It was a down week for the ASX200, falling by 0.63% as a major tech sell-off in the US sent shockwaves through global stocks.

The S&P500 finished higher on Friday, but that wasn’t enough to eke out a gain for the week, with the index down 1%. However, every sector in the S&P500 rose on Friday, with the view of a Fed rate cut coming into touching distance as the bull market broadens.

Donald Trump spoke at the Bitcoin 2024 conference in Nashville over the weekend and declared he would make the US the ‘crypto capital of the planet’ if he was elected in November. His bullish comments didn’t see any significant moves from the market, with bitcoin remaining relatively stable at around USD$68,000.

3 things that happened last week:

- Tesla shares sink on disappointing results

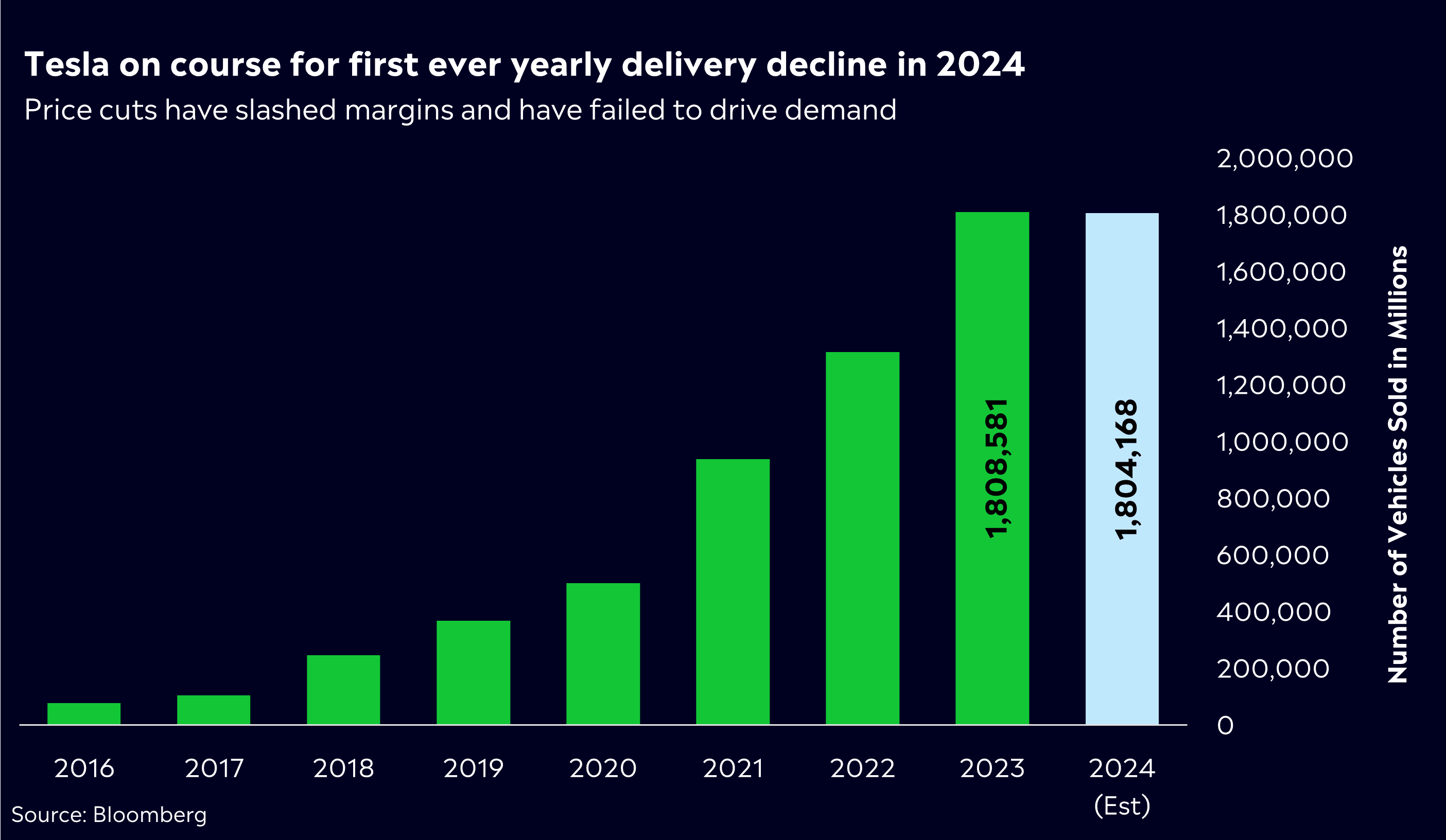

Tesla (TSLA) missed earnings estimates for the fourth quarter in a row, extending its tumultuous 2024. Most other key metrics missed estimates, but revenue did jump to $25.5 billion, above the $24.6 billion expected. After a better-than-expected delivery result at the start of Q2, spurred on by price cuts, shares have been on a tear. However, that positivity has come back to bite, with its automotive gross margin excluding regulatory credits falling to 14.6%, lower than the 16.4% in the first quarter. One of the biggest disappointments is the view of ‘notably lower’ vehicle sales in 2024. Essentially, we may see a year where Tesla doesn’t see vehicle delivery growth, and that would be a real sucker punch for investors, with profitability falling on the view of higher volume promised by Elon Musk.

- China cuts rates, economic support could be stepping up

The People’s Bank of China reduced the cost of its one-year policy loans by the most since April 2020 in more good news for the region. It follows a move to cut a key short-term rate just days ago, showing they are stepping up with more significant support for the slowing economy. The PBOC is continuing to take advantage of the recent weakness in the dollar to ease monetary policy. The consensus was that we wouldn’t see a cut until the Fed began to cut interest rates, so the fact we’ve seen easing from China earlier than expected is a real boost.

- A winner and loser last week from the S&P/ASX200

Iress (IRE) shares jumped 17% for the week after the company announced it expects around a 50% increase in earnings for H1 2024 and is therefore positioned to raise its full-year guidance. A number of brokers increase their price targets following the news.

Bellevue Gold (BGL) was the standout faller of the week, down by -21%. Shares sank after the gold miner announced a placement looking to raise funds at $1.55, which was around a 15% discount at the time of its release.

3 things to watch for the week ahead:

1. Q2 CPI AU (Wed)

This quarter’s CPI reading is the make-or-break moment ahead of the RBA’s August rate decision. It’s fair to say this is the most important data point Australia has received all year. There’s no doubt the RBA’s job over the next few months remains difficult. Data points have been mixed, with unemployment climbing, but seeing strong employment additions and retail sales data coming in surprisingly strong. Ultimately, the central bank is still reluctant to hike rates any further, with a hike likely to concede the fact the board may have made a policy mistake.

Meanwhile, pessimists are taking a “never say never” approach and believe that if inflation not only remains firm but starts moving upwards again, the RBA may act hawkishly to prevent rapid price escalation.

According to eToro’s Q2 Retail Investor Beat data, inflation remains the biggest concern for young Aussie retail investors and a growing proportion (34 per cent) view inflation as the most significant external risk to their investments, so household anxiety around these upcoming figures is understandable.

Despite this doom and gloom, it’s important to remember that in the grand scheme of things, the world is fighting inflationary conditions right now and many central banks are holding firm on rates while pushing out the prospect of cuts but importantly, they’re also softening the prospect of additional hikes. Economically, Australia is unlikely to break rank with the UK and US without a much more compelling reason than some uptick in quarterly inflation. The market consensus is for inflation to rise to 3.8% for the 2nd quarter.

2. Fed Rate Decision

As we approach the Fed’s rate decision on July 31, markets expect the Fed to hold interest rates steady, remaining unchanged at 5.25% to 5.50% for the eighth consecutive month. But, Jerome Powell has been clear that significant progress has been made on inflation, saying recently that the US is back on a “disinflationary path.” The progress on inflation has laid the groundwork for a September cut, which seems all but secured given the markets pricing a 100% chance of a cut. This is significant because, for the last 14 years, the Fed has done exactly what the market has priced in every meeting.

With rates at a peak unseen in two decades, the Fed’s commitment to curbing inflation seems unwavering but GDP data last week showed that the Federal Reserve is nearing closer to a soft landing. With the market eyeing two rate cuts in 2024, and a third rate cut in January, the rotation trade is gathering further legs. That is clear in the performance of the Russell 2000 and the S&P 500, with the Russell up 10.15% and the S&P 500 falling 1.45% in the last month.

Despite confidence that inflation can return to target by 2026, previous inflationary spikes have disrupted expectations, delaying potential rate cuts. The way forward is not as clear as many would hope, but the Fed’s measured approach continues to inspire confidence.

3. Big Tech – Microsoft, Meta, Amazon, Apple

It’s a big week ahead with four of the Magnificent Seven reporting earnings. While most of the seven have seen glorious performances this year, last week ushered in some doubts over what we might expect this week.

Notably, Tesla’s shares dropped by over 11% when its earnings missed the mark. This warning of notably lower vehicle sales in 2024 caused ripples of uncertainty throughout the sector. Alphabet (GOOG) also suffered a drop despite solid results, with investors questioning its spending on AI. However, those very investments could prove to be prudent.

Going into this week’s earnings reports, Microsoft (MSFT), in particular, will have their work cut out for them in establishing an optimistic narrative, given next quarter’s results may be marred by the impact of July’s disastrous CrowdStrike (CRWD) outage. Focus will be on the company’s AI ventures and the performance of Azure, its cloud computing platform – both of which are likely to be positive reports. Keep an eye out for capital expenditure figures, which Wall Street is concentrating on with Big Tech spending big.

AI will undoubtedly be the topic of the week across all four tech giants. Amazon (AMZN) is racing to develop a more cost-effective chip to compete with frontrunner NVIDIA (NVDA), and Meta (META) continues to integrate its own AI models into its apps and platforms. Apple (APPL) is accelerating its AI effort, integrating the technology into its new iPhone models, which is hoped will drive stronger sales in the second half of the year. However, news that its AI features may miss the initial launch of the new iPhone will be a disappointment. Apple’s debut VR headset, the Vision Pro, has had an underwhelming consumer response and may fast become the company’s proverbial albatross without a significant expansion of use cases to justify its steep price point.

It hasn’t been a great start to Q3 for the Magnificent Seven, experiencing significant drawdowns, with an index tracking all seven stocks falling by 4% last week. However, it’s hard to ignore the track record these stocks have delivered when it matters, despite high expectations. These stocks have taken a punch, but don’t expect a ten count anytime soon.

*All data accurate as of 29/07/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.