The ASX200 hit a new all-time high in July, with the index gaining more than 4%, with consumer discretionary and real estate sectors leading the way. With a Federal Reserve rate cut penned for September and the RBA now likely leaning towards cuts over hikes, investor sentiment is rising. A key reporting season is ahead in Australia in August, which will see plenty of volatility across the share market.

Here are four stocks for investors to watch in the month ahead.

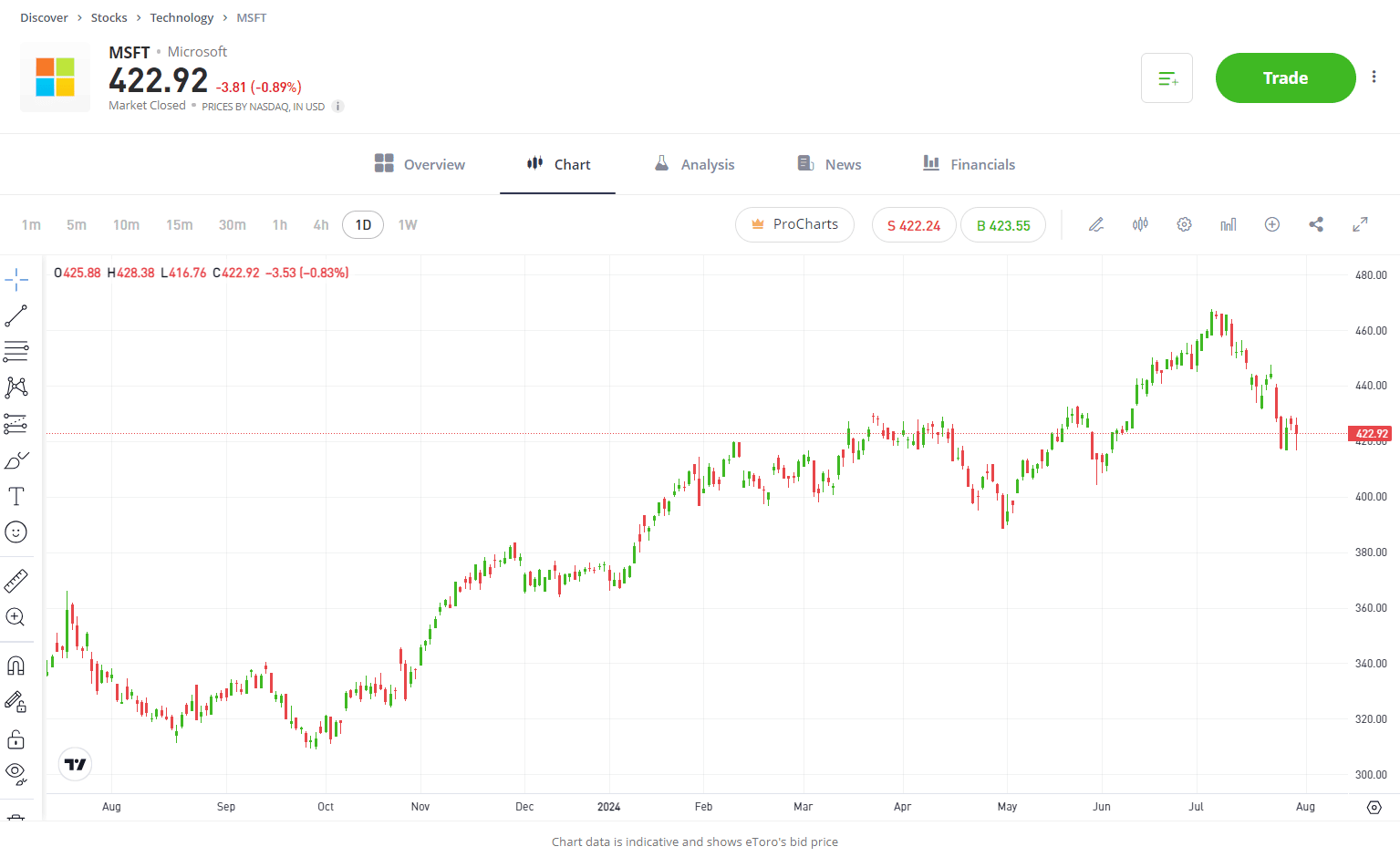

Stock #1: Microsoft (MSFT)

Sector: Technology

July was a tough month for tech shares. A potential Fed rate cut in September saw investors rotate into cheaper, more cyclical assets. In addition, investors had question marks over big tech’s spending on AI. Microsoft’s Azure cloud business missed expectations last month, sending shares tumbling, and showing how little the margin for error is for tech. However, the results really weren’t that bad. Revenue and profitability all came in above expectations, with profit up 10% in the quarter, showing that the business continues to successfully monetise its AI efforts. Investments in AI will take time to materialise, and big tech names have no time to waste asserting their dominance in AI. Investors will need patience and should see current investments as well placed, especially with how well Microsoft has already implemented its suite of AI products. Investors are likely to see any extended sell-off as an opportunity to buy a business perfectly positioned to reap the rewards of the AI revolution. According to Bloomberg’s Analyst Recommendations, Microsoft has 65 buys, 5 holds and 0 sells.

Past performance is not an indication of future results.

Past performance is not an indication of future results.

View Microsoft

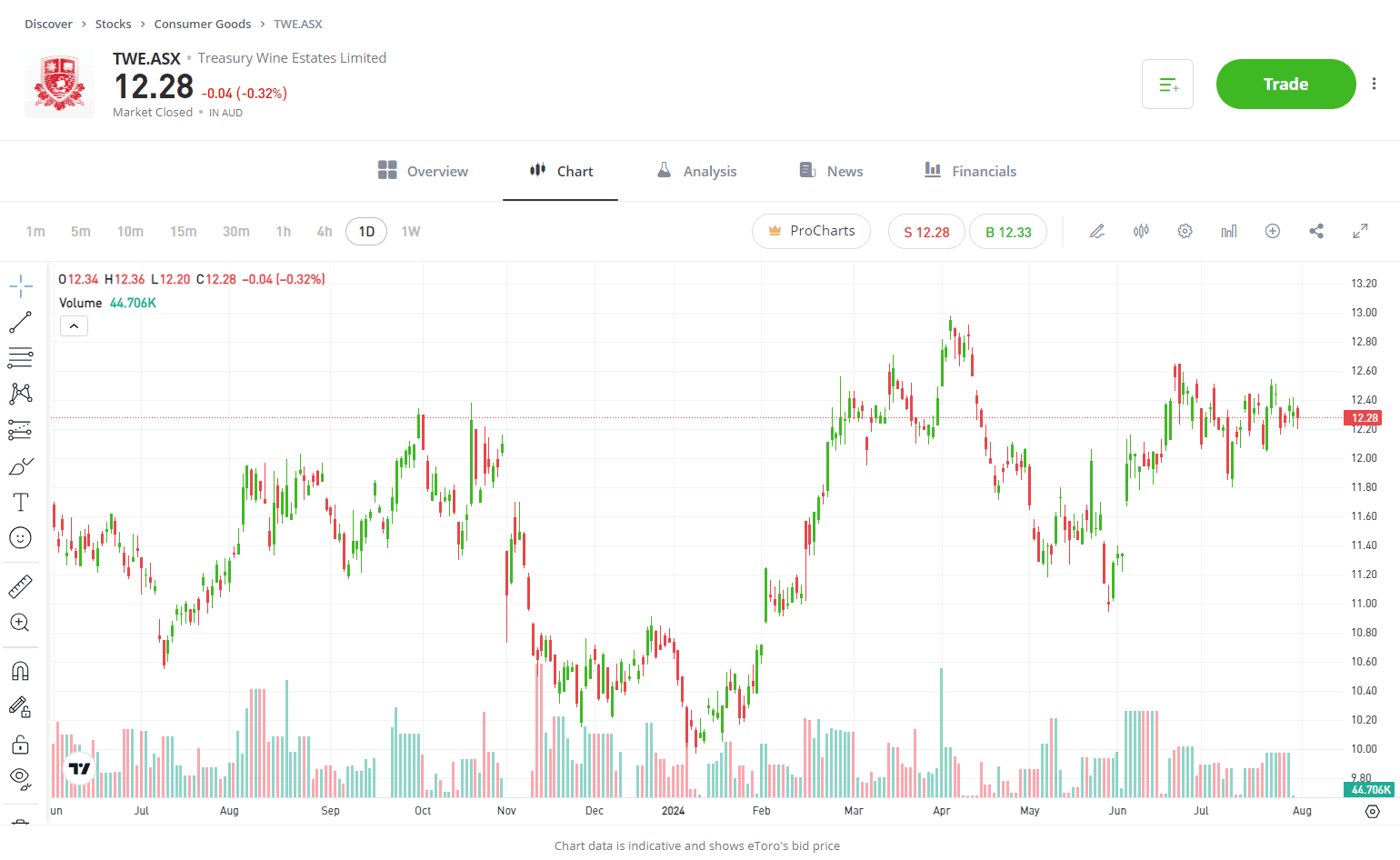

Stock #2: Treasury Wine Estates (TWE.ASX)

Sector: Consumer Goods

Luxury goods continue to be prevalent in today’s society driven by growing affluence and rising disposable incomes globally. With that, the luxury wine market is thriving with solid growth in the Asia-Pacific region. Treasury Wine Estates is one of the world’s largest producers of luxury wines and is positioned for ongoing growth with its re-entry into China. The company’s bottom line is growing at a solid rate. The market expects double-digit earnings growth over the next five years from 2024 onwards, thanks to the removal of those Chinese wine tariffs, solid growth in the US and rising prices. Shares currently trade at around 23x FY4 earnings and 20x FY25 earnings, which likely doesn’t fully represent the business’s growth potential over the years ahead, potentially creating an attractive entry point for investors. With a robust portfolio of premium and luxury wine brands, Treasury Wines has established itself as a key player as demand for luxury wine continues to grow.

Past performance is not an indication of future results.

Past performance is not an indication of future results.

View Treasury Wine

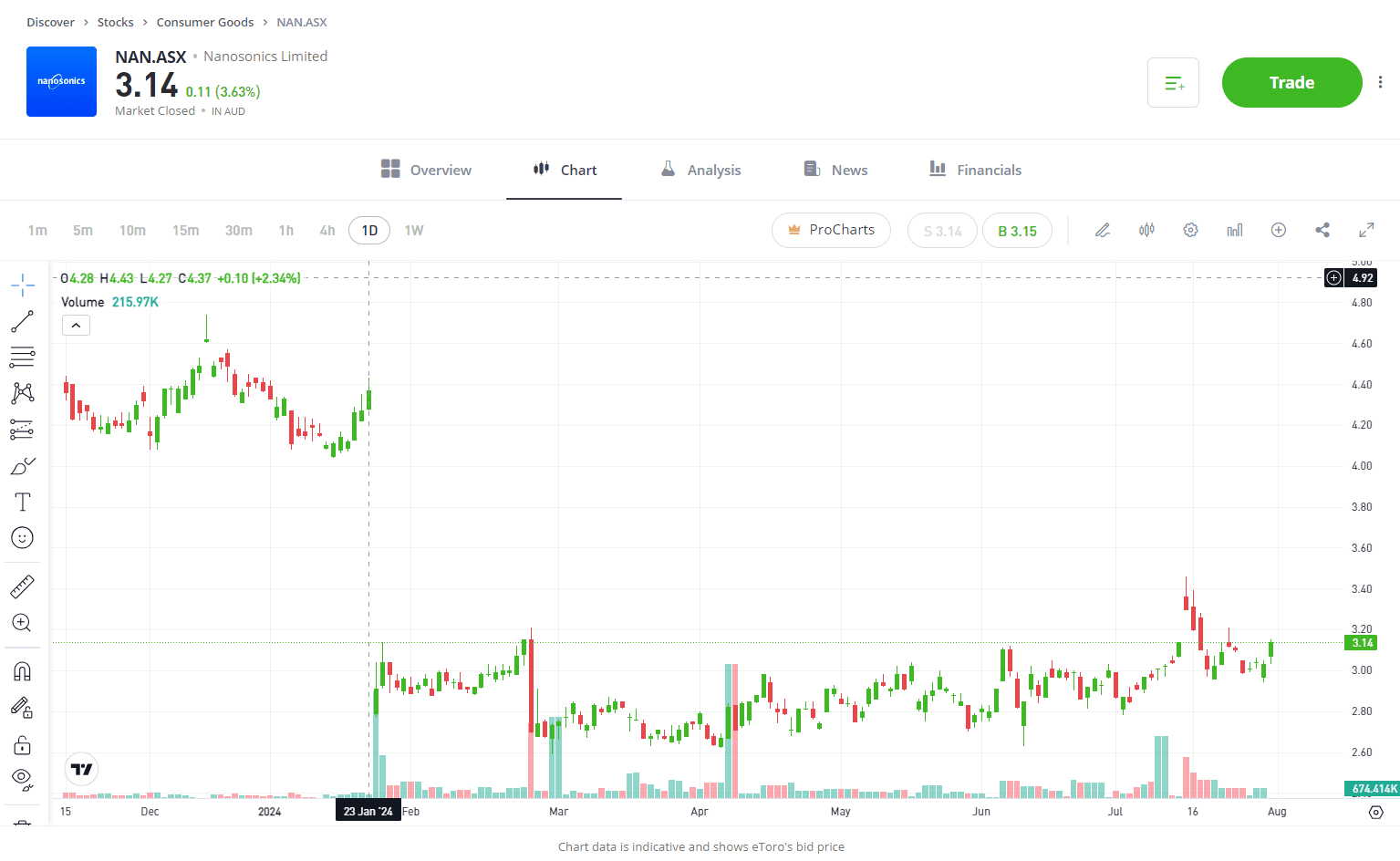

Stock #3: Nanosonics (NAN.ASX)

Sector: Consumer Goods

It’s been a challenging 2024 so far for Nanosonics, with shares down over 28%. The Australian company is leading the way with innovative solutions focused on preventing the transmission of potentially life-altering infections. Shares have been under pressure this year as profitability has been affected by hospital capital budget constraints, low ultrasound procedural volume, and its investment into its new product, Coris, ahead of its expected launch in fiscal 2025. However, things have been more positive in recent weeks, with an update showing revenues have grown, leading to analyst lifting their revenue forecast for the full year. The launch of its Coris product provides a solid tailwind for the business heading into 2025, and if it upgrades its guidance for FY25 in its full-year results this month, shares will undoubtedly move higher as a result.

Past performance is not an indication of future results.

Past performance is not an indication of future results.

View Nanosonic

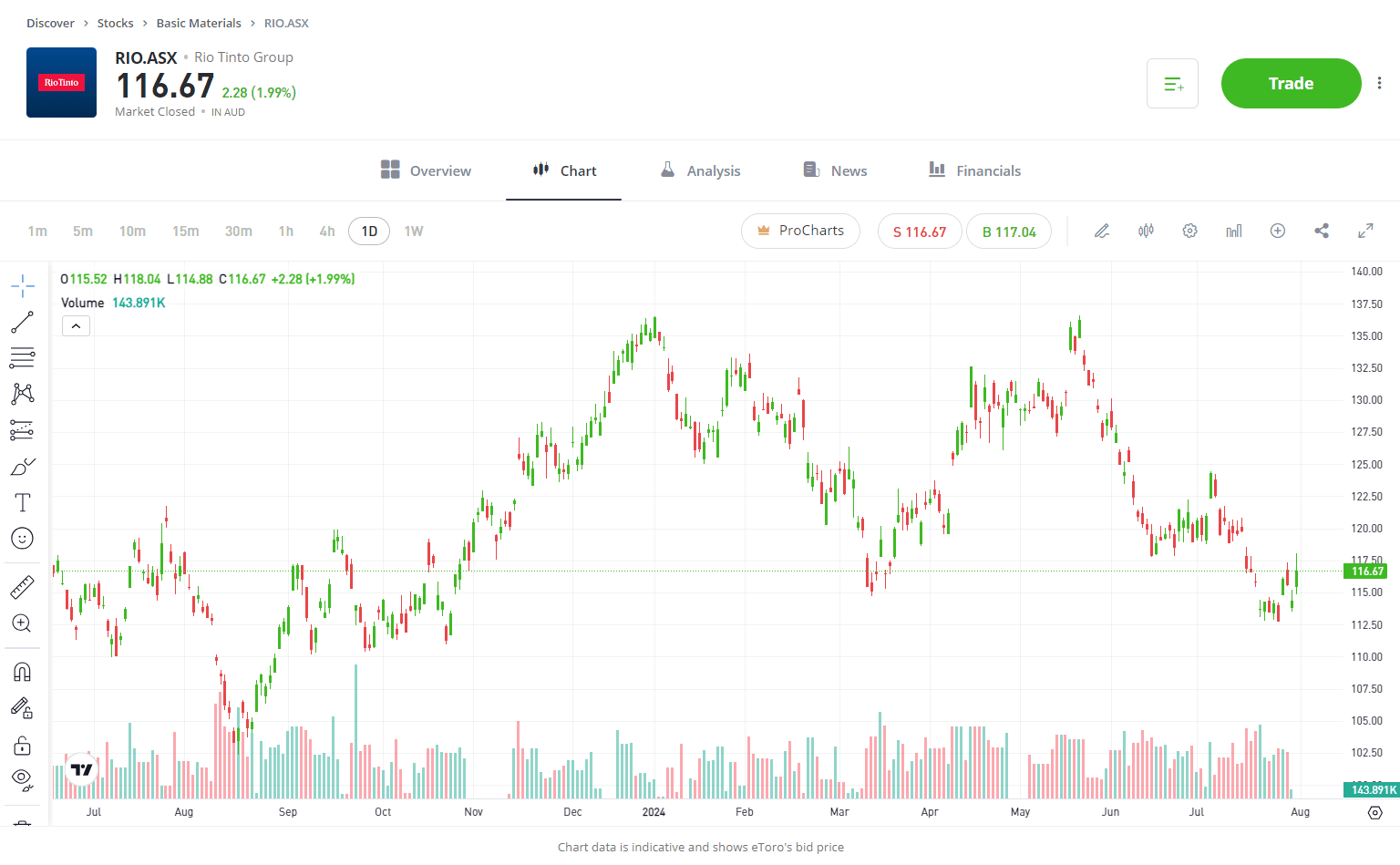

Stock #4: Rio Tinto (RIO.ASX)

Sector: Materials

Rio Tinto’s first-half profit missed estimates last month, but rose year-over-year, showing some resilience to the economic slowdown in China. The company reported underlying earnings of $5.8 billion in the first half of the year, up from 1.8% from the previous year. Iron ore prices have slumped by around 15% in the last 12 months putting a lot of pressure on the miner, whose revenue was essentially flat. Rio Tinto shares are down 15.5% this year, reflecting China’s spluttering economic recovery and real estate crisis that has tainted steel demand. Recent efforts to stimulate the economy in China may provide some positivity. Still, for now, the measures lack any real substance, and therefore, investor sentiment for these huge miners will remain weak. There are a few positives to take away. Despite all the headwinds Rio faces, the business is still profitable, and its dividend remains intact, a key attraction for many investors. The company is laying the groundwork for future growth with investments in copper, a key commodity in the future of the energy transition. However, increased spending at a time when the business is struggling may unsettle some investors, but a long-term view could prove prudent when commodity prices pick up. It may still be too early for investors to feel confident there isn’t any further downside for the stock, but a bottom isn’t too far away, and therefore, Rio Tinto is a stock to watch.

Past performance is not an indication of future results.

Past performance is not an indication of future results.

View Rio Tinto

Disclaimer: eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.