Imagine being Australia’s largest tech company and seeing four of your six board directors dramatically resign in a single day. That’s exactly what happened at WiseTech this week, as its boardroom imploded amid “intractable differences” over founder Richard White’s role. Meanwhile, behind this corporate soap opera, the company quietly delivered stellar results: 17% revenue growth, expanding margins, and solid customer retention rates. It’s a tale of two WiseTech’s – a dominant software powerhouse controlling 75% of global trade flows, and a governance nightmare where the founder declared the company “can’t survive without him”. So, is this just a temporary storm creating an attractive entry for investors or will this dark cloud loom over WiseTech? Let’s find out.

- Boardroom drama sent shares 20% lower on Monday, but better-than-expected earnings on Wednesday, with margins growing to 50% helped stem some of the bleeding.

- The logistics industry is digitalising rapidly, a trend accelerated by global supply chain disruptions and expected to continue over the next decade.

- Analysts remain bullish – Bloomberg analyst’s recommendations has 14 buys, 4 holds, and 1 sell, with a price target of AUD$12.62, implying 30% upside.

Explore WiseTech Global

The Basics

WiseTech Global makes software that powers global shipping. Its flagship product, CargoWise, is the operating system that major freight forwarders use to track shipments, manage customs paperwork, and coordinate complex global supply chains. Think of it as the invisible technology that ensures your online purchases actually make it to your doorstep.

Since being founded by Richard White in 1994, WiseTech has transformed into an Australian tech powerhouse. The company aggressively expanded by acquiring over 40 smaller competitors in the past decade, cementing its dominance in the logistics software industry. Its subscription revenue model benefits from supply chain digitalisation trends and creates sticky, long-term customer relationships.

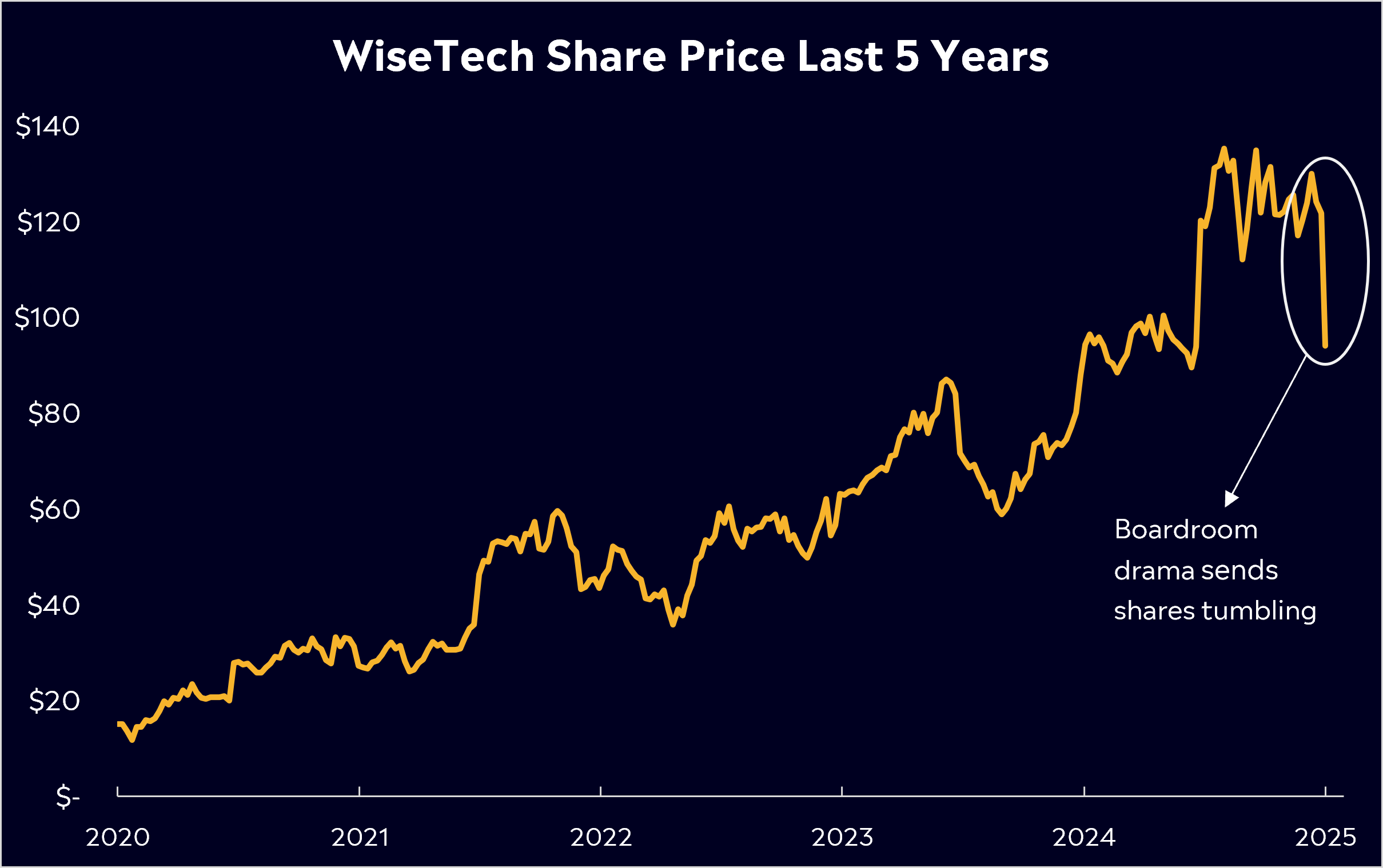

This strategy has paid off handsomely for investors, WiseTech shares have soared an impressive 450% over the past five years, making it the largest technology stock listed in Australia. No easy feat indeed.

But in the past week, WiseTech has faced significant boardroom turmoil, sending shares plummeting. four of WiseTech’s six board directors, including Chairman Richard Dammery, resigned simultaneously. The mass exodus was attributed to “intractable differences” concerning founder Richard White’s role and influence within the company. This has raised concerns about the company’s governance and future direction.

This upheaval follows White stepping down as CEO in October 2024, a move that had already unsettled investors amid a wave of allegations. Despite resigning, he retained significant influence within the company, contributing to internal conflicts that have now culminated in a mass board exodus. Following the resignations, White has now regained formal control and has been appointed Executive Chairman as the company continues its search for a new CEO. Some may see this as a positive development, with White himself boldly claiming that WiseTech “can’t survive without him.”

While White may have built one of Australia’s most successful tech companies, this governance crisis falls squarely on his shoulders. Markets hate uncertainty, and WiseTech now faces serious questions about who will become the next CEO, whether the company can fix its governance issues, and if the business can continue executing while leadership remains in flux.

Competitor Diagnosis

WiseTech Global has established itself as the dominant player in global logistics software. Its flagship platform, CargoWise, has become the industry standard with remarkable market penetration—covering more than 75% of global manufactured trade flows worldwide. WiseTech’s edge has been its aggressive acquisition-driven growth strategy, essentially eliminating competition by acquiring over 40 smaller companies and helping it grow non-organically.

While WiseTech does lead in global freight software, competition is heating up:

- Descartes Systems – A Canadian logistics tech firm with a growing market share, popular in North America. They haven’t yet expanded aggressively internationally.

- Oracle (NYSE: ORCL) – The tech giant uses AI-driven automation to optimise warehouse and transportation management. They aren’t shipping specialists but have deep pockets.

- Flexport and other startups – A Silicon Valley-backed logistics firm that combines AI-driven freight forwarding with real-time supply chain visibility. Other names are looking to gain a slice, but can’t yet compete with WiseTech’s global reach and software.

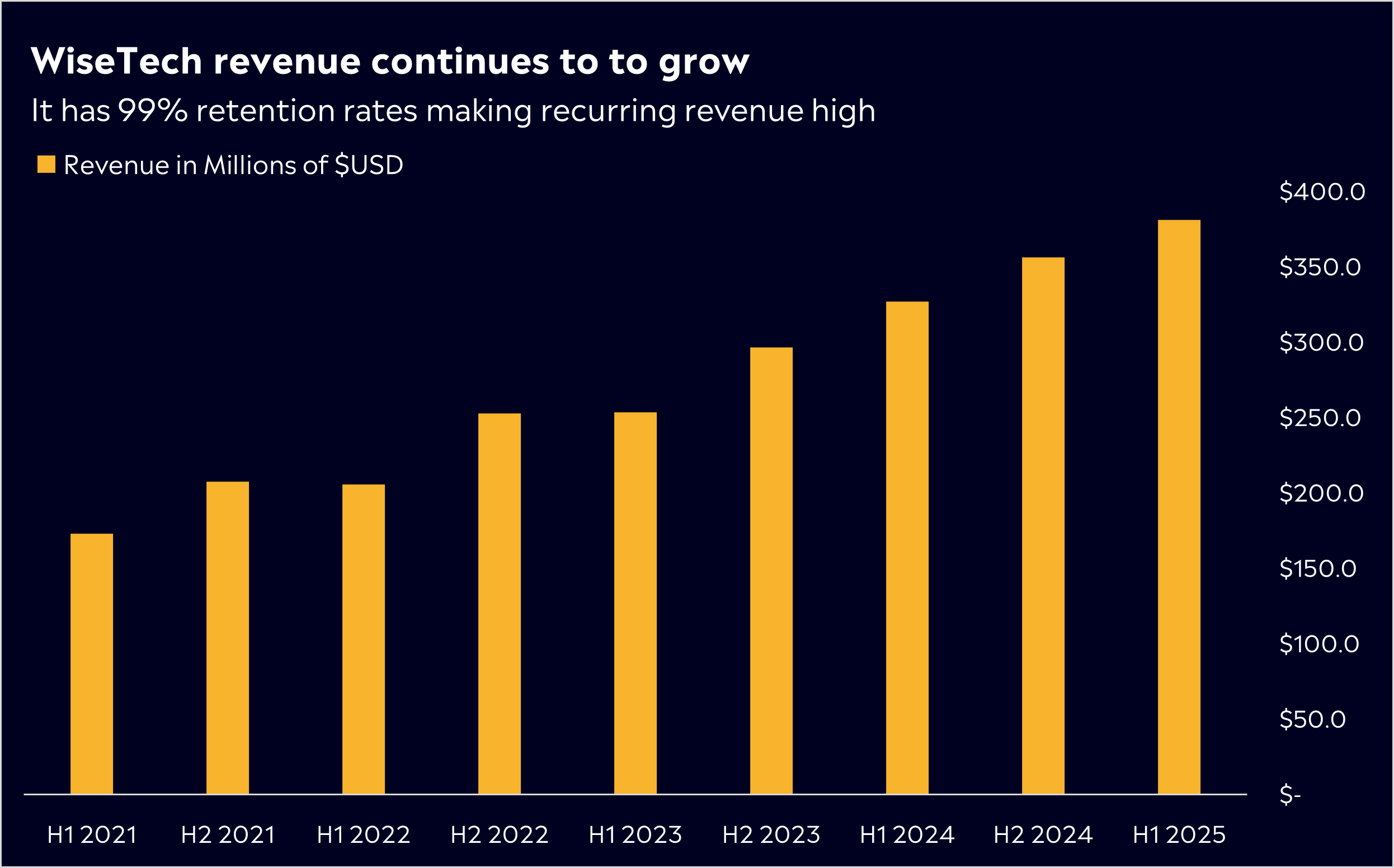

The problem for challengers is that once shipping companies start using WiseTech’s software, they rarely leave. Over 99% stay each year – that’s extremely high and means reliable income. That comes from deep industry integration and long-term contracts with major players.

The logistics industry is digitalising rapidly, a trend accelerated by global supply chain disruptions and expected to continue over the next decade. While CargoWise provides the best software for freight-forwarding solutions and will likely remain the industry standard, the competitive landscape is evolving.

If WiseTech keeps its current customers (and it usually does), you can expect steady, reliable growth. The global shipping industry isn’t going away, and companies using WiseTech’s software find it very difficult to switch to competitors. Think of WiseTech as installing a complex operating system – once it’s in and working, companies rarely want to go through the hassle of changing it.

Financial Health Check

It was a busy week for WiseTech, with its boardroom saga taking the limelight and arguably overshadowing its strong first-half fiscal year 2025 results. Revenue grew by 17% to US$381 million with its flagship CargoWise platform seeing revenue surge 21% to US$331.7 million.

What’s impressive is the logistics software provider has shown it can grow both its top and bottom lines simultaneously, with EBITDA jumping 28% to US$192.3 million and EBITDA margins expanded from 46% to 50%, showing the company is squeezing more profit from every dollar of revenue. This means WiseTech isn’t just selling more software, it’s becoming more profitable with each sale.

WiseTech has been heavily focused on streamlining the business and improving efficiency, helping to deliver better-than-expected results in this report. It maintains a healthy balance sheet, with around US$160 million in cash and equivalents. With cash flow also solid WiseTech has plenty of firepower for continued acquisitions or investment in product development. Shareholders also received a 31% increase in the interim dividend, rising to 6.7 cents per share.

Despite these strong numbers, management has guided revenue towards the lower end of its forecast range of US$1.2 billion to US$1.3 billion. This represents annual growth of 15% to 25%, but the company cited delays in rolling out breakthrough products as the reason for its more conservative outlook. WiseTech expects margins to rise to the top end of its guidance in the second half of the year, between 50% and 51%.

Looking deeper into the earnings call, founder Richard White was quick to quash governance concerns, stating: “WiseTech’s customers around the world care little about governance issues; they’re more worried about their own businesses and the value WiseTech can create.” In this case, only time will tell.

These results show that WiseTech is executing well in its core business, expanding margins, and raising its dividend. However, its guidance and boardroom drama have given investors plenty to digest.

Buy, Hold or Sell?

When zooming out, it’s been a great five years for WiseTech’s share price, but the last 12 months have been more tumultuous, with shares down about 1% in that time and falling 22% so far this year. However, for investors looking to buy the dip, it’s worth considering that the stock is still trading at a lofty 75× forward earnings, leaving very little room for error. With slightly clouded guidance and a heavily disrupted boardroom, perfection isn’t quite what WiseTech is delivering right now.

Interestingly, analysts remain broadly positive on the stock despite the weaker outlook and recent dramas. According to Bloomberg’s Analyst Recommendations, WiseTech boasts 14 buy ratings, 4 hold ratings, and just 1 sell rating. The average price target sits at AUD$12.62, implying a potential 30% upside from current levels.

The company dominates global logistics technology with high-margin recurring revenue that most software companies would envy. However, the boardroom instability, particularly concerning for investors focused on ESG principles, casts a shadow over near-term performance.

For potential investors: Add to your watchlist and watch for further weakness in shares. The premium valuation may be hard for investors to justify, but this remains a quality business with solid long-term potential.

Explore WiseTech Global

*Data Accurate as of 27/02/2025

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.