When we think of sports or athletic brands, the first names that often come to mind are Nike or Adidas. That’s not surprising, given the size and brand awareness of these two businesses. However, they continue to face ongoing competition from up-and-coming sports brands that want a slice of the trillion-dollar industry, particularly as health and fitness become increasingly prevalent among today’s generation. ANTA Sports has established itself on a global scale with continued investments in new products and expansion overseas. It’s closing in on Nike for the top spot as China’s top-selling sports brand. So, does the future look bright, or are there hurdles ahead? Let’s find out.

- ANTA Sports is challenging global giants with rapid market share gains and a strong foothold in both China and international sportswear markets.

- Despite China’s economic headwinds, ANTA’s focus on diverse brand offerings and e-commerce growth has propelled its profitability.

- ANTA Sports has 51 buy ratings, 4 holds, and 0 sells, with an average price target of HKD$113.58, signalling a potential upside of 40.9% from its last closing price.

View ANTA Sport

The Basics

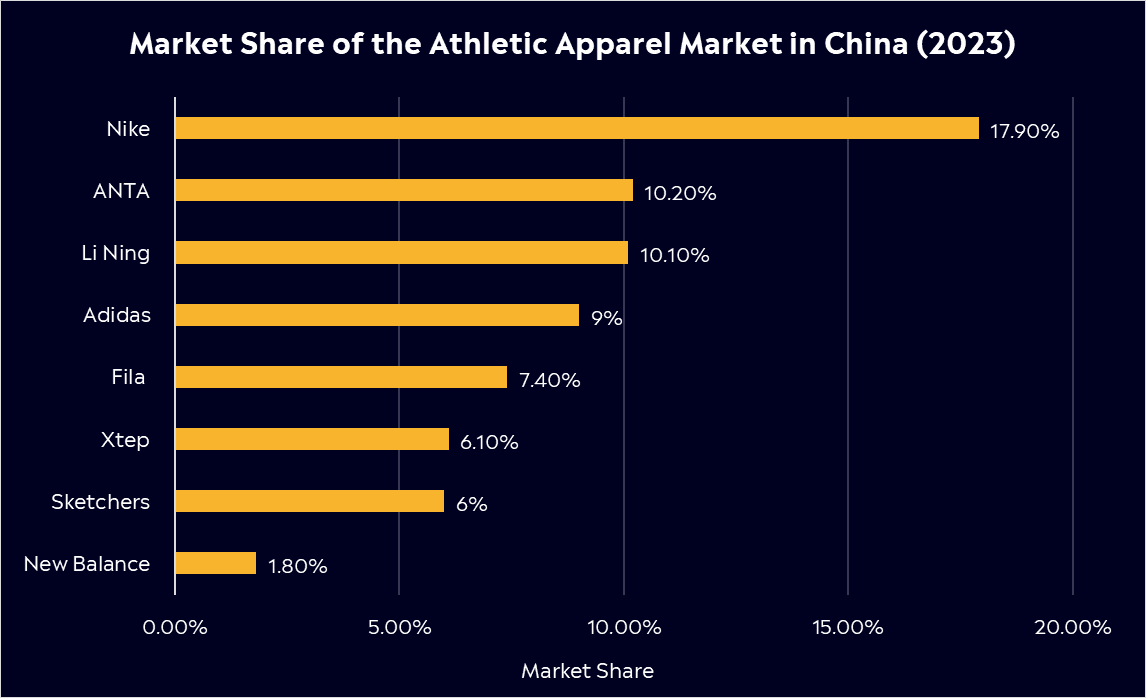

ANTA Sports is China’s largest sportswear brand and is ranked second for market share in the region behind, you guessed it, Nike! You may not have heard of ANTA Sports before, but their business is booming. They own brands you would have heard of, including Fila and the company also holds a 43.33% stake in US-listed Amer Sports, which owns brands such as Wilson, Arc’teryx, and Salomon. This makes ANTA a major player in China and the global sports and outdoor apparel market, with Amer Sports generating 72% of its revenue from Europe and America.

One of the reasons the business has found success in recent years is its diversified set of brands, which allow it to cater to a wide audience. For example, Fila is a premium offering, Anta label is a value-for-money brand, and they also offer China’s Lululemon equivalent through Maia Active. Additionally, through Amer Sports, they’ve gained a foothold in tennis through Wilson and Arc’teryx has become a go-to luxury brand for outdoor gear. (Being based in Sydney, I often see a queue for the Arc’teryx store on George St.)

Fun Fact: ANTA Sports has a longstanding partnership with the Chinese National Basketball Team. The brand has NBA stars Klay Thompson and Kyrie Irving as brand ambassadors.

Competitor Diagnosis

Competition for sportswear brands in China is intense. ANTA has invested heavily in digital transformation and has seen significant growth in its e-commerce channels. Its focus on digital innovation is crucial in reaching younger, tech-savvy consumers, particularly in China, where online shopping has boomed in recent years. It also complements its vast retail network with over 12,000 stores globally.

If we look at the local brands ANTA competes with, the standout name is Li-Ning. Known for its performance-focused footwear and stylish apparel, Li-Ning appeals strongly to younger Chinese consumers thanks to its trend-driven designs and collaborations. Xtep is another up-and-coming brand positioning itself as a mid-range alternative. While not as large as ANTA or Li-Ning, Xtep’s steady growth in China and Southeast Asia poses a challenge in the value segment.

It goes without saying that its fiercest competition comes from brands such as Nike, Adidas, and Lululemon. Nike has dominated market share in China for years, with its premium branding and huge global presence through the world’s most prominent athletes. However, the brand has struggled in recent years, allowing ANTA to gain market share. It has already successfully leapfrogged Adidas in recent years, with sales declining in China.

It’s also worth noting that we’re continuing to see competition arise. Though more known for its footwear than Apparel, OnHoldings has emerged as one of the trendiest names in the fitness industry. Shares have rallied almost 100% this year as a running craze seems to captivate the globe. However, with ANTA’s strong brand diversification, recent market gains in China, and global reach through Amer Sports, ANTA may have a leg up on the competition.

Financial Health Check

It would be alien not to mention the challenges that China has faced in recent years. Its economy has struggled to take off post-pandemic, and the nation is still grappling with deflation concerns. Consumers have been frugal and unwilling to part with their cash, which has seen slumping retail sales in 2024. However, consumer sentiment seems to be improving with a recent pick-up in sales and better-than-expected sales at China’s biggest shopping event, Singles Day.

In addition, recent measures rolled out by policymakers have yet to target consumers directly. We expect to see direct stimulus measures targeted at consumers in early 2025, which will support the economy but likely drive a pick-up in retail spending, a huge win for ANTA Sports.

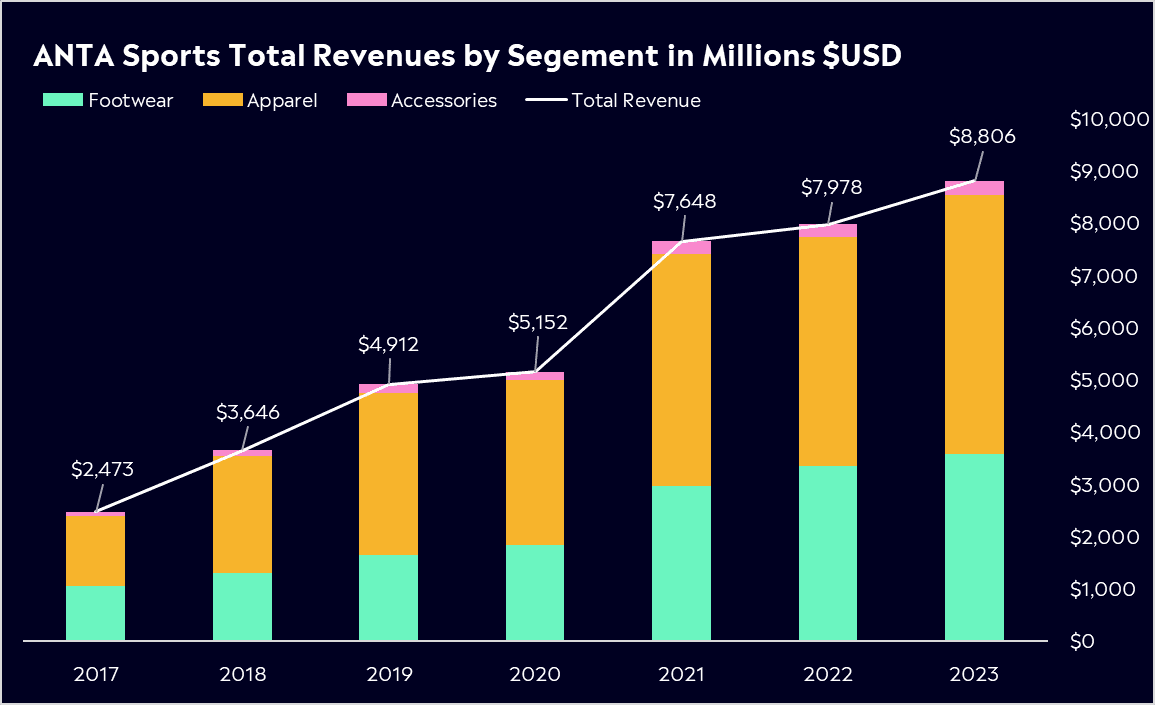

Over the last four years, ANTA Sports has grown its revenue by 17.5% on an annualised basis, led by growth in footwear that has seen almost 100% growth since 2020. Despite the challenges mentioned in China, the business has grown significantly, with profits increasing by 41% last year and set to see over double-digit growth again this year. The company boasts impressive gross margins at 63%, higher than its competitors, such as Nike, Adidas, and Li-Ning. ANTA Sports also pays a healthy dividend of 2.8%, given it has a solid ability to generate free cash flow, reaching USD$2.5 billion in 2023.

In China, there remains a persistent and increasing focus on health that is likely to see greater engagement in sports and outdoor activities through 2025. With ANTA still growing at a solid rate despite sluggish retail sales, 2025 looks to be a promising year if retail sales drive higher as expected. Given the uncertainty in China, shares have only gained 5.9% this year and remain somewhere from their record high reached in 2021 at HKD$182.80.

Buy, Hold or Sell?

ANTA’s diverse brand portfolio and focus on innovation have allowed it to maintain growth despite macroeconomic challenges. If you’re looking for exposure to the growing health and fitness trend in Asia and beyond, coupled with an established track record of growth, this is a business that stands out.

However, investors should keep in mind the uncertainties tied to China’s economic recovery and the ongoing competition from global and local players. While ANTA is well-placed to benefit from improving consumer sentiment and potential government stimulus, these factors are not guaranteed to materialise as expected. Its valuation of 15x forward P/E reflects some of these challenges but may not fully price in ANTA’s growth potential.

According to Bloomberg’s Analyst Recommendations, ANTA Sports has 51 buy ratings, 4 holds, and 0 sells, with an average price target of HKD$113.58, signalling a potential upside of 40.9% from its last closing price.

ANTA Sports has positioned itself as a compelling investment opportunity with its growth in China’s sportswear market, robust global expansion, and impressive financial health.

View ANTA Sport

*Data Accurate as of 20/11/2024

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.