It’s been a turbulent month in markets. If history tells us anything, it’s that Trump loves shaking things up, and his latest tariffs are no exception. In short, tariff threats have turned into a tariff war and have now become a major source of market risk, injecting volatility into the world economy and keeping investors on edge. While this pullback may be tough for investors, it’s a healthy correction for the market overall and investors shouldn’t panic when the market dips. So here are four stocks we’re watching in April:

#1 WiseTech

Sector: Technology

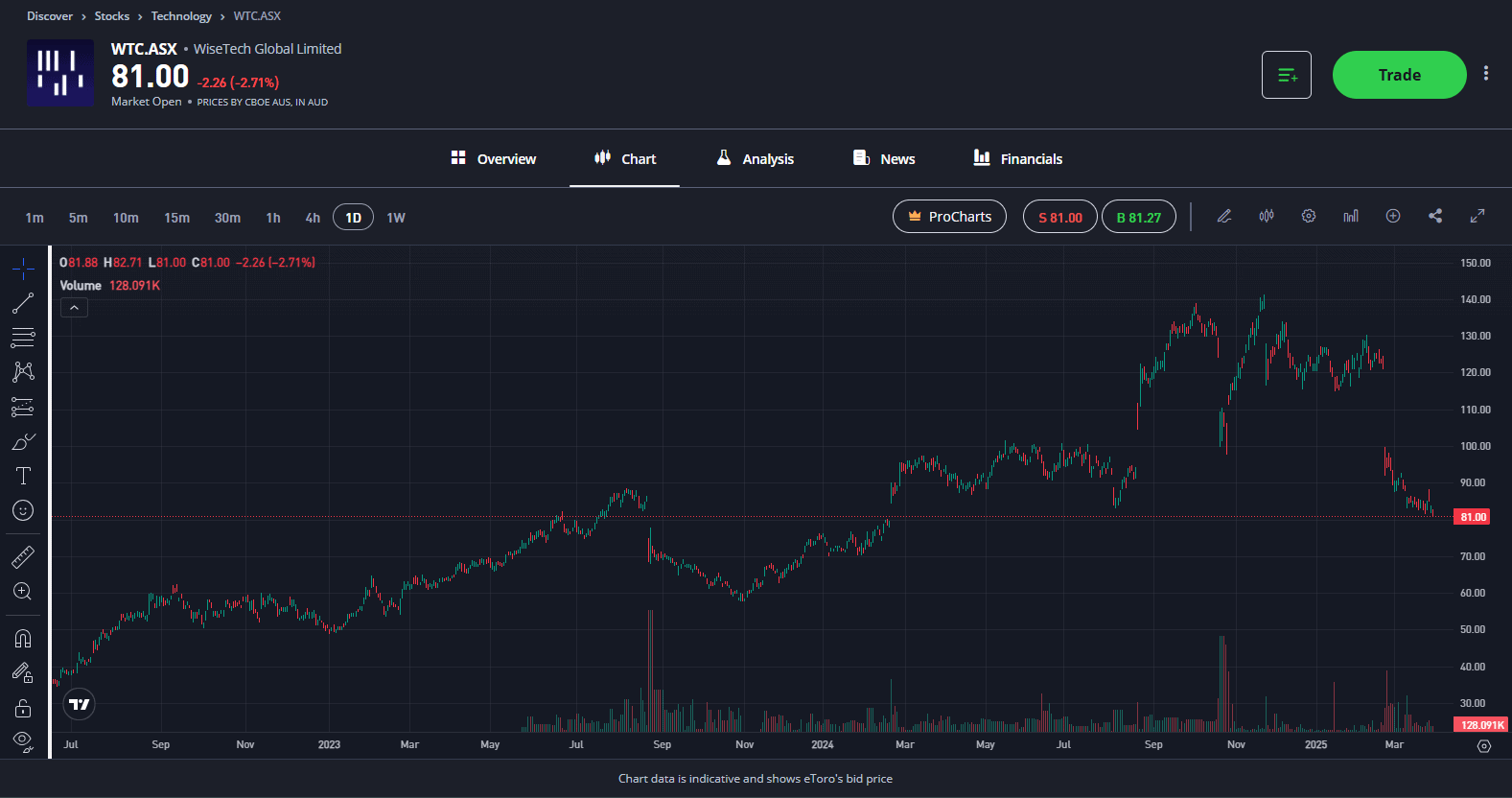

WiseTech Global makes software that powers global shipping. Its flagship product, CargoWise, is the operating system that major freight forwarders use to track shipments, manage customs paperwork, and coordinate complex global supply chains. Last month though, four of its six board directors left in one day causing plenty of uncertainty and sending shares lower. In the same week, the company quietly delivered stellar results: 17% revenue growth, expanding margins, and solid customer retention rates. CargoWise, has become the industry standard with remarkable market penetration—covering more than 75% of global manufactured trade flows worldwide. It’s dominating its industry but shares have tumbled 32% in the last 3 months on governance concerns. Analysts though are bullish, it currently has 14 buy ratings, 4 holds and 1 sell, with the average analyst price target signalling a 47% upside from current levels.

Past performance is not an indication of future results.

Explore WiseTech

#2 Qantas

Sector: Consumer Goods

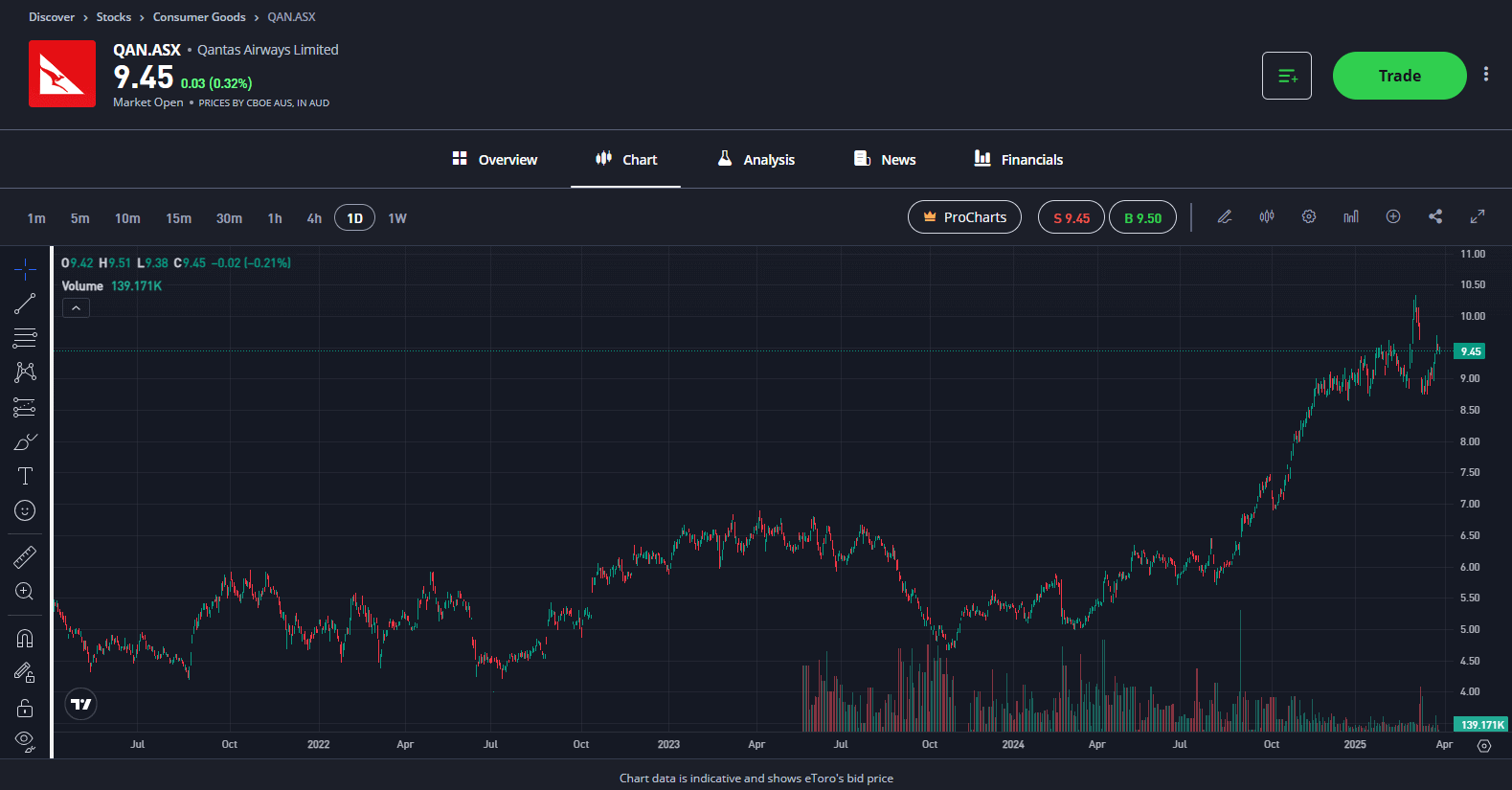

For the first time in over 5 years, Qantas today reintroduced its dividend to shareholders in its most recent half-year results. It’s been a turbulent few years for Australia’s flag carrier: record profitability, immense consumer pressure, ACCC investigations, and a change of leadership. However, it seems that Vanessa Hudson is striking the right balance between profits and keeping passengers happy. It’s important not to underestimate the mammoth task that the new CEO had on her hands, and the job she has done is reflected in the share price, which is up 70% in the last year. Net profit for the first half missed estimates but rose 11% year-over-year to A$1.39 billion. The standout, however, was Jetstar, which is proving to be an important cog in Qantas’ wheel amid the cost of living crisis, delivering a 54% increase in domestic earnings from a year ago, while passenger count hit a record high. It won’t continue to be a one-way flight to success, but it feels like Qantas has made the right moves at the right time to get back to its best and CEO, Vanessa Hudson has told shareholders to expect these numbers to continue.

Past performance is not an indication of future results.

Explore Qantas

#3 Spotify

Sector: Technology

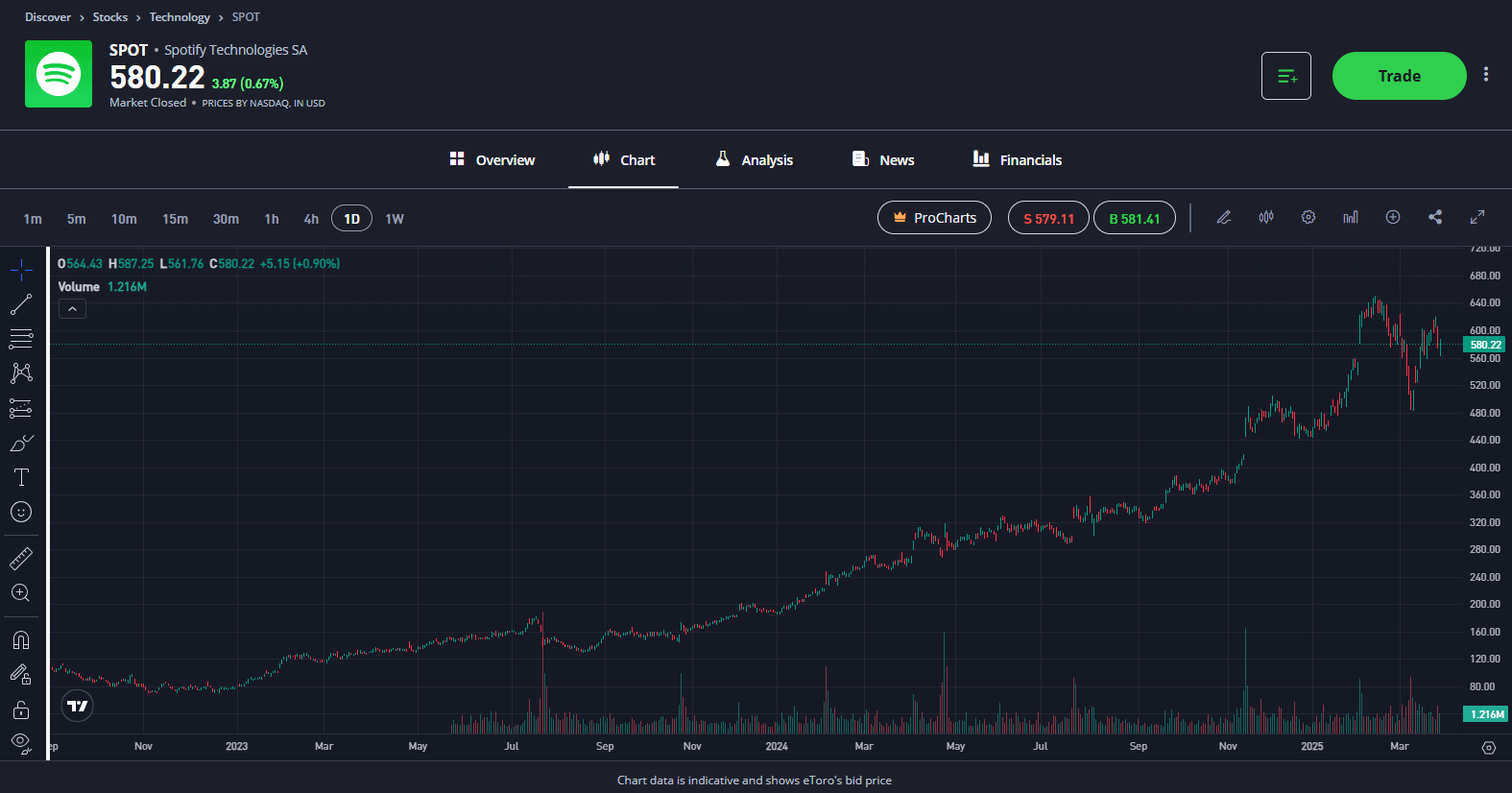

Spotify is the undisputed leader in music streaming, with 675 million users and counting. But, Spotify is no longer just about music, it’s an audio empire, expanding into podcasts and audiobooks. Now, after years of losses, Spotify is finally making serious money, with rapid subscriber growth, rising margins, and a renewed focus on profitability. Shares hit a record high at the start of this year, topping out at USD$648. Spotify remains an attractive long-term growth story, with strong fundamentals and expanding profitability.

However, much of its success depends on executing price increases without deterring users. With music streaming penetration still low in many markets, especially compared to video streaming, there’s substantial room for expansion. Spotify is currently trading at 44x forward earnings, with high expectations baked into its valuation, any slowdown could hit shares hard, but it looks to have what it takes to keep delivering.

Past performance is not an indication of future results.

Explore Spotify

#4 Nike

Sector: Consumer Goods

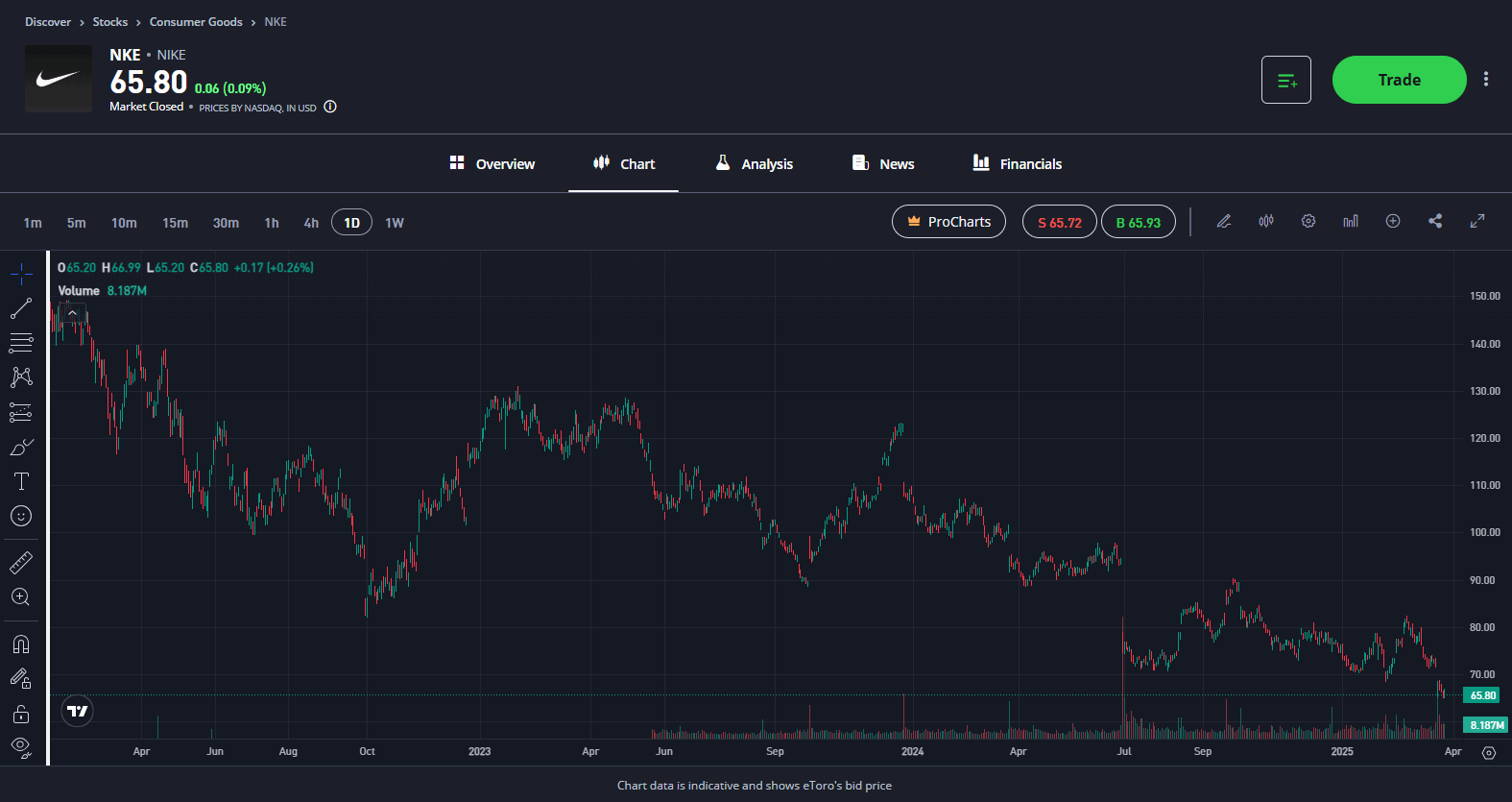

Nike is down, but is it out? Shares have fallen 60% from their high in 2021 after facing a myriad of challenges over recent years, from slowing sales, growing competition and a sales strategy shift that just really didn’t work. However, the world-renowned brand is fighting back with a new CEO at the helm who is looking to turn its fortunes around. This drawdown has attracted billionaire investor Bill Ackman has been accumulating shares within the last year, with his firm, Pershing Square Capital Management holding over 18 million shares worth $1.4 billion at the end of Q4 2024. A substantial vote of confidence from one of Wall Street’s sharpest minds. CEO Elliott Hill has an arduous task ahead. He needs to return Nike to its roots by improving wholesale partnerships after a disastrous direct-to-consumer strategy, reconnect with younger consumers, who increasingly view the swoosh as their parents’ brand and navigate inventory challenges.

Past performance is not an indication of future results.

Explore Nike

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD.

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.