Interested in IPOs – particularly those involving tech companies? Then you are probably already aware of Arm’s recent initial public offering. But what does it mean for the industry, particularly for investors who want to know what is on the horizon for this fast-paced sector?

What you need to know about Arm

Arm Holdings is a British semiconductor and software design company founded in 1990. While Arm specialises in cutting-edge microprocessor architecture, its influence spans various electronic devices globally.

Arm’s inception traces back to a joint venture between Acorn Computers, Apple and VLSI Technology, initially named Advanced RISC Machines. It later went public, listing on the London Stock Exchange and NASDAQ in 1998. However, the most significant chapter in its history happened in 2016 when it was acquired by SoftBank Group, the Japanese investment giant, in a whopping $32 billion acquisition.

Arm is renowned for developing energy-efficient products without compromising on performance. Their central processing units (CPUs) are designed and developed in-house and then licensed to several leading semiconductor companies worldwide. As of 2023, more than 250 billion Arm-based chips are used in everything from sensors and smartphones to servers.

Arm products power 99% of premium smartphones, including industry giants like Apple and Samsung, so it is no wonder investors expect Arm to remain a cornerstone of computing innovation for years to come.

INVEST IN ARM

Arm’s IPO

Arm IPO date

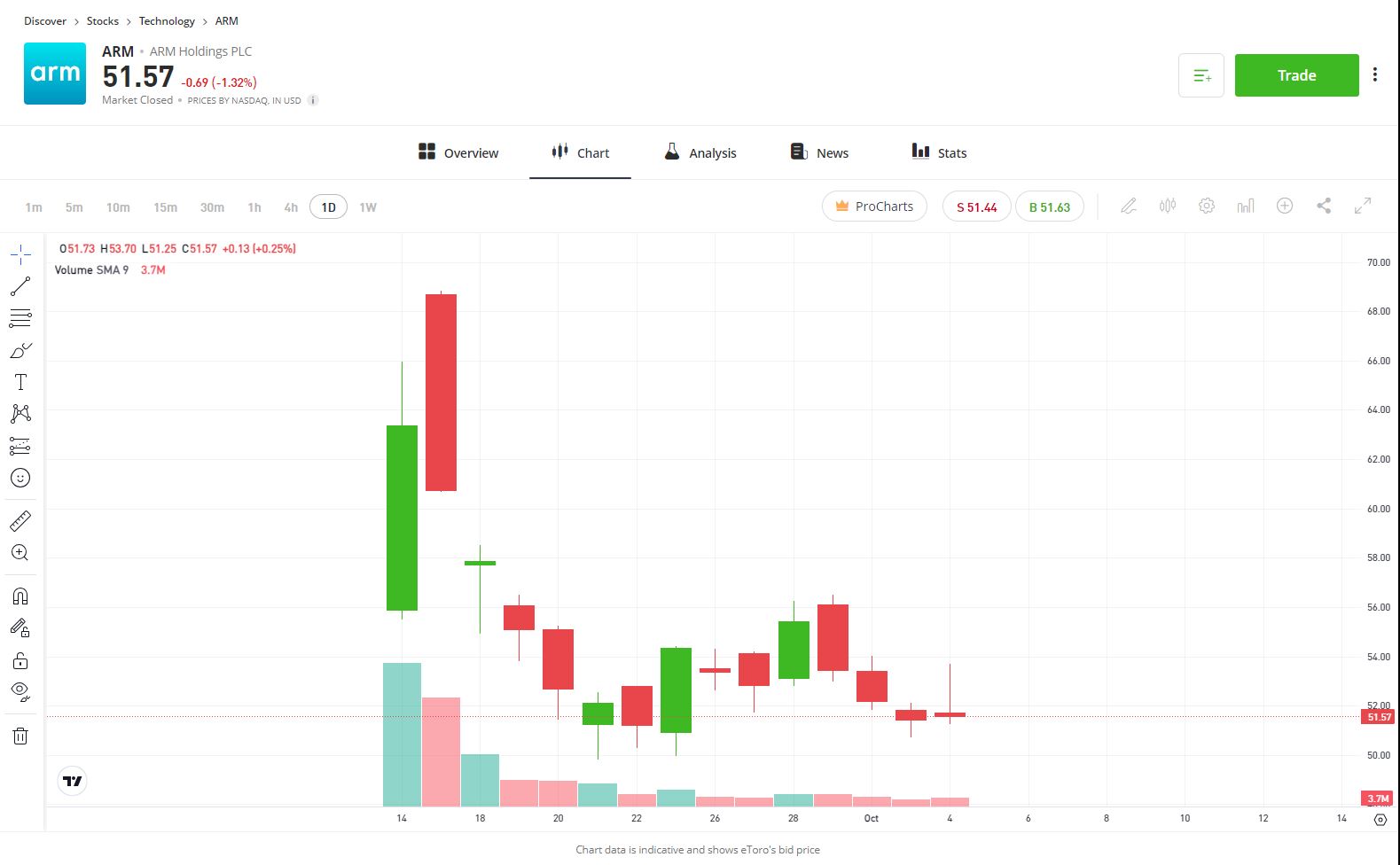

Arm Holdings returned to public markets with its IPO on the NASDAQ on 14 September 2023, trading under the symbol ARM.

Arm IPO valuation

Arm’s IPO was priced at $51 per share, valuing the company at around $54.5 billion. However, as trading commenced, the stock quickly surged 25% and closed at $63.59 on its first trading day.

Was the Arm IPO overvalued?

The IPO size combined with Arm’s post-IPO valuation raised questions over whether the company was overvalued. With an IPO valuation far exceeding its annual sales figures, some market observers have raised concerns about the premium attached to Arm’s shares. Only the coming months and years will provide clarity on whether Arm’s performance aligns with the market’s high expectations.

What may the future hold for Arm?

Arm’s business model faces several headwinds that could impact its growth prospects. While not a certainty, it is important investors have all the data at their disposal to make the best decision for their portfolio.

- Threats to growth: One of the top threats to Arm is the rise of RISC-V, an open-source chip architecture gaining momentum. If RISC-V continues to develop and gain market support, it could challenge Arm’s dominance, especially in the AI sector.

- Economic and geopolitical challenges: Arm’s significant exposure to China, where it pulls about a quarter of its revenue, presents economic and geopolitical risks. Escalating tensions between Western nations and China, coupled with uncertainties surrounding China’s business environment, could impact Arm’s revenue growth.

- Competition from tech giants: Arm faces stiff competition from tech giants such as Google, Microsoft and Nvidia (who terminated a previous attempt to purchase Arm), all of whom have a vested interest in the semiconductor industry. All these competitors have near-endless resources to potentially disrupt Arm’s market position.

- Supply and demand dynamics: The smartphone and consumer electronics markets, which account for over 50% of Arm’s royalty revenues, have stagnated slightly, potentially limiting short-term growth.

- Future opportunities: Despite these challenges, Arm’s future growth could be fuelled by emerging technologies such as AI. While the company is mainly focused on high-end smartphone chips, there is potential for Arm to expand its presence further.

Where is the tech industry heading in the next 12 months?

IPO volume

While the tech sector continues to be a hotbed of innovation, the turbulence in public markets over the past year may prompt some companies to delay their IPO plans until conditions stabilise. Investors’ appetite for new tech offerings will be influenced by global economic conditions and regulatory developments.

Performance outlook

Tech companies that have meticulously prepared for their upcoming IPO – showing strong fundamentals, profitability and sustainable growth – are likely to attract attention from investors, especially those with an existing interest in the sector. But the heady valuations from a few years ago might not be immediately achievable. Instead, some investors might prefer to focus on companies with compelling equity stories that showcase their resilience and adaptability in volatile market conditions.

Market sentiment

While some believe the recent (and highly successful) debuts of Instacart and Klaviyo should set the stage for others considering a public offering, their success is not necessarily a sign that new entrants will do the same.

Regulatory impact

Increased scrutiny and potential regulatory action could dampen investor enthusiasm in the coming months, especially for companies that rely heavily on data and digital platforms.

If you are interested in joining Arm on its second foray into the stock market, do your research and due diligence before investing, and always assess the potential rewards against your risk appetite.

INVEST IN ARM

Disclaimer:

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.