The ASX200 lost ground last week as a raft of earnings came through, with some big names disappointing. The index fell by 0.19%, with the biggest losses coming from the consumer staples and real estate sectors. In the US, stocks hit another record high, led higher by the AI euphoria. The S&P500 lifted 1.6% for the week, continuing its strong start to the year, returning 6.7%. Elsewhere, the Nikkei225 closed at a new all-time high, the first time in 34 years, and Reddit filed for its IPO, set to list on the NYSE under the ticket ‘RDDT’ once approved.

3 things that happened last week:

1. Nvidia remains undeniably magnificent

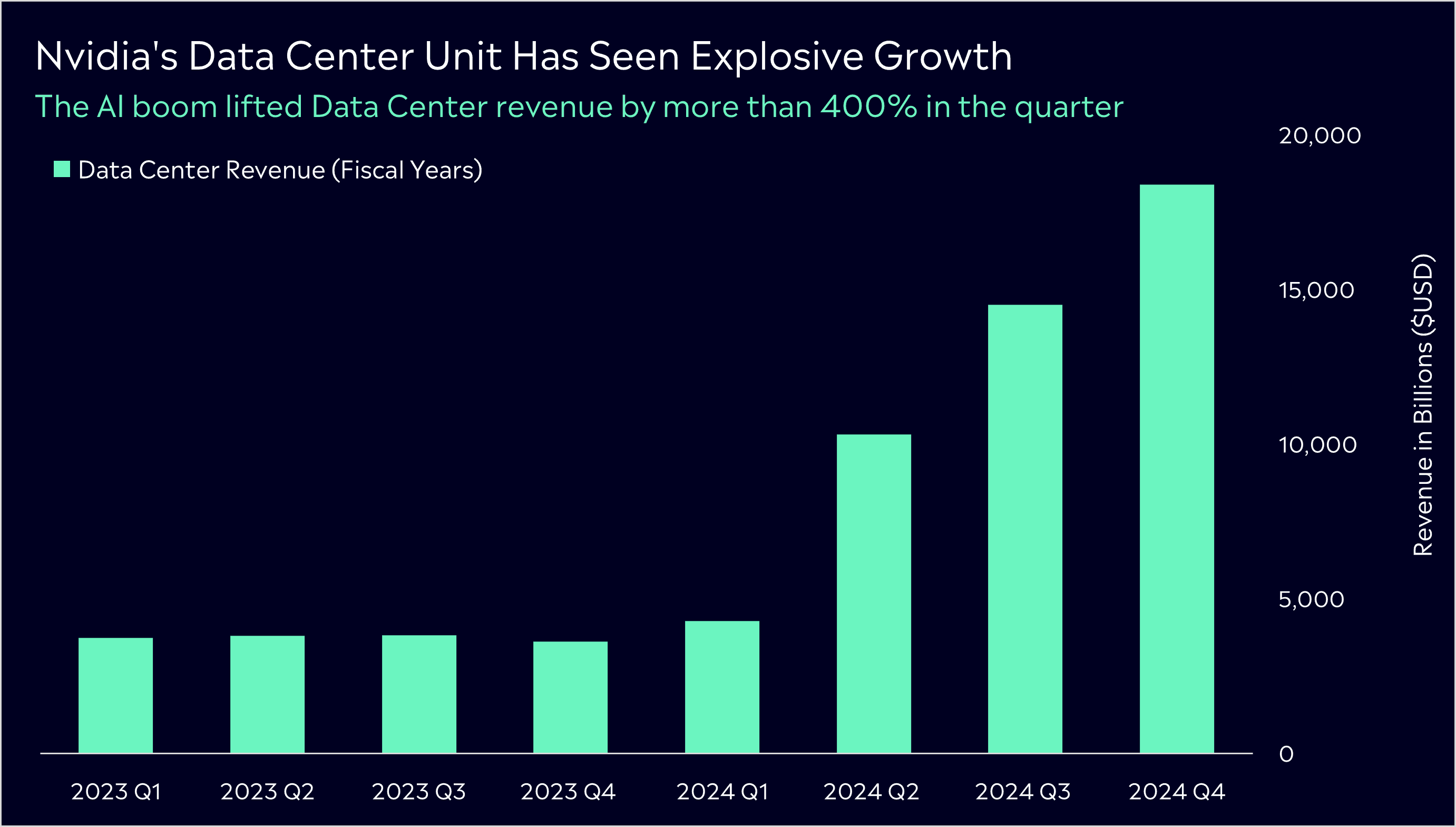

Nvidia reasserted its place in the Magnificent 7 with another blowout quarter showing that AI use cases are exploding, and the AI boom is showing no signs of slowing down.

It was a massive beat on earnings at $5.16 compared to estimates of $4.60, whilst revenue hit $22.1 billion, higher than the $20.41 expected. Its data centre business, the catalyst behind this impressive growth, saw revenue jump by 400% year-over-year, underpinning its status as the golden child of AI.

The big question for investors is, can this continue? Put simply, yes. Nvidia continues to deliver in every way, and its results show there is still plenty of growth ahead. This isn’t just a flash in the pan, nor a bubble, but a business that continues to make serious cash.

Despite the risks from issues in China and ongoing competition, that can pose headwinds moving forward, Nvidia raised its guidance for the next quarter to $24 billion in revenue, putting it on track to nearly $100 billion in sales over the next year.

2. Woolworths CEO steps down in shock move

Last week, Woolworths announced a wider net loss than expected of AU$781 million in the first half of the fiscal year, whilst also warning that sales to start this year had begun to moderate with consumers becoming more cautious.

The big news was Woolworths’ announcement that CEO Brad Banducci would step down as CEO and be replaced by Amanda Bardwell starting September 1st. The announcement will garner plenty of chatter given Banducci’s disastrous Four Corners interview this week – although this leadership change has likely been in the works for months and not a direct result of the CEO’s headline-grabbing walkout.

The changing of the guard at Woolworths comes amidst an arduous period for the business that has seen it thrown into the limelight – and not in a good way. Shifts in senior leadership will often result in some uncertainty for shareholders, especially given Brad Branducci has spent eight years in charge.

However, for some investors, this may feel like a timely pivot, and it may prove to be a prudent decision with recent challenges not handled in the way many would have likely expected. Amanda Bardwell appears to be a great fit to take over the helm at Woolworths, having run two highly successful businesses in eCommerce and Loyalty.

3. A winner and loser last week from the S&P/ASX200

CSR shares were the winner last week, jumping by 23% following a takeover offer from Saint-Gobain to acquire the building materials business. The offer is subject to approval from shareholders.

Sayona Mining had another torrid week last week, falling by 23% taking its losses for 2024 to 40%. The sell-off last week follows fellow lithium company Piedmont Lithium offloading its entire stake in the company.

3 things to watch for the week ahead:

- AU Monthly CPI

This Wednesday sees the release of January’s CPI. With December’s inflation figures coming in below the RBA’s projections, households and the Reserve Bank will be eager to see if the upcoming inflation figures continue their downward trajectory, with CPI falling to 4.1% in Q4, down from 5.4% in Q3 2023.

This week’s data will be the big data point for the Reserve Bank before the board’s next meeting in March, alongside Q4 GDP data. Expectations are for inflation to rise 3.5% year-over-year, stalling slightly from January’s 3.4% and snapping a streak of continuous easing. Market pricing has shifted in recent weeks, but June is still the first meeting where the expectation is a cut. The good news for the RBA is that data is most likely coming in as expected, leaving the potential for three cuts on the table in 2024.

Inflation remains the most important number in markets and the easing of inflation is a net positive for investors. This week, the ABS also reported that Australians experienced the highest recorded rise in wages in almost 14 years, and the first significant pay increase in nearly three years. Wages rose by 4.2% in the 12 months leading up to December, slightly surpassing Australia’s inflation rate of 4.1%. This marked the first time since March 2021 that wage growth outpaced inflation, a welcome figure that many Australians will be hoping continues in 2024.

- Coles Earnings

After Woolworths reported a wider net loss than expected of AU$781 million in the first half of the fiscal year, investors’ eyes will this week be on Coles as they report their half-yearly earnings. This is especially true given last week’s spectacular announcement of Woolworths’ CEO Brad Banducci’s resignation in the wake of a scathing Four Corners report into both of the supermarket giants.

Similar to Woolworths, Coles is also expected to report declining profits, but revenue is set to grow at the fastest pace for almost three years, which may prove to be a silver lining. Coles has experienced intensifying scrutiny over the past couple of months, with an influx of media interest and the Australian government directing the ACCC to review prices and competition in the supermarket sector following accusations of price gouging.

In 2023, Coles reported a net income of AU$1.10 billion for the full year, slightly below analyst estimates of AU$1.11 billion, with profits growing by 4.8%. As the supermarket giant has been transferring some of the increased costs onto consumers to manage the impacts of inflation, it will be interesting to see this Tuesday how negative consumer sentiment affects Coles’ results for the first half of the fiscal year. It’s a tough period for any businesses in the limelight, as Qantas and Woolworths found out last week. Balancing profitability alongside customer relations is no easy task, and this will be an ongoing challenge for Coles.

- Flight Centres’ Half-Year Results

Flight Centre is another company that will be on the radar for investors, following Qantas’ half-year results, which posted profits that beat estimates earlier last week, but a 13% decrease in underlying profit.

Following Flight Centre’s struggle during 2020 due to COVID restrictions on travel, around 15,000 staff were laid off in a bid to greatly reduce costs. This appeared to be a good move for the company, with Flight Centre announcing solid results for FY23, reporting revenue that was up 126% to A$2.28 billion, and EBITDA rising by 260% to A$300 million.

Although travel demand is still high, airfares are beginning to normalise. At the start of February, the business’, Global Leisure CEO James Kavanagh noted that the cost of flights is experiencing a huge drop this year, with some international economy class fares even falling to pre-Covid levels.

Flight Centre’s upcoming earnings results may be a contrast to Qantas, given they are expected to post a solid jump in profits year over year, but declining from the second half of 2023. Investors will be focused on future guidance given that the market expects solid profits for the full year that have not been since the pandemic. Any shift away from current guidance will put shares under pressure, but reaffirming guidance will put shares on the front foot.

For more on markets each week, check out eToro’s Market Bites podcast:

*All data accurate as of 26/02/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.