Artificial intelligence (AI) – particularly generative technology – has taken huge strides in recent years. Not only has it captured our collective attention, but it has also captivated investors with its potential to revolutionise a variety of industries.

But does that make it a good sector to invest in? That depends on various factors, including your long-term financial goals, risk tolerance and risk management skills. Here, we look at what’s been happening in the world of AI and discuss whether investing in AI stocks on the ASX could be for you.

What has been happening in the world of AI?

The AI industry has displayed significant growth lately. One major recent breakthrough has been the rise of language models such as ChatGPT, showcasing the sheer power of generative tools. AI models have found applications across multiple domains, including content creation, customer support and virtual assistance.

AI has also modernised online search engines, allowing for more accurate and personalised search results. In short, the AI industry is evolving at a rapid and exciting pace, with ongoing research and new innovations fuelling its growth.

Is AI just a trend?

If recent history has taught us anything, it is that artificial intelligence is not just a passing trend but rather a transformative technology that could – and most likely will – shape our future. Over the short term, AI is likely to continue expanding its reach across sectors, driving new efficiencies, greater automation and better decision-making.

As AI becomes increasingly integrated into everyday business tasks and consumer applications, companies that harness its power successfully are likely to gain a competitive edge. That is why the AI market presents such a significant opportunity for investors to capitalise on the tech revolution.

What are the pros and cons of investing in AI stocks on the ASX?

Investing in AI stocks on the ASX comes with numerous advantages but also a few challenges. Here are some of the key pros and cons to consider:

Pros

- Growth potential: The AI industry is projected to grow exponentially, presenting an opportunity for investors to benefit from rapid expansion.

- Diversification: AI stocks can help you diversify your investment portfolio, as they expose you to a sector that operates across multiple industries.

- Innovation and disruption: Companies at the forefront of AI innovation have the potential to disrupt traditional business models and create significant value for shareholders.

Cons

- Volatility: The AI industry can be volatile, as it is influenced by technological advancements, regulatory changes and general market sentiment. Be prepared for potential fluctuations in stock prices.

- Competition and risks: As a highly competitive market, AI comprises countless players, all vying for dominance. Investing in AI stocks, therefore, involves risks related to market competition, intellectual property (IP) and regulatory challenges.

- Unpredictability: While AI holds tremendous promise, its full potential and impact on the world remains to be seen. The future trajectory of the industry remains uncertain, which is why you should carefully consider both the risks and opportunities before making any new investment decisions.

What are some of the top ASX AI stocks to look out for?

If you are interested in investing in AI stocks on the ASX, here are some well-known companies to consider:

BrainChip Holdings Ltd (BRN.ASX)

- Specialises in AI-powered edge computing solutions for AI applications, including facial recognition and object detection.

- Partners with leading institutions and private companies to develop innovative AI technologies.

- Focuses on low-power, high-performance AI processors for edge devices.

WiseTech Global Limited (WTC.ASX)

- Develops AI-driven software solutions for logistics and supply chain management.

- Has a comprehensive platform that streamlines and automates complex logistics operations.

- Holds a global presence with a strong customer base.

Xero Limited (XRO.ASX)

- Creates cloud-based accounting software that uses AI to automate financial tasks.

- Includes features such as invoice management, bank reconciliation and financial reporting.

- Gives businesses real-time insights and enhances their ability to manage their day-to-day finances.

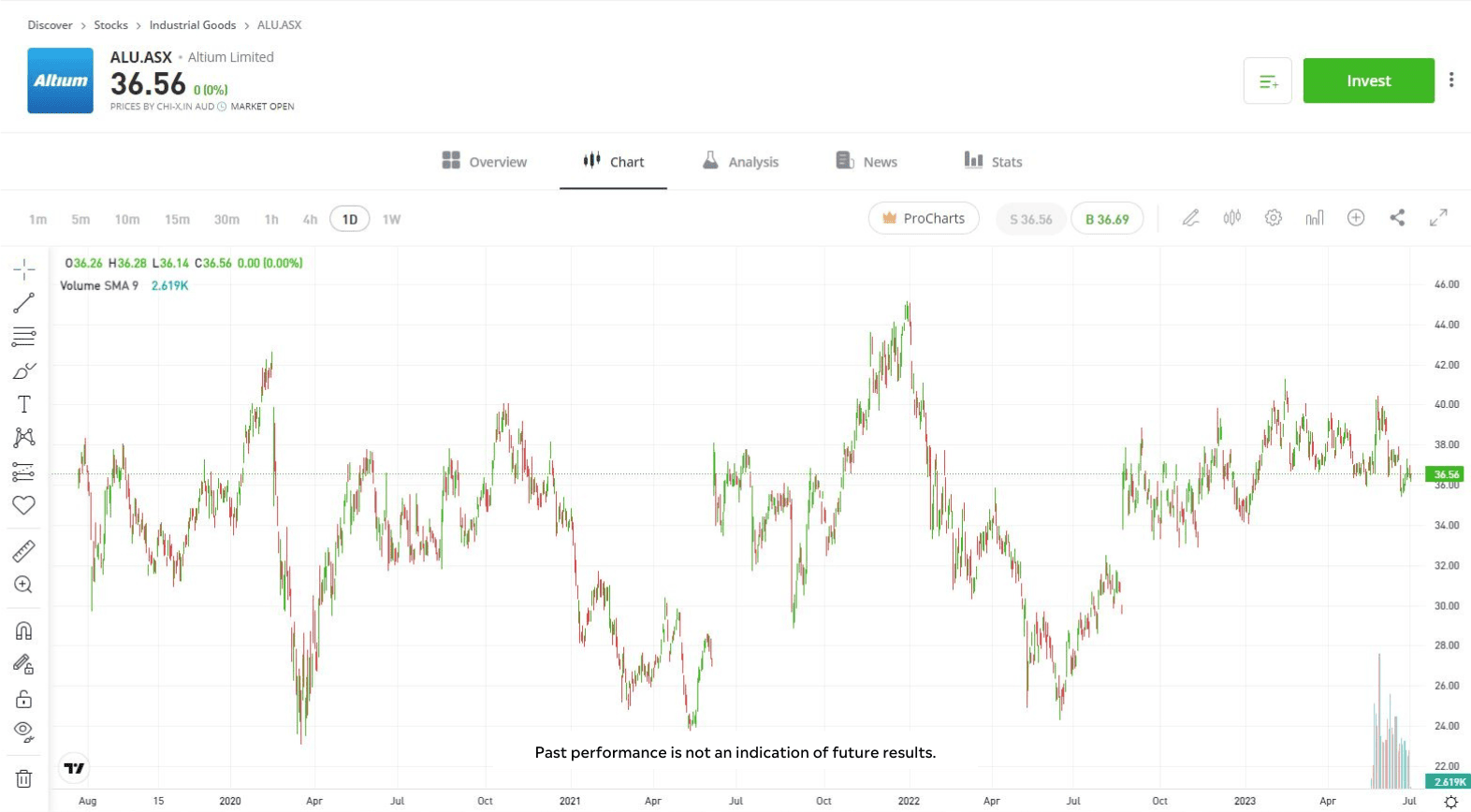

Altium Limited (ALU.ASX)

- Specialises in electronic design automation (EDA) software – powered by AI.

- Helps engineers design and develop electronic products more efficiently and with greater accuracy.

- Services multiple industries, including automotive, aerospace and consumer electronics.

As AI continues to transform almost every sector, investing in AI stocks on the ASX could provide some exciting new investment opportunities. However, while AI has enormous potential, it is also important to consider the drawbacks of investing in a relatively new industry. Diversification, growth potential and innovation are attractive features, but it is also prone to volatility and regulatory uncertainty.

Remember to do your due diligence and balance any potential investments against your risk tolerance before making a move into the AI market.

AU disclaimer: eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD.

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication