April saw the long-awaited market reality check, with the ASX200 and S&P500 pulling back. Unexpected upside inflation surprises in both Australia and the US reshaped expectations around interest rate cuts, with Australia even facing the potential for another hike. However, market pullbacks are healthy and come with the territory of investing, and often present opportunities for savvy investors to capitalise. We see continued weakness being bought by investors with plenty of cash sitting on the sidelines.

Elsewhere, Bitcoin sold off into its four-yearly halving, Oil briefly broke $90 on geopolitical risks and inflation protection demand, with Gold also reaching record highs. US earnings season has already seen 80% beats across all sectors, and Nvidia is set to report during May. The start of weaker ‘sell in May’ seasonality may also keep the market technically on edge, but here are four stocks to watch during May.

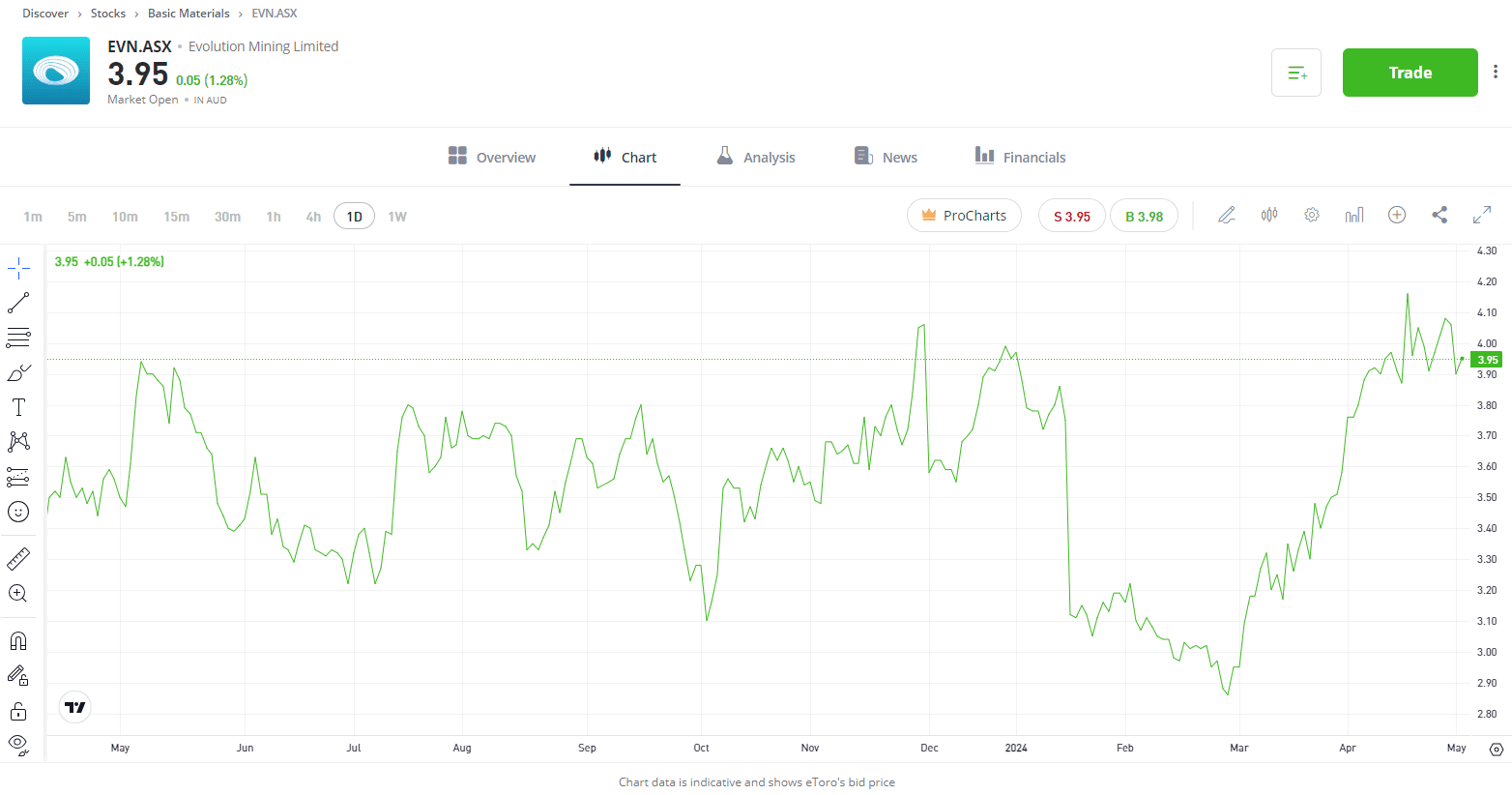

Stock #1: Evolution Mining (EVN.ASX)

Sector: Basic Materials

Gold prices have rallied in 2024 on a mix of growing geopolitical tensions and record levels of buying from central banks, already gaining as much as 12% this year. Most gold miners on the ASX200 have underperformed the price of gold, including Evolution Mining, whose shares are down 1% YTD. With continued sticky inflation, uncertain economic pathways, and heightened geopolitical tensions, Evolution Mining has strong tailwinds, especially as gold prices are likely to stay elevated for those very reasons. The company also recently provided a solid quarterly update in which gold production rose by 15% in the quarter to 185,252 ounces, but the cost of mining that gold fell by 9.6%. Evolution Mining has a solid runway if production can stay elevated and the business can keep costs low while gold stays near record levels.

Invest in Evolution Mining

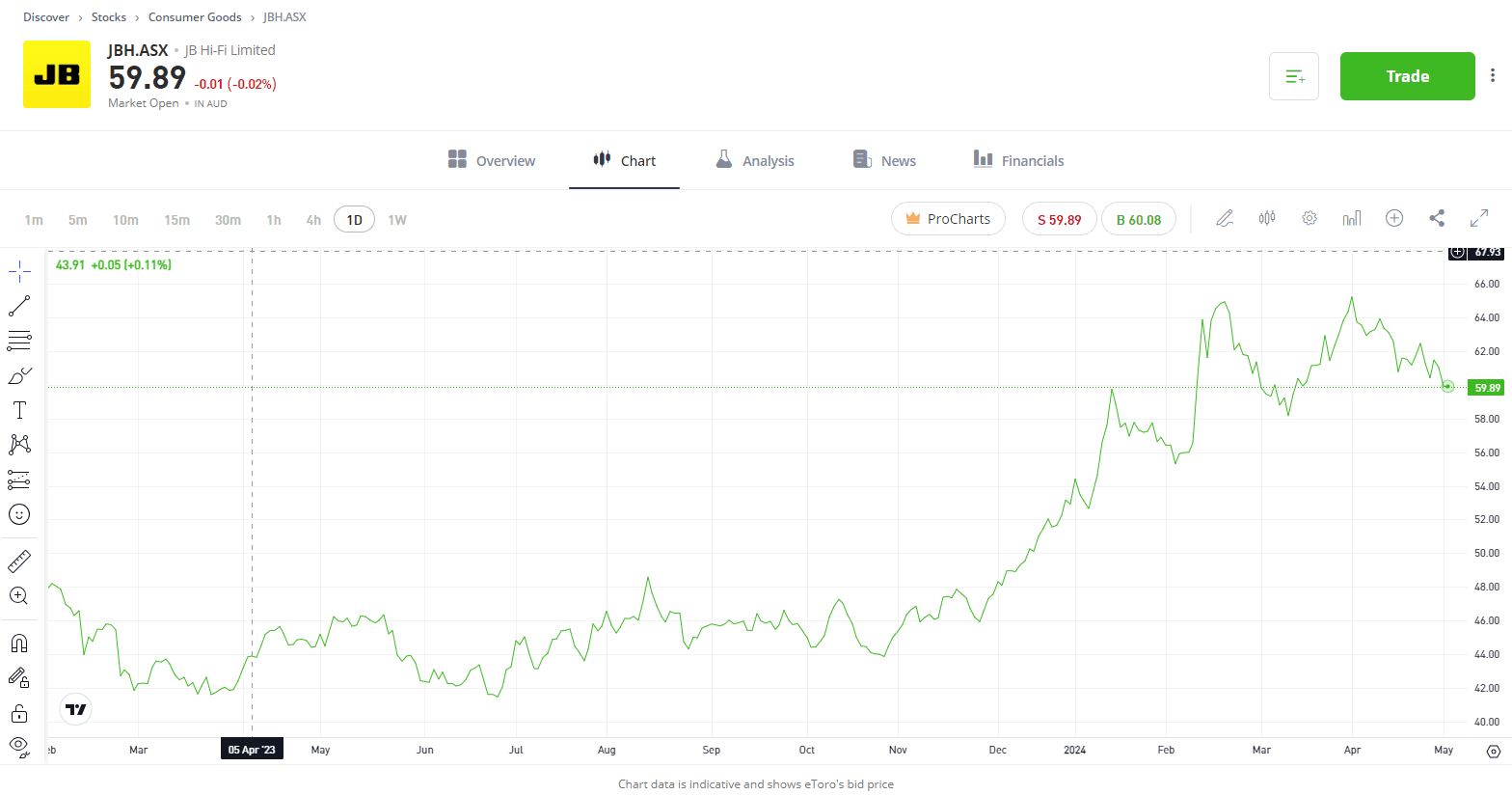

Stock #2: JB Hi-Fi (JBH.ASX)

Sector: Consumer Goods

The cost of living has put pressure on consumers over the last 12 months, but discretionary stocks continue to show resilience. We may now expect to see a higher for longer narrative playout from the Reserve Bank of Australia, but Australia’s migration surge is supporting retail spending, a big boost for retailers such as JB HiFi. The company reported better-than-expected half-year results in February, but profit did fall by 20% due to inflationary pressures and a slight dip in sales. However, on top of the catalyst of a surging population, the government is set to roll out stage 3 tax cuts in early July, providing households with more disposable income to spend on discretionary items. On top of those catalysts, the stock also pays a solid dividend yield of 6.5%, making it a stock for the watchlist.

Invest in JB Hi-Fi

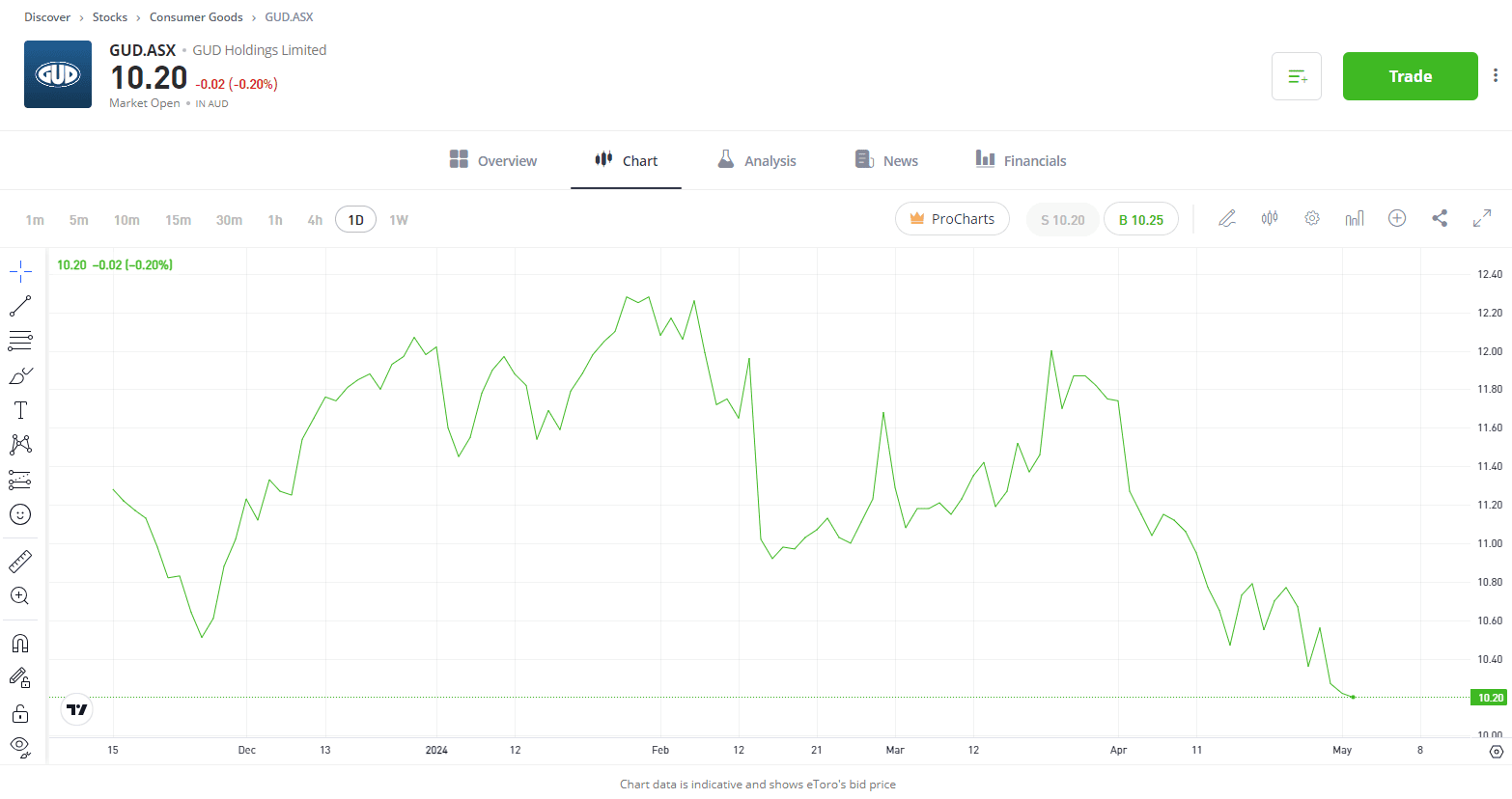

Stock #3: GUD Holdings (GUD.ASX)

Sector: Consumer Goods

GUD holdings may not be a well-known business for many investors, but it is a stock that should be on their radar. The company owns a variety of brands in the automotive aftermarket and accessories sector, solely focusing on this sector after selling down other product segments in Water and Garden Equipment. This has been a strong win for the business, with margins expanding and net profit growing by 19.5% in the first half of the fiscal year 2024. The automotive industry remains a staple in any economy, especially in Australia, where there is a love for outdoor adventure and road trips. The stock is loved by analysts right now, with Bloomberg Analyst Ratings showing ten buy ratings and one hold, with an average price target of $13.33, which would signal over 30% upside from its last traded price of $10.20. With an investor day on the 15th of May, investors will have the opportunity to get further insights into the business and understand potential catalysts for future growth.

Invest in GUD Holdings

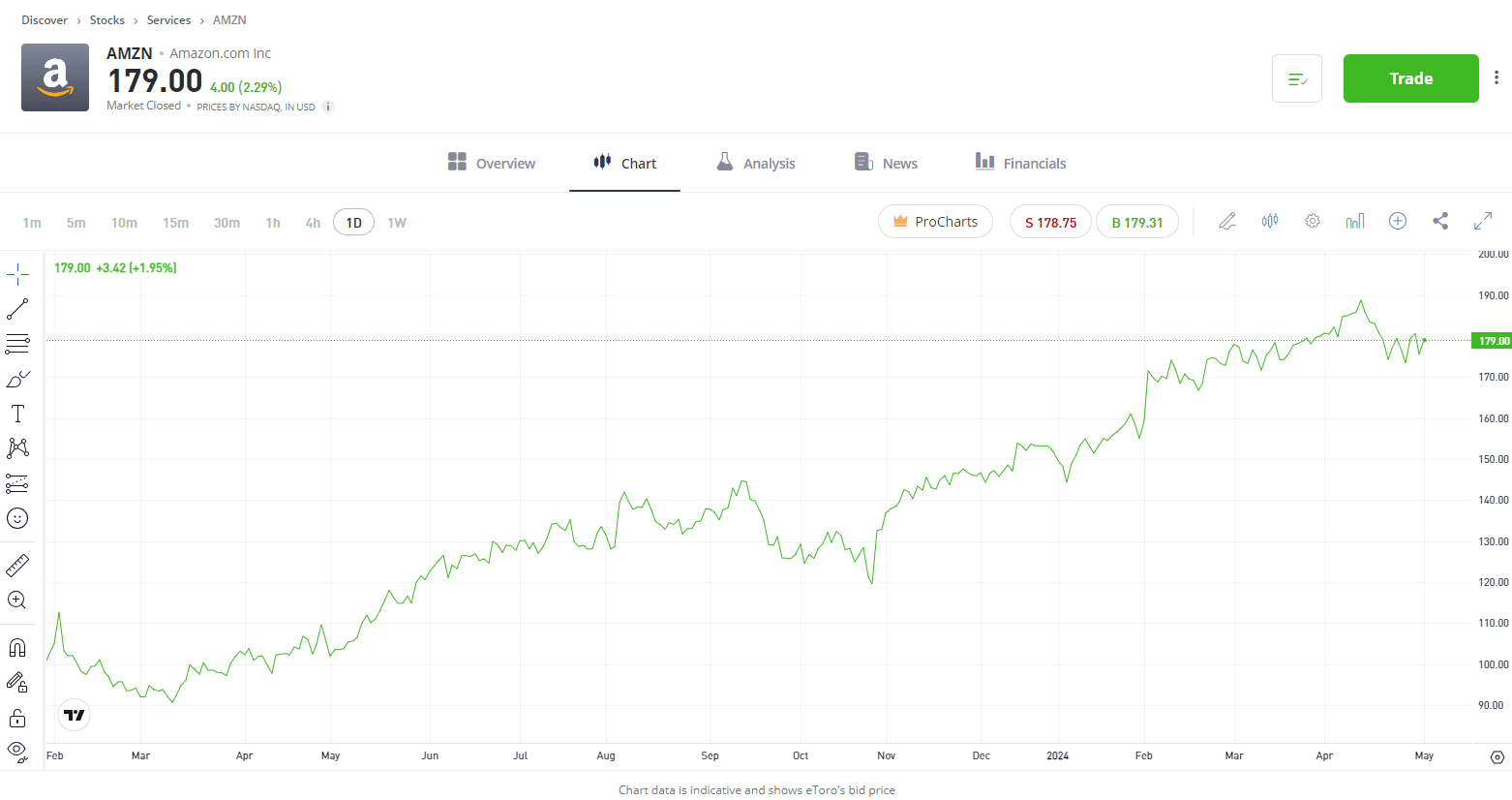

Stock #4: Amazon (AMZN)

Sector: Services

The online retailer has enjoyed a stellar 12 months with shares climbing by more than 70% with revenue growing by 11% in 2023. But, it’s AI that is driving Amazon’s success. Not only are they offering AI in their eCommerce offering through personalised product recommendations and target advertising, but AWS, Amazon’s Cloud business, is reaping the rewards of the tidal wave of spending we are seeing on AI across the globe. This area of the business was responsible for 62% of its operating profit in Q1 earnings, despite generating just 17% of overall revenue, showing how important this segment of the business is. After announcing a $70 billion cash pile in the quarter, many expected Amazon to declare a dividend for the first time in its history. Instead, Amazon said they would be reinvesting back into the business, an that approach aligns with the company’s ethos of prioritising growth and innovation. The focus will be on building data centres, and supporting further growth opportunities, which is a long-term win if they can use the capital in the right way.

Invest in Amazon

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD.

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.