Qantas is a company that is very well known to most Australians, but the business has been under the pump in the last two years, facing regulatory scrutiny, heightened media attention, and some tough love from the public. Despite this, shares jumped by 21% in that period thanks to sky-high airfares, which sent profits to record highs. With new CEO Vanessa Hudson at the helm, Qantas is embarking on a journey to rebuild trust and restore its brand. So, is this the right time to add Qantas to your portfolio, or will challenges leave the stock grounded? Let’s find out.

- Qantas dominates the Australian domestic market, especially after the collapse of competitors, but faces intense international competition from luxury carriers.

- Despite recent challenges, travel demand is expected to stay strong, while increased spending seems the right choice at the right time.

- Qantas has 13 buy ratings, 3 holds, and 0 sells, with an average price target of $7.17, signalling a 12.2% upside.

View Qantas

The Basics

Qantas Airways, famously known as the ‘Flying Kangaroo,’ is Australia’s largest airline and the nation’s flag carrier. Renowned for its strong brand identity built on safety and reliability, Qantas has long been a symbol of Australian excellence. However, its brand has taken a hit in the last two years following the aftermath of the pandemic, with cancellations, delays, ticket prices, and enquiries from local regulators. During that period, former CEO Alan Joyce managed to steer the company to record profits, but his attention to detail for customers was fleeting at the end of his tenure.

However, Joyce was swiftly replaced with new CEO Vanessa Hudson, who had been with the business for almost 30 years—a smart replacement. She is now looking to repair Qantas’ tarnished reputation by spending in key areas to rebuild consumers’ trust. Her strategy includes enhancing the loyalty program, improving customer service, and promoting greater transparency. While these steps are promising, regaining the confidence of the public will be no easy task.

The company operates domestic and international flights, with award-winning cabins from economy to first class. The company is structured around four main business segments: Qantas Domestic, Qantas International, Jetstar Group, and Qantas Loyalty. While international routes generate a significant portion of Qantas’ revenue, its domestic business is the money maker due to its high margins, meaning its the biggest contributor to EBITDA.

Fun Fact: The Sydney to Melbourne flight path is the most lucrative in the world, generating more revenue than any other route globally.

Competitor Diagnosis

The Australian domestic airline market has seen fluctuating levels of competition, but the recent collapse of Bonza and Rex Airlines has left Qantas and Virgin Australia once again dominating the market. These collapses highlight the difficulties of successfully challenging the duopoly in Australia, where operational costs, regulatory challenges, and customer loyalty make it hard for new entrants to sustain long-term success. For now, Qantas continues to gain market share, and its budget airline, Jetstar, is seeing passenger growth, especially as new aircraft add capacity. This positions Qantas to capitalise on the gaps left by its recent rivals’ exits, particularly in the low-cost segment, but investors should keep one eye on ongoing reforms to raise competition in Australia.

Internationally, though, Qantas faces much stiffer competition, with the world’s biggest airlines stealing its lunch in recent years. It recently lost its place among the SkyTrax ‘Worlds Best Airlines’ after ranking 5th in 2022, with airlines such as Qatar Airways, Singapore Airlines and Emirates enticing consumers with their luxury fleets and quality service.

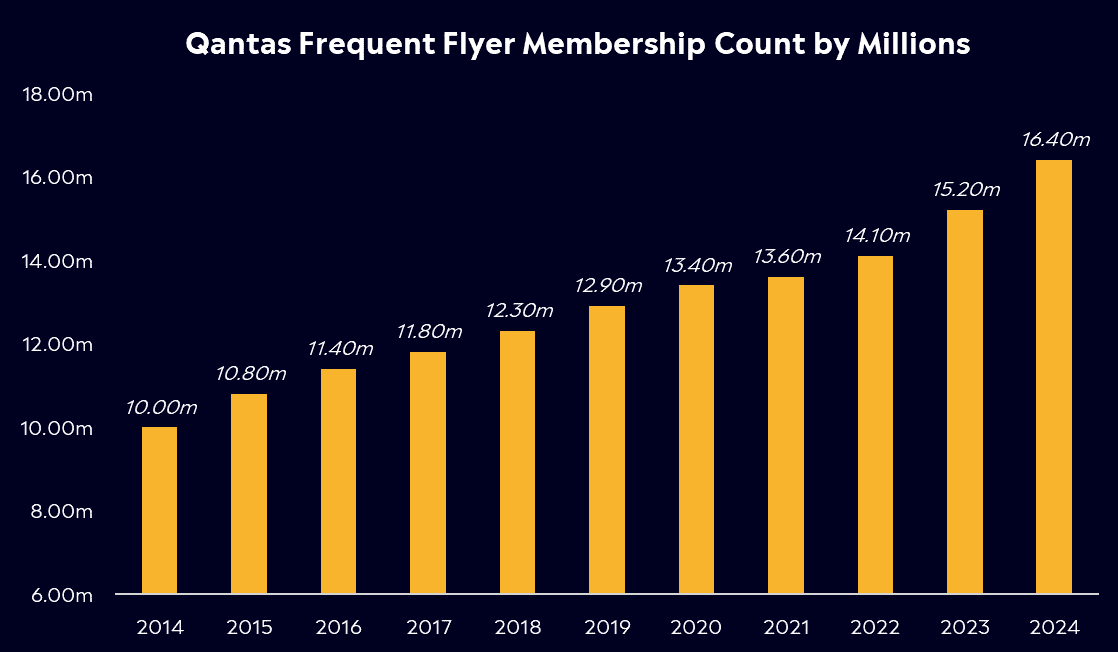

One of Qantas’ standout competitive advantages is its Qantas Loyalty program, which is not just a frequent flyer program but a comprehensive ecosystem that deeply integrates customers into the Qantas network. The program’s success lies in the variety of ways members can earn and redeem points. Members are encouraged to use Qantas-branded credit cards, spend their points on flights, purchase wines, insurance, and even take out mortgages through the program. This creates a loyalty cycle where customers are more likely to choose Qantas for their travel needs to maximise their benefits while also offering a defensive revenue stream.

Financial Health Check

Qantas’ soaring profits took a dent in FY2024 as new CEO Vanessa Hudson’s push to restore trust coincided with moderating airfares. Everything comes with a price, and the cost of rebuilding Qantas’ tarnished public perception through improved customer initiatives is hurting its bottom line. Revenue for the year came in at AUD$21.9 billion, missing estimates, while net income fell 28% year-over-year to AUD$1.25 billion, also missing the mark. However, these results were in line with expectations, it saw lower fuel costs and domestic airfares look set to grow, all positives to take away.

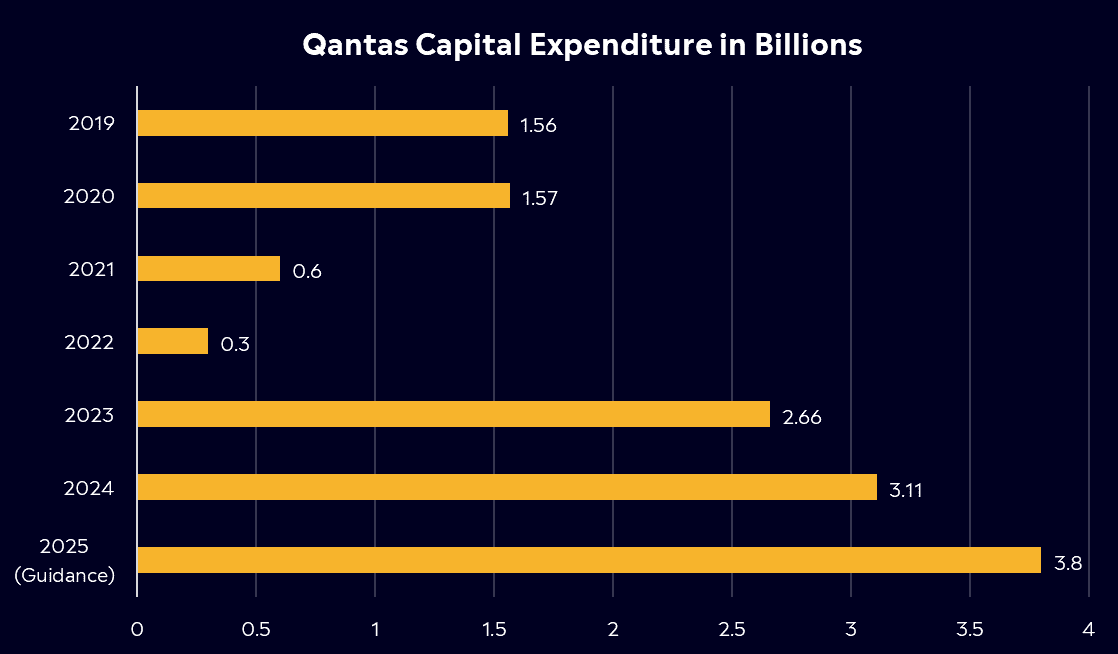

Qantas’ capital expenditure is growing. They’re opening up their purse because their fleet is ageing and reaching retirement age. For a long period, Qantas delayed upgrading its planes to defer increasing capital expenditure, and depreciation expenses can also outweigh increased running costs. It is the most significant fleet renewal in its history, including 12 new Airbus A350-1000s set to arrive in 2026, which will operate ‘Project Sunrise’ from Sydney to London.

That doesn’t come cheap, though, with net debt at AUD$4.1billion in FY2024. That may come as a worry for some shareholders as the business is still healing from the pandemic, but investors should see its spending on new customer initiatives and its shiny new fleet as a runway for growth and that its increased spend is quite simply a necessity.

Its dividend didn’t reappear in FY2024, which seems like a smart choice for now – but investors can be optimistic of Qantas’ view that its dividend may return this time next year. For that to happen, bookings and travel demand will need to stay robust, which seems completely feasible.

Buy, Hold or Sell?

Qantas has continued to benefit from the resurgence of travel demand locally and internationally. Travel after the pandemic has even been coined as ‘revenge travel’ with consumers unwilling to give up on travel after years of having it taken away. This new wave of travel is a huge win for Qantas at a time when new CEO Vanessa Hudson is taking the necessary steps to make the airline great again.

With travel demand looking set to stay robust, analysts are positive about Qantas’s future. According to Bloomberg’s Analyst Recommendations, Qantas has 13 buy ratings, 3 holds, and 0 sells, with an average price target of $7.17, signalling a 12.2% upside.

Its journey in the next year will certainly be a turbulent one; managing ongoing ACCC investigations, continuing to repair its damaged reputation and navigating increased spending. It won’t be a one-way flight to success, but it feels like Qantas’ is making the right moves at the right times to get back to its best.

View Qantas

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.