberg’s Analyst Recommendations, CrowdStrike has 40 buy ratings, 10 holds, and 1 sell, with an average price target of USD$359.29, signalling a 60% upside.

CrowdStrike is a clear leader in the cybersecurity space. It is a great company with solid long-term prospects, but it will face a number of challenges over the months ahead, which poses risks for investors. Warren Buffett once said to be greedy when others are fearful, and that may prove prudent if CrowdStrike can effectively steady its ship.

View CrowdStrike

*Data Accurate as of 01/08/2024

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.