September was a month expected to show weakness across markets, but global stocks defied poor seasonality to finish higher at the end of the month, capping off another stellar quarter for global equities. The S&P500 end five years of a negative returns during September, jumping 2% for the month as the Federal Reserve slashed interest rates by 50bps. But, the ASX200 outperformed the S&P500 in the third quarter thanks to impressive gains from Technology and Real Estate stocks with the index gaining 6.47%.

The question now is, can that rally continue into the year end. Well, the fundamental backdrop looks solid, we’ve got solid earnings growth, strong US GDP, China coming to the table, and a Federal Reserve who are doing a pretty good job so far.

Stock #1

Sector: Materials

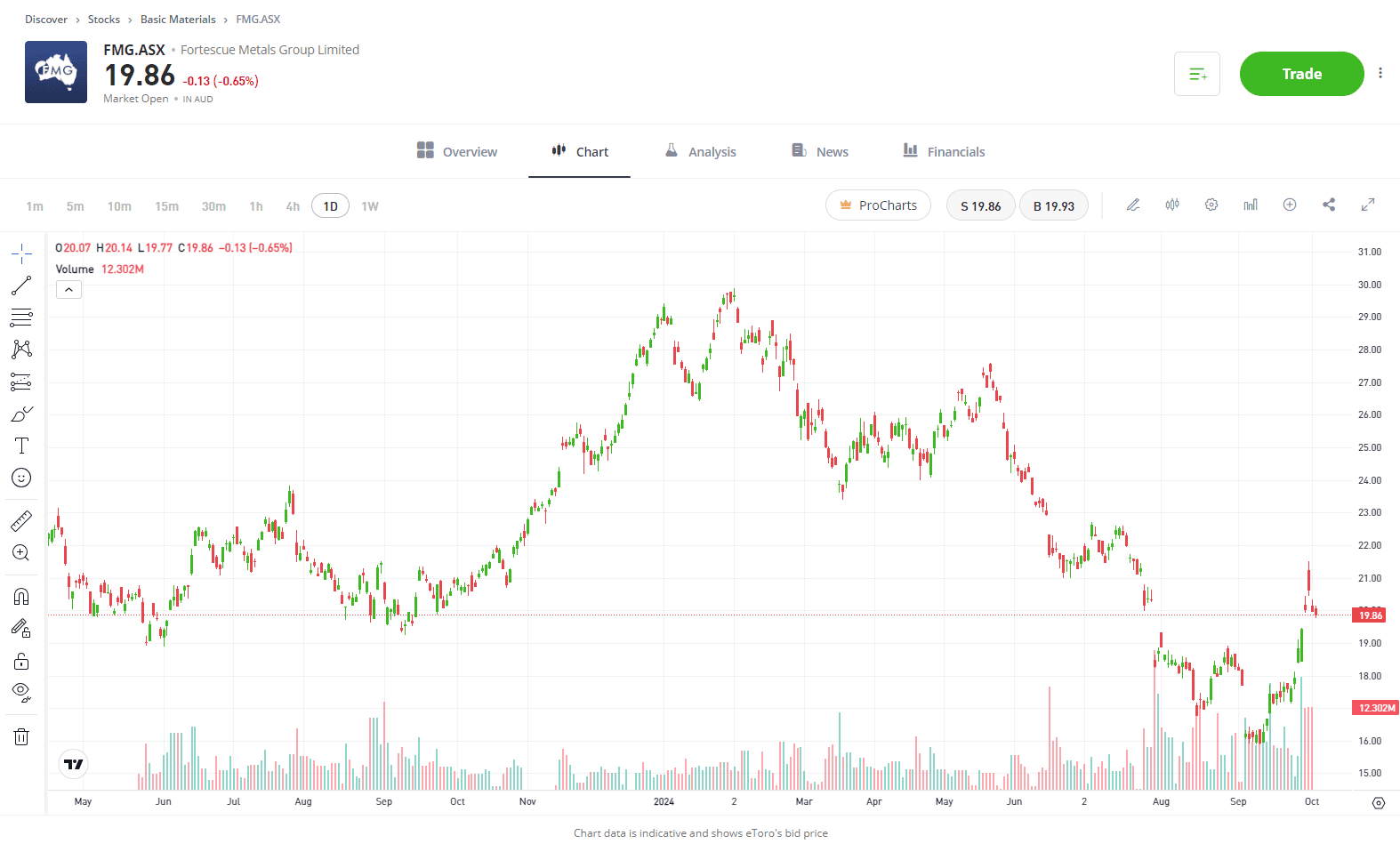

Fortescue Metals Group

China has finally come to the party, recently rolling out a large stimulus package in a bid to boost the economy and support the ailing property market. Iron ore miners have already seen great reward, but Fortescue Metals Group has positioned itself in recent weeks to stand out from the crowd. It announced it would pay $2.8 billion to replace two-thirds of its fleet of haulage trucks and equipment in Western Australia with electric versions to cut diesel consumption and meet ambitious emissions-reduction targets. The miner will buy 475 emissions-free machines, including 360 autonomous battery-electric trucks, from Germany’s Liebherr Group, it said in a statement Wednesday. The fleet, which was developed using Fortescue’s battery technology, will service its sprawling iron ore operations in the remote Pilbara region and is aimed at reducing costs in the longer term. This gives Fortescue a leg up on the emissions race against competitors, but the business may also continue to glow in the glory of China’s support package.

View Fortescue Metals

Stock #2

Sector: Consumer Goods

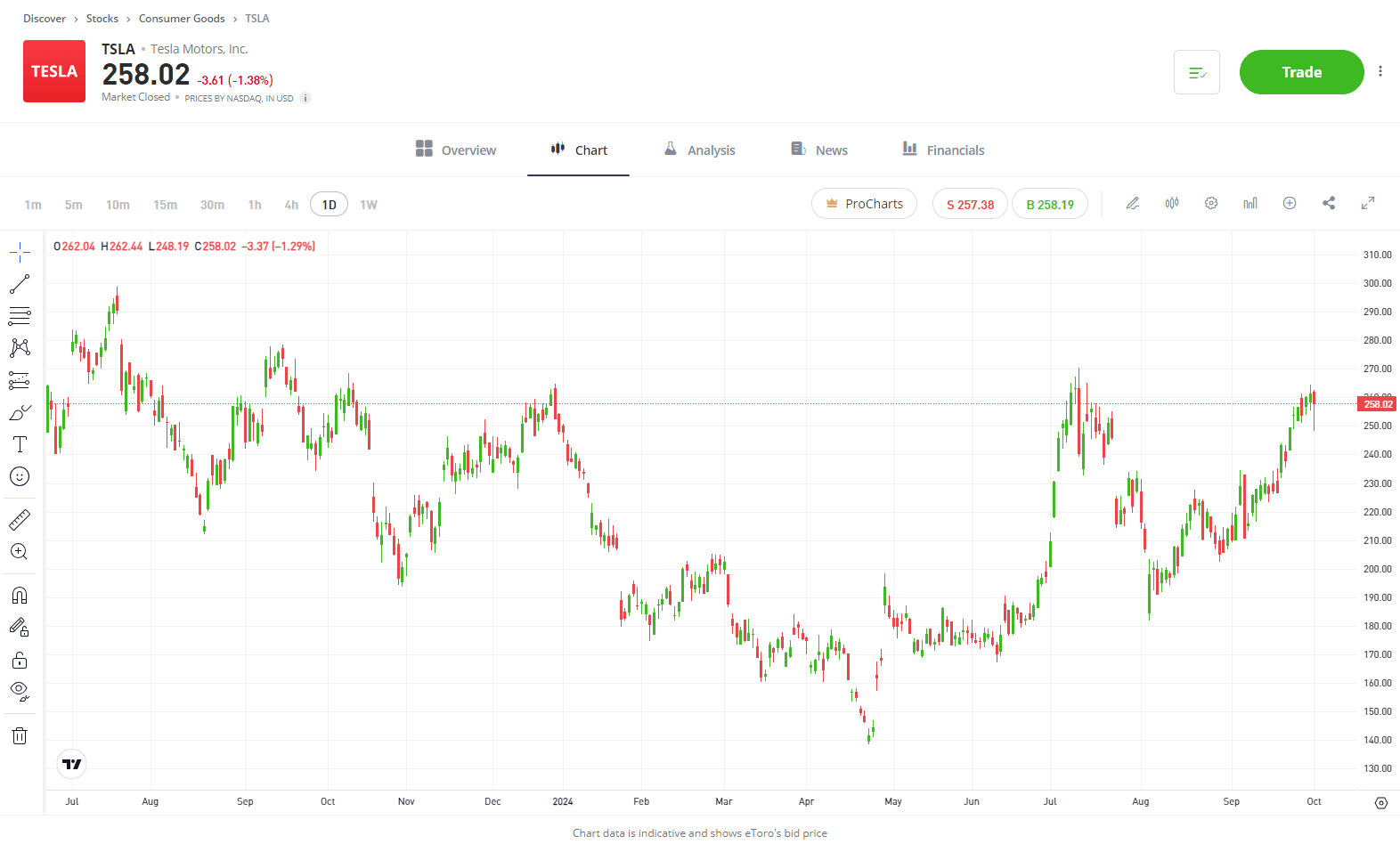

Tesla

It’s been a turbulent year for Tesla shareholders, with shares the worst performer on the S&P 500 in the first quarter but rallying almost 80% since May, and the good news might not be over. Tesla hands down its quarterly delivery numbers this week, a figure eagerly watched by investors, especially following two consecutive quarters of negative growth. However, the market expects Tesla to deliver 460k vehicles, a 6% jump from last year, with China expected to see record deliveries. A strong number would go a long way to shelving concerns of weakening demand while also boosting shares. Next week, Tesla will also hold its ‘Robotaxi’ event, where the EV manufacturer will unveil its highly anticipated self-driving technology. This bumper next few weeks, combined with the Fed starting its easing cycle, a catalyst Elon Musk has previously pointed towards, alongside the huge stimulus package in China, could create a perfect cocktail in October for Tesla. Its delivery numbers are expected on October 2nd.

View Tesla

Stock #3

Sector: Consumer Goods

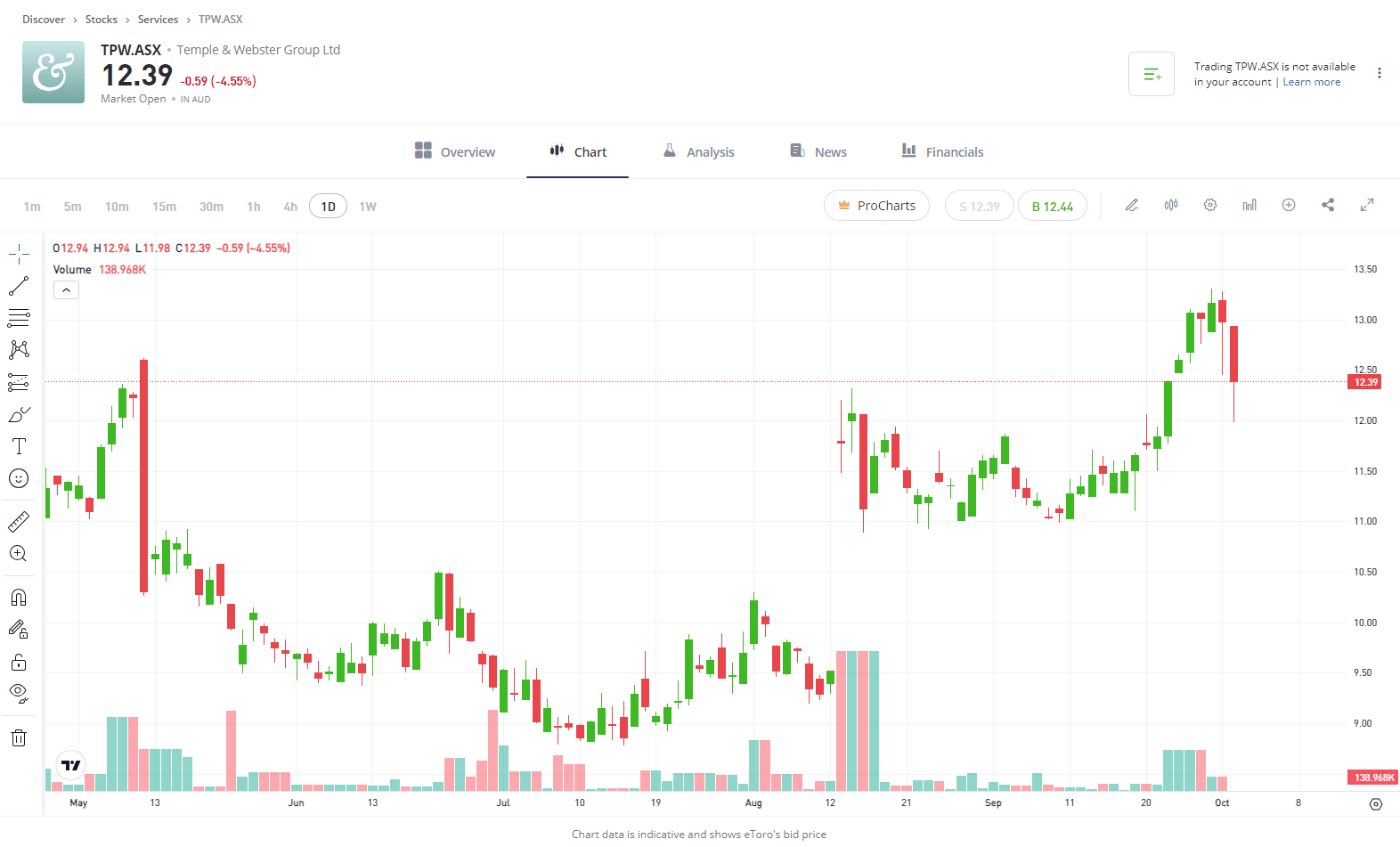

Temple & Webster

The growing world of eCommerce is no easy market to conquer, but Temple & Webster continues to grow its market share in Australia and has plenty of room to grow further. In Fiscal Year 2024, its market share of the total furniture & homewares market is now 2.3%, up 31% year on year. They run a profitable asset-light business model, with FY24 EBITDA at AUD$13.1 million and profit is set to grow dramatically over the next couple of years. That asset-light business model has helped its balance sheet. The business finished the year with AUD$116 million in cash and no debt, allowing Temple & Webster to enter into an AUD$30 million on-market buyback. Its balance sheet also allows the business to continue investing in logistics, customer experience, and technology while benefiting from the economies of scale.

View Temple & Webster

Stock #4

Sector: Services

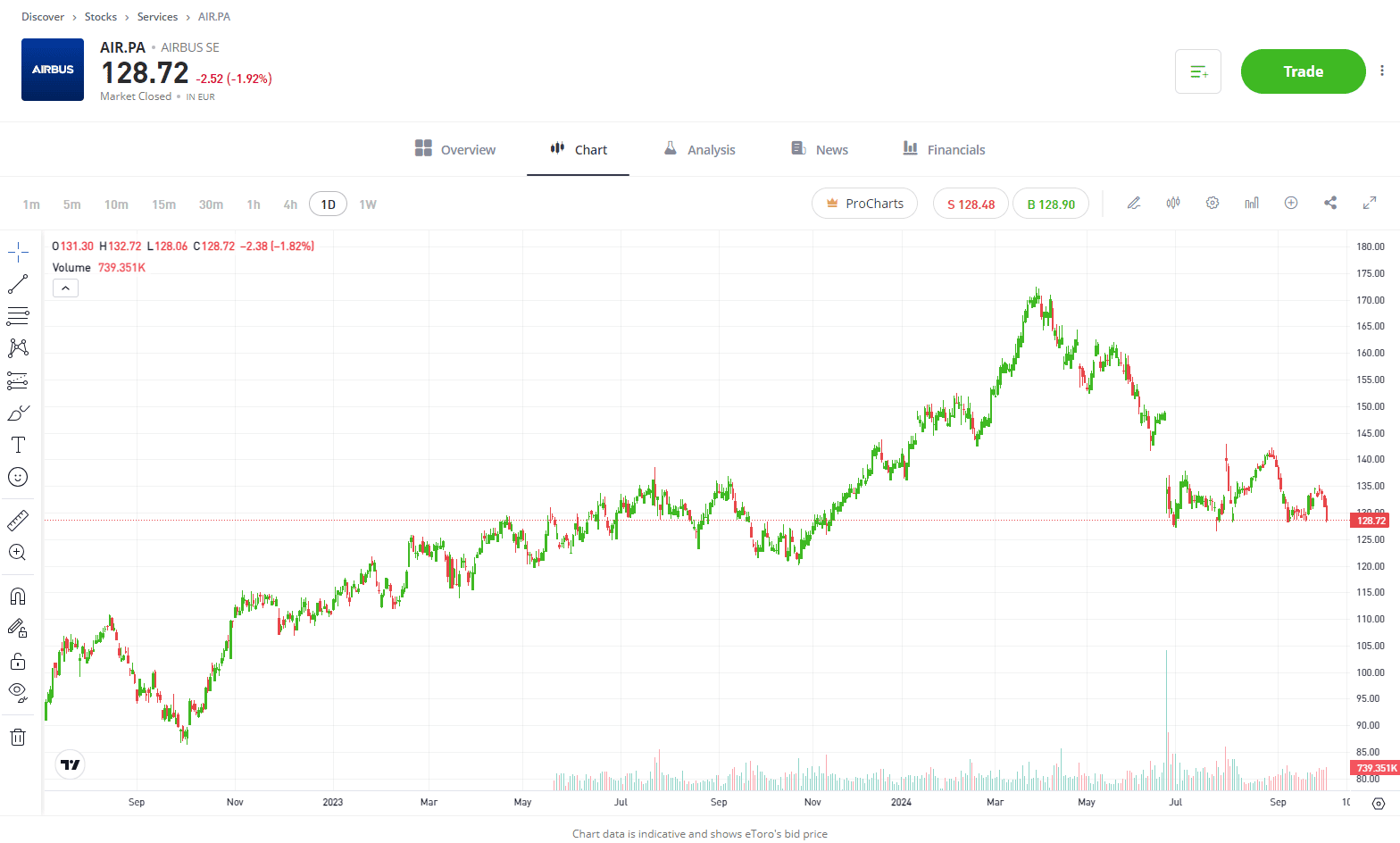

Airbus

Boeing has been under immense pressure due to a series of issues with its planes and production processes in the last 18 months, leaving room for Airbus to sneak in and gain further market share on its competitor. Currently, Airbus dominates around 60% of the airplane manufacturing industry and is hoping to extend that amid recent troubles for Boeing. Ultimately, navigating the turbulent skies of the aerospace industry is no small feat, but Airbus has proven it has what it takes. With a focus on innovation and efficiency, Airbus has positioned itself as a leader in both commercial and defence aviation. The company’s strategic initiatives to ramp up production and capitalise on increasing military spending have set the stage for significant growth. Rising military spending across Europe further supports growth, particularly in the defence and helicopter segments. Airbus has 21 buy ratings, 5 holds, and 1 sell, with an average price target of EUR€163 signalling 27% upside.

View Airbus

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.