It was a positive week for the ASX200 last week, finishing up 0.71%, led by Energy and Materials. Iron Ore jumped on growing expectations that China’s real estate market has found a bottom. At the same time, local retail sales data came in hotter than expected, fuelling speculation of another hike from the RBA.

The S&P500 set yet another record high after gaining 2% last week. Once again, tech led the way, with the Nasdaq up 3% last week. Tesla (TSLA) defied critics and stole the show last week, gaining 27% after better-than-expected delivery numbers, making it the best performer on the S&P500.

European markets may see volatility this week with substantial government changes from the UK to France. This creates uncertainty for investors and traders alike, and markets hate uncertainty.

3 things that happened last week:

1. RBA Minutes signal higher for longer rates

Last week’s RBA minutes showed that the board remains vigilant to the upside risks of inflation, which has reared its head in recent weeks. The minutes indicate that the Q2 CPI reading towards the end of July carries huge significance ahead of August’s rate call. The data points over the next month are crucial for the data-dependent RBA, which, in addition to Q2 CPI, includes retail sales later this week and employment data on the 18th of July. What’s clear is that investors will need to accept the view of higher for longer rates, and the prospect of rate cuts continues to be kicked further along the trail, at least for now. The minutes also reiterate that the board isn’t willing to rule anything in or out, meaning another rate hike in 2024 is still quite clearly on the cards.

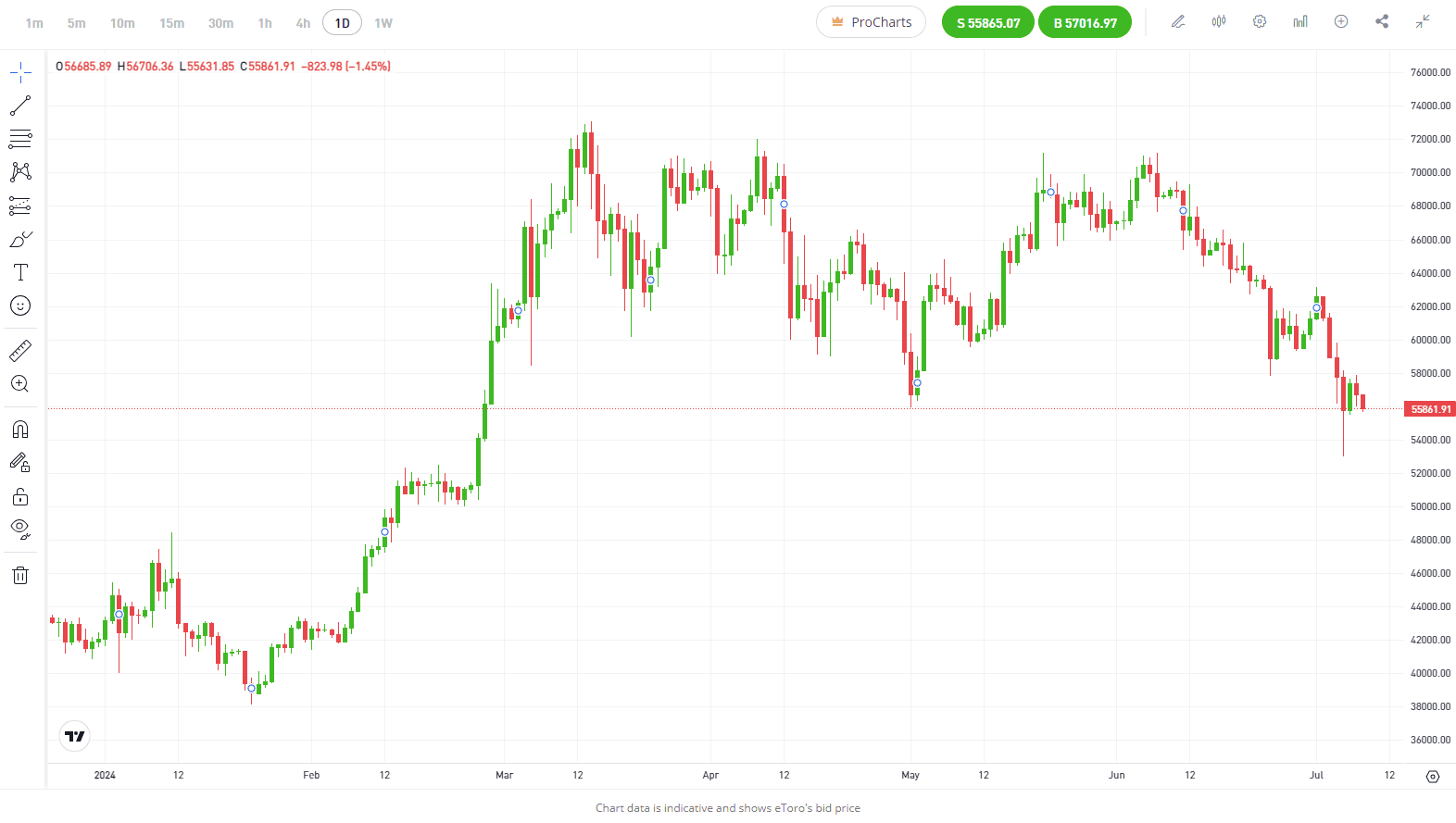

2. Crypto tumbles

Bitcoin and crypto assets saw red across the board last week as US elections and the fallout from Mt.Gox see investors going risk off. Bitcoin tumbled below USD$54,000 for the first time since February. Investors are coming to terms with the administrators of the failed Mt. Gox exchange handing Bitcoin to creditors in stages. The fear is that the USD$8 billion in bitcoin could end up being sold. A supply dump like that would impact prices. However, these sell-offs are par for the course when it comes to crypto assets. New crypto investors will undoubtedly feel a sense of unease with bitcoin falling more than 20% since its highs in March, but we have seen this many times before in previous bull markets. Asset prices don’t just go straight up; this is a crucial reminder that crypto is a volatile asset.

*Past performance is not an indication of future results.

3. A winner and loser last week from the S&P/ASX200

Whitehaven Coal (WHC) shares surged 17.25% last week following fires at a competitor’s mine, fuelling concerns over shortages that would drive coal prices higher.

On the other end of the ASX last week, West African Resources (WAF) fell 10.25%. The drop came following a share placement at $1.37, a discount from its previous price of $1.59 on Monday.

3 things to watch for the week ahead:

- Westpac Consumer Sentiment (Tuesday)

Last month, the Westpac Consumer Sentiment bumped up 1.7 per cent after a three-month stretch in the negative. On Tuesday, we’ll get to see if that was an incidental blip or an indication that Australians are once again hitting the shopping aisles despite a persistent cost of living crisis.

We’ve just seen May’s retail sales figures indicate a surprise surge as EOFY deals commenced early and bargain hunters eagerly snapped up sales, positive news for the 24% of Australian retail investors currently holding investments in discretionary consumer goods, according to eToro’s ‘Retail Investor Beat’ data. A 0.6% rise in month-on-month sales in May beat the 0.3% consensus forecast by double, with retail spending totalling $35.9 billion nationwide. Combine those indicators with CPI coming in alarmingly hot, and it’s becoming clearer that those with the power to spend are doing so with aplomb. On that basis, we will likely see this month’s consumer confidence come in on the positive once more, which will inevitably fuel speculation of a rate rise in August and turn eyes firmly back on Michelle Bullock for any sign of a hawkish tone.

eToro’s data found that more Aussie retail investors are more concerned about inflation now than at the beginning of the year. This suggests that investors are well aware of the potential for another rate rise this year and are concerned about how it will impact their portfolio. In short: it might be happy days for Aussie retailers but a grim foreshadowing that another rate rise may arrive before year’s end.

- US Inflation (Thursday)

Fed meeting minutes last week revealed that the US central bank is steadfast on inflation returning to 2% levels before considering a rate cut. With the last two months’ CPI readings coming in cooler than estimated, analysts are once again forecasting conservatively and likely expecting the true number to come in somewhere between 3.1% and 3.4%.

US consumer prices are looking flat and inflation is undeniably cooling, albeit slowly, as the November presidential election creeps up. Recent PCE data, the Fed’s preferred measure of inflation, came in line with expectations, lifting expectations that we will see multiple cuts in 2024. July is still too early for the Fed to feel confident enough to cut rates, however, absent any meaningful upside surprises in CPI and PCE over the months ahead, firmly setting the stage for a September rate cut. On the other hand, a few hotter-than-expected reports will likely delay the Fed’s first rate cut of this cycle with a focus on services inflation that remains the sticking point, with healthcare and housing still the biggest contributors.

On the presidential campaign trail, the cost of living will no doubt continue to remain a central issue and the timing of this creates the potential to make-or-break key talking points for both candidates around the management of the economy. If the summer months heat inflation back up and push a rate cut further out to sea, President Biden will undoubtedly have to weather pointed accusations of economic mismanagement. As we’ve seen, this is a talking point that Donald Trump has already been more than happy to tap, even as the economy slows.

- Q2 US Earnings Season Gets Underway

The S&P500 has been absolutely flying this year, to say the least, gaining 14.5% in the first six months of the year. For that impressive run to continue, the focus shifts to Q2 earnings season, which kicks off this week. Current projections have the S&P500 reporting double-digit earnings growth in 2024 but for that to come to reality, Q2 earnings will need to impress. Markets expect to see 8.5% earnings growth year-over-year, with eight of eleven sectors set to see year-over-year growth, led by Communication Services, Technology, Healthcare and Energy.

We’ll once again see investors looking to market darling Nvidia to deliver to reaffirm the AI boom is still in full swing. But, as usual, financials get us underway alongside PepsiCo (PEP) and Delta Airlines (DAF). According to our top stocks data, Delta is among the top stock fallers on the eToro platform globally for Q2, with a 13% decrease in holders for the quarter. Financials look set to post earnings growth of just over 4%, but banks specifically are set to see earnings decline by -10%. There will be a big focus on net interest margins, with interest rates still elevated and how the consumer is holding up, looking to any credit deterioration.

*All data accurate as of 08/07/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.