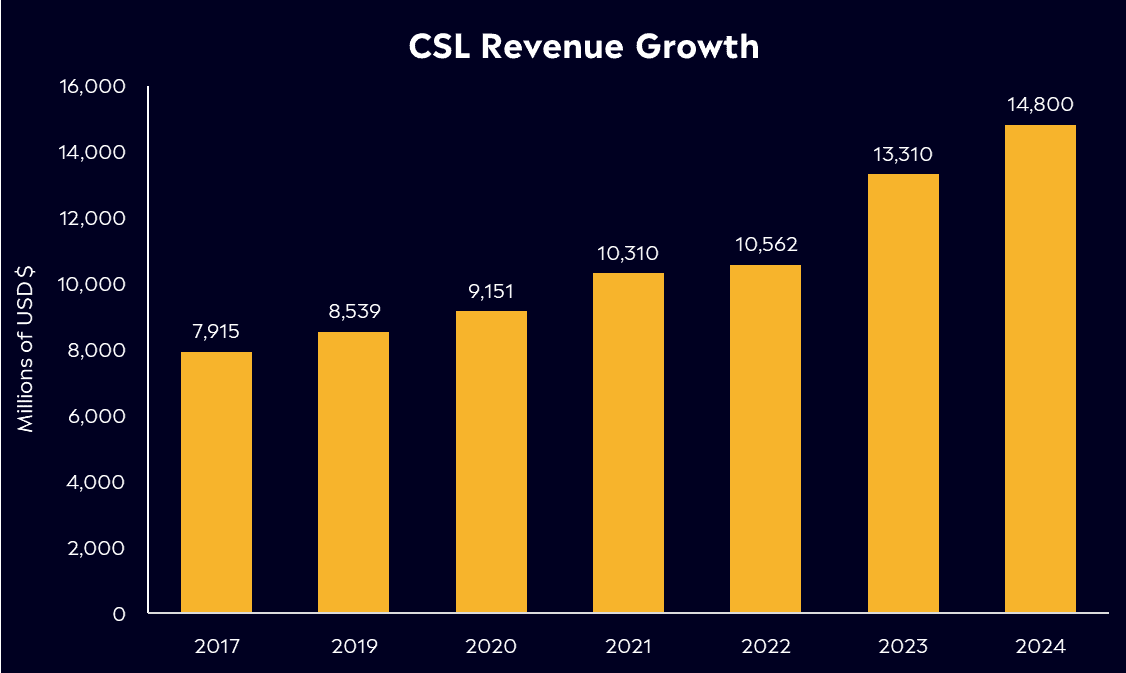

CSL has been a standout company on the ASX200 and has rewarded shareholders with 18% annualised returns, including dividends over the last ten years. However, recently shares have stalled, leaving investors questioning what’s next for the business. Its full-year results were solid, and its main plasma business delivered strong growth that looks set to continue. We’ll break down the complexities of CSL’s business segments, explore its competitive landscape, and assess its latest financial results to understand why this biotech giant continues to capture investor attention. So, is this a company worth watching? Let’s find out.

- The business dominates around 30% of the world’s plasma collection networks, benefiting from economies of scale and therefore improving margins.

- Despite intense competition, CSL’s heavy investment in R&D keeps it at the forefront of innovation in the biotech industry.

- CSL delivered a solid full-year result, with net profits growing by 25%. Analysts are still bullish, with 13 buy ratings, 4 holds, and 0 sells.

View CSL

The Basics

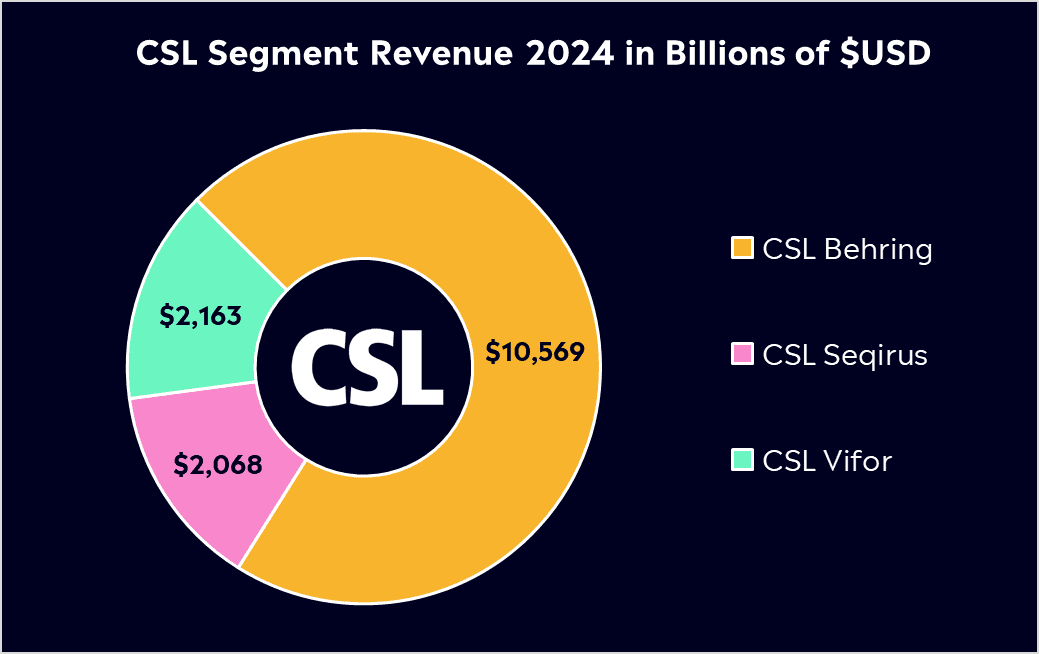

CSL Limited (CSL.ASX) is a global biotechnology company and is the largest pharmaceutical stock on the ASX200. It’s branded as a ‘market darling’ after delivering extensive returns for investors over the last ten years. The business primarily operates in three segments: CSL Behring, Seqirus, and CSL Vifor. To be frank, the company can be slightly complex to understand, so here’s a simple breakdown of how they make their money and what each segment does:

CSL Behring is the largest and most important segment of CSL. It focuses on developing and delivering life-saving medicines derived from human plasma. Plasma is a component of blood, and CSL Behring uses it to create therapies for people with rare and serious conditions, like immune deficiencies and other genetic diseases. It collects plasma from donors, processes it, and manufactures various therapies that are sold to healthcare providers and patients worldwide. This segment is the primary revenue driver for CSL because of the high demand for these essential therapies.

CSL Seqirus is one of the largest providers of influenza vaccines globally. It was formed after CSL acquired Novartis’ flu vaccine business in 2015. Seqirus generates revenue by producing and selling flu vaccines to governments, healthcare providers, and pharmacies. Vaccination is a seasonal but critical need, so this segment contributes significantly to CSL’s overall revenue, particularly during flu seasons.

CSL Vifor focuses on treatments for iron deficiency, kidney diseases, and other related health conditions. This segment was added when CSL acquired Vifor Pharma, a Swiss-based company, in 2021. This segment makes money by developing and selling therapies for chronic kidney disease and iron deficiency. These treatments are critical for patients undergoing dialysis and those with chronic health issues.

TL;DR

- CSL Behring: Makes life-saving plasma-based therapies (largest revenue contributor).

- CSL Seqirus: Provides flu vaccines globally.

- CSL Vifor: Focuses on treatments for kidney disease and iron deficiency.

Competitor Diagnosis

CSL has asserted itself as one of Asia’s most prominent pharmaceutical companies, building a reputation for innovation and excellence. However, it faces stiff competition from other major players in the biotech and pharmaceutical world across the different segments of its business.

If we look at its Behring unit, the main competitors are Grifols and Takeda. CSL is well positioned, though, owning around 30% of the world’s plasma collection networks. However, these companies challenge CSL’s dominance with their own extensive plasma collective networks. Given that CSL is the biggest, they benefit from economies of scale, minimising the cost of collecting and processing plasma.

In the flu vaccine market, Seqirus, CSL’s vaccine division, is up against global giants like Sanofi, GSK, and AstraZeneca, companies with strong distribution networks, making it a highly competitive space. CSL Vifor is challenged by Amgen, Fresenius, and Pharmacosmos in the nephrology and iron deficiency treatment space.

CSL invests heavily in research and development, ensuring that it stays at the cutting edge of biotechnology. It has also used acquisitions to solidify its market position, expand its product offerings, and enter new markets. Competition will remain high, especially in such an innovative sector. One look at the launch of GLP-1 drugs such as Ozempic in the last 12 months underscores the importance of innovation and the need for companies like CSL to stay ahead by continually advancing their own research and development efforts.

Financial Health Check

CSL handed down its full-year results at the start of the week, and the numbers came in pretty good. Revenue beat expectations, coming in at USD$14.8 billion, up 11% from last year and net profit on a constant currency basis rose 25% to USD$2.75 billion. Importantly for shareholders, its dividend grew again, paying out $1.45 per share, signalling 12.5% growth in the last year, and that’s set to be paid in October. Its Behring unit was the standout, with an increase in collections, driving growth and helping to reduce costs.

Despite this, shares sank on Tuesday, down by 4.5%, following a slightly uninspiring forecast for fiscal year 2025. They signalled revenue growth between 5-7% and profit growth of between 10-13%, much softer than the growth this year and below analyst estimates. This guidance felt conservative, especially with its plasma business delivering and set for continued growth, a vital component of the business. Its new ‘Rika’ system should also continue to drive plasma collection, helping decrease the time needed to collect donations, which should help margins.

Looking at its valuation, it’s trading at around 30x forward earnings. Although not cheap, that doesn’t look completely stretched, particularly if it can outperform that slightly lighter guidance. US rate cuts are inbound, which will more than likely see the US Dollar drop and provide a tailwind for CSL, given that the business generates a large portion of revenue outside of the US.

Buy, Hold or Sell?

CSL has demonstrated strong and stable growth over the last ten years, and as the global economy slows, the business will continue to become more appealing to investors, especially at current levels.

Given the company’s continued growth, analysts are bullish. According to Bloomberg’s Analyst Recommendations, CSL has 13 buy ratings, 4 holds, and 0 sells, with an average price target of $14.25, signalling a 6.2% upside.

CSL isn’t immune to increasing competition, but it’s a high-quality business that has delivered for investors over the years with great dividend growth. After the weakness in shares on Tuesday, investors were quick to take the opportunity to scoop up shares on Wednesday, showing that the price remains attractive for many savvy investors.

View CSL

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.