October was a volatile month for markets, with global stocks falling with uncertainty heightened by the upcoming US election and the potential implications of a policy shift on inflation and interest rates. Closer to home, Australia stocks also fell with only the financial sector finishing in the green for the month. Utilities and Consumer Staples stocks led in index lower, with major supermarket chains Woolworths and Coles coming under pressure. However, a pullback was expected at some point across global equities given how strong their performance has been this year. Here are four stocks for you to watch in November.

Stock #1

Sector: Tech

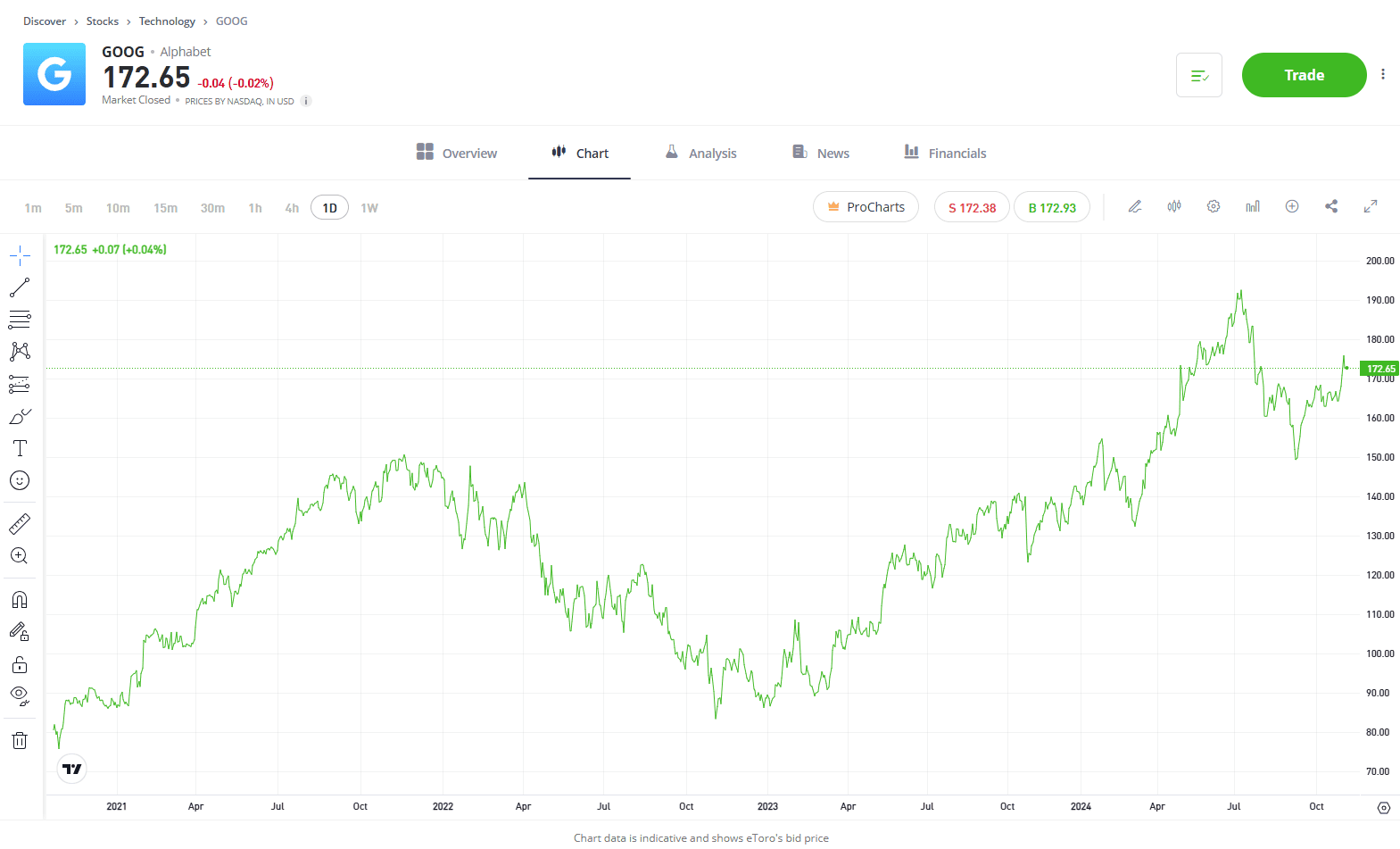

Alphabet

The Magnificent Seven’s eye-watering rally cooled slightly in recent months as investors questioned whether their large investments into AI were really paying off. Recent earnings from Alphabet showed they were. Profitability rose at a solid pace, with operating margins jumping to 32% from 28% a year ago despite rising capital expenditures. The company spent USD$13.1 billion in the quarter, more than expected, but with net income rising 33% year over year, investors can know that their spending is well placed. Every key segment has beat expectations, which shows precisely why the company is branded as magnificent. Alphabet is a money-making machine, and its growth is nothing short of impressive. Its cloud division was the standout, seeing revenue rise to USD$11.4 billion, higher than the USD$10.8 billion Wall Street expected. Microsoft and Amazon are the leaders in the cloud business, but Google is gaining ground and attracting more cloud customers as the rise of AI across enterprises continues.

Past performance is not an indication of future results.

View Alphabet

Stock #2

Sector: Consumer Goods

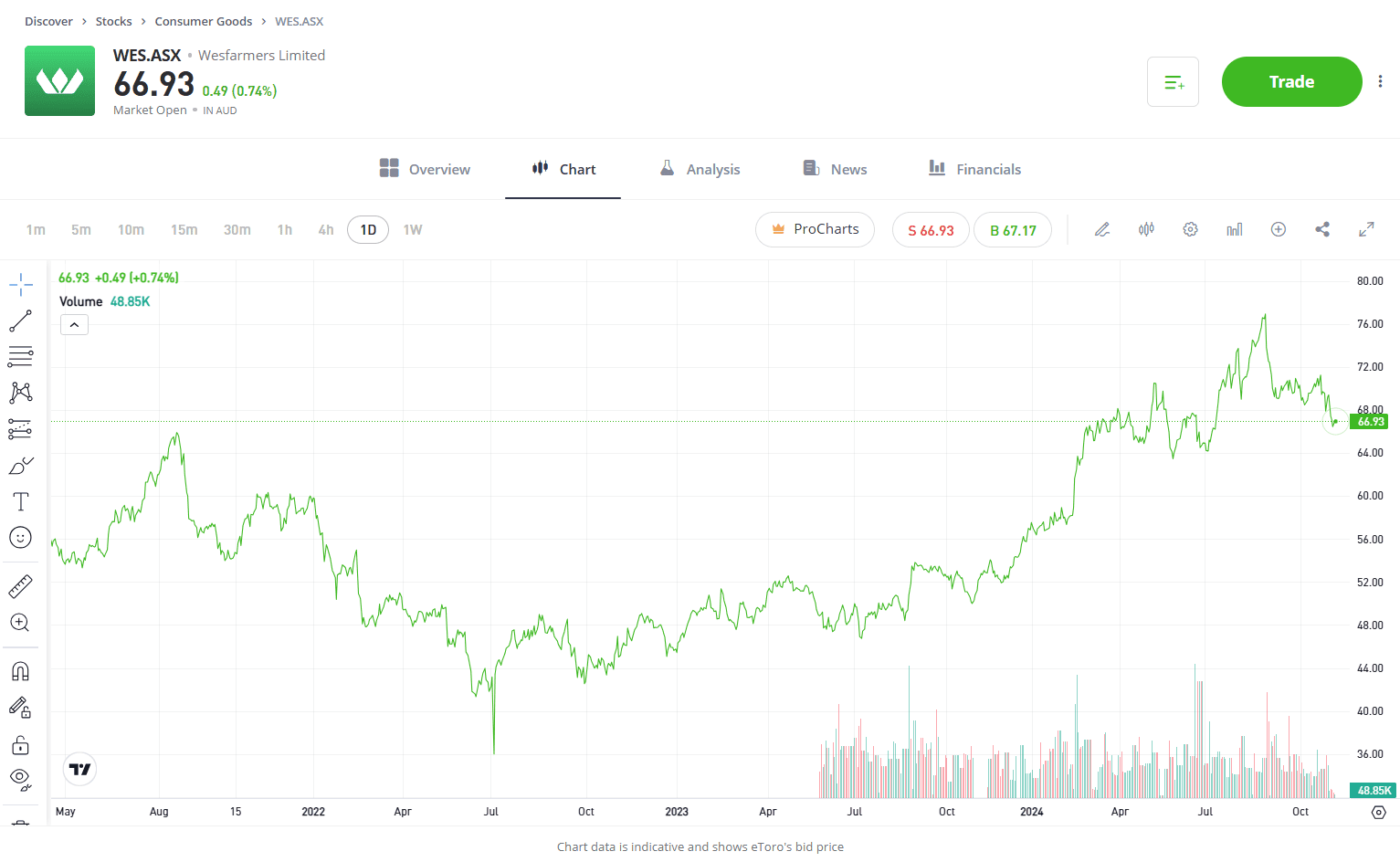

Wesfarmers

After a solid yearly result back in August, which saw Wesfarmers announce growing profits and increased dividends, the business may still have more time in the sun. Kmart was one of the standout performers in FY2024, which may not be a huge surprise given its cost-conscious focus, with higher interest rates and inflation squeezing Australian’s wallets, with profits rising by 25%. Wesfarmers brands like Kmart, Bunnings, and Officeworks, which offer lower prices due to solid cost efficiency, will continue to be attractive to consumers who are looking for those value products. Kmart is also feeling the love among Gen Z’s with its ‘dupe’-like products, which are proving to be a hit. Although the business will have challenges to navigate over the months ahead, it seems to be in a great position to benefit from consumer preferences.

Past performance is not an indication of future results.

View Wesfarmers

Stock #3

Sector: Services

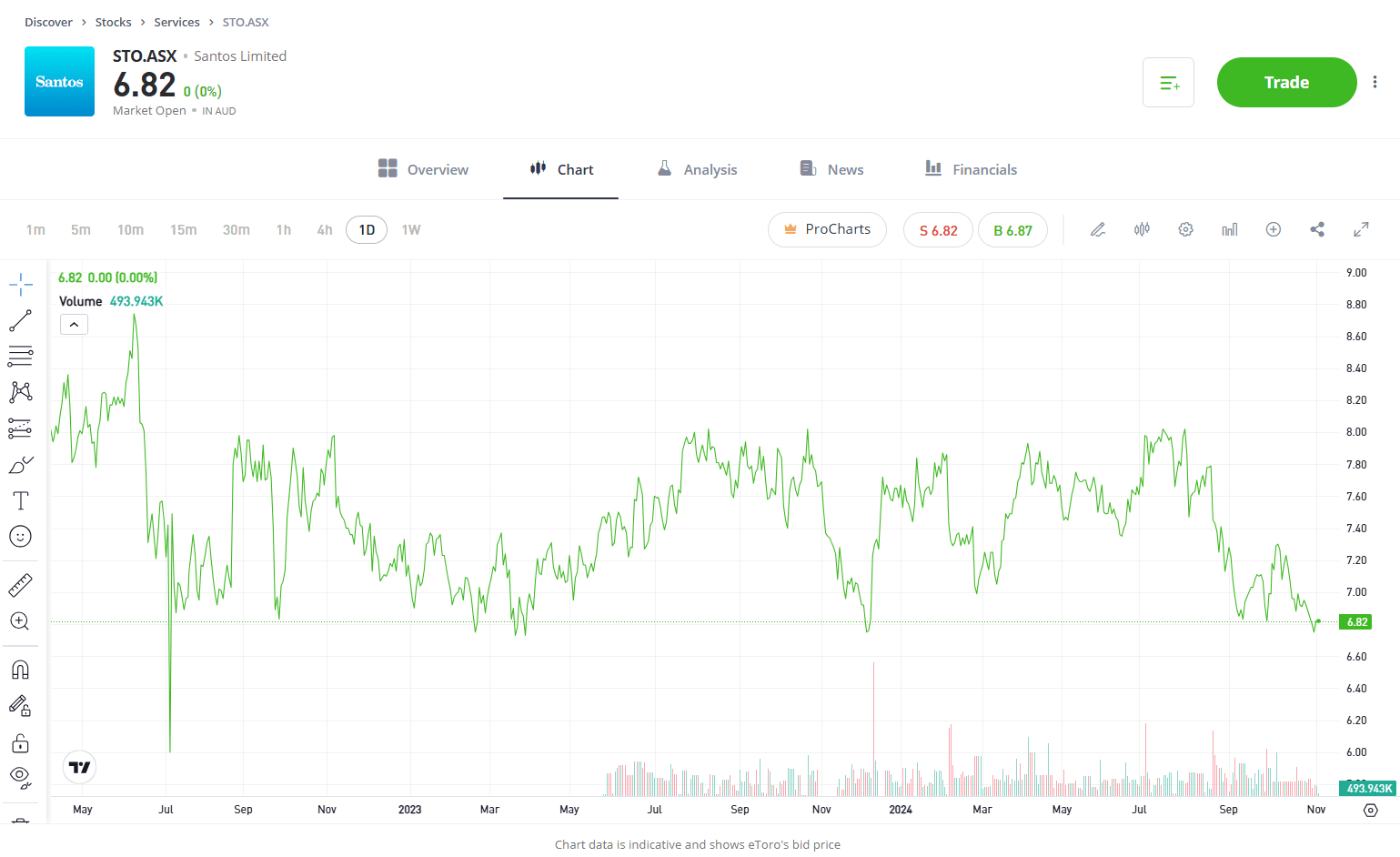

Santos

The ASX energy sector has had a tough year and is the worst-performing sector on the ASX200. Volatility across energy prices has been a driver of the weakness. Santos, one of the biggest names on the ASX200, is strategically positioned to benefit from both traditional energy sources and the growing demand for cleaner alternatives as global economies grapple with the energy transition. Santos is a major Australian oil and gas exploration and production company. It operates across Australia, Papua New Guinea, and Asia, with a primary focus on LNG (Liquefied Natural Gas), which it exports to key Asian markets. Santos’ exposure to both oil and gas provides a diversified earnings base that should support its long-term growth, especially as it looks set to see production growth across its energy assets. Santos has paid out a healthy 6.7% dividend in the last 12 months and has grown its dividend by almost 50% in the last 3 years.

Past performance is not an indication of future results.

View Santos

Stock #4

Sector: Materials

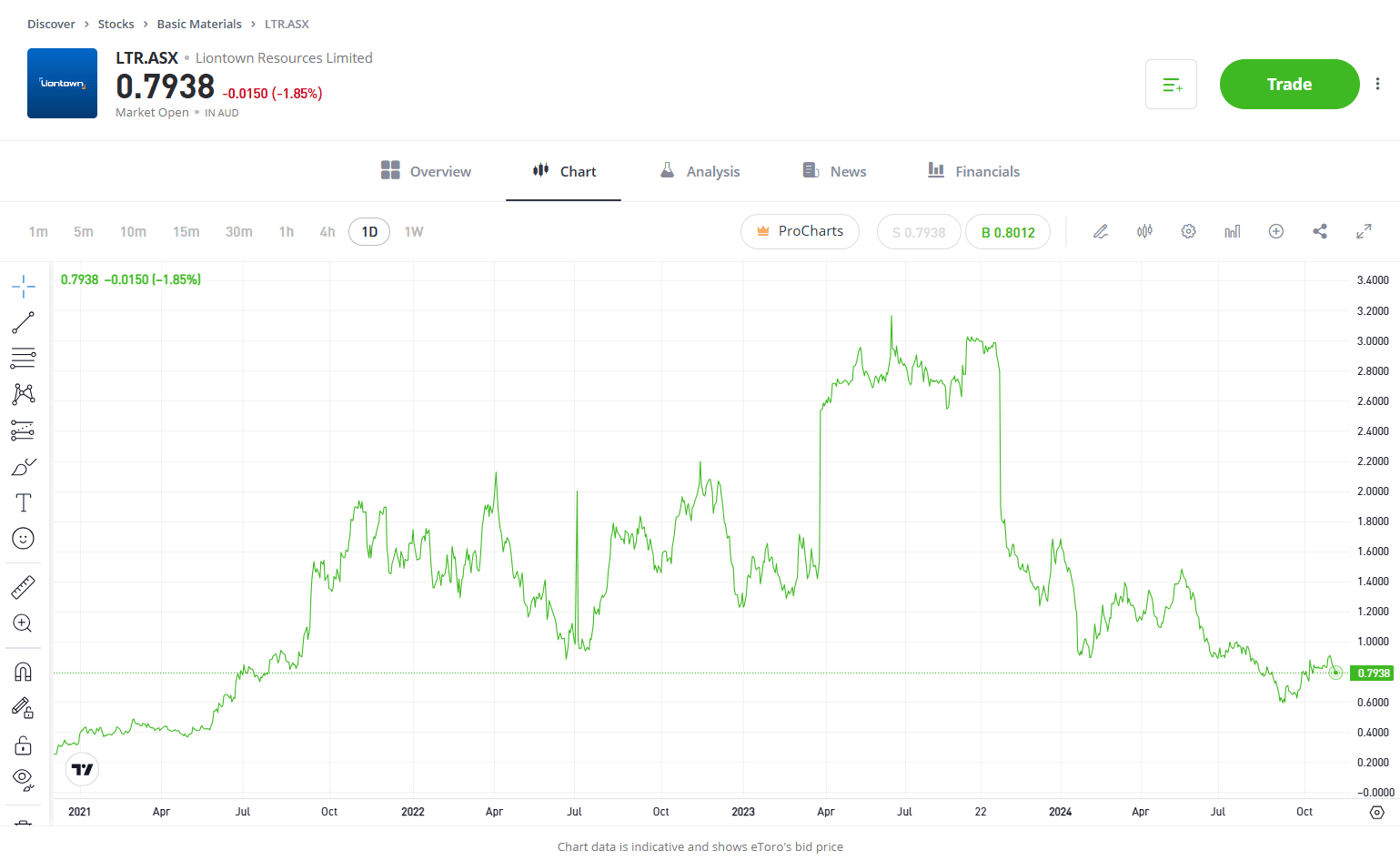

Liontown Resources

Lithium miners have seen significant drawdowns in the last 12 to 18 months after a golden few years that saw share prices rally to dizzying heights. However, the world’s largest miners are scrambling to increase their exposure to energy transition commodities such as lithium, putting stocks such as Liontown Resources front and centre. With the company’s new Kathleen Valley facility now producing lithium and shipping its first load to China last month, shares could be in for a brighter time ahead. Governments around the world, including in the US and Europe, are rolling out policies to incentivise EV adoption, which should only increase demand for lithium. With the latest move from Rio Tinto to acquire Acardium, Liontown, once an acquisition target of the world’s largest lithium Albermarle, makes the stock one investors should watch closely.

Past performance is not an indication of future results.

View Liontown Resources

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.