The ASX hit a new record high in November, and investors are hoping the Santa Rally will extend long into December. The local market followed in the footsteps of the S&P500, which also hit a record high in November and set its best month of the year, climbing 5.73%. Sigma Healthcare stole the limelight in November, with shares jumping 47% following approval from the ACCC of its merger with Chemist Warehouse. On the other side of the market, Paladin Energy shares tumbled 25% after a disappointing market update. Although it may feel like the Santa Rally has come early this year, here are four stocks to watch in December.

Stock #1

Sector: Materials

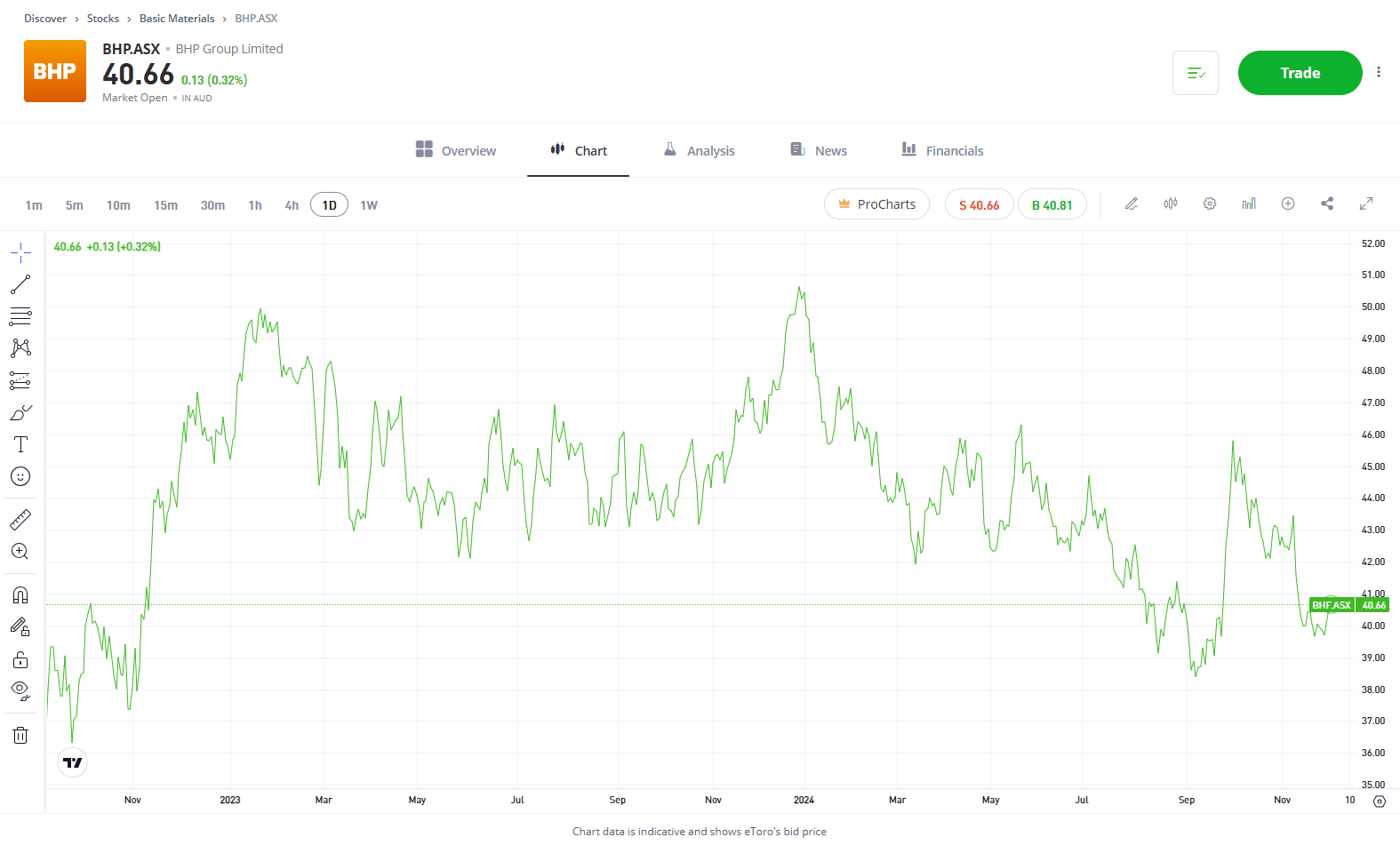

BHP

It’s one of the largest mining stocks in the world and is a powerhouse business, but it has struggled in 2024 as iron ore prices have slumped. However, iron ore prices are showing some resilience as we head into the end of the year, with a potential stimulus package from China early next year, offering some optimism. To add to that optimism, the average crude steel output in the nation during the first 20 days of November reached the highest for that time of year since 2020, according to data from the China Iron and Steel Association. BHP is also free to launch another attempt to acquire Anglo American as it looks to increase its copper exposure. The case for increasing BHP’s exposure to copper is only growing, with the asset a key commodity in the energy transition. For BHP, it looks to be an exciting December and a more positive one if iron ore prices stay elevated.

Past performance is not an indication of future results.

View BHP

Stock #2

Sector: Tech

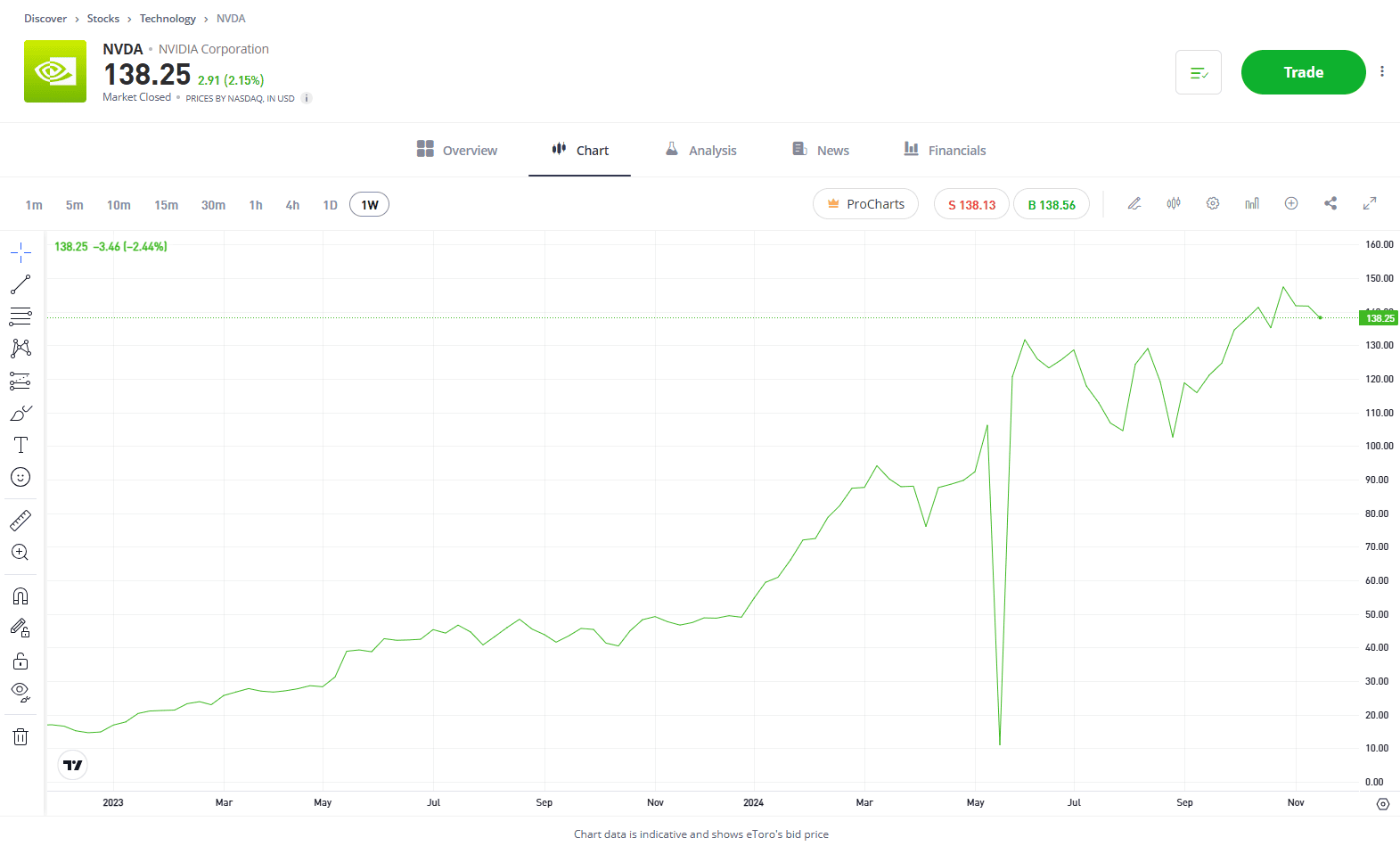

Nvidia

Unless you’ve been hiding under a rock for two years, you’ll be well aware of the transformative potential of Artificial Intelligence (AI) across just about every industry, with ChatGPT a key catalyst of mainstream adoption. Within that time, arguably the biggest beneficiary from the AI boom, Nvidia, has become the world’s largest stock, surpassing tech titans Microsoft and Apple, reaching a market cap of USD$3.3 trillion. After continuously delivering outstanding numbers, can the golden child of AI keep delivering? Its valuation has become more attractive than it was a year ago, with a price-to-earnings multiple of 32x based on expected earnings over the next twelve months. That is lower than its 5-year average, given the sheer rise of its earnings. However, the S&P500 currently trades at 24x expected earnings, and Nvidia certainly deserves a premium to the other 499 companies. Nvidia remains an industry leader, but maintaining its competitive edge and satisfying investors will depend on its innovation and ability to meet the growing demands of the market. When you’re branded as Magnificent, nothing but the best will do and for now, that’s exactly what Nvidia is delivering for investors.

Past performance is not an indication of future results.

View Nvidia

Stock #3

Sector: Consumer Goods

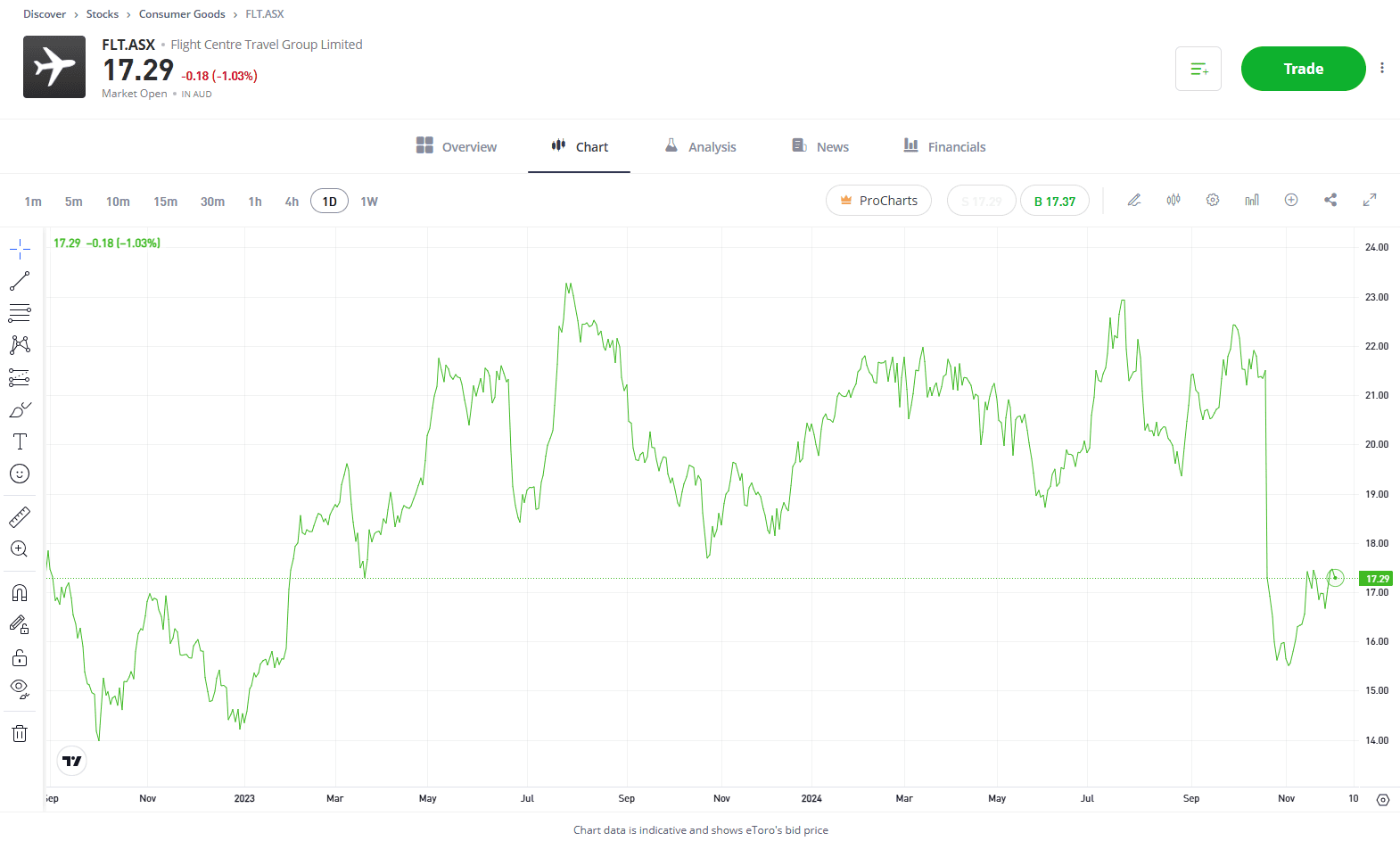

Flight Centre

Travel demand is back, but for Flight Centre, the journey to recovery has been a turbulent one. The pandemic brought unprecedented challenges, and shares have struggled to regain previous highs. However, Flight Centre is growing revenues at a solid pace and operating more efficiently than ever, with record profitability in 2024. Despite recent challenges and increased competition from online travel platforms, the company’s strong brand, wide geographic reach, and well-established presence in both leisure and corporate travel sectors have solidified its position in the industry. It won’t be a one-way flight to success for Flight Centre over the next 12 months, with its recent update a clear sign of that. But, with an attractive valuation and record profits, the business looks to be making the right moves at the right times to get shares back to where they once were.

Past performance is not an indication of future results.

View Flight Centre

Stock #4

Sector: Industrial Goods

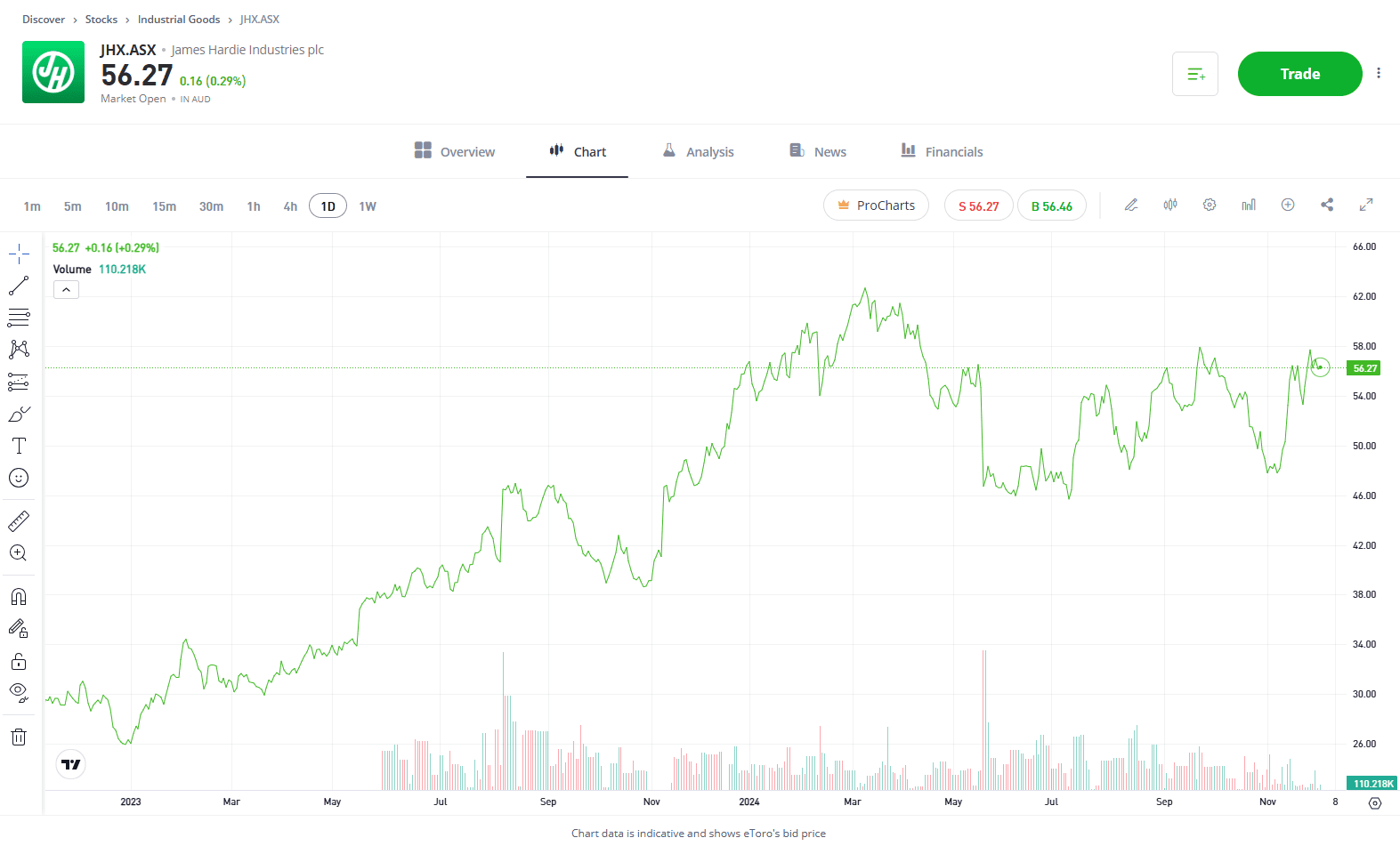

James Hardie

After months of uncertainty, we now know that Donald Trump will be the next President of the United States. It’s key to note that its difficult for investors to front-run policy, and instead of politics, the focus should often be on the fundamentals. With US interest rates already being slashed by 75bps and set to fall further, we would expect to see an acceleration of homebuilding. This would boost demand for building materials, putting James Hardie front and centre. With US interest rates already being slashed by 75bps and set to fall further, we would expect to see an acceleration of homebuilding. This would boost demand for building materials, putting James Hardie front and centre. Lower rates and a favourable President-Elect create a promising environment for consumer spending on homes and business expansion, putting James Hardie in a strong position to benefit from increased demand in the housing and renovation sectors. In this scenario, fundamentals look set to improve, and analysts are clearly positive about the business’s future.

Past performance is not an indication of future results.

View James Hardie

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.