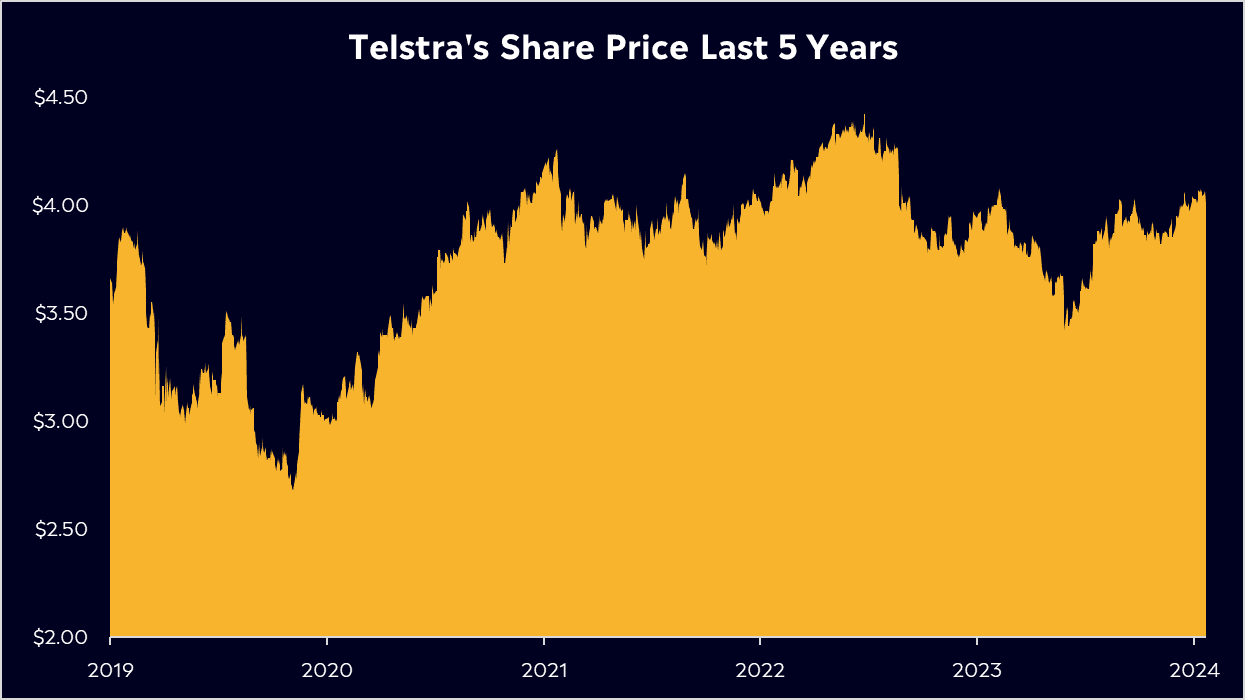

Telstra has long been a pillar of Australia’s communications sector, but as competition grows, it’s positioning itself for the future with bold investments in AI and 5G infrastructure. Under CEO Vicky Brady, the company is streamlining operations while betting on emerging technologies to drive future growth. But, shares have hardly moved in the last five years and shareholders only have its dividend to thank for returns. So, will its operational efficiencies and investments pay off for shareholders in 2025? Let’s find out.

- Telstra’s efficiency push under CEO Vicky Brady has stabilised operations, with $700 million in AI investments and 5G rollout driving future growth.

- Partnerships with Starlink and a landmark deal with Microsoft signal Telstra’s ambition to innovate and maintain its competitive edge in Australia’s telecom sector.

- Telstra does get the nod from analysts. According to Bloomberg’s Analyst Recommendations, it boasts 14 buy ratings, 1 hold rating, and 1 sell rating. With an average price target of $4.35, that implies an 8.5% upside.

Explore Telstra

The Basics

Telstra is Australia’s largest telecommunications provider, with roots dating back to the early 1900s. The business plays a critical role in connecting Australians, offering services across mobile networks, broadband, enterprise solutions, and international connectivity.

Telstra’s revenue comes from three segments:

- Mobile (over 40% of revenue): Covering personal and business mobile plans, Telstra leads the 5G race with nationwide coverage. It has invested heavily to build Australia’s fastest and most reliable network covering 99.5% of the population with over 24 million mobile accounts.

- Fixed Broadband & Connectivity (approx. 20%): Includes NBN services and bundled internet offerings, essential for homes and businesses.

- Enterprise & International (25%+): Focused on corporate clients, providing IT solutions, cloud services, and connectivity infrastructure like subsea cables linking Australia to global markets.

So, what sets Telstra apart?

- Dominate Force: Telstra dominates in Australia, with 49% mobile market share and 39% NBN market share.

- 5G Leader: Telstra is spearheading 5G adoption in Australia, which is expected to drive future growth by enabling industries like autonomous vehicles and advanced logistics.

- Infrastructure Investment: Through ventures like InfraCo, Telstra monetises its physical infrastructure, such as fibre-optic cables and data centres, creating long-term value.

- Dividends for Stability: Telstra has a strong track record of dividends, appealing to income-focused investors, with payouts supported by predictable cash flows.

Telecommunications is a capital-intensive business. Right now, Telstra is building intercity fibre networks to connect data centres, tapping into the surging demand for data infrastructure. Microsoft recently extended their partnership with Telstra, selecting them as its chosen partner to extend its AI infrastructure in Australia. Despite its dominance, Telstra has had a challenging few years. Shares are up a measly 3.2% but up 42%, including dividends. Its weakness comes from growing spending, slowing revenues, and, therefore, lower profits. But with cost controls back in place, profit is set to rise again this year.

Fun Fact: Telstra has announced that it will work with Elon Musk’s SpaceX, through Starlink to introduce technology that would allow smartphone users to send messages via satellite when a regular connection isn’t available. This is particularly important in regional and remote areas of Australia.

Competitor Diagnosis

Telstra operates in a competitive telecommunications landscape with major players like Optus and TPG Telecom contending for market share. To add some pressure on Telstra’s dominant market positioning, both these competitors recently inked a network-sharing deal, which is aimed at accelerating 5G deployments in regional areas. By sharing mobile network assets, TPG and Optus can speed up 5G infrastructure rollouts, improve efficiency, and monetise 5G services faster.

Both competitors are also targeting younger, cost-conscious demographics with competitive prepaid and internet plans, but their coverage limits growth potential. To address this, Telstra recently acquired Boost Mobile to bolster its younger user base, help it maintain customer loyalty, and defend against rivals’ competitive pricing tactics. The bottom line is that Telstra is the dominant telco in Australia due to its sheer size, superior network, and strong brand image. Telstra maintains higher customer retention rates due to its network reliability and customer service.

It supplies 5G services to over 87% of the population, which can help defend its market position despite its competitors’ attempts to challenge it. However, Telstra will need to continue to innovate and stay on top of its game to maintain its dominating market share, particularly if Optus and TPG look to pricing wars that could pressure Telstra’s margins.

Financial Health Check

When Telstra handed down its full-year results in August, it was pretty mixed. Its fixed enterprise business continued to be a drag, following the weakness it saw in the first half of the year. But, CEO Vicky Brady who has implemented a cost reduction strategy, hopes to see $350 million in costs cut by the end of FY25. Some key highlights include:

- Revenue: Rose by 1% year over year to AU$23.5 billion, reflecting growth in mobile services with 5.6% growth.

- Reported EBITDA: Decreased by 4.2% to AU$7.5 billion, influenced by one-off costs totaling AU$715 million related to restructuring and strategic decisions.

- Net Profit After Tax: Declined by 12.8% to AU$1.8 billion, primarily due to the one-off costs mentioned above.

- Dividend: The Board declared a fully franked final dividend of 9 cents per share, bringing the total annual dividend to 18 cents per share, a 5.9% increase from the previous year.

Telstra demonstrates solid financial health with revenue growth and increased dividends, despite a decline in EBITDA and NPAT due to strategic one-off costs. The company continues to invest in infrastructure and make strategic acquisitions, positioning itself for sustained growth. In December, Telstra announced the sale of a 35% stake in its cable TV and streaming unit, Foxtel, to British streaming platform DAZN for A$128 million.

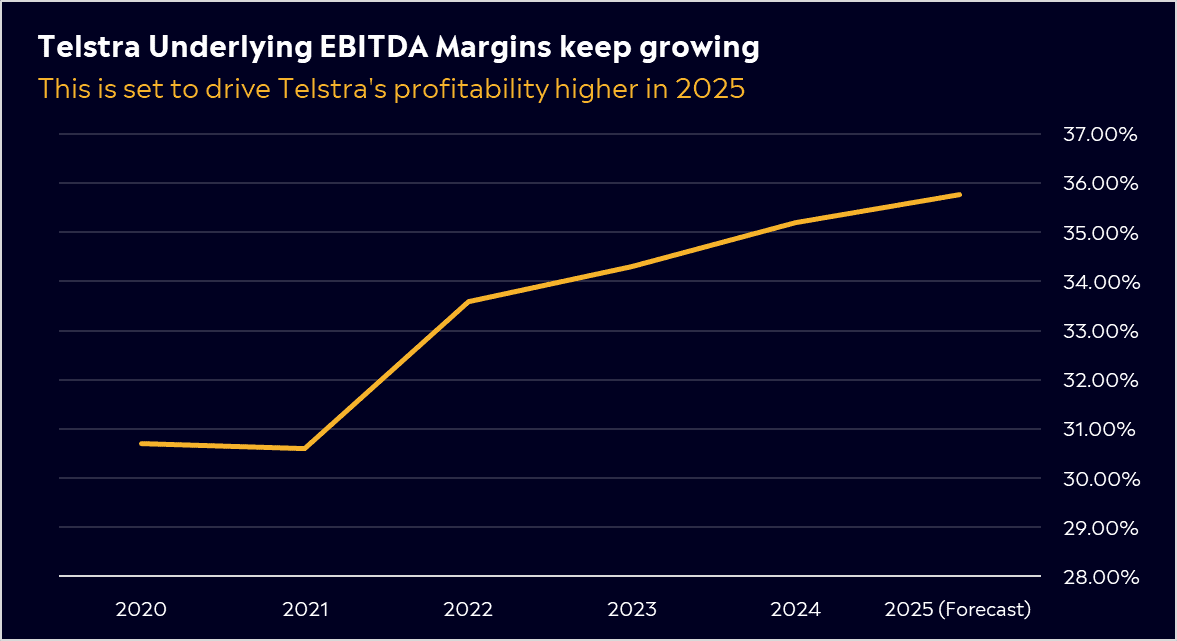

Tighter cost management is anticipated to underpin profit growth, alongside investment in 5G is paying off as customers shift to premium plans with higher revenue. Ongoing operational efficiencies and its strategy to simplify the business have driven productivity gains, supporting EBITDA margins and could be set to drive cash flow by 80% for the full year 2025.

* EBITDA (Earnings before interest, taxes, depreciation, and amortisation)

Buy, Hold or Sell?

As mentioned throughout, cost-cutting has been a key theme since CEO Vicky Brady took over. It was necessary to get the house back in order. However, that doesn’t mean they aren’t investing in the right places. Telstra recently announced it will spend $700 million over seven years rolling out AI across its business, one of the biggest deployments from any Australian company in AI to date. Shares currently trade at a 20x forward price-to-earnings ratio, lower than their 5-year average of 23x and cheaper than that of rival TPG, which is 34x. That might seem a little expensive given its lack of growth over recent years, but the business has become more efficient in recent years and profits should start to look healthy this year. Risks remain, from fierce competition and a slow 5G rollout monetisation to persistent higher interest rates pressuring consumers and costs.

Telstra does get the nod from analysts, though. According to Bloomberg’s Analyst Recommendations, it boasts 14 buy ratings, 1 hold rating, and 1 sell rating. With an average price target of $4.35, that implies an 8.5% upside. Telstra is the backbone of Australia’s telecoms, keeping millions connected daily. While it’s leading the charge in 5G and infrastructure, staying on top means constant innovation and sharper strategies, meaning it still has plenty of work to do. It’s a quality business with a fantastic dividend and 2025 might be the year it catches a break.

Explore Telstra

*Data Accurate as of 16/01/2025

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.