The ASX200 has reached new highs in 2024, alongside other records for the Nasdaq, the S&P500, Gold, the Nikkei225 and bitcoin. The Australian market has been led by the magnificent performance of tech, followed by resilient consumer discretionary stocks, and heavily weighted financial stocks. A better-than-feared reporting season helped boost stocks, with the prospects of improving earnings ahead as interest rates begin to fall. That is a reminder for investors to be forward-looking, with global central banks set to be cutting interest rates throughout 2024, which should keep the bullish sentiment intact.

So, let us take a look at four top stocks that might be worth exploring this month. Spanning multiple industries packed with growth opportunities there is plenty to get excited about as an investor in March.

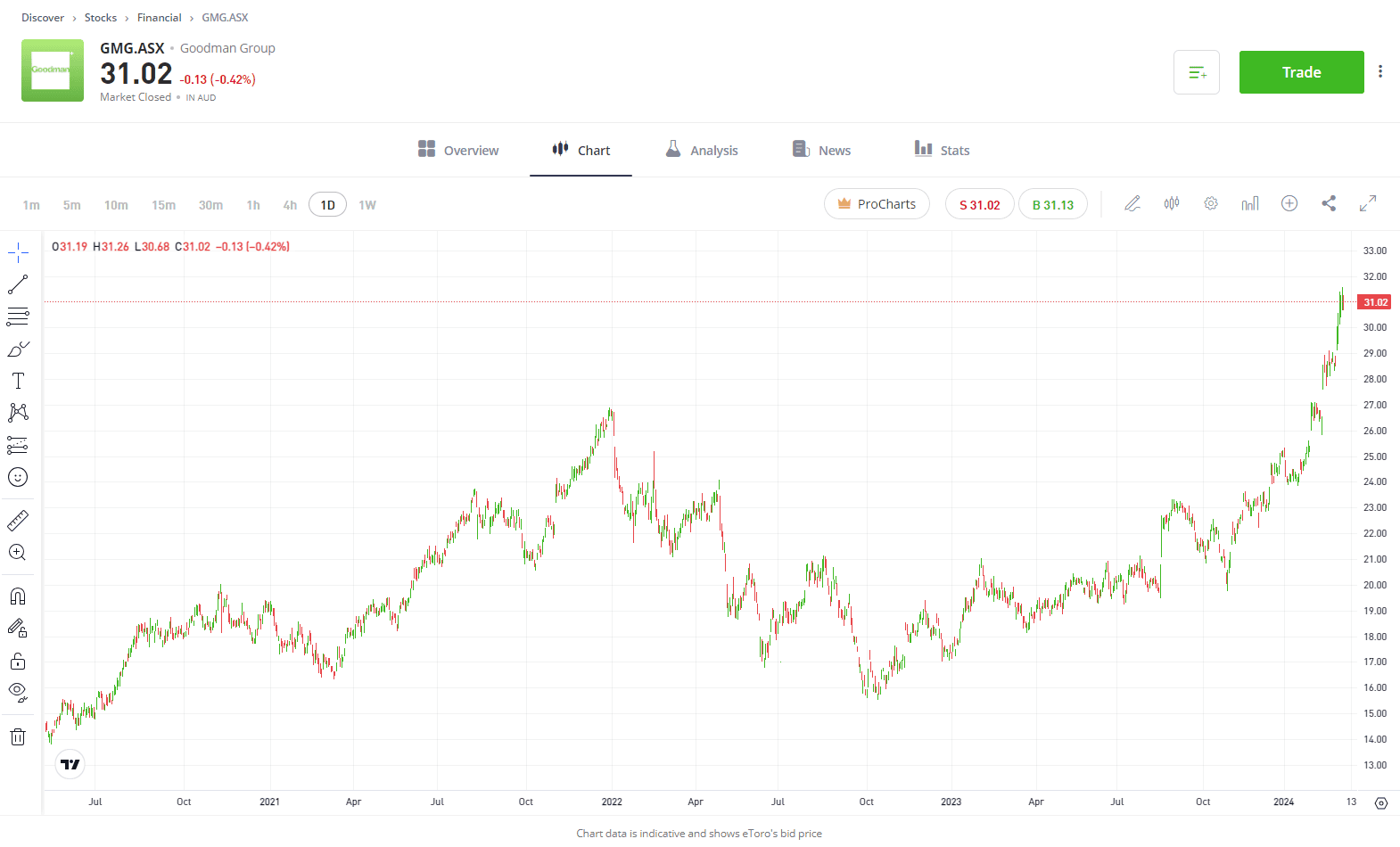

Stock #1: Goodman Group (GMG.ASX)

Sector: Real Estate

The AI boom has captivated markets globally as companies such as Nvidia begin to make billions of dollars from the technology revolution. But, as investors look locally, they are greeted with a small basket of stocks from the tech sector. However, Goodman Group is a business that stands out in the AI revolution as Australia’s largest industrial real estate manager as global data requirements continue to grow. Thanks to demand from Data Centers, operating profit rose 28% in the first six months of the fiscal year, and the group expect solid growth in the second half of the year, with AI demand in full swing. Nvidia is the name making money front and centre, but companies like Goodman Group are background winners of AI.

Invest in Goodman Group

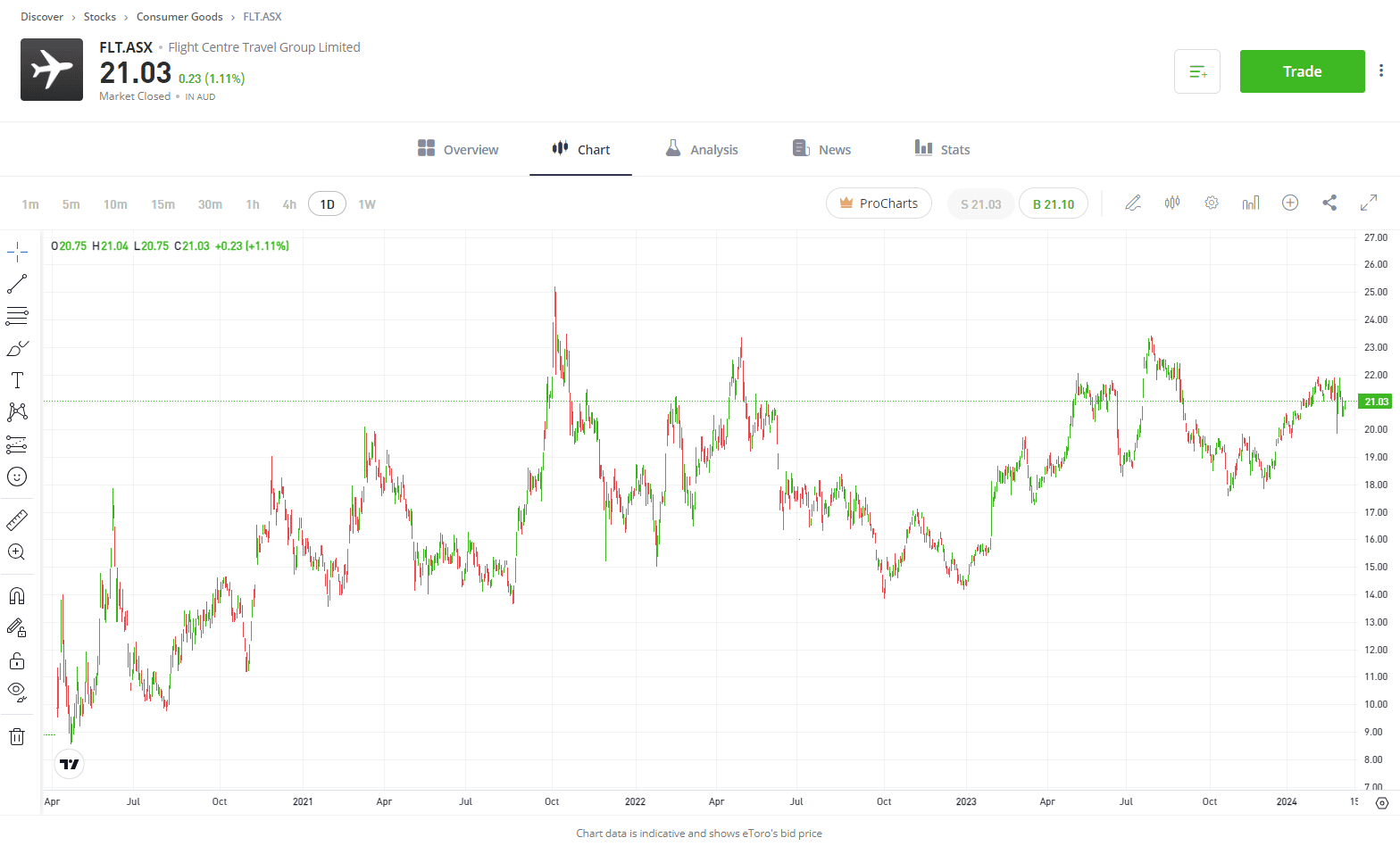

Stock #2: Flight Centre (FLT.ASX)

Sector: Consumer Cyclical

The travel industry has bounced back with a vengeance since the difficulty of the pandemic, with travel demand solid as consumers aren’t willing to delay their holidays any longer. Flight Centre has continued to reap the rewards as consumers take to the sky, reporting a net profit of $86 million in the first half of the fiscal year. Demand throughout the business looks solid and is set to continue in the second half of the year, especially with corporate travel demand returning. It won’t be a one-way ticket to success over the next six months, but its better-than-expected guidance for the year shows there are still good times ahead, matched by analysts’ price targets of around $23.37, signalling more than 11% upside from current levels.

Invest in Flight Centre

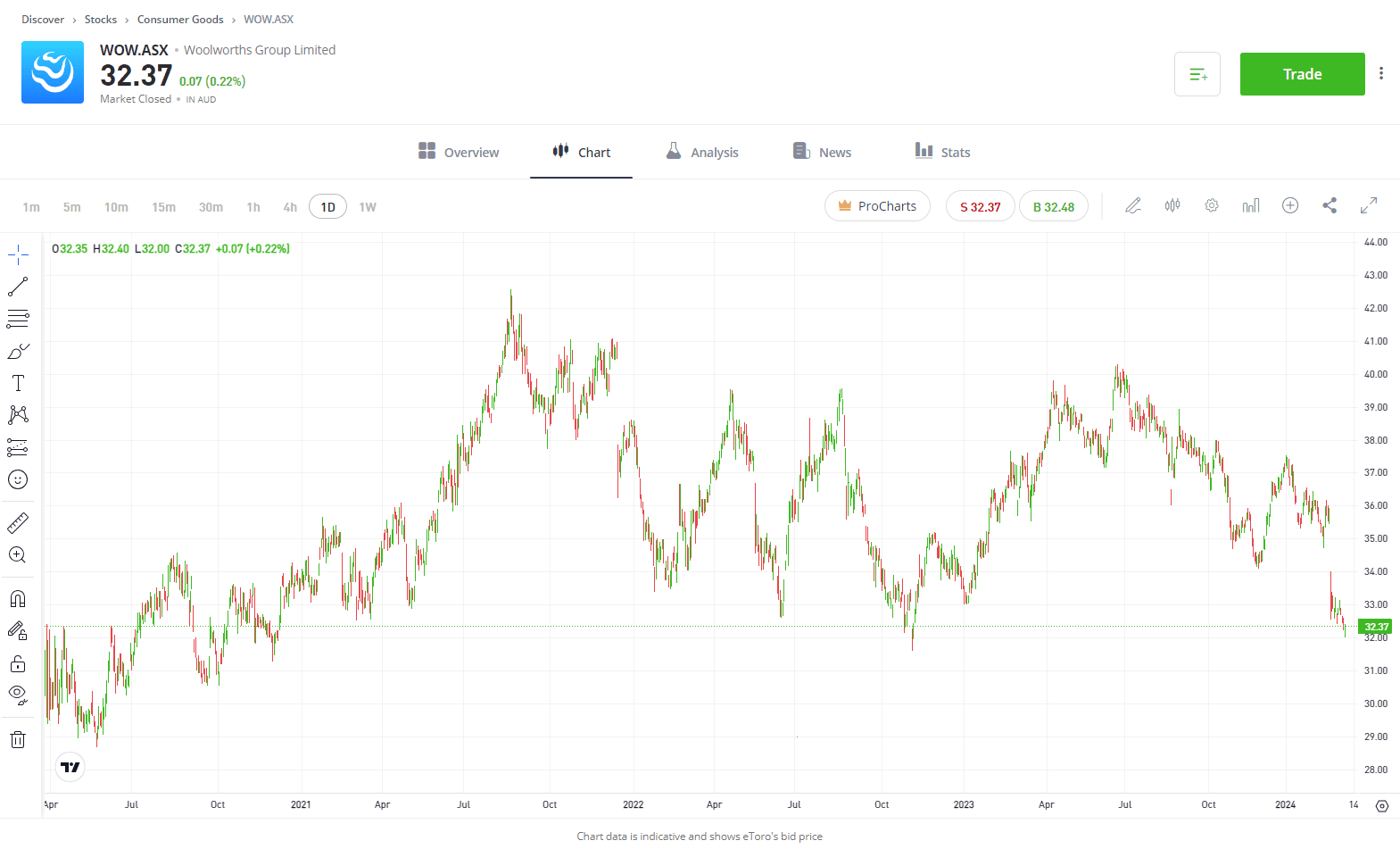

Stock #3: Woolworths Group (WOW.ASX)

Sector: Consumer Goods

Woolworths has faced a PR nightmare to start 2024 after accusations of price gouging and a car-crash four-corners interview by CEO Brand Banducci. However, in its first-half results, Banducci announced he would be stepping down from his role. For some investors, this will feel like a timely pivot, and it may prove to be a prudent decision with recent challenges not handled in the way many would have expected. Amanda Bardwell appears to be a great fit to take over the helm at Woolworths, having run two highly successful businesses in eCommerce and Loyalty. She is a top performer, and hiring from within removes that external risk, which is all good news for investors and concerned stakeholders. Woolworths shares recently hit a 52-week low at $32.17, and investors may see this as an opportunity to own a solid Australian business as it looks to turn its fortunes around.

Invest in Woolworths Group

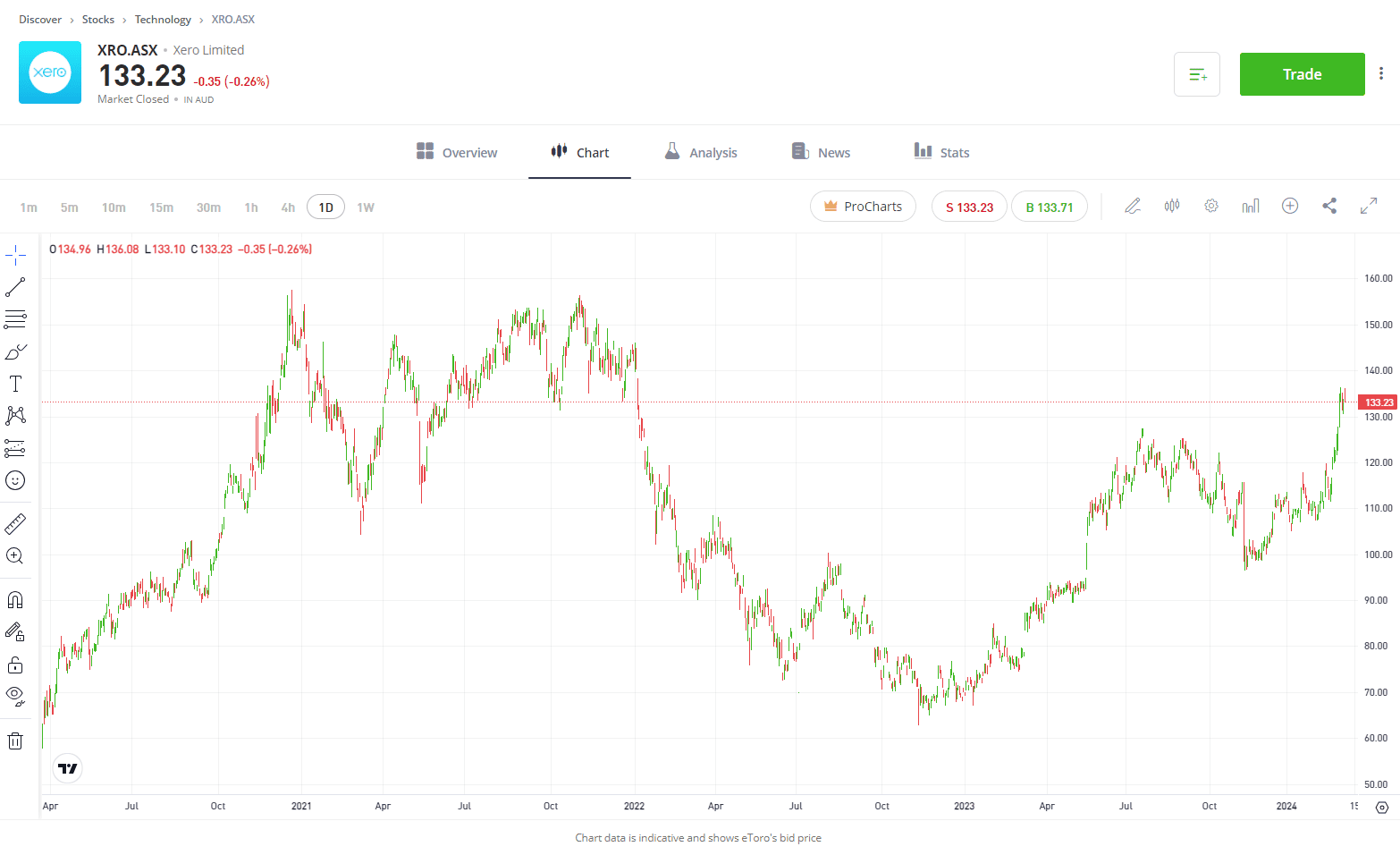

Stock #4: Xero (XRO.ASX)

Sector: Technology

Since taking over as Xero’s CEO in 2023, Sukinder Singh Cassidy has been in efficiency mode, cutting jobs and streamlining the business in an attempt to drive profitability. The good news is that this strategy is paying off, with subscriber numbers continuing to grow and the business reaching profitability once again. The key to ongoing growth is global expansion, which is no easy feat, but its management team looks to have what it takes to grow the business overseas while increasing profitability. In a seal of approval, Macquarie recently upgraded its price target to $152.60 with an ‘Outperform’ rating.

Invest in Xero

With March offering opportunities, staying informed and adaptable is key to successful investing. Keep a vigilant eye on these top 4 stocks, but remember to conduct thorough research and consider your investment goals and risk tolerance before making any decisions. Whether you’re looking for short-term gains or long-term growth prospects, strategic planning and informed decision-making will guide you towards financial success in the ever-evolving world of stocks. Happy investing!

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD.

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.