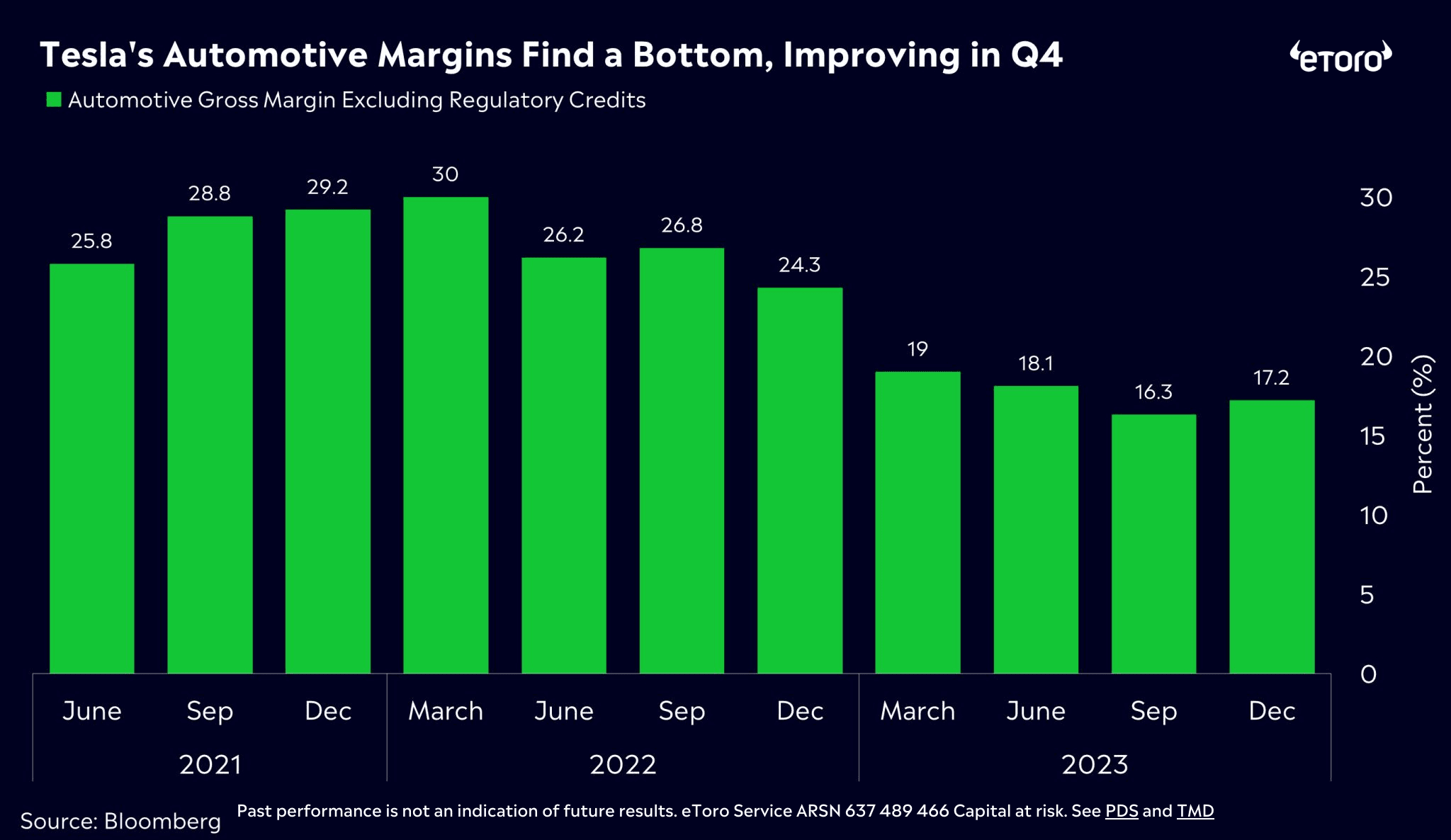

Renewable and electric vehicle (EV) stocks have faced a challenging time, with the Q4 surge proving short-lived. Recent underperformance is attributed to familiar challenges, including demand uncertainties and elevated interest rates, casting a shadow on once-favoured stocks.Tesla, a retail investor favourite, has faced a rocky start to the year, with shares down by 16% in 2024. Tesla’s stock has faced recent declines, with year-to-date and six-month figures showing -16.3% and -21.6%, respectively. The company’s shareholder deck highlights a transitional phase between major growth waves, anticipating slower vehicle volume growth in 2024 due to the launch of the next-generation vehicle platform at Gigafactory Texas, while emphasising a potential shift towards higher growth in the Energy Storage business compared to the Automotive sector. The autonomous and electric vehicle sector, represented by the Solactive Autonomous and EV index, has also seen a lacklustre return this year, declining by 16.5% over the past two years.

Despite recent setbacks, the sector can potentially be the high-risk zero-to-hero winners of the year. Valuations have been reset due to recent price declines, presenting a potential long-term opportunity. Demand for EVs remains robust, with a substantial growth trajectory ahead. Anticipated interest rate cuts could alleviate some pressure on these stocks. However, a slowdown in EV demand has emerged due to affordability concerns. Car rental giant Hertz scaled back its EV offerings due to weak customer demand and high maintenance costs. Meanwhile, Tesla pursued aggressive price cuts in China and Europe to stimulate demand. The good news is that global EV growth, mainly driven by the US, is projected to exceed 30% this year. While the short-term outlook may face challenges, the long-term potential for EVs remains evident, accounting for less than 3% of the global vehicle base.

On a positive note for producers like Tesla, costs are decreasing. Battery costs and lithium prices have both experienced declines. Lower lithium prices benefit EV producers but pose challenges for miners. Benchmark Mineral Intelligence reports an over 84% drop in lithium spodumene prices from December 2022 to today. Australian lithium miners, including Chalice Mining, Sayona Mining, and Core Lithium, have seen significant share price declines, with investor-favorite Pilbara Minerals experiencing a more modest 31% drop. AustralianSuper, the country’s largest pension fund, plans to double its exposure to local lithium stocks over the next five years, seizing the opportunity amid the substantial sell-off.

In the short term, miners may encounter further challenges as lower prices impact capital raising, while inflation and higher interest rates elevate the cost of initiating new projects. The transition to EVs and renewables presents a varied path for these stocks, but steadfast long-term investors are likely to remain undeterred by short-term fluctuations.

Explore Energy Stocks

eToro AUS Capital Limited AFSL 491139. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.