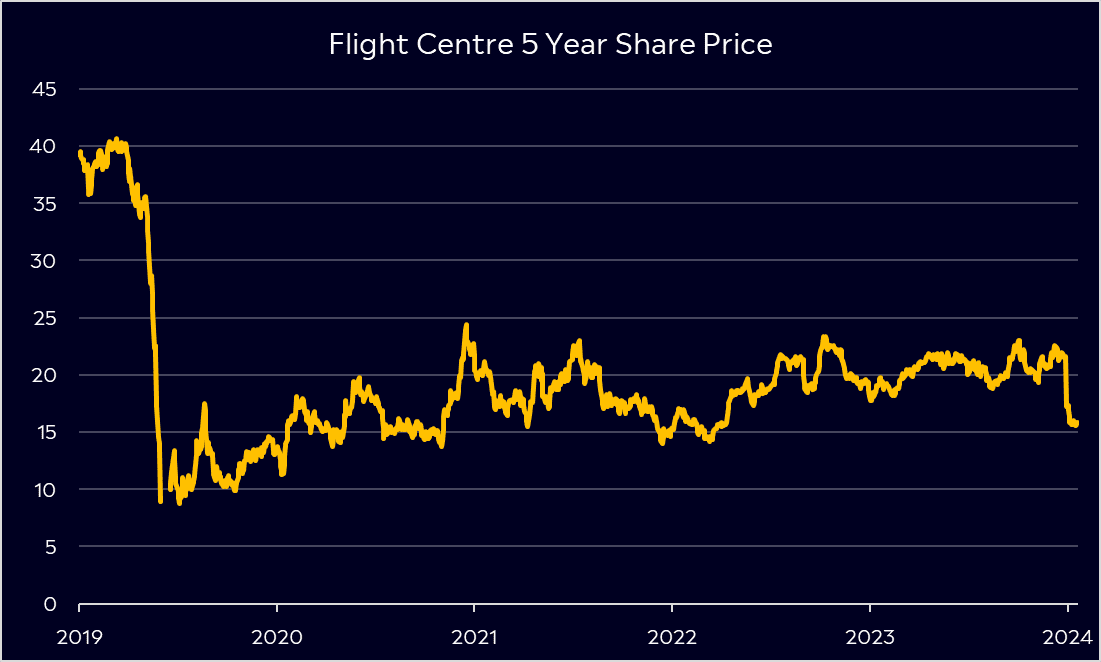

Travel demand is back, but for Flight Centre, the journey to recovery has been a turbulent one. The pandemic brought unprecedented challenges, and shares have struggled to regain previous highs. Recently, the stock hit a new 52-week low after its latest trading update underwhelmed the market. Yet, under the surface, Flight Centre is growing revenues at a solid pace and operating more efficiently than ever, with record profitability in 2024. So, will Flight Centre soar back to previous highs, or are there more challenges ahead?

- Record profits and a huge dividend increase showcase improving margins and more efficient operations.

- The company is refocusing on high-growth areas like corporate travel and cruising, positioning itself for the future as travel competition grows.

- Flight Centre Travel Group has 10 buy ratings, 7 holds, and 0 sells, with an average price target of AUD$21.32, signalling a potential upside of 32.8% from its last closing price.

View Flight Centre

The Basics

Founded in 1982, Flight Centre Travel Group (ASX: FLT) has grown from a small Brisbane-based travel agency to one of the largest global players in the travel and tourism industry. The business has operations across multiple continents and provides a range of services from holiday packages to corporate travel solutions.

Since the pandemic, Flight Centre has looked to adapt to changing travel landscapes and refocus on high-demand areas. The business generates its revenue from three main segments.

Leisure Travel – This is the heart of Flight Centre’s business. The company sells flights, accommodation, and travel packages to individual travellers through its physical stores and online platforms.

Corporate Travel – Flight Centre’s corporate travel arm serves business clients with a comprehensive suite of travel management services, from flights and accommodation to expense management. This segment has grown as business travel demand recovers and has become a key driver of profit, with strong growth potential as companies resume international operations.

Other Services – Flight Centre also provides specialised services like travel insurance, finance, and in-house tour operators. These other services complement their main offerings and add revenue streams beyond traditional bookings.

Fun Fact: Flight Centre’s founder, Graham Turner, started the company from a single travel shop in Sydney and has since grown it to a global travel powerhouse generating over AUD$2 billion of revenue in over 80 countries.

Competitor Diagnosis

Flight Centre operates in a highly competitive industry, facing pressure from both traditional travel agencies and digital-first platforms. Companies like Booking.com, Expedia, and Skyscanner have reshaped the travel industry, offering consumers easy-to-use platforms to book flights, hotels, and packages without the need for in-person agents. As more travellers opt for digital convenience and lower fees, these online travel agencies do pose a threat to Flight Centre’s retail business.

Corporate travel also remains highly competitive, with local competitors including Corporate Travel Management. The business has sophisticated booking tools and data analytics to streamline corporate travel planning. Globally, Flight Centre also has to compete against one of the world’s largest corporate travel providers, American Express Business Travel. Its established network and wide-reaching brand recognition make it a formidable competitor, especially for multinational clients who need global consistency and service.

Despite these competitors, Flight Centre’s strengths lie in its established brand, extensive brick-and-mortar network, and comprehensive customer service. Its presence in both leisure and corporate travel also allows it to capture demand from a diverse customer base. However, as consumer preferences continue shifting toward digital platforms and direct bookings, Flight Centre must balance innovation in its digital offerings with maintaining the personalised service it’s known for.

Financial Health Check

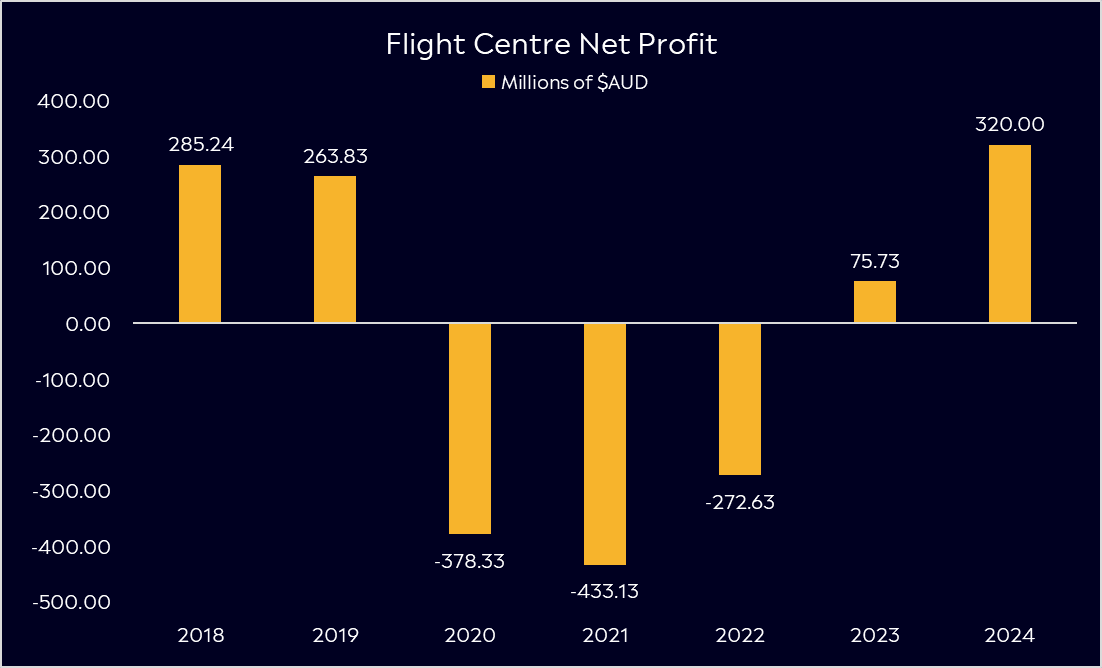

In August, the business handed down its full-year results for fiscal year 2024, which the market loved. Record profits and a 122% jump in its dividend sent shares soaring. Total transaction value (TTV) rose 8% to AUD $23.74 billion and net profit rose to $320 million.

However, since that report, shares have tumbled by more than 25%, and a more recent update from the business did not go down well with the market. One of the disappoints came from its corporate travel sector with Flight Centre saying activity was flat in the first quarter of the fiscal year. They also said that airfare deflation may impact total transaction value in the short term.

We’ll get a clear picture from Flight Centre next week when the company holds its Annual General Meeting (AGM) where they are expected to offer forward guidance. We’ll also hear from the business surrounding its most recent acquisition of Cruise Club UK. Cruising is one of the fastest-growing travel segments following the pandemic and helps grow Flight Centre’s international business.

The business paid a 2.5% net dividend yield for fiscal year 2024, and that could continue to grow if profits continue to grow into next year. With a more efficient business post-pandemic, margins are improving with operating expenses 15% lower than pre-pandemic. This gives the business room to keep growing profits and increasing its dividend over the years ahead.

Buy, Hold or Sell?

Flight Centre has come a long way from its single-shop origins, evolving into a global travel powerhouse with diverse revenue streams across leisure, corporate, and other services. Despite recent challenges and increased competition from online travel platforms, the company’s strong brand, wide geographic reach, and well-established presence in both leisure and corporate travel sectors have solidified its position in the industry.

Flight Centre’s shares recently dropped to a 52-week low and are still someway from their record high. With improving margins, growing profits and a valuation of just 12.5x forward earnings, savvy investors may see value at current levels, especially as they refocus on high-growth areas like corporate travel and cruising.

According to Bloomberg’s Analyst Recommendations, Flight Centre Travel Group has 10 buy ratings, 7 holds, and 0 sells, with an average price target of AUD$21.32, signalling a potential upside of 32.8% from its last closing price.

It won’t be a one-way flight to success for Flight Centre over the next 12 months, with its recent update a clear sign of that. But, with an attractive valuation and record profits, the business looks to be making the right moves at the right times to get shares back to where they once were.

View Flight Centre

*Data Accurate as of 7/11/2024

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.