In May, investors navigated a whirlwind of challenges, from mounting inflation concerns to unprecedented volatility in the tech sector. Amidst rising consumer prices and supply chain disruptions, anxiety over inflation reached a fever pitch, prompting a reevaluation of investment strategies and expectations for future monetary policy. Additionally, earnings season provided insights into the health of various sectors, with strong performances driving some stocks to new heights while others faced selling pressure despite exceeding expectations.

As we turn the page to June, we highlight top stocks poised for action. So here are four stocks to watch in June.

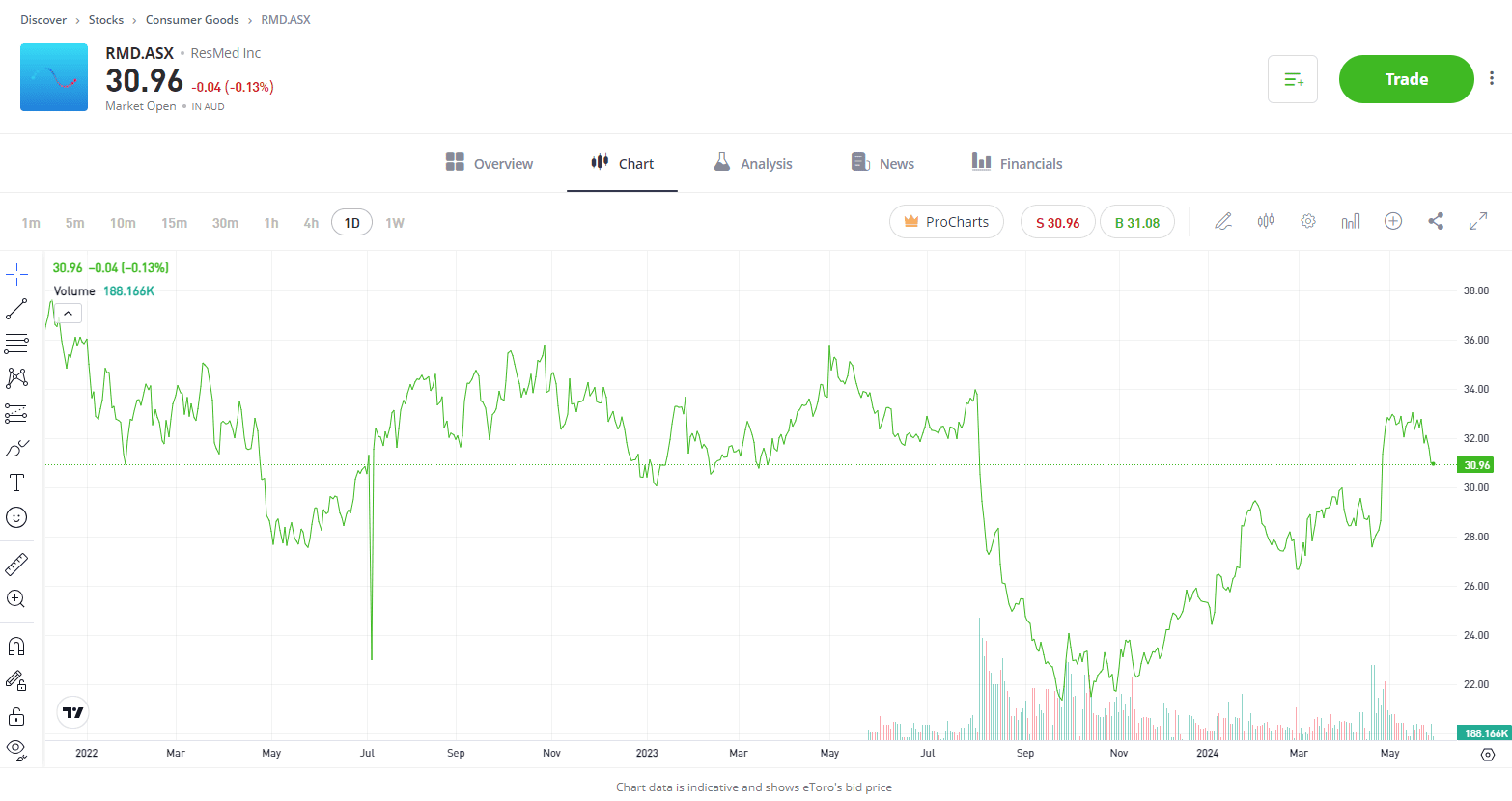

Stock #1: ResMed (RMD.ASX)

Sector: Consumer Goods

ResMed is one of the largest makers of respiratory devices used to treat sleep apnea. Their aim is to design innovative solutions to treat and keep people out of the hospital, empowering them to live healthier, higher-quality lives. Shares have had a great start to the year, bouncing back after shares tumbled towards the end of 2023 following the development of GLP-1 drugs like Ozempic. The fear was that their development would impact ResMed due to the connection between obesity and sleep apnea, potentially reducing the demand for its devices and posing a threat. However, for the time being, that hasn’t come to fruition, and ResMed has continued to deliver. Device sales in the most recent quarter were strong while gross margins rebounded, seeing analysts lift their price targets across the board. According to Bloomberg’s Analyst Recommendations, the company currently has 14 buys, 0 holds, and 0 sells, with an average price target of AUD$35.23 a share.

View ResMed

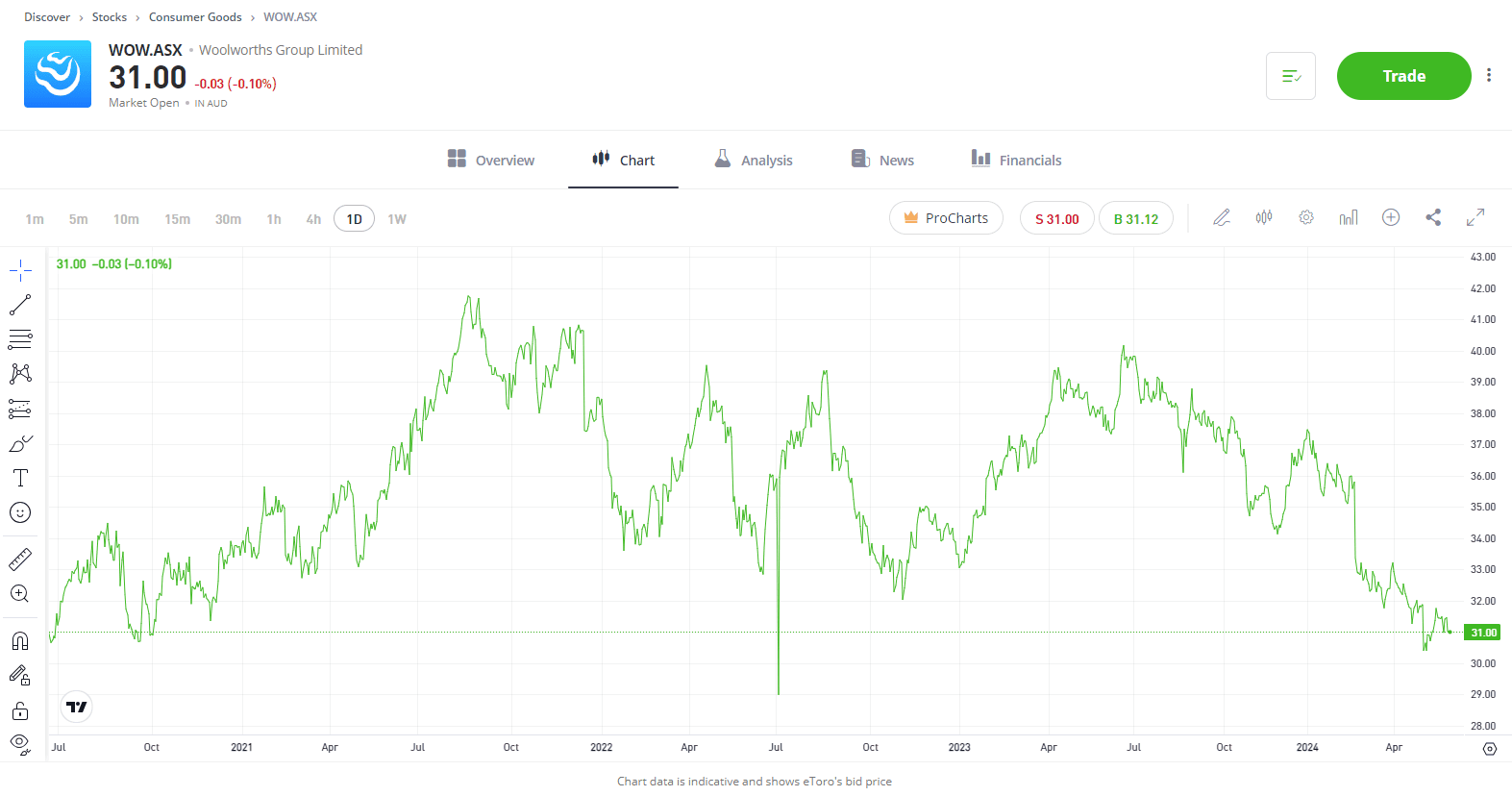

Stock #2: Woolworths (WOW.ASX)

Sector: Consumer Goods

Woolworths is a household name to most Australians, and in the last 12 months, the business has been thrown into the limelight facing heightened political and media scrutiny. This, combined with slower sales to start the year, recently sent shares to a four-year low of AUD$30.49. Investors’ confidence in Woolworths has undoubtedly been dented over the last 12 months, and that’s represented in the weakness we’re seeing across shares. However, the last time shares saw a fall of 20% or more, back between 2015 and 2016, shares soared by 120% over the next five years. The next few months will remain challenging for Woolworths, but many investors will see recent weakness as an opportunity to own a high-quality and defensive business at an attractive valuation.

View Woolworths

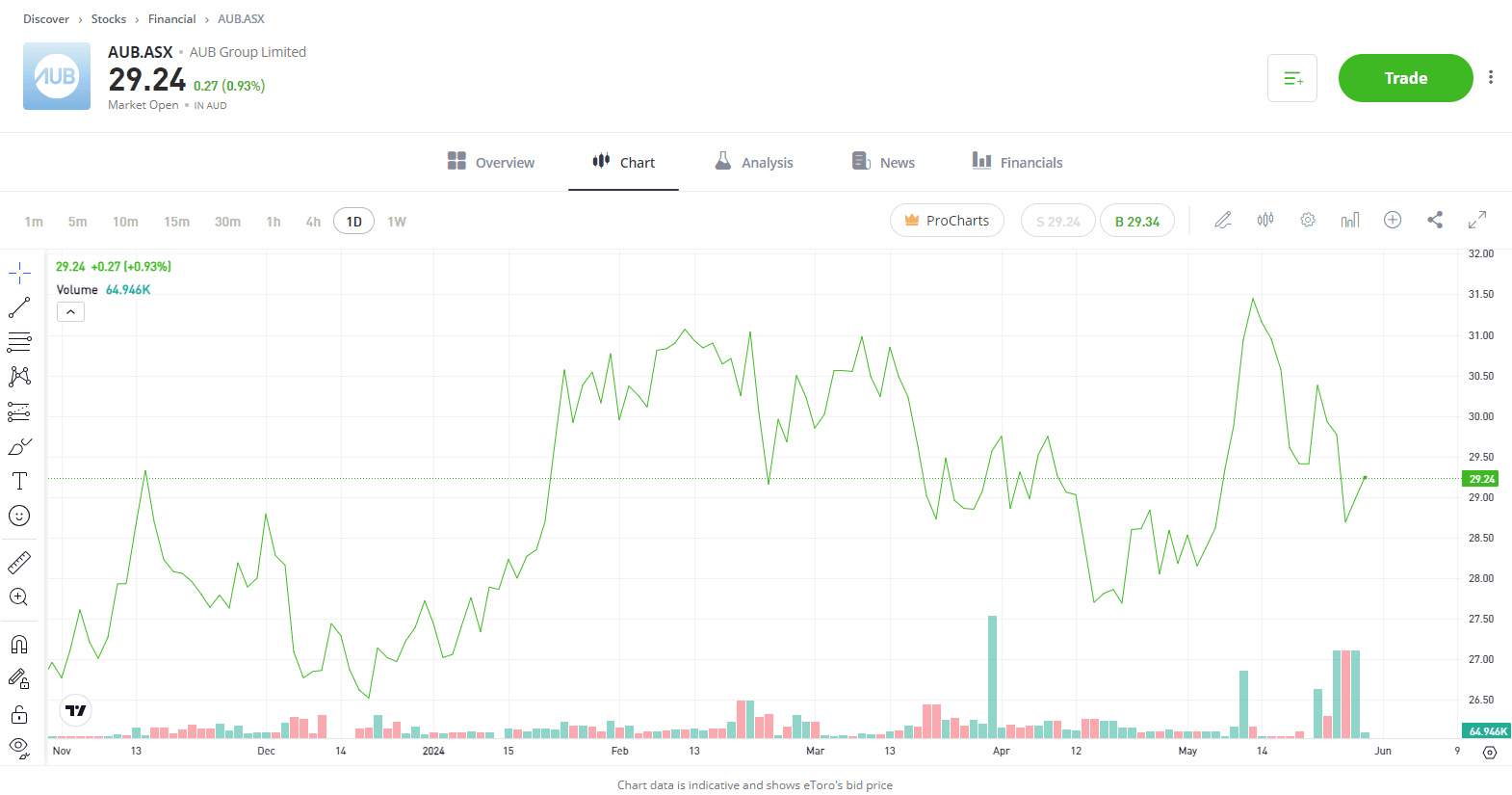

Stock #3: AUB Group (AUB.ASX)

Sector: Financials

AUB Group is an ASX200-listed group of retail & wholesale insurance brokers and underwriting agencies operating in 570 locations globally. AUB is a high cash-generating business, and as a broker, it is benefiting from the increases in insurance premiums that we are seeing right now. Earlier in the year, the company handed down full-year profit guidance that came in above analyst estimates, seeing net profit for the full fiscal year at AUD$161.0 million to AUD$171.0, signalling around 25% growth year-over-year. That growth looks set to continue into fiscal year 2025, which is why analysts are excited. According to Bloomberg’s Analyst Recommendations, the company has 11 buys, 0 holds, and 0 holds, with a price target of AUD$34.36 a share. The business also pays an attractive dividend with a yield of around 3.25% in the last 12 months.

View AUB Group

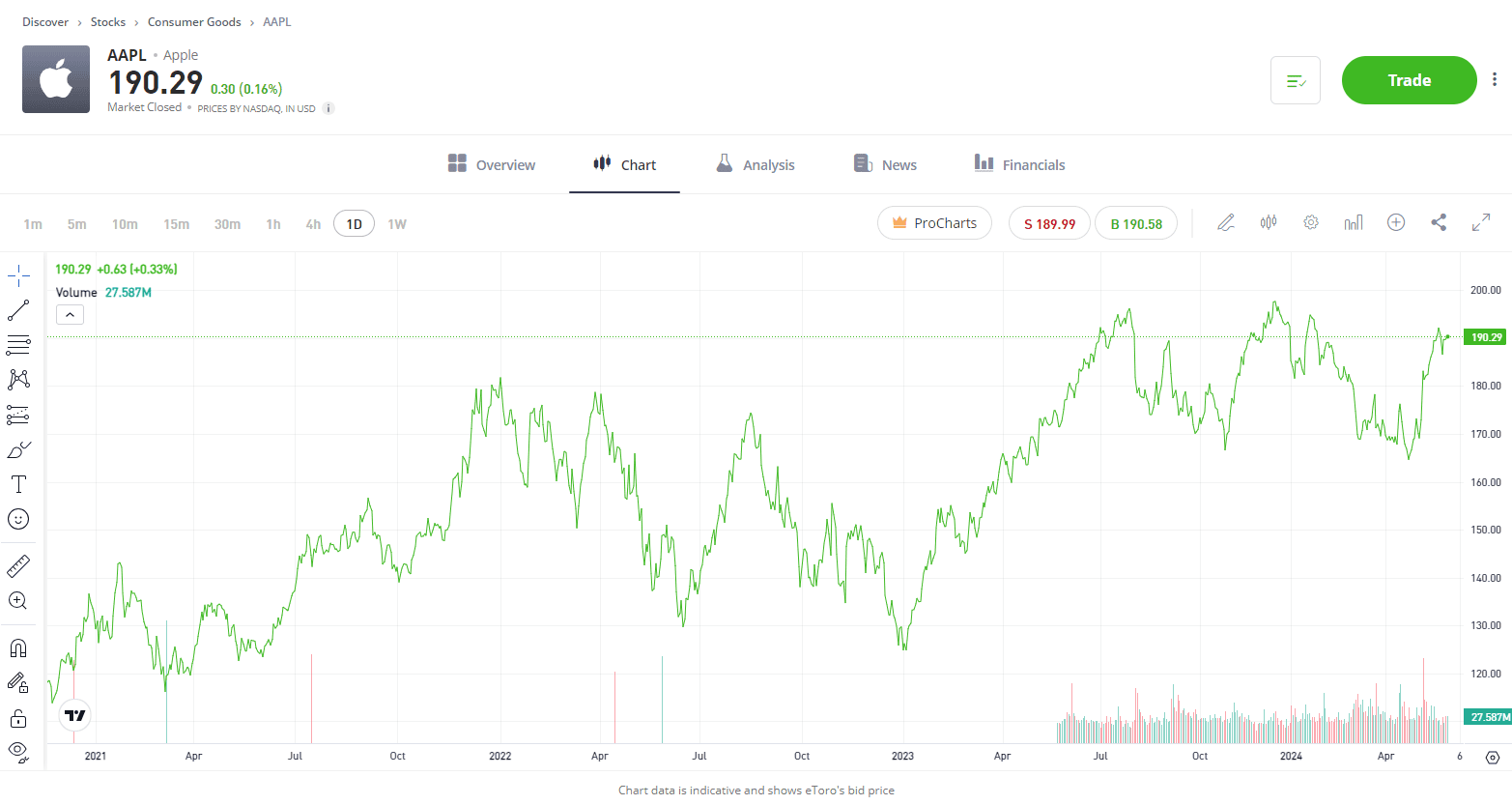

Stock #4: Apple (AAPL)

Sector: Consumer Goods

it certainly hasn’t been the best start to the year for Apple, with shares basically flat, well underperforming against most of the magnificent seven, except Tesla. The weakness comes following slowing growth and weak demand in China. Many investors had begun to question if Apple still has what it takes to deliver the top growth they have become accustomed to over the years. However, its recent earnings result showed resilience with better than expected revenue and earnings, while announcing a USD$110 billion buyback, the largest in company history. Apple has also begun to lay more groundwork surrounding AI, with a potential deal with OpenAI on the cards. The deal could see OpenAI’s software introduced on the iPhone16, set to be launched in September. If they can navigate the next couple of quarters and keep giving investors more insight into their AI plans and what’s ahead for the new iPhone16, we’ll see a much shinier Apple come the end of 2024.

View Apple

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.