Given the speed at which the stock market moves, it’s easy to get caught up in a never-ending cycle of chasing ‘the next big thing’. But for investors with long-term goals who want to diversify their portfolios with strong picks, there’s something to be said for looking beyond the latest IPOs and instead turning to established companies.

Some of the oldest Australian companies have survived decades of market fluctuations and thrived. Let’s explore the history of five top companies on the ASX and find out why these esteemed corporations continue to shape the Australian business landscape.

Rio Tinto (RIO.ASX)

Established in 1873, Rio Tinto is likely one of the first names that comes to mind when considering established ASX stocks. It boasts a long and storied history that reaches back to its origins as a mining venture in southern Spain. The company’s name comes from the Rio Tinto River, known for its distinctive red hue caused by heavy iron deposits.

Over the years, Rio Tinto transformed from a burgeoning operation into one of the world’s leading mining and metals enterprises. Today, its operations span multiple commodities, including iron ore, copper, aluminium and diamonds. It may be attractive for investors seeking exposure to these asset types from a long-established company. With a strong commitment to sustainable practices and technological advancements, Rio Tinto will likely remain a key player on the global mining stage.

10-year stock price performance: +101%

Stock price performance since 1981: +2,179%

INVEST IN RIO TINTO

BHP Group Limited (BHP.ASX)

BHP Group Limited, founded in 1885 as Broken Hill Proprietary Company, started off in the humble mining town of Broken Hill, New South Wales. Initially focused on silver, lead and zinc mining, BHP’s operations quickly expanded to include a wide range of natural resources.

Today, BHP is a highly diversified resources enterprise engaged in mining, oil and gas exploration. The company has a robust global presence and plays a key role in supplying essential commodities to industries worldwide. Despite the markets in which it operates, BHP also has an above-average ESG score, underlining its commitment to sustainability and flexibility to align with a more eco-conscious society.

10-year stock price performance: +62%

Stock price performance since 1981: +2,630%

INVEST IN BHP

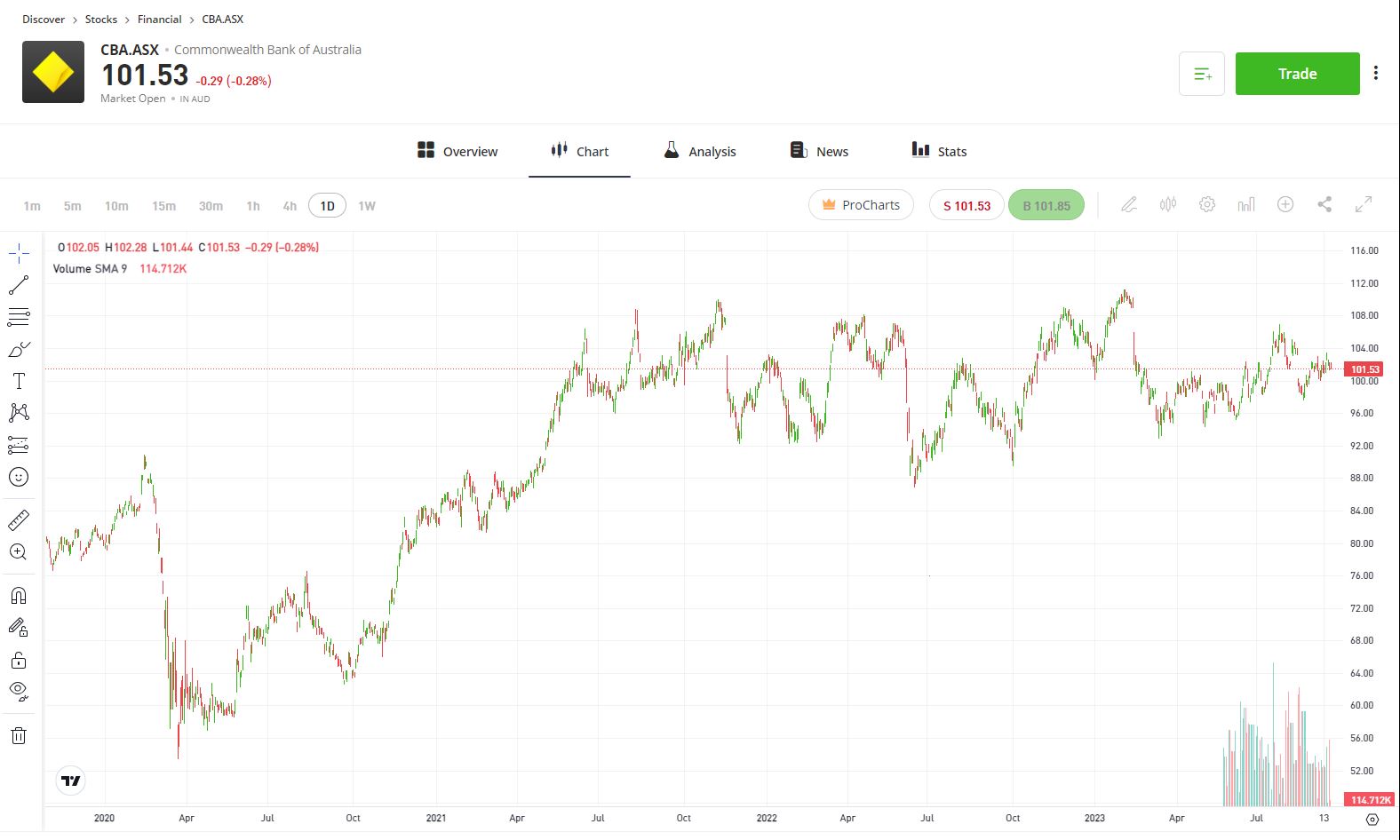

Commonwealth Bank of Australia (CBA.ASX)

The Commonwealth Bank of Australia (CBA) can trace its roots back to 1911 when it was established as a government-owned bank. It was initially created to address a shortage of banking services and credit across the country. However, it quickly became evident that the company’s savvy business practices would make it a market staple for decades to come.

In the years since, CBA has evolved and expanded its financial offerings, eventually becoming a publicly listed entity in September 1991. It is today one of Australia’s largest banks – part of the ‘Big Four’ financial institutions – servicing millions of customers and businesses with its wide range of products and services. Prospective investors might be interested in its generous dividend scheme, with a strong annual yield of 4.47%.

10-year stock price performance: +405%

Stock price performance since listing (1991): +1,012%

INVEST IN COMMONWEALTH BANK

Wesfarmers Limited (WES.ASX)

Wesfarmers Limited emerged in 1914 as a farmers’ cooperative in Western Australia. Its initial aim was to provide rural communities with essential goods and services, but those minor goals quickly ballooned into ambitions of global proportions.

Over the decades, Wesfarmers has diversified its operations and dipped its toes into various sectors, from retail and mining to industrial and technology products. If you’re looking for a company that has monopolised specific industries, look no further than Wesfarmers – it’s the parent company of retail giants like Bunnings Warehouse, Target, Kmart and Officeworks. Looking to the future, the company’s history of adaptability and strategic acquisitions will likely continue to feed into its long-standing success.

10-year stock price performance: +99%

Stock price performance since listing (1984): +4,170%

INVEST IN WESFARMERS

Qantas Airways Limited (QAN.ASX)

Founded in Winton in 1920 as the Queensland and Northern Territory Aerial Services Limited, Qantas Airways Limited marked the inception of commercial aviation in Australia. With just one aircraft in those initial heady days, Qantas soon expanded its fleet and service offering.

Over the decades, Qantas has played arguably the most pivotal role in the country’s aviation sector. They are responsible for connecting regions across our vast landscape, and today, Qantas is one of the most respected airlines on the planet, serving both domestic and international routes. After years of pandemic-induced travel disruptions, Qantas has gone from strength to strength and recently announced a record $2.5 billion profit.

10-year stock price performance: +349%

Stock price performance since listing (1995): -27%

If you’re considering investing in these time-tested companies, conduct thorough research and always consider your investment goals and risk tolerance. While the past achievements of these enterprises are impressive, future investment decisions should be based on a comprehensive analysis of their current performance, industry trends and potential for long-term growth.

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD.

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future