Global stocks continue to trade at record highs as central banks ease off their tightening cycles and lean closer towards cutting interest rates in the middle of the year. We see two fundamental pillars in place that will continue to drive stocks in the near term. Earnings growth and rate cuts. As long as these two fundamental pillars remain in place over the months ahead, investors can feel confident. If your definition of a bull market is a new all-time high, then we hit that at a couple of months ago.

The good news? A bull market averages five years, and therefore I think we’re right at the beginning.

So, let us take a look at four top stocks that might be worth exploring this month. Spanning multiple industries packed with growth opportunities, there is plenty to get excited about as an investor in April.

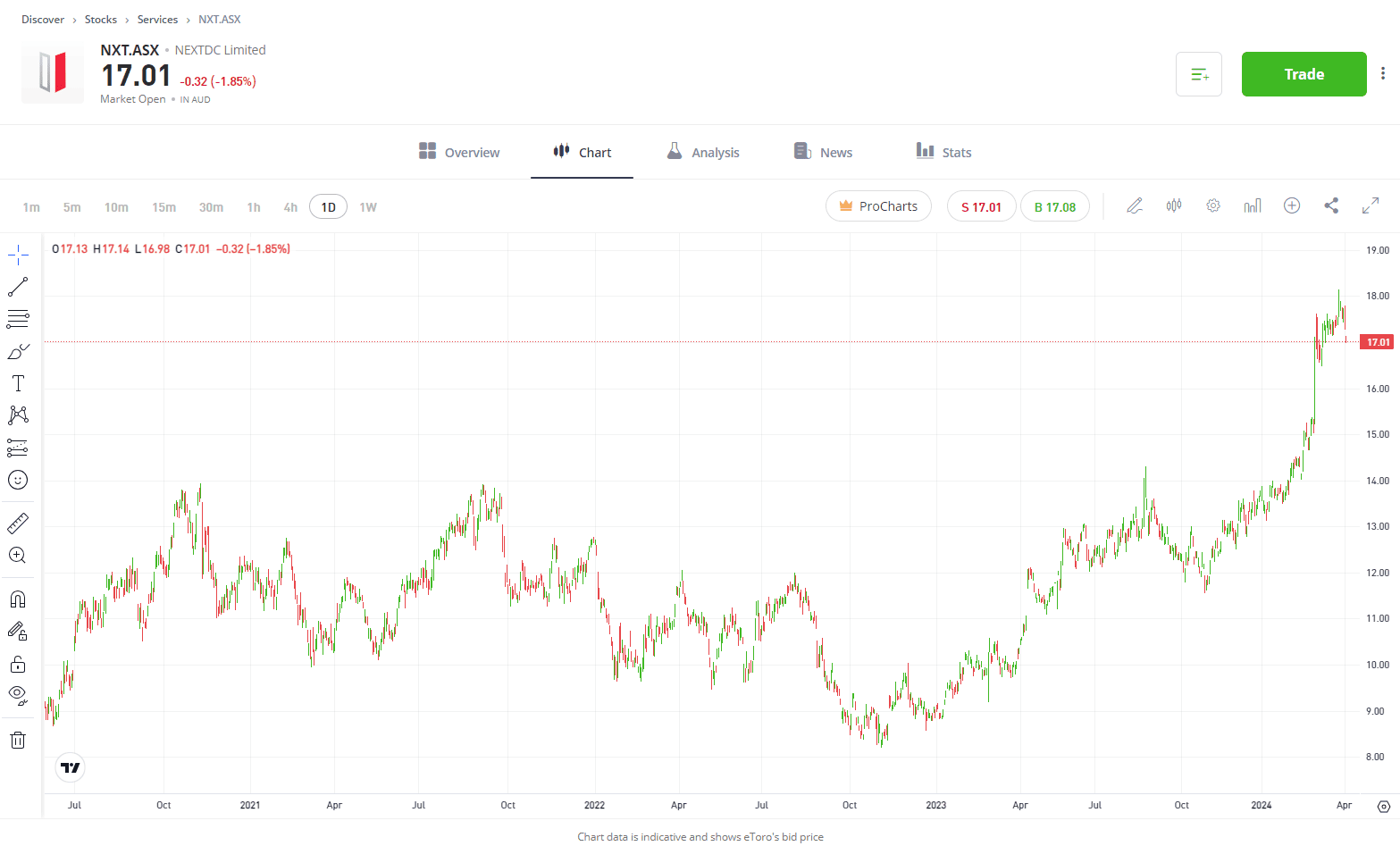

Stock #1: NextDC (NXT.ASX)

Sector: Services

Technology stocks on the ASX have well outperformed any other sector so far this year, and NextDC has been a big contributor, with shares rising 29% in 2024. The data centre business has continued to move from strength to strength in recent years, firstly from the pandemic when the transition to the cloud accelerated and more recently with the global adoption of artificial intelligence. Data centre demand is continuing to grow at a rapid pace, and NextDC expects revenue to rise by 18% in the current fiscal year. However, risks lie with the business still being unprofitable, and not set to reach profitability until FY2028. However, profitability could come sooner if we continue to see growth in AI and Cloud. Macquarie recently upgraded the stock to outperforming, setting a price target of $20 a share, signalling further upside from its last close of $17.70.

Invest in NextDC

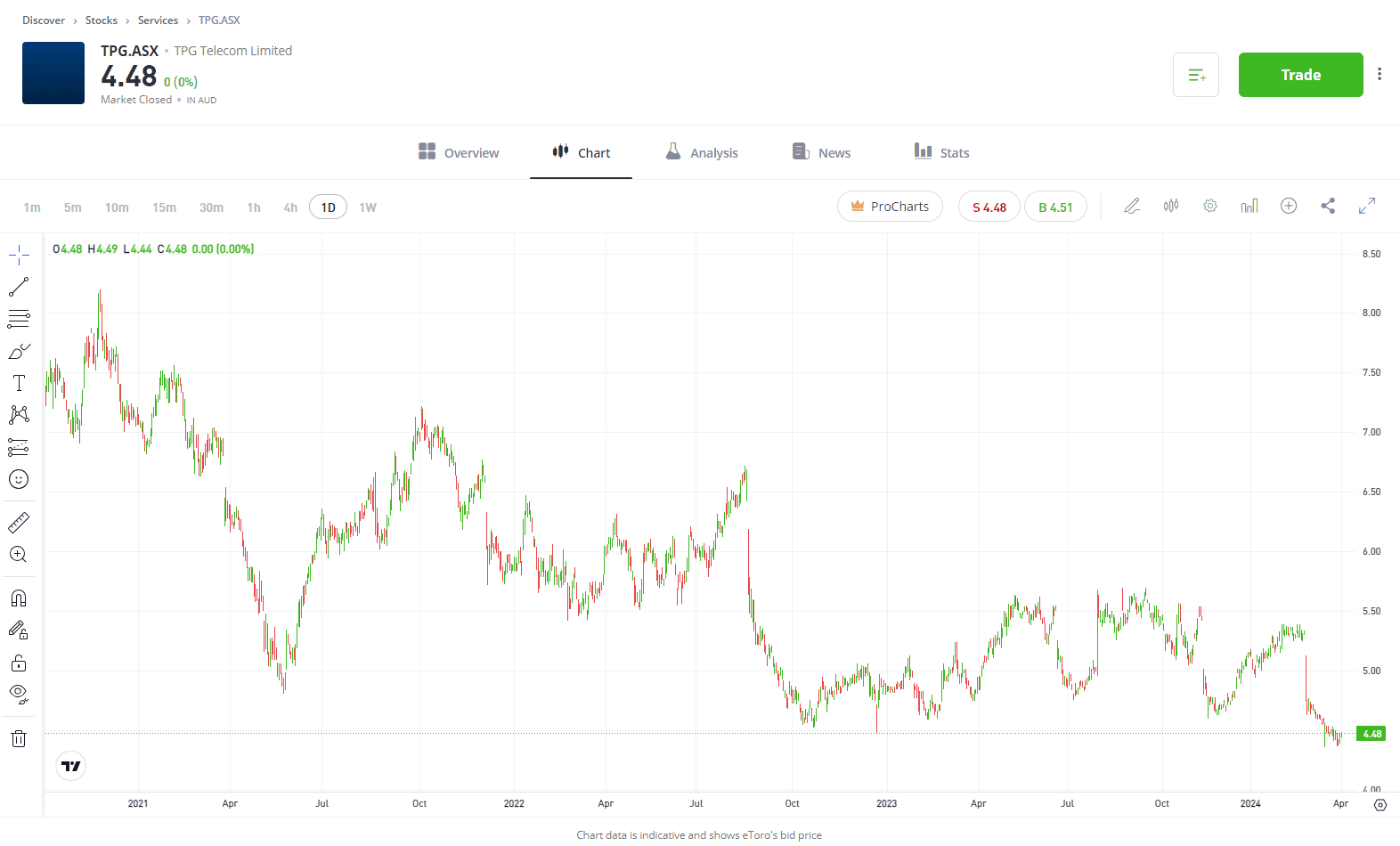

Stock #2: TPG Telecom (TPG.ASX)

Sector: Services

It’s been a torrid couple of years for TPG Telecom, with shares falling by 47% since 2020, hitting a record low of $4.38 in the process. Low single-digit earnings growth has put shares on the back foot, and left investors concerned about future growth, which is more than reflected in the share price performance in the last few years. However, the roll-out of the fifth-generation mobile network or 5G, shouldn’t be forgotten. Investors may have pushed it to one side with a focus on AI, but the 5G services market is set to grow at an annual rate of 59.4% over the next seven years, a huge opportunity for telecom businesses. and its prospects are just as sexy as those of AI, if not as much in the headlines. With an attractive dividend yield of 5.7%, and a solid consumer business in Australia, TPG is a name investors should watch when looking at the transition to 5G.

Invest in TPG Telecom

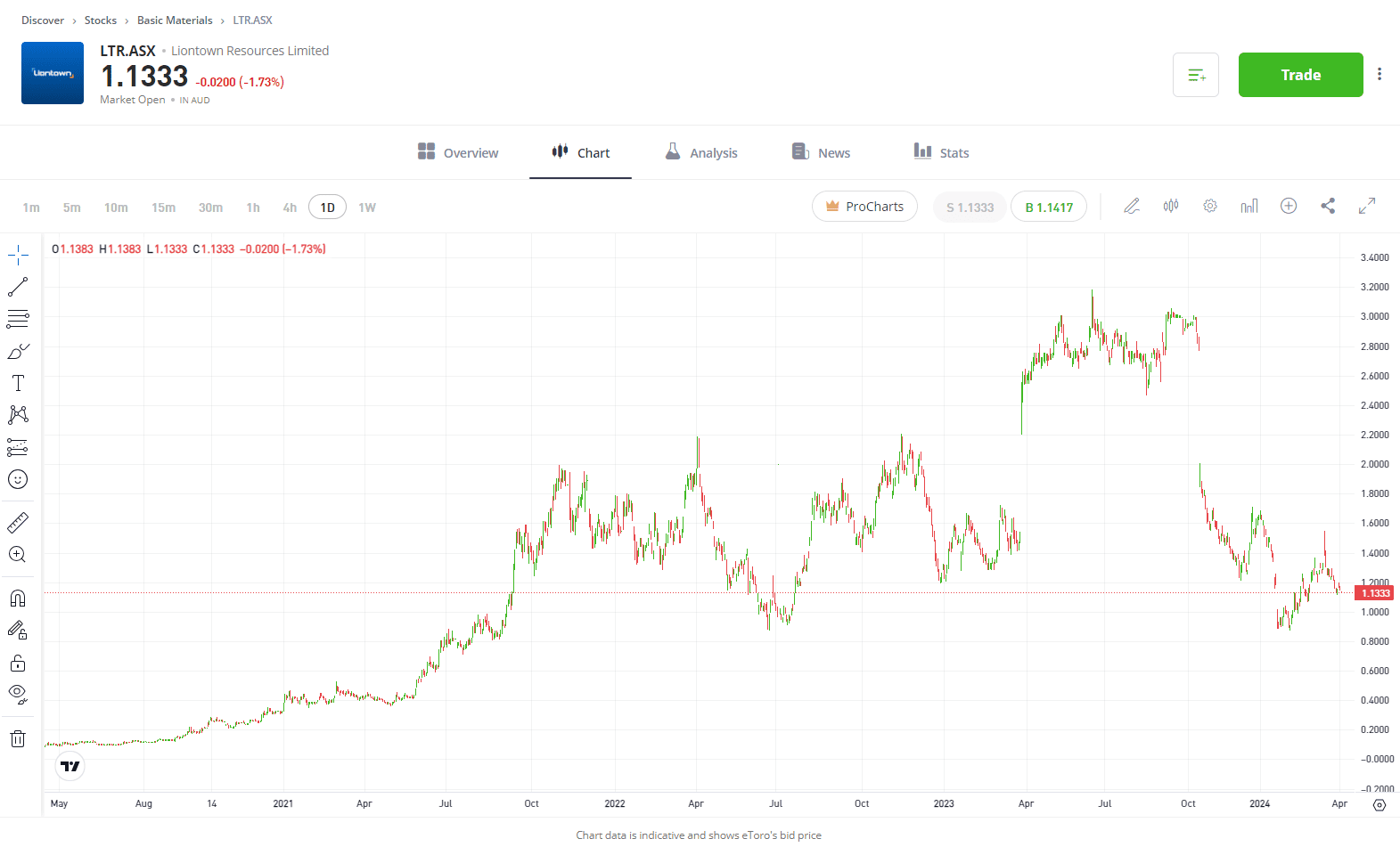

Stock #3: Liontown Resources (LTR.ASX)

Sector: Basic Materials

It’s been a tough period for lithium mining stocks, with significant drawdowns since the euphoria that took most stocks to record highs in 2023. For Liontown Resources, the sell-off took shape when Albemarle, the world’s largest lithium miner, walked away from its $6.6 billion takeover. Since then, shares have been in free fall, hitting the lowest level in over three years, as lithium prices continue to struggle. However, Liontown Resources does find itself in a great position, recently securing funding for its Kathleen Valley project and ongoing contracts with top tier EV manufacturers such as Ford and Tesla. Lithium prices have also started to stabilise after continuing to tumble over the last 12 months. A bottom in the lithium price could also signal a bottom in Liontown’s shares, and there may be more positivity on the horizon for Liontown as lithium demand looks to be improving once again.

Invest in Lionstown Resources

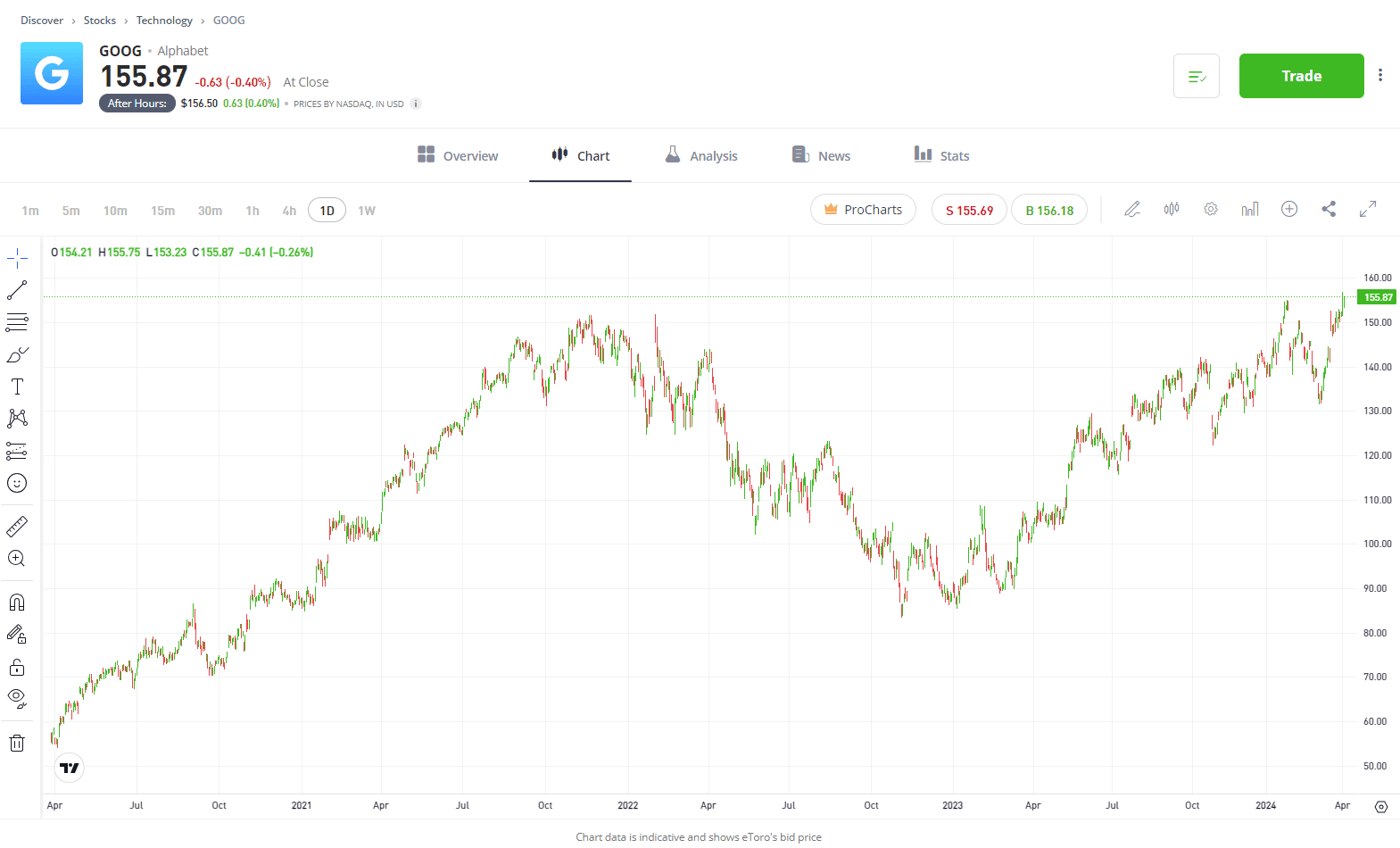

Stock #4: Alphabet (GOOG)

Sector: Technology

The magnificent seven have stolen the limelight in the last 12 months, led by outsized gains from the likes of Nvidia and Meta. However, Alphabet has lagged behind in the last 12 months with investors seeing Microsoft as a more apparent AI play. Microsoft’s investments in ChatGPT creator OpenAI have been very public and successful, whereas Alphabet’s AI rollout has been less of a hit with consumers. However, Alphabet has seen much stronger earnings growth than Microsoft in the last two quarters, with its cloud segment continuing to grow, and advertising spending returning in a big way thanks to Google and YouTube. Given the lack of growth in its share price, the business is trading at a low valuation relative to its growth and competitors, at just 22x forward earnings. With a potential landmark deal on the horizon with Apple around AI, and margins set to expand further this fiscal year, the business looks to be a great choice amongst the Magnificent Seven.

Invest in Alphabet

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD.

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.