The digitisation of money has accelerated in recent years, and like any technological advancement, there are assets that stand to succeed. With the emergence of contactless payments and the slow removal of cash from society, Mastercard has continued to benefit, with its payments volume growing by more than 50% since 2020. This digital trend is set to continue and serves as a tailwind for Mastercard. So, let’s take a closer look at the payments leader.

- Mastercard has a remarkable track record of returns for shareholders, delivering annualised returns of 30% since its IPO in 2006.

- With 3.4 billion cards in circulation and over 110 million merchant locations, Mastercard’s reach continues to expand.

- Strong financial health and continuous innovation position Mastercard for future growth, with analysts projecting a 14.5% upside

View Mastercard

The basics

Mastercard Inc. (MA) is a global technology company operating in over 210 countries. It offers a comprehensive range of payment solutions, including credit, debit, and prepaid card services and digital payment options.

The company’s core business revolves around processing transactions made through Mastercard-branded payment products, facilitating seamless and secure transactions for millions of users globally. At the end of Q1 2024, the company had 3.4 billion cards in circulation.

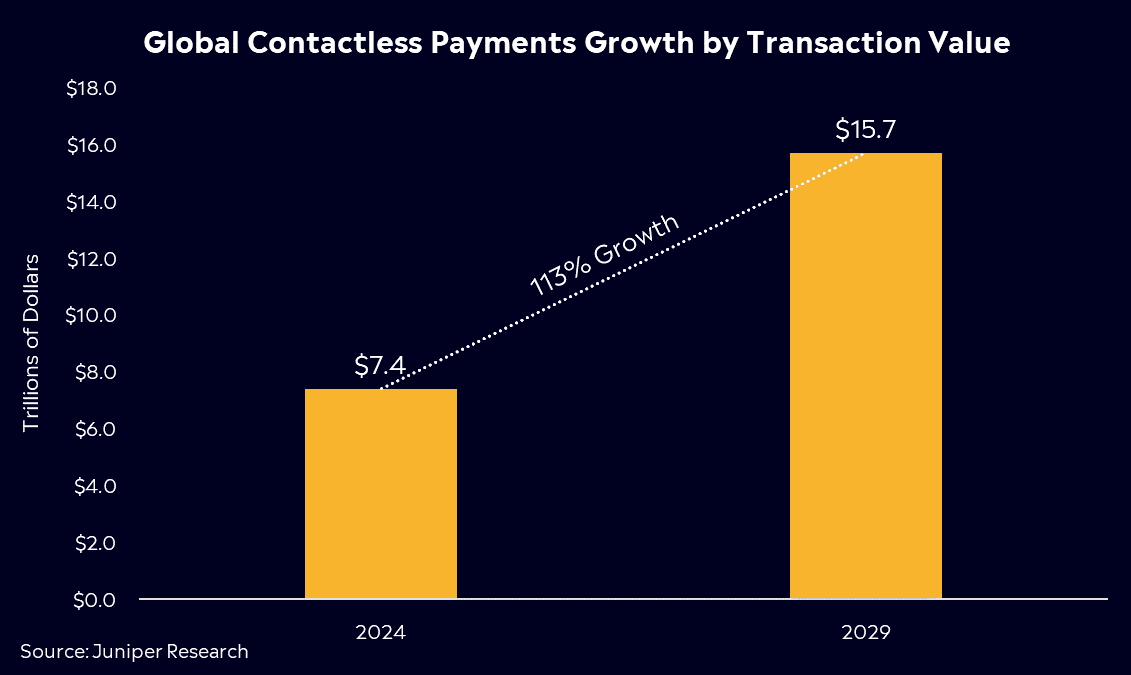

The business has doubled its merchant locations in the last five years, now boasting over 110 million locations. Mastercard continues to invest in new technologies such as AI and blockchain to drive innovation and enhance its service offerings. With cashless transactions on the rise, global contactless payments are projected to grow by 113% in the next five years, which bodes well for payment providers like Mastercard.

*Past performance is not an indication of future results.

Competitor Diagnosis

The competitive landscape of the payments industry has become more crowded over recent years with the emergence of growth names such as Block (SQ) and Stripe, alongside the rise of buy now, pay later options, which has presented new challenges for the business. However, Mastercard’s biggest competition remains with major players such as Visa (V), the largest name in the payments industry, and American Express (AXP), known for its premium customer base.

Mastercard is constantly innovating, and Sachin Mehra, the company’s CFO, recently stated that the business is ‘all for’ making whatever payment options consumers choose available. They have also harnessed AI recently to improve security, helping to maintain customers’ trust.

When comparing Mastercard to its biggest competitor, Visa, both have strong global networks, brand recognition, and financial performance, with solid growth rates. Mastercard has seen better revenue and earnings growth over the past 3, 5, and 10 years, which is expected to continue, making for a slightly more compelling growth story. However, both companies are well-positioned for future growth with the rise of digital payments.

It’s worth noting that the duopoly of Visa and Mastercard hasn’t gone unnoticed. Some merchants have complained about the high costs of accepting their cards, leading to a USD$30 billion court case where merchants claim they ‘overpaid’ when accepting both payment providers. This case remains unsettled and may impact both businesses in the future.

Financial Health Check

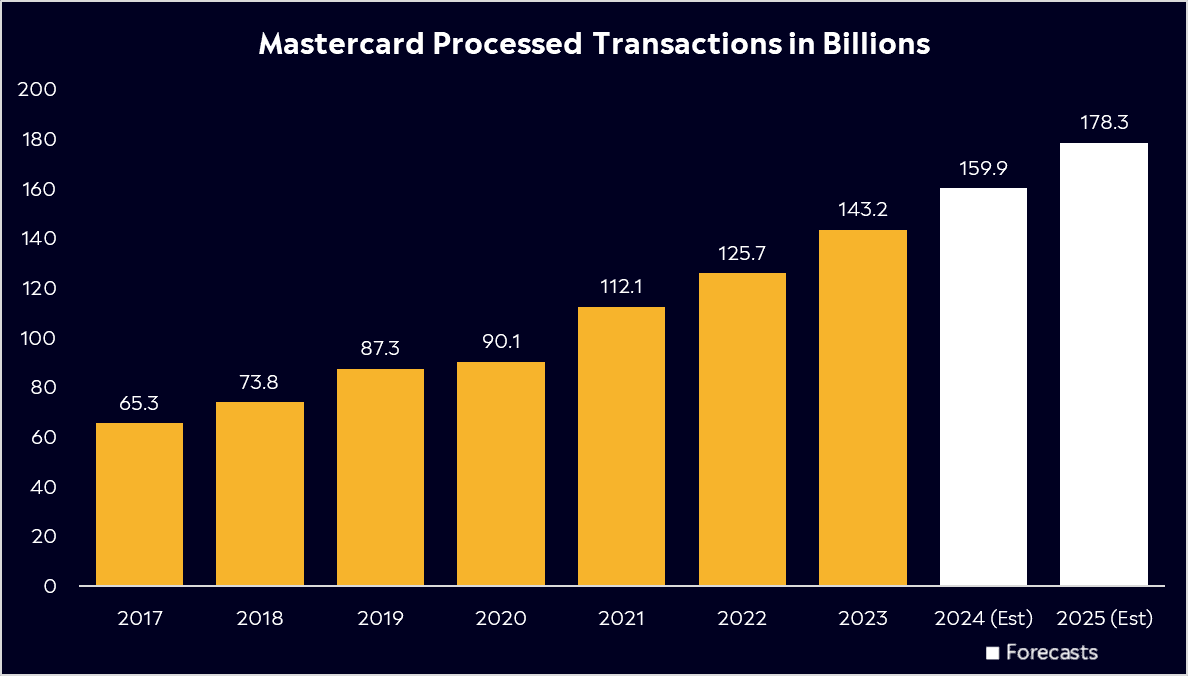

The bulk of Mastercard’s revenue comes from core consumer payments, which is driven by spending. Mastercard processed 143 billion transactions in 2023, with markets expecting this to grow by at least 11% over the next four years. This is helping to drive revenue and earnings growth, which are projected to increase by 11% and 16%, respectively, in 2024, led by healthy US consumer spending and strength in overseas volume. Consumers have remained resilient in the face of higher interest rates, but a potential pullback in spending could be a headwind for Mastercard.

Mastercard is a financial powerhouse in more ways than one. Its very healthy cash flow enables the business to continue pursuing M&A opportunities in an ever-growing fintech space while still delivering a decent dividend with a yield of around 0.6% for shareholders. It’s worth highlighting Mastercard’s expectational return on capital employed (ROCE), which currently stands at 58%, almost double that of Visa’s, showcasing the company’s efficiency in utilising its capital and generating profit.

It’s slated to release Q2 earnings at the end of July, and the business has a strong history of beating earnings expectations, missing estimates just once since 2015. Mastercard should also benefit in the months ahead from a flurry of large sporting events and travel, including the Olympics and the European Football Championships, while international travel isn’t slowing down either.

*Past performance is not an indication of future results.

Buy, Hold or Sell?

Mastercard’s strategic investments in technology and innovation, coupled with its robust financial health, position it well to capitalise on the ongoing digital transformation in the payments industry. However, the business will undoubtedly face challenges from emerging competitors, dependency on consumer spending, and legal and regulatory risks.

Nevertheless, Mastercard’s strong revenue and earnings growth, high return on capital employed, and remarkable track record of returns for shareholders, delivering annualised returns of 30% since its IPO in 2006, underscore its resilience and potential for future success.

The good news is that analysts see gains ahead in the next 12 months. According to Bloomberg’s Analyst Recommendations, Mastercard has 44 buy ratings, 4 holds, and 0 sells, with an average price target of USD$513, signalling 14.5% upside.

As the world continues to move towards a cashless society, whether we like it or not, Mastercard’s extensive global network will likely drive sustained growth, and shareholders should continue to benefit from their high-quality business model.

View Mastercard

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.