Gold has been a staple in investment portfolios for centuries, and even in 2025, it’s still proving why it deserves a place. Gold prices just hit a record high of USD$3057/oz with Trump’s presidency creating uncertainty, rising geopolitical tensions and continued central bank buying. The good news? Owning a slice of the shiny metal is more accessible than ever. Instead of stashing away coins or bars in a vault, investors can now gain exposure via exchange-traded funds (ETFs). But in today’s world of tech stocks, AI and crypto, does gold still have a role to play in your portfolio? Let’s find out.

- Gold has hit record highs amid rising geopolitical tensions, inflation concerns, and tariff-related uncertainty, reminding investors why it’s long been a trusted safe haven.

- ETFs have democratised gold investing, allowing everyday investors to add a time-tested asset to their portfolio with just a few clicks.

- Are gold miners making a comeback? The top five performing ASX stocks this year are all gold miners, outperforming physical gold this year as improved fundamentals and strong cash flows attract renewed interest.

Why is gold performing well right now?

As the saying goes, ‘Diamonds are forever’, and in an investment portfolio, investors may view gold in the same light. Think of gold as a financial security blanket, it’s the asset many turn to when storms are brewing and offers beginner, intermediate and advanced investors a ‘safe haven’ in times of uncertainty. Gold is a commodity, which means supply and demand drive its price fluctuations. As demand increases from investors, central banks, institutional firms, semiconductor companies, jewellers, and so on, gold’s price will rise.

In March, Gold hit an all-time high of USD$3057/oz (AUD$4870/oz), and as of the time of writing, it’s still hovering near those record highs, rallying 16% YTD. So, what’s driving it? Most recently, its been the uncertainty caused by President Donald Trump and his tariff tantrum. The latest trade announcements from the US have created market uncertainty, and markets hate uncertainty. Investors are witnessing a trade policy that can change from day to day, with Trump taking aim at most countries and regions, so it’s not surprising that more investors are seeking cover in the precious metal. Meanwhile, persistent inflation concerns, linked back to tariffs, have revived interest in gold as a hedge.

Another key driver has been continued geopolitical uncertainty – from tensions in Eastern Europe to instability in the Middle East, global risks have kept investors on edge. Then we’ve got central banks. In recent years, countries like China and India have been adding to their gold reserves at a record pace, partly as a move away from reliance on the US dollar. This institutional demand has provided a powerful tailwind for gold.

Fun Fact: The standard gold bar known as the Good Delivery bar is 400oz of gold or 12.4kg. As of those record-high prices, it will now set you back a cool $1.22 million.

*Past performance is not an indication of future results.

The precious metal at your fingertips

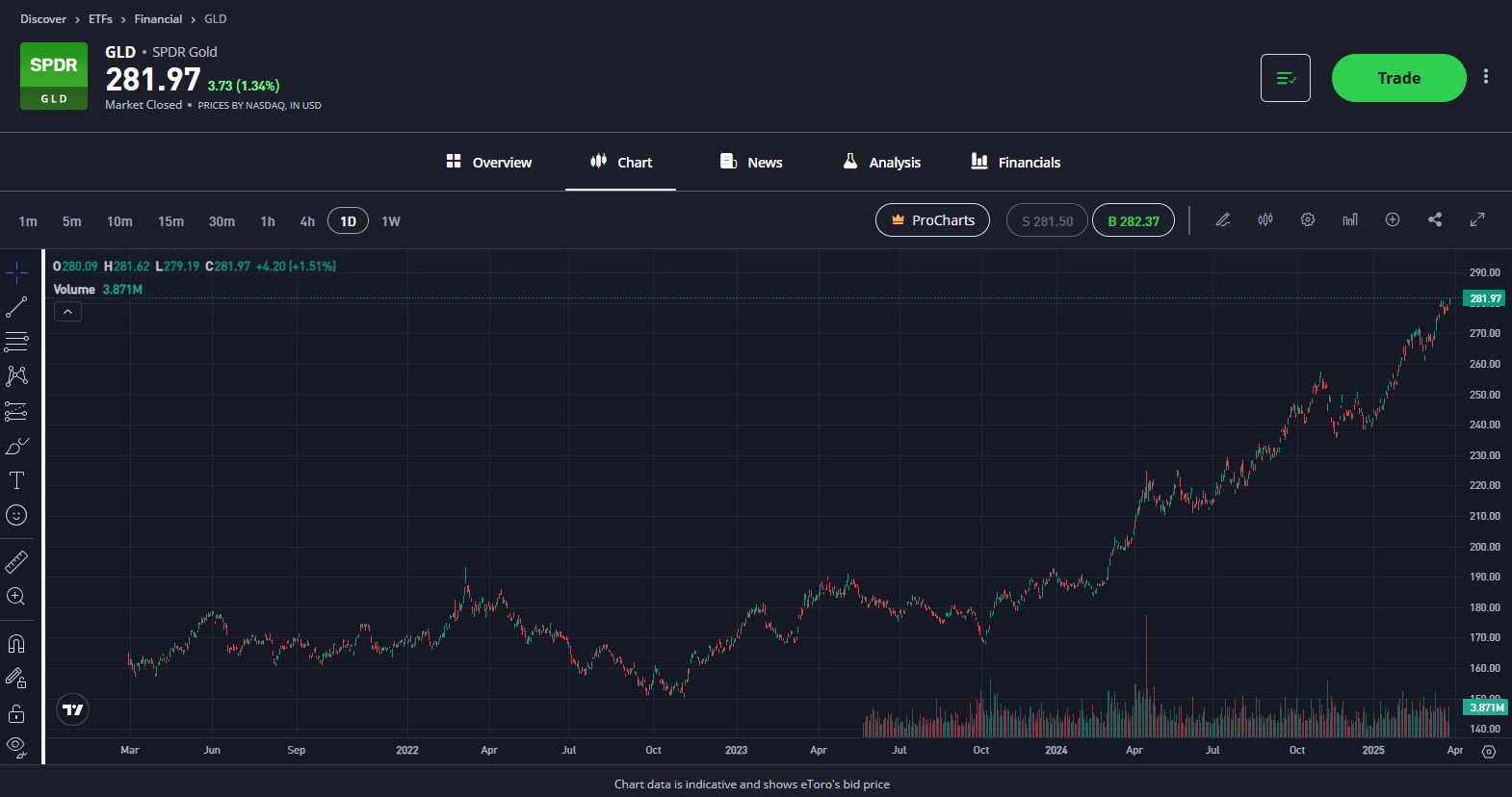

The fun fact above shows how important more accessible investing in assets like gold is. One of the reasons gold has become so accessible to retail investors is gold ETFs and similar investment products. In the past, if you wanted to invest in gold, you had to buy physical gold bars or coins, worry about authenticity, find a safe place to store them, and eventually find a dealer to sell to when you wanted to cash out. Today, ETFs like GLD have streamlined the process. When you buy a slice of the gold ETF, you are essentially purchasing a piece of the physical gold that the fund holds in custody. For example, GLD stores gold bars in London vaults on behalf of shareholders. You don’t have to think about vault security, insurance, or transportation, it’s all handled by the fund.

With a gold ETF, you can trade gold just like a stock, anytime the market is open. If you suddenly need cash or want to rebalance, you can sell your gold ETF shares in seconds. And that’s the beauty of these modern gold vehicles: you can invest in gold without turning your living room into a mini Fort Knox.

Gold as a Safe Haven

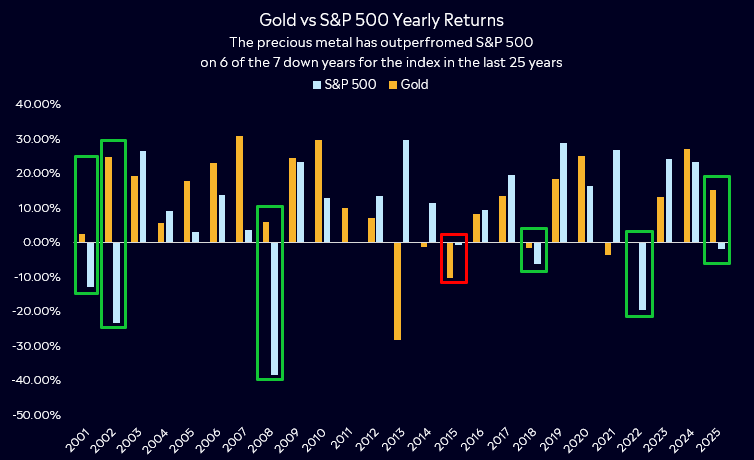

When markets turn gloomy, gold often shines. Investors call gold a “safe haven” because it tends to hold its value, or even increase, during uncertain or volatile periods. It’s like an insurance policy for your portfolio: when share prices are falling and uncertainty is high, gold can provide a proven sense of stability. Gold has historically had a low or negative correlation with traditional assets like stocks and bonds. That means when stocks are falling, gold often outperforms, helping cushion portfolio losses. This diversification benefit is one of the key reasons why gold is often suggested as part of a balanced portfolio.

During the 2008 financial crisis, for instance, the S&P 500 fell around 38%. While Gold initially dipped in the panic, it ended 2008 with a +5.5% gain. Over the next two years, 2009 and 2010, gold actually rose more than 25% each year, providing a crucial buffer for investors and outperforming the S&P500.

Fast-forward to 2020, during the pandemic-related market sell-off. Central banks and governments leapt into action, and investors sought safe assets. Gold surged to all-time highs after an initial sell-off. By early August 2020, gold hit a record of around $2,070/oz amid the chaos. Once again, gold outperformed the S&P500 that year. In 2025? A similar scenario. Gold is up 16% for the year while the S&P500 is down -3.2% and the ASX200 is down -2.64%. Clearly, data shows that during major stock market corrections, gold either falls far less or actually goes up. It doesn’t always outperform, but it moves to a different rhythm than share markets. And that’s incredibly valuable when you’re trying to smooth out returns and reduce volatility over time. Whether it’s geopolitical conflict, a banking crisis, or soaring inflation, gold often benefits from a “flight to safety.”

Gold has a long-standing reputation as a hedge against inflation. Unlike dollar bills or other fiat currency that governments can print in unlimited quantities, gold is a tangible asset with a relatively fixed supply. You can’t just create more gold out of thin air, so each ounce of gold generally retains its worth over time. While gold does provide that portfolio buffer, it’s not immune to ups and downs. When interest rates go up, gold becomes less attractive. If you can earn a good, real return from bonds or savings accounts, holding gold (which pays no interest or dividends) has a higher “opportunity cost.” When the US dollar is strong, gold tends to be weaker (they often move in opposite directions). A firmer dollar also makes gold more expensive for overseas buyers, dampening demand and weighing on the price.

Past performance is not an indication of future results.

Gold or Gold Miners?

It’s important to clarify that investing in gold is not the same as investing in gold mining companies. While both offer investors exposure to the shiny metal, they have varying risk profiles. Physical gold, as we know, has become a reliable store of value, while gold miners provide a slightly different risk element but do provide a proxy for the gold price. Gold miners present additional layers of risk, tied not only to gold prices that come with market fluctuations but they also have the complexities that gold doesn’t have, think: corporate management, mining costs, debt levels, exploration success (or failure), and so on.

Before the first Gold ETF was launched back in 2003, gold miners traded at a premium as investors sought gold-producing tangible assets and therefore became a preferred investment method for those looking to gain exposure. The best way to put gold vs gold miners is a bit like this. If gold is the steady, shiny metal itself, then gold mining stocks are like the adventurous treasure hunters, potentially rewarding but with more risk along the way, as mentioned above. In good times, these stocks can often amplify gold’s gains because miners’ profits can surge when gold prices rise. We’ve seen that to start this year with the top five gainers on the ASX200 in 2025, all gold miners, each gaining over 40% with West African Resources leading the pack with a 60% gain.

Although gold has arguably faired better in the last decade, there are still reasons to own gold miners. Their outperformance to gold this year is thanks to improving fundamentals, with companies ramping up dividends and buybacks while valuations have become far more attractive after years of underperformance. Newmont Mining, the world’s largest gold miner, has been generating significantly better cash flows in recent years, with its net change in cash up by over 300% at the end of 2024. Time will tell if this is truly the miners’ moment to shine, but the interest and momentum building in 2025 suggest that the long-unloved gold mining sector might finally be regaining some of its sparkle.

Some seasoned investors may choose a two-pronged strategy, holding a bit of both physical gold via an ETF and, in some cases, a small exposure to miners. If you’re looking for stability, you’re looking for the physical asset via an ETF, but if you’re open to taking on a little more risk in the view of higher returns, then gold miners could provide that.

Past performance is not an indication of future results.

Gold vs Bitcoin

In recent years, a new contender has entered the scene: bitcoin. Often dubbed “digital gold,” Bitcoin has attracted a following of investors who see it as the modern equivalent of gold—a store of value and hedge against fiat currency debasement. Both gold and Bitcoin share some similarities: neither is tied to a company’s earnings or bond interest payments, and both have limited supplies (gold by nature, Bitcoin by code).

Volatility is the first big difference. Gold has earned its safe-haven reputation over centuries, whereas Bitcoin is still arguably in its infancy and has behaved more like a high-risk asset throughout its history. If your primary aim is portfolio insurance and stability during crises, gold’s long history and lower volatility make it the more reliable choice. Bitcoin is more of a speculative diversifier – it might play a role in a portfolio, but it’s not a proven safe haven in the way gold is.

As institutional adoption grows and regulatory clarity improves, bitcoin and crypto are gradually alleviating their purely speculative image and growing toward mainstream acceptance as assets that deserve a place in investment portfolios. This built-in scarcity underpins the idea that Bitcoin should hold its value when inflation erodes the purchasing power of dollars. Over the past decade, Bitcoin’s price appreciation has well outpaced inflation. However, in 2022, when inflation in the U.S. and Europe hit decade highs, bitcoin’s price fell 65% for the year, even as gold stayed roughly flat.

Bitcoin is a promising but still maturing asset that, under the right conditions, can act as a hedge. However, it still falls short of the consistency that traditional hedges like gold offer. For now, investors see it as a long-term store of value, not a safe haven.

Does gold still have a role to play in your portfolio?

Quite simply, yes. However, some younger investors with a high-risk tolerance and long time horizon might favour Bitcoin or high-growth stocks as their “alternative” asset and skip gold entirely. In my experience, the question of gold in a portfolio often comes down to this: Does it help you stay disciplined and calm? If knowing you have a bit of gold helps you not panic-sell your stocks in a downturn because you see something in your portfolio holding value, then gold is doing its job.

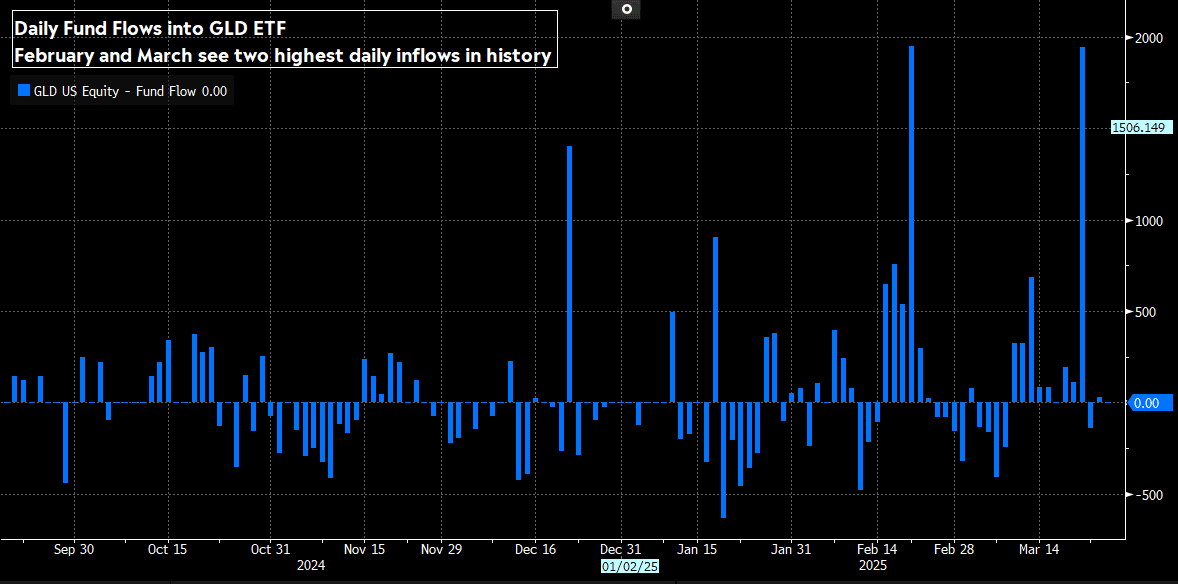

In today’s world of inflation worries, geopolitical conflicts, and uncertainty, gold as a portfolio stabiliser can be worthwhile. On the other hand, it’s important to keep expectations realistic. Don’t buy gold expecting it to offer returns that bitcoin or high-growth stocks provide. Importantly for investors, demand for gold is still very high, helping to su5pport record prices. Last week, inflows into the world’s largest gold ETF GLD reached their second highest ever at USD$1.95 billion. And, according to two of the world’s biggest investment banks, the rally in gold isn’t over. Goldman Sachs and Bank of America have also reaffirmed their bullishness on the asset, setting price targets around USD$3500/oz in the next two years, pointing to robust demand from central banks and ongoing buying from retail investors.

On the other side of that, there are of course risks. Traditionally, gold doesn’t perform as well in high interest rate environments, combined with a stronger US dollar. But, prices have seemingly ignored the higher-for-longer stance from the Fed so far this year. Prices could come under pressure if the US dollar remains strong and rates don’t come down. On top of this, if investors look more positively at the tariff environment and markets, shifting back to risk, gold would likely face some downside. From a technical perspective, prices above $3000/oz are important for bullish momentum, below that level, and it may signal some profit-taking and selling from record levels. Ultimately, for long-term investors, gold has clearly justified its position in a diversified portfolio. It offers some stability against risk events while providing a reliable longer-term store of value and, importantly, as a portfolio diversifier. Even in the age of digital assets and complex financial products, a bit of that classic yellow metal can provide balance and reassurance.

Past performance is not an indication of future results.

*Data Accurate as of 28/03/2025

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.