After months of uncertainty, we now know that Donald Trump will be the 47th President of the United States. It’s key to note that its difficult for investors to front-run policy, and instead of politics, the focus should often be on the fundamentals. However, it is worth highlighting a stock that looks set to benefit from when President Trump takes the Oval Office. With US interest rates already being slashed by 75bps and set to fall further, we would expect to see an acceleration of homebuilding. This would boost demand for building materials, putting James Hardie front and centre. So could lower rates and a Trump presidency drive growth for James Hardie through a stronger US housing market, or will other factors hold it back? Let’s find out.

- With interest rates being slashed significantly in the US, the environment should favour more new housing projects, a win for James Hardie.

- Recent quarterly earnings showed sales falling, but the company reaffirmed its full-year profit guidance and initiated a $300 million buyback program.

- James Hardie Industries has 9 buy ratings, 6 holds, and 1 sell, with an average price target of AUD$55.97, signalling a potential upside of 1.4% from its last closing price.

View James Hardie

The Basics

James Hardie Industries is a global leader in fibre cement products for the building industry. The business supplies materials primarily for residential construction, specialising in durable, low-maintenance fibre cement siding and boards. Unlike traditional wood and vinyl siding, James Hardie’s fibre cement is highly resistant to fire, pests, and weather, making it a popular choice for modern and sustainable home builds. The company’s primary customers are homebuilders rather than commercial property. You may have seen the business featured on the Australian TV show The Block over the years.

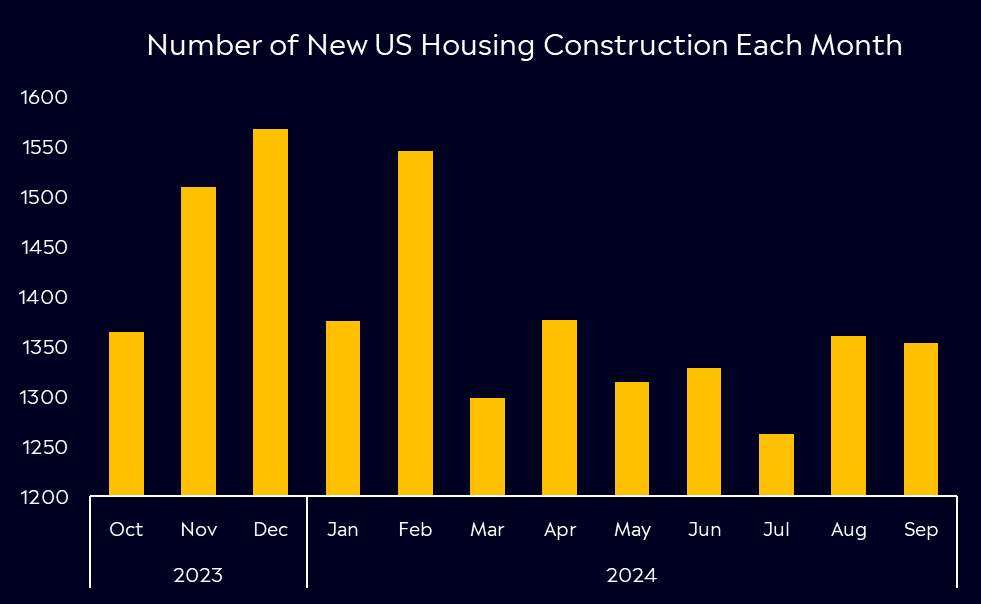

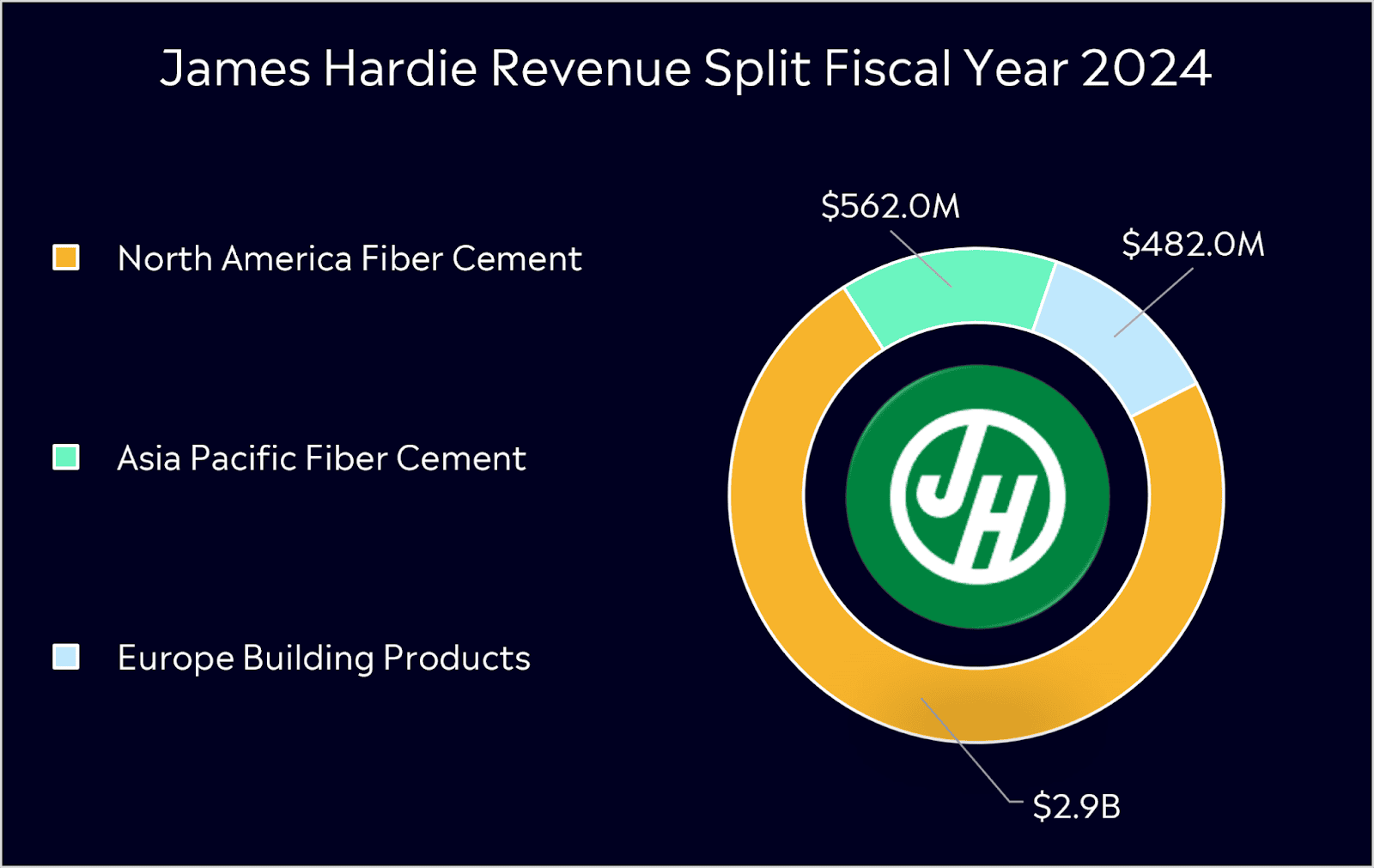

James Hardie has established itself as a major player in America and Australia, generating over 70% of its revenue from the US. With interest rate cuts starting in the US and set to continue, building activity is set to pick up with home loans and project financing more affordable. Alongside that, a Trump presidency is also set to benefit the construction sector with his promise to drive the US economy. An increase in homebuilding in the years ahead is a win for James Hardie with an increased demand for building materials. US housing starts have fallen since rates began to rise, but we may have seen this number bottom out in July and begin a move higher into 2025.

Competitor Diagnosis

James Hardie operates in a competitive market, facing key players like Louisiana-Pacific Corporation (LP Building Solutions), Boral Limited, and Nichiha Corporation. LP Building Solutions competes in the US with engineered wood siding, often at a lower price point than fibre cement, but it lacks the durability and fire resistance that James Hardie offers.

Boral, a major Australian competitor, offers a range of building materials but struggles to match James Hardie’s dominance in fibre cement, particularly in North America. Nichiha, a Japanese manufacturer, specialises in fibre cement but focuses more on custom design solutions, giving it an edge in high-end residential and commercial projects, especially in Asia.

James Hardie’s strong brand recognition allows it to retain a competitive edge, with its ‘HardiePlank’ a top choice in the housing market. Its superior durability, strong market presence, and focus on sustainability make it a top choice for builders seeking long-lasting, eco-friendly solutions. While competitors challenge James Hardie in price and product variety, its innovation, reputation, and leadership in the space keep it ahead of the pack.

Financial Health Check

James Hardie’s sales growth has slowed in recent years, with their Q2 earnings earlier this week showing net sales fell 3.6% year over year. This comes as higher rates pressure new home builds in the US, with homebuilders struggling to get projects off the ground. However, this trend looks set to reverse in the years ahead. The market expects profits and sales to grow by double digits for the fiscal year ending March 2026.

Profit also declined in the quarter due to increased costs and inflationary pressures on materials, labour, and logistics. However, the company’s guidance impressed. It reaffirmed its guidance for the full year, showing resilience and growth prospects with an improving macro backdrop ahead. They also announced a new $300 million buyback program, signalling the business’s confidence in what’s ahead. However, there is a clear correlation between James Hardie’s profits and interest rates. If US interest rates don’t fall at the rate the market expects, this could hold back growth for the business.

A crucial point to note here is that the US, James Hardie’s biggest market, is significantly short on the housing supply side, with supply not keeping pace with demand. With the large millennial generation forming households and trying to buy homes, there is a clear imbalance that will likely drive new housing growth in the US in the years ahead.

Buy, Hold or Sell?

Lower rates and a favourable President-Elect create a promising environment for consumer spending on homes and business expansion, putting James Hardie in a strong position to benefit from increased demand in the housing and renovation sectors. According to Bloomberg’s Analyst Recommendations, James Hardie Industries has 9 buy ratings, 6 holds, and 1 sell, with an average price target of AUD$55.97, signalling a potential upside of 1.4% from its last closing price.

As I mentioned at the start of this piece, it’s challenging to predict policy, so it’s important to focus on the fundamentals. In this scenario, those fundamentals look set to improve, and analysts are clearly positive about the business’s future. The view of President Trump driving growth, housing shortages, and lower rates could be the catalysts needed for growth.

However, it’s worth noting that President Trump could also drive inflation higher, which may see rates stay higher for longer, and that would delay new building starts. Globally, there is a clear housing shortage. UN-Habitat says the world will need to build 96,000 homes daily to house 1.6 billion people worldwide who lack adequate housing, creating a global opportunity for James Hardie.

View James Hardie

*Data Accurate as of 14/11/2024

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.