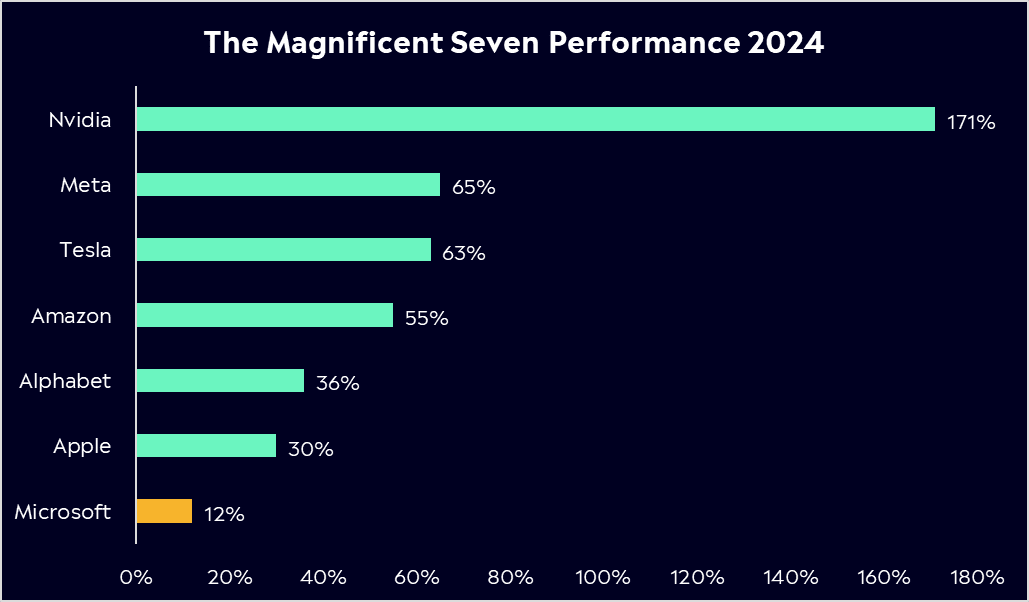

Microsoft’s 2024 performance was less than Magnificent. It was the worst performer among the Magnificent Seven, delivering a modest 12% return and lagging behind the S&P 500. Heavy investments in AI, with USD$14.9 billion in capital expenditures last quarter, have raised some investor concerns. Yet, with a proven track record of efficient spending and strong returns on capital, 2025 could be the year these investments pay off. As Microsoft enters the new year balancing challenges and opportunities, the question remains: is this tech giant still a powerhouse worth backing?

- AI demand is booming, with ChatGPT surpassing 300M weekly active users, and Microsoft looks set to generate USD$10 billion in annual recurring AI revenue next quarter.

- Microsoft’s AI spending and Azure growth are driving a transformative period, but high capital expenditures are raising concerns over margin pressures.

- Microsoft boasts 63 buy ratings, 6 holds, and 0 sells, according to Bloomberg’s Analyst Recommendations. With an average price target of USD$505.37, that implies a 20% upside—the highest potential gain among the Magnificent Seven stocks.

Explore Microsoft

The Basics

Microsoft is an immovable tech giant. It is the only tech name that has been in the top 10 largest companies in the US over the last 24 years. That’s because it’s deeply woven into our personal and professional lives. Office365 is a cornerstone of productivity, especially now with its AI Power Assistant, Copilot. Whether you write reports on Word, build presentations on PowerPoint, or manage finances in Excel. Chances are your inbox, and virtual meetings run on Outlook or Teams, which millions use daily.

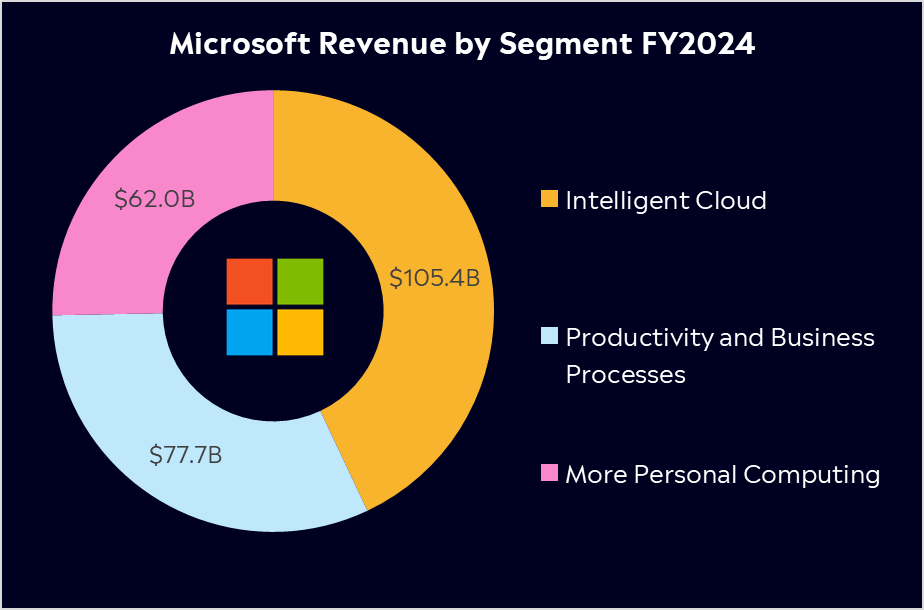

Even behind the scenes, Microsoft’s Azure, its cloud business and main revenue driver, powers many websites, apps, and services we rely on without even realising it. Whether it’s a quick game on the Xbox or enjoying Activision Blizzard hits like Call of Duty, Microsoft is part of our downtime, too. Many households and offices will also have a Microsoft-built tablet or laptop, merging hardware and software seamlessly.

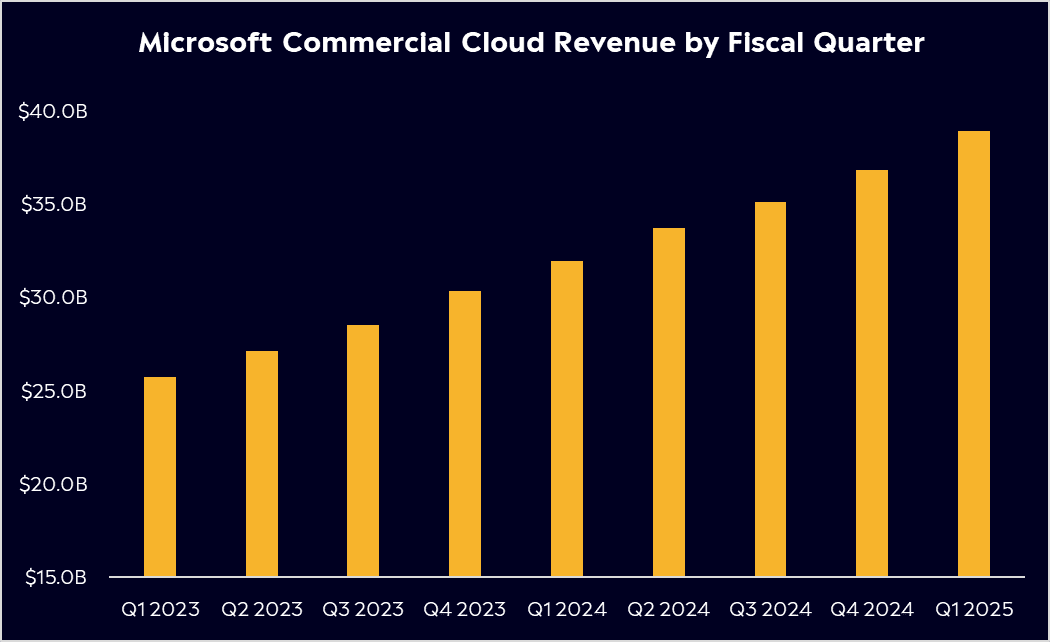

Now, Microsoft is positioning itself as a leader in artificial intelligence. Its early investment in OpenAI, which brought ChatGPT to the world, represents a generational leap in AI technology. However, despite its leadership in AI, 2024 was a challenging year for Microsoft shares. Heavy spending raised concerns among investors, and capacity constraints in data centres have limited their ability to meet demand, resulting in a slower growth forecast for Azure’s cloud-computing business.

Microsoft isn’t just reacting to AI; it’s driving it. Yet, as 2025 begins, its ambitious AI vision must strike a delicate balance between innovation and execution to reassure investors.

Fun Fact: Microsoft’s early investment in OpenAI wasn’t just about ChatGPT. Today, 85% of Fortune 500 companies use Microsoft’s AI solutions to shape their future. Impressive.

Competitor Diagnosis

Although Microsoft was an early investor in the AI space, its competition is spending big to catch up. Amazon was the biggest spender last quarter among the Magnificent Seven, outlaying USD$22.6 billion as it aims to catch up in AI. Microsoft’s Azure cloud platform is battling for dominance with Amazon Web Services (AWS) and Google Cloud. While Azure holds a solid second place globally, Google Cloud is closing the gap with aggressive pricing and innovative AI integration.

AWS continues to expand its offerings with specialised cloud solutions and advanced AI services, appealing to industries like healthcare, financial services, and government. Microsoft, meanwhile, leverages its Office 365 dominance and broad customer base to cross-sell Azure solutions, creating a stickiness few competitors can match.Additionally, through DeepMind and Bard, Alphabet is testing Microsoft’s early lead with OpenAI. As all these tech giants spend more, they will all face the challenge of converting their AI investments into sustainable revenue, particularly amid investor scrutiny of their heavy spending.

Microsoft also faces competition from Oracle, Salesforce, Adobe, and ServiceNow in the software space. Each of these players holds a unique advantage. Oracle, with its database expertise. Salesforce, with its CRM solutions. Adobe, with creative software and ServiceNow, with workflow management, pushes Microsoft to stay ahead with constant innovation.

Financial Health Check

Microsoft last reported earnings in October, dropping its Fiscal Q1 2025 results. These were better than expected. Revenue climbed 16% year-over-year to USD$65.6 billion, while net income rose 11% to USD$24.7 billion. Azure Cloud remained a growth engine, expanding by 30%

However, the company issued a lower-than-expected revenue forecast for Q2, accompanied by slightly slower Azure growth, which caused the stock to drop 10%. This feels like an overreaction, as demand for its AI products remains robust. Commercial cloud revenue increased 23% year-over-year, driven by strong enterprise renewals and growing interest in AI. Notably, Microsoft expects to surpass USD$10 billion in annual recurring AI revenue during the second quarter, with results expected later this month.

A key focus for analysts has been Microsoft’s soaring capital expenditures. Q1 capex reached USD$14.9 billion, up over 50% year-over-year, and is projected to total USD$80 billion for Fiscal 2025. While this spending has sparked concerns over margins margin, it’s a strategic move to maintain AI and cloud dominance. Importantly, AI monetisation is already underway, bolstered by the rising adoption of OpenAI models. In December, ChatGPT crossed 300 million weekly active users, reflecting strong sales momentum.They are spending a lot of money, but it’s needed to stay ahead. It’s also important to remember they sit on a war chest. They have USD$75 billion in cash, expected to reach USD$100 billion by the middle of 2025. Additionally, the company announced a 10% dividend increase last year, marking 15 consecutive years of growth. While heavy spending may weigh on margins, Microsoft’s ability to generate high returns on capital and sustained revenue growth should help temper concerns.

Buy, Hold or Sell?

Microsoft is trading at 32x forward earnings, higher than the S&P500’s 22x. While this premium might raise eyebrows, the valuation reflects the transformative period Microsoft is entering, driven by its AI ambitions. Investors will want to see solid earnings next quarter, especially after Microsoft underperformed the S&P500 last year.

Microsoft is monetising AI, accelerating revenue growth, and a colossal balance sheet supports it. Its minimal exposure to tariff changes or China-related risks also gives it somewhat of a ‘safe-haven’ status in a potentially volatile market post-election. However, competition from other tech giants like Amazon and Google is intensifying, and they are also spending big to capture market share in both cloud and AI.

Analysts remain bullish. Microsoft boasts 63 buy ratings, 6 holds, and 0 sells, according to Bloomberg’s Analyst Recommendations. With an average price target of USD$505.37, that implies a 20% upside—the highest potential gain among the Magnificent Seven stocks. For long-term investors, patience may be key as Microsoft’s massive investments bear fruit. Watch for updates on Azure Cloud growth, AI contributions, and any impact on margins, especially as Fiscal Q2 earnings later this month could set the tone for 2025.

If you believe Microsoft’s investments into AI provide a solid foundation, supported by its diversified revenue streams, strong profitability, fortress-like balance sheet, and growing dividend, this might be a stock worth keeping on your radar this year.

Explore Microsoft

*Data Accurate as of 10/01/2025

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.