Disrupting a multi-billion dollar industry is no easy feat, but that’s precisely what elf Beauty has managed to do. With prices as low as $1, elf has bridged the gap between luxury and accessibility, making quality cosmetics available to everyone. But elf’s journey is more than just a story of affordability; it’s about smart strategies and innovative marketing that have positioned the brand at the forefront of Gen Z beauty trends. They’ve delivered stellar returns for shareholders in the last five years, so it’s no surprise that Warren Buffett has dipped into the world of beauty, recently adding Ulta Beauty to his portfolio. But what’s driving this growth, and is it set to continue? Let’s find out.

- Since 2021, elf has tripled its revenue with its affordability, rapid product development, and strong digital presence, solidifying it as a market leader, particularly among younger consumers.

- The company’s international revenue surged 91% last quarter, with new retail partnerships in Australia boosting its global footprint.

- elf Beauty has 12 buy ratings, 3 holds, and 0 sells, with an average price target of USD$221.92, signalling a 30% upside.

View Elf Beauty

The Basics

Founded in 2004 with the visionary mission of offering ‘quality cosmetics at a cheap price’ elf Beauty (ELF), aptly named for Eyes, Lips, & Face (e.l.f), revolutionised the beauty industry by delivering affordable products sourced from China. With prices as low as $1, elf bridged the gap between luxury brands like Chanel, Dior and Lancôme, captivating the mass market with its accessible offerings.

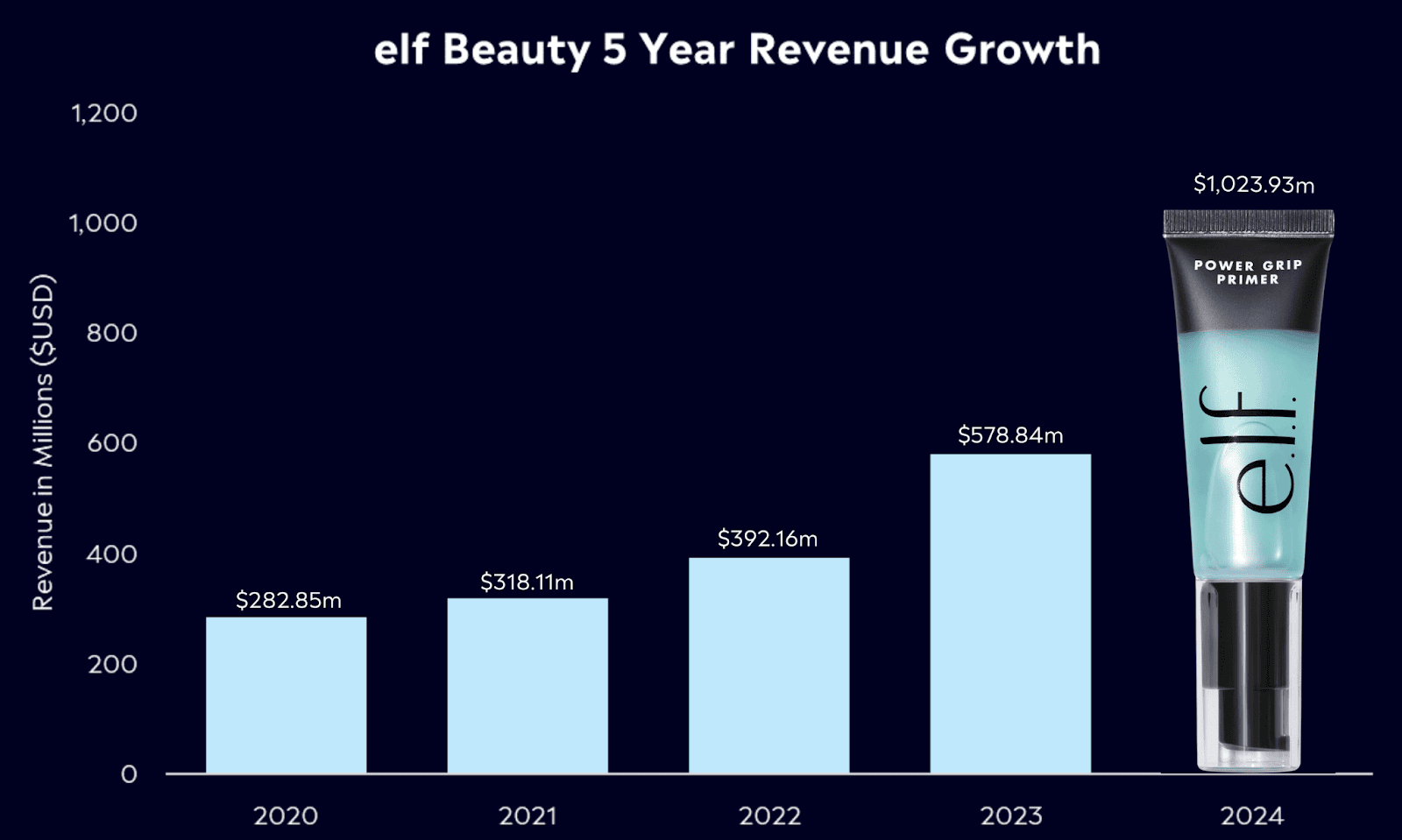

By 2016, the brand had a wealth of partnerships with huge US stores such as Walmart and Target, expanding its reach and cementing its position as a household name across the US. In a pivotal move in 2019, Tarang Amin, elf’s CEO, made the bold decision to shut all physical stores, pivoting towards amplifying partnerships with retailers and bolstering its online presence. This strategic pivot proved to be a game-changer, with the business more than tripling its revenue since 2021 and seeing gross profit grow by an impressive 85% in the last fiscal year.

elf Beauty became one of the fastest-growing and most profitable beauty businesses by overhauling its product offering to be more accessible and relevant across mass and prestige categories with an aggressive first-to-market marketing and social media strategy. The business continues to make strides overseas, with international revenue growing 91% last quarter and now accounting for around 16% of sales. It’s making further strides in Australia, stocking in stores such as Kmart and Priceline and recently establishing a new partnership with supermarket giant Coles.

Fun Fact: Every employee receives stock equity in the company every year, so every employee has ownership and benefits from the company’s long-term growth. Motivation.

Competitor Diagnosis

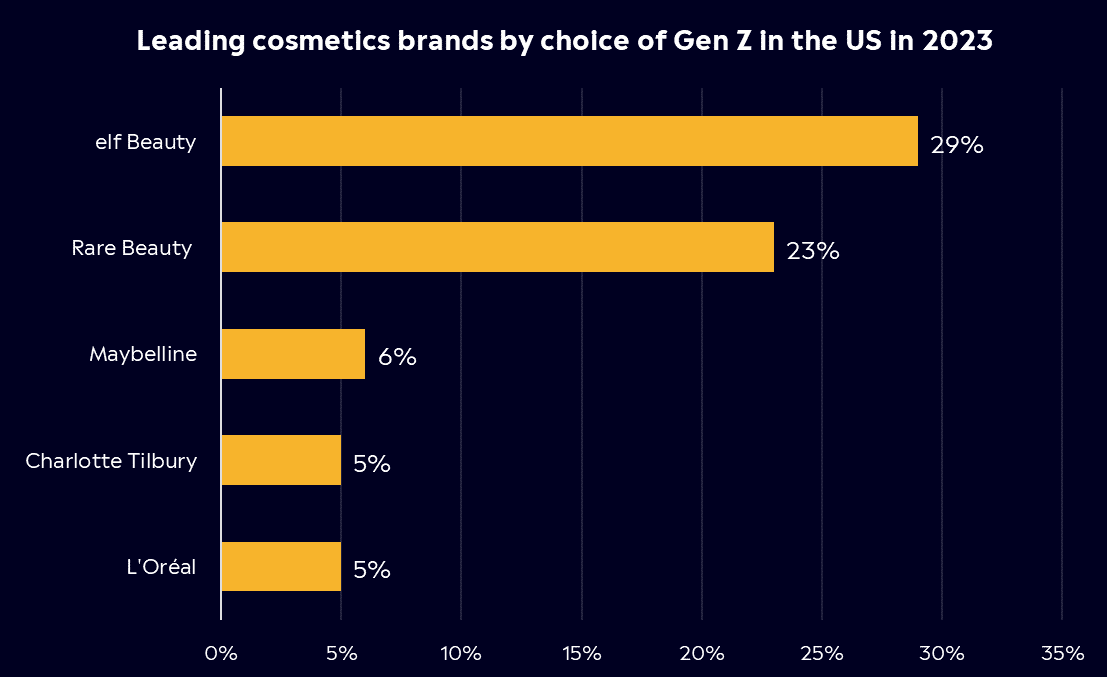

Elf operates in a highly competitive market alongside major players such as L’Oréal, Maybelline, Charlotte Tilbury, and Revlon. However, its focus on affordability, inclusivity, and trend-driven products has allowed it to carve out a niche in the market. It has attracted consumers from all age cohorts and incomes, making it accessible to essentially everyone.

Given its trending marketing campaigns and online engagement, the business can capture Gen Z and younger millennials faster than most other brands. According to Statista, elf Beauty was ranked as the leading cosmetic brand in the US by Gen Z in 2023. They’ve amassed a huge online following, with 6.5 million followers on Instagram, 1.1 million on TikTok, 2.4 million on Facebook, and nearly 120k on YouTube. It works with influencers across the globe and has become well known for its ‘dupe’ products, which have become a must-have for Gen Z’s.

The company’s average product price is about $6.50, below others in the mass beauty space, which are closer to $10, and the $20 plus range for prestige beauty. However, it faces growing competition in the mass beauty space, with smaller challenger brands such as MCoBeauty in Australia looking to replicate elf’s success. A standout for elf, though, remains its ability to to take a product concept to launch in an average of 20 weeks, meaning it can respond to changing consumer trends and deliver precisely what they want, fast.

Despite being a ‘mass’ beauty brand, the business has focused on sustainability. It streamlines packaging to eliminate waste, sources all packaging from responsibly managed forests, aims to use recycled packaging materials whenever possible and doesn’t test its products or ingredients on animals.

Financial Health Check

Elf Beauty is firing on all cylinders when it comes to financials. At the start of the month, the business smashed through expectations, reporting earnings of $1.10 vs $0.83 Wall Street estimated. Sales grew by 50% in the quarter after the business had signalled between just 25-27% growth. They saw strength in both its retailer and e-commerce channels, with CFO Mandy Fields saying they’d gained further market share, all while maintaining very high-profit margins, which is notable given its affordable pricing strategy, coming in at 71.28% last quarter.

There was a disappointment, though, which was its guidance for the next quarter. Earnings and sales forecasts fell slightly below Wall Street estimates. However, it’s important to remember that elf beauty has beat expectations and raised guidance every quarter since the pandemic, which is no easy feat. Therefore, expectations aresky-highh, but the guidance feels slightly light, given that they almost doubled their sales forecast at the start of August.

Recently, we’ve also heard the recession bell ringing across the globe, which is a perfect time to look at the ‘lipstick indicator’. This is an economic theory coined by Leonard Lauder, chairman of the board of Estee Lauder, after he noticed that lipstick sales were rising, not decreasing, during the US recession in the early 2000s. Essentially, it’s a view that when a recession or economic slowdown is looming, consumers down-trade to “affordable luxury” items such as lipstick or beauty products. It’s also worth noting that arguably the greatest investor ever, Warren Buffett, recently added cosmetic retailer Ulta Beauty to his portfolio, which stocks elf beauty, highlighting the beauty sector’s potential.

One look at LVMH’s earnings may signal that the ‘indicator’ could be at play. Last quarter ‘Fashion and Leather Goods’, known for their high cost, saw sales decline, while ‘Perfume and Cosmetics’ sales grew. Elf’s price point makes it attractive to virtually all incomes, and therefore, even if the consumer does pullback on spending, elf could be set to benefit from that down trade.

Buy, Hold or Sell?

The business looks set to continue benefiting from strengthening retail partnerships, ongoing international expansion, and solid customer retention thanks to its online connection with Gen Z. Its ongoing innovation and repeat customers, thanks to its brand recognition, leave plenty of room for further sales growth. Risks do exist, though, with increasing trade tensions between the US and China, a key area for manufacturing, and competition from other brands at brick-and-mortar stores, which could dent its market share.

Given the catalysts mentioned, analysts are bullish. According to Bloomberg’s Analyst Recommendations elf Beauty has 12 buy ratings, 3 holds, and 0 sells, with an average price target of USD$221.92, signalling a 30% upside.

Its affordability, rapid product development, and strong digital presence have solidified it as a market leader, particularly among younger consumers. Shares have fallen by 27% from their recent peak, and this could be an attractive entry for investors, especially with a solid runway for future growth and the potential for ongoing earnings beats ahead.

View Elf Beauty

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.