August was a turbulent month for global equities, the unwinding of the Yen carry trade following Japan’s surprising decision to raise interest rates sent global risk assets sharply lower. Investors also had to contend with heightened political tensions in the US, with the Presidential Election approaching, and rising geopolitical tensions globally, while Warren Buffett sold nearly half of his Apple (APPL). However this was merely a blip, markets overreacted and stocks recovered fast. The ASX200 even set one of its longest winning streaks in history gaining for ten consecutive days. Now, we look to September to see the stocks you should watch.

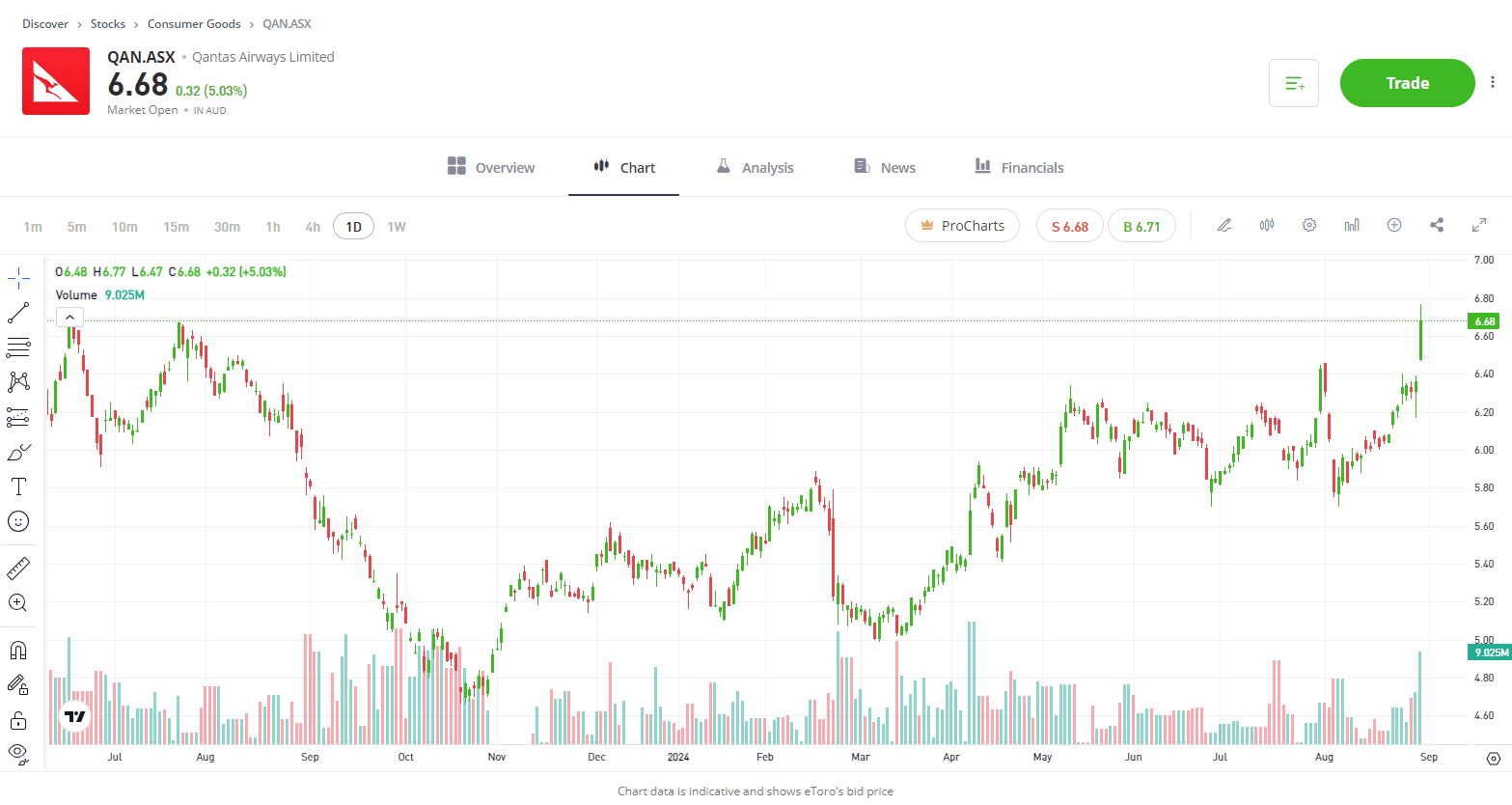

Stock #1: Qantas Airways (QAN.ASX)

Sector: Consumer Goods

Despite reporting a drop in full-year profits, Qantas’ full-year results offered optimism. Net income fell 28% year-over-year to AUD$1.25 billion as CEO Vanessa Hudson’s push to restore trust coincided with moderating airfares. The cost of rebuilding Qantas’ tarnished public perception through improved customer initiatives is hurting its bottom line. The business could see strength in its most profitable area of the business, domestic, following the exit of Bonza and Rex from the market. Jetstar will remain a key growth driver as consumers look for budget fares. Its journey in the next year will certainly be a turbulent one; managing ongoing ACCC investigations, continuing to repair its damaged reputation and navigating increased spending. It won’t be a one-way flight to success, but it feels like Qantas’ is making the right moves at the right times to get back to its best. Analysts have been quick to upgrade their price targets with 13 buys, 3 holds and 0 sells.

Past performance is not an indication of future results.

Past performance is not an indication of future results.

View Qantas

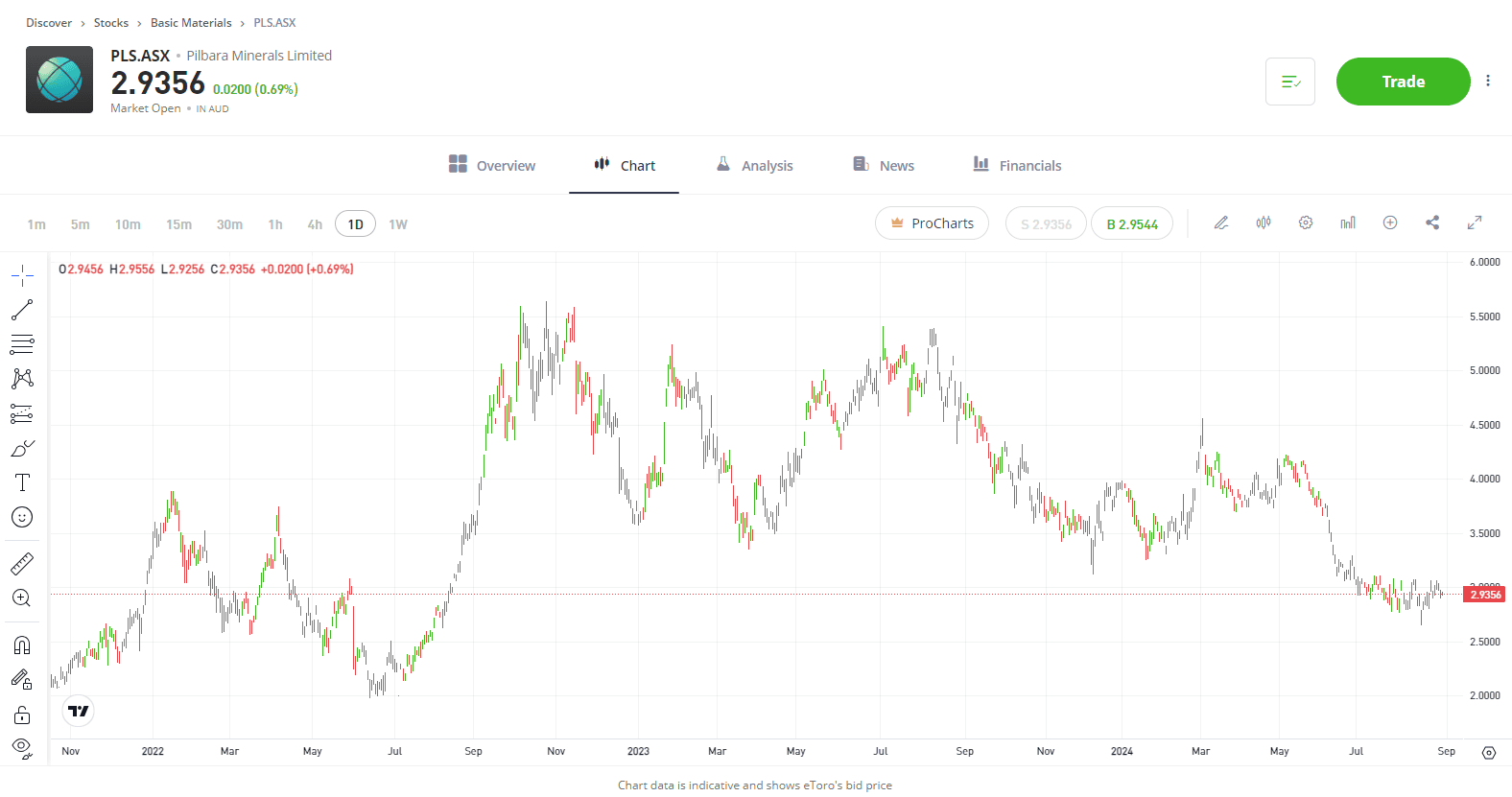

Stock #2: Pilbara Minerals (PLS.ASX)

Sector: Materials

Pilbara Minerals has had a tough 12 months. Last year may have been a golden year for Pilbara Minerals and it will certainly take some time to see those numbers again, with lithium prices needing to stage a serious rebound for that to be seen which is optimistic, to say the least in the short term. Revenue fell by 69% for the full year, and net income collapsed by 89%, falling from AUD$2.39 billion last year to a mere AUD$256.9 million this year. However, CEO Dale Henderson and his team aren’t ready to roll over just yet and believe in the long-term demand story for lithium. The business continues to push forward with its growth projects, recently opening the world’s largest lithium processing facility at its Pilgangoora operation in WA while also announcing a takeover of Latin Resources to improve its exposure in South America. The business has also lined up a new AUD$1 billion debt facility to strengthen its balance sheet and lay the foundations for future growth.

Past performance is not an indication of future results.

Past performance is not an indication of future results.

View Pilbara

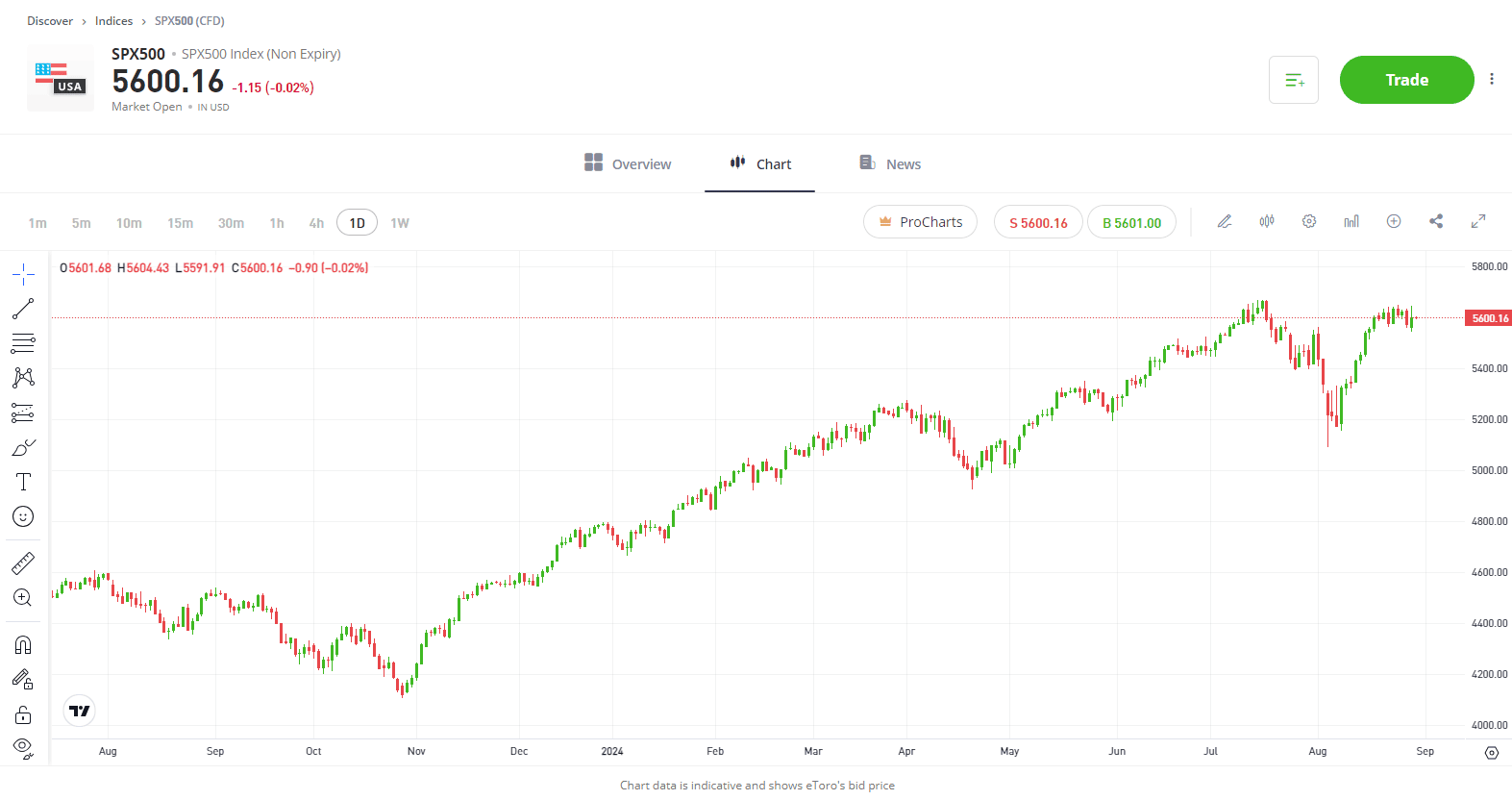

Stock #3: S&P500 (SPX500)

Sector: Indices

Last month’s volatility highlights the importance of diversification in an investment portfolio. By spreading investments across a variety of assets, diversification reduces the impact of any single asset’s poor performance. In times of market turbulence, not all sectors or individual stocks react the same way; some may even see gains, which can help offset losses in other areas. This strategy smooths out the volatility in a portfolio, providing a steadier return over time and leading to better risk-adjusted returns. Let’s take an S&P500 ETF as an example, this can be SPY, VOO, or IVV. This type of ETF invests in the 500 largest publicly traded companies in the US, offering broad market exposure. The S&P500 includes a wide range of industries such as technology, healthcare, finance, and consumer goods, which means that the ETF is inherently diversified across multiple sectors. Within the S&P500, different sectors perform differently based on various economic conditions. For instance, during a pullback in the technology sector, other sectors like utilities or consumer staples may perform better, thereby cushioning the overall impact on the ETF.

Past performance is not an indication of future results.

Past performance is not an indication of future results.

View S&P500

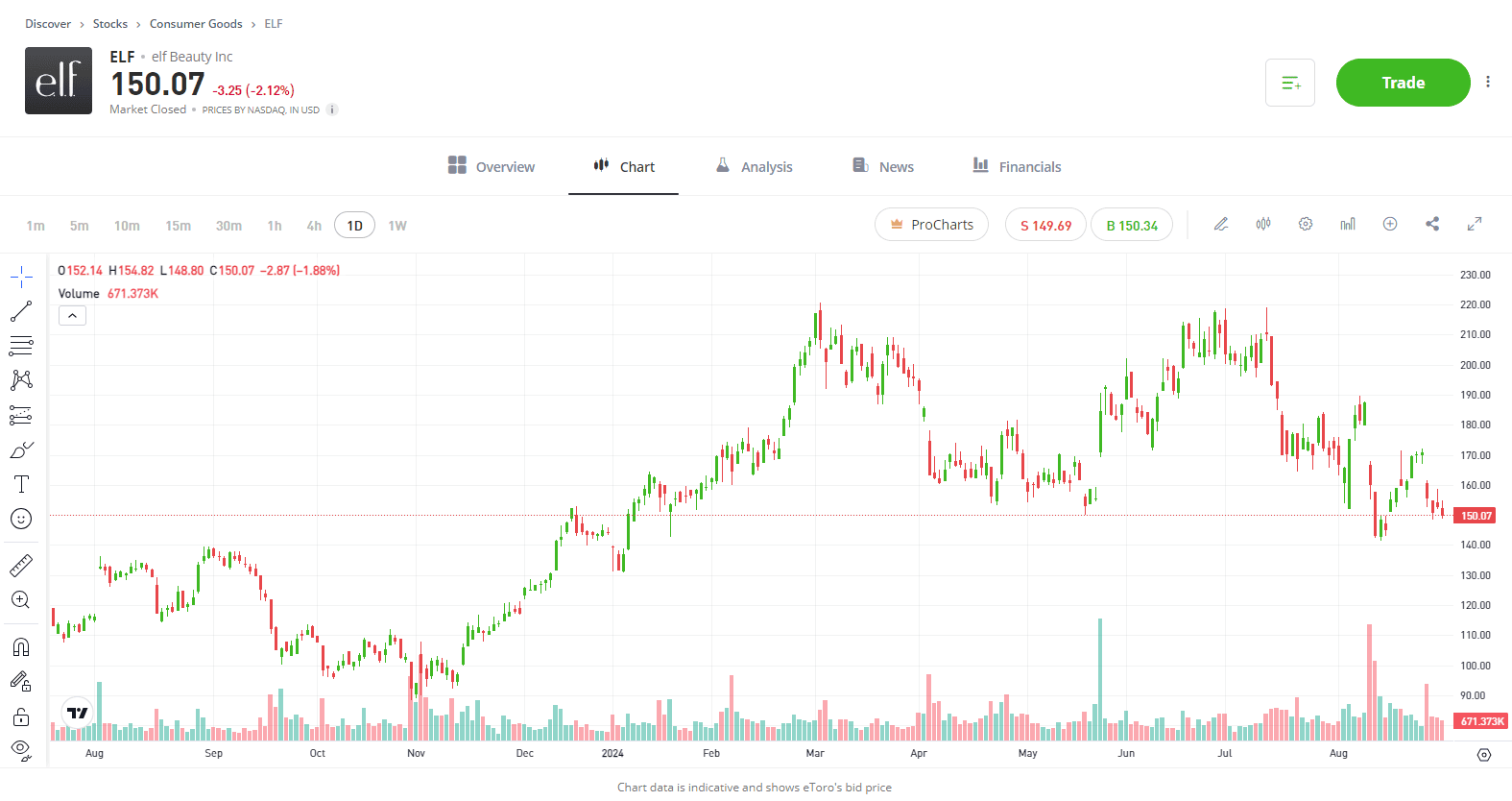

Stock #4: e.l.f Beauty (ELF)

Sector: Consumer Goods

Disrupting a multi-billion dollar industry is no easy feat, but that’s precisely what elf Beauty has managed to do. With prices as low as $1, elf has bridged the gap between luxury and accessibility, making quality cosmetics available to everyone. But elf’s journey is more than just a story of affordability; it’s about smart strategies and innovative marketing that have positioned the brand at the forefront of Gen Z beauty trends. They’ve delivered stellar returns for shareholders in the last five years, so it’s no surprise that Warren Buffett has dipped into the world of beauty, recently adding Ulta Beauty to his portfolio. Its affordability, rapid product development, and strong digital presence have solidified it as a market leader, particularly among younger consumers. Shares have fallen by 27% from their recent peak, and this could be an attractive entry for investors, especially with a solid runway for future growth and the potential for ongoing earnings beats ahead.

Past performance is not an indication of future results.

Past performance is not an indication of future results.

View elf Beauty

Disclaimer: eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.