It was a winning week for the ASX200, with the index gaining 2.5% helped by better-than-expected US economic data and solid corporate results.

US stocks had their best week of the year. Inflation and retail sales data, alongside upbeat comments from Walmart, helped curb fears of a sharp economic slowdown, which saw investors pile back into growth. For the week, the S&P500 gained almost 4%, and the Nasdaq gained more than 5%.

The bumper Aussie reporting season continues with some particularly notable names clocking in results this week, including WiseTech (WTC.ASX), Megaport (MP1.ASX), Whitehaven (WHC.ASX), Santos (STO.ASX), Telix Pharmaceuticals (TLX.ASX) and Domino’s (DMP.ASX). The second quarter earnings season starts to slow down, but there are still some major names scheduled to report their results, including retailers Target (TGT) and cybersecurity firm Palo Alto Networks (PANW).

3 things that happened last week:

- JB Hi-Fi does it again

At the start of last week, JB Hi-Fi (JBH.ASX) delivered a solid full-year result with net income beating estimates and the announcement of a special full-franked dividend. In what has been a tough period for retailers, there was undoubtedly a grey cloud looming over JB Hi-Fi’s results today, but these figures show resilience and the market will be duly impressed. These results demonstrate how we continue to see consumers saying one thing and doing another. Consumer confidence is highly pessimistic, but JB-HiFi’s July update showed sales have grown across all areas of the business year-over-year. This strong indicator of increasing consumer spending comes at a time when interest rates are sitting at their highest level in a decade. The tax cuts implemented at the start of the financial year could be one of the key drivers of sales through July, ultimately offering consumers some ‘discretionary’ cash that they wouldn’t have had this time a year ago, which has given them the freedom to splurge on new electronics.

- CSL disappoints with guidance

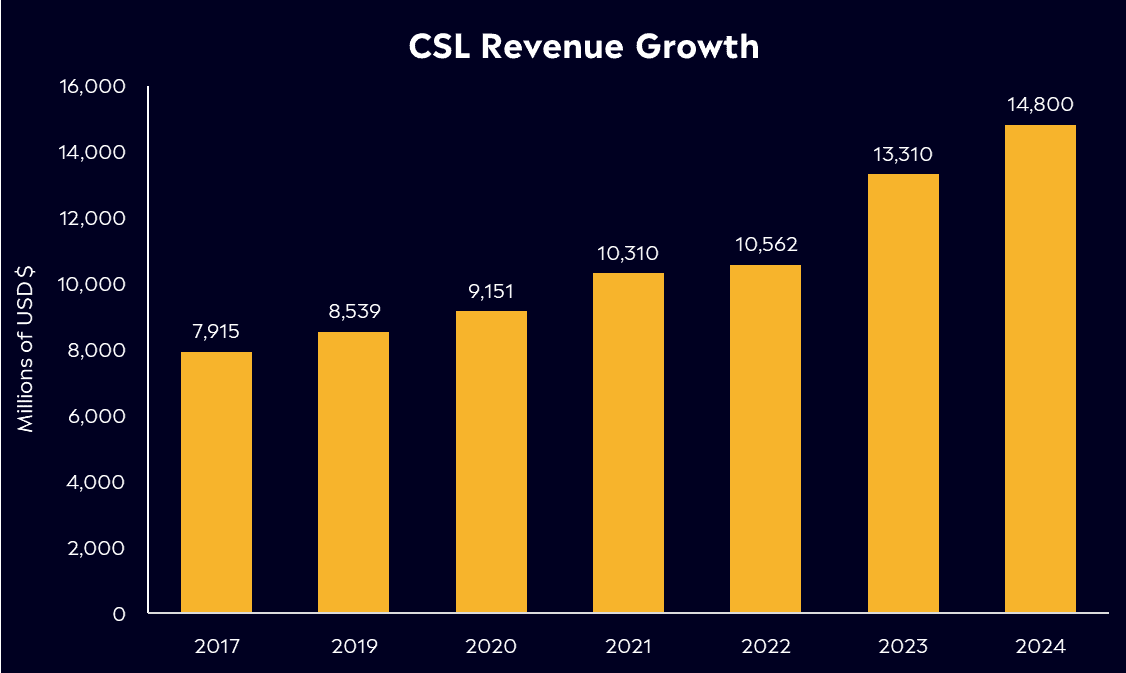

CSL (CSL.ASX) handed down its full-year results and the numbers came in pretty good. Revenue beat expectations, coming in at USD$14.8 billion, up 11% from last year and net profit on a constant currency basis rose 25% to USD$2.75 billion. Importantly for shareholders, its dividend grew again, paying out $1.45 per share, signalling 12.5% growth in the last year, and that’s set to be paid in October. Its Behring unit was the standout, with an increase in collections, driving growth and helping to reduce costs. Despite this, shares sank on Tuesday, down by 4.5%, following a slightly uninspiring forecast for fiscal year 2025. They signalled revenue growth between 5-7% and profit growth of between 10-13%, much softer than the growth this year and below analyst estimates. This guidance felt conservative, especially with its plasma business delivering and set for continued growth, a vital component of the business. Its new ‘Rika’ system should also continue to drive plasma collection, helping decrease the time needed to collect donations, which should help margins.

- A winner and loser last week from the S&P/ASX200

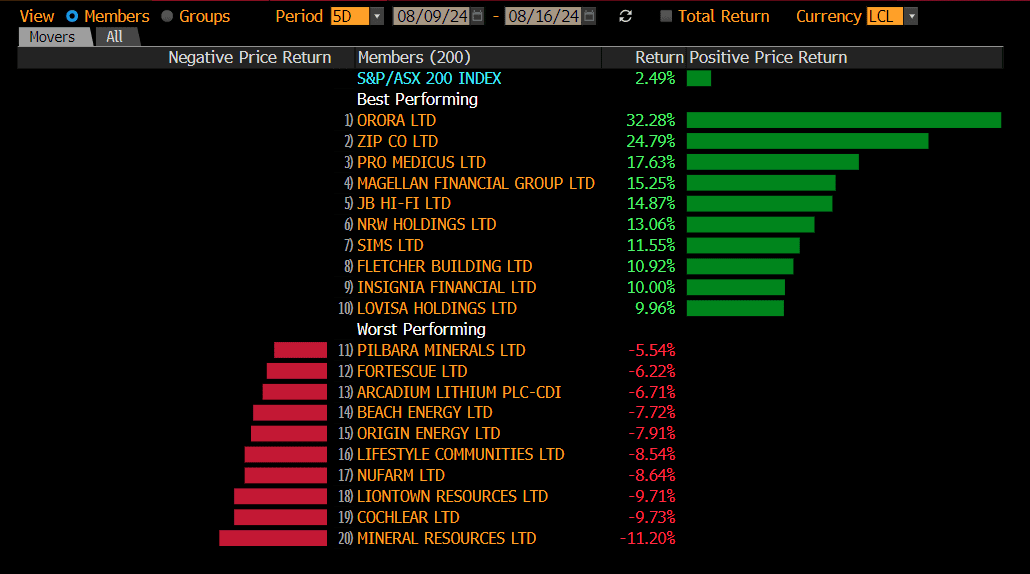

Orora (ORA.ASX) stole the show on the ASX200 last week, gaining more than 32%. The packing and distribution company announced better-than-expected full-year results, with profit jumping by 10%.

It was a tough week, though, for Mineral Resources (MIN.ASX), whose shares fell by -11.2%. With Iron Ore prices hitting their lowest level since 2022 investors continued to hit sell on the miner.

3 things to watch for the week ahead:

- AU Reports

The bumper Aussie reporting season continues with some particularly notable names clocking in results this week, including WiseTech, Megaport, Whitehaven, Santos, Telix and Domino’s.

In particular, Santos represents an exciting prospect for investors, given it has two significant growth projects underway and stock prices for the oil and gas giant continue to look comparatively cheap. Whitehaven Coal’s results are likely to be a bit more muted, with the earnings from coal operations it purchased from BHP and Mitsubishi earlier this year used to pay transaction costs that had been previously deferred during the acquisition process.

Telix Pharmaceuticals is a bit of an undersung stock darling, having risen almost 90% in the year-to-date. Recent regulatory setbacks may lead to slightly underwhelming results for this quarter, however, as the company has been struggling to secure US FDA approval for one of its key products, leading to multiple delays in product rollout. Regardless, the stock continues to reward patient investors and slight shortcomings likely won’t be enough to cause a sell-off.

Domino’s Pizza has had a terrible year so far, kicking off with the share price experiencing a record drop in January after it withdrew its fiscal 2024 outlook in response to poor network sales across Asia and Europe.

We’re a long way away from the pizza empire’s 2021 share price high, and the company’s attempt to cut costs in order to stoke profit margins does not seem to have struck a chord with customers. At the end of last week, Domino’s announced it is appointing current Domino’s COO Kerri Hayman, who also happens to be CEO Don Meij’s sister, to run its Australian and NZ enterprise. Hayman has exceptional Domino’s experience – spanning almost 40 years – which will give investors confidence and hopefully lead to better fiscal outlooks, but it’s unlikely we’ll see any of that magic in the earnings this time around.

- RBA Meeting Minutes

The minutes for August’s RBA meeting, which are set to come out on Tuesday, will be of interest to many following Michelle Bullock’s comments stating that the Reserve Bank had seriously considered another rate hike this month just recently.

While it’s clear that investors need to accept the reality of higher for longer rates, Bullock’s appearance before the committee last Friday revealed an unsavoury reality for many: the board did not expect inflation to get back to the 2-3% target range until next year or possibly even into 2026.

This may be rubbing salt into the wound of many borrowers and investors who were already coming to terms with the fact that the board had already ruled out an interest rate cut in the next six months.

In Bullock’s own words, “high inflation hurts everyone” and there’s not expected to be much pain relief in the margins of these meeting minutes. It is likely to once again show that the RBA will keep its hawkish stance and that a cut by year end seems far too optimistic.

- Jackson Hole Symposium

Federal Reserve Chair Jerome Powell is expected to deliver an address next Friday at Jackson Hole in Wyoming. The countryside town is the location of the Kansas City Fed’s annual economic symposium, a three-day conference where the Fed chair’s address is regarded as one of the headline moments.

His speech is usually watched closely, but Powell’s remarks will probably be of extra interest, given that the central bank appears very close to lowering interest rates from their current two-decade high.

Employment rates are weaker than expected right now in the US and inflation continues to ease in the region, meaning analysts won’t be looking to see if they’re cutting, but an indicator of how much they’re likely to cut by. That said, those looking for actual details on whether it will be 25 or 50 basis points will have to wait until September’s Fed meeting proper.

America appears to slowly be solving its inflation problem and the UK has already begun cutting rates, which may represent a concern to Australians as our allies grow more economically optimistic while the prospect of interest rate cuts here continue to be pushed out past the horizon.

*All data accurate as of 19/08/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.