Australian stocks fared far better than their American counterparts last week, but the ASX200 still fell by 1%. The index was buoyed by the big banks, who enjoyed a strong week; the financial sector gained 2.5%. Energy stocks were the worst performing, as oil prices neared a 14-month low on demand fears.

It was a terrible week for US stocks, with the S&P500 falling more than 4%. The hotly anticipated August jobs report showed US hiring fell short of forecast, with the two prior months revised lower, lifting expectations for a 50bps cut. However, those expectations have fallen to start this week, with markets now only eyeing a 25bps move from the Fed later this month.

On Friday, the S&P500 saw its quarterly shakeup. Palantir Technologies, Dell Technologies, and Erie Indemnity were all added, while American Airlines Group, Etsy, and Bio-Rad Laboratories dropped out.

3 things that happened last week:

- Aus GDP rises but at slowest pace since the pandemic

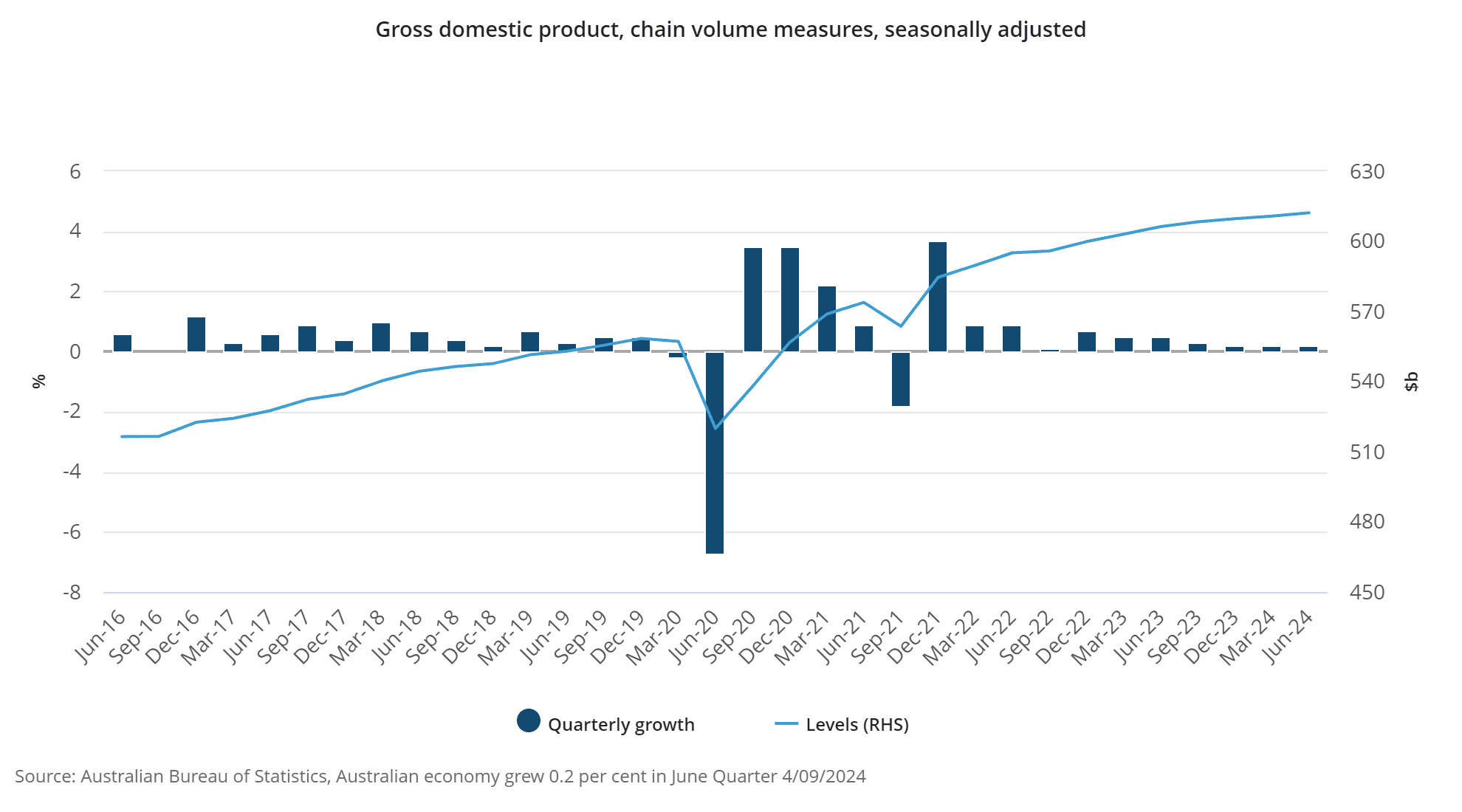

Australian GDP rose 1% in Q2, down from 1.3% in the first quarter of the year, the slowest pace since the pandemic.

A big driver of the slowdown came from discretionary spending that fell 1.1% in the quarter, driven by decade-high interest rates and stubborn inflation eating away at household budgets. However, spending on essentials increased, while the saving rate hit a 16-year low, showing that consumers were more focused on day-to-day items than new shiny TVs, nor did they have any spare funds to tuck away over Q2. That may change in the third quarter, with consumers getting some relief from tax cuts that could provide a tailwind to discretionary spending. Early signs from retailers such as JB Hi-Fi show that may be the case with robust sales in July.

From an RBA perspective, this won’t change a lot. Inflation is subsiding gradually, and the job market has remained pretty resilient. The board had expected growth of around 0.9%, so we’ve actually got a slightly stronger reading than expected, not likely adding any expectation of a rate cut. However, there is a clear trend of slower growth and there is a delicate balance between seeing a gradual slowdown and a significant slowdown that would hurt the economy.

- REA looks to expand overseas

REA Group is looking to acquire the UK’s biggest property portal, Rightmove in what would be a $5.8 billion deal. REA Group’s shares fell by 6% in the view that the business would need to undergo a capital raise to fund the purchase, but Rightmove shares soared by as much as 27.6%. The move would help REA expand its overseas operations with it already dominating locally. Australia has had a fairly sluggish year until now, not helped by BHP Group ditching a potential $49 billion bid for Anglo American Plc. Deal volume involving Australian companies is down 20% from January to August 2023.

- A winner and loser last week from the S&P/ASX200

Nanosonics is still riding higher after its full-year result. Investors have continued to flock to the healthcare stock, and shares rose by more than 10% last week.

Mineral Resources had a horrible week, with shares falling by -23.66%, with shares nearing their lowest level since the pandemic. With lithium and iron ore prices remaining in reverse, shares have come under severe pressure in 2024.

3 things to watch for the week ahead:

1. AU Consumer Confidence

In August, Westpac Consumer Sentiment increased by 2.8%, surpassing market estimates of a 0.5% rise. With rates continuing to remain steady and fears of another hike subsiding, Consumer Confidence reached a six-month high of 85.0, marking the highest reading since February.

On Tuesday, we’ll get to see if Australians are continuing to spend despite persistent cost of living pressures, with July’s retail trade data indicating a relatively unchanged turnover estimate of 0.0%. However, the recent Q2 GDP data indicated that the Australian economy only grew by 0.2% for the June quarter, a poor performance that was blamed on a fall in household spending coupled with government spending, something which may affect Tuesday’s sentiment results.

With tax cuts and cost-of-living relief measures, such as the $300 energy bill relief for every household, potentially boosting the disposable income of many Aussies, there is a belief that these relief measures will encourage consumer spending. This may lead to stronger consumer confidence levels in the months to come and into 2025, especially with additional cost of living support in the form of rental assistance and Centrelink payment increases coming into play from this month.

2. Global Inflation (US & China)

China and the US are set to release their monthly CPI data on Monday and Wednesday, respectively.

China’s YoY inflation rate is expected to increase slightly, even as both local industry and its export markets continue to struggle.

Export growth has been a key concern in the region, which seems to have led to a loosening of some of the trade restrictions the superpower imposed on Australia in 2020. China’s automotive export industry, one of the strongest cards in its hand, may also be facing a difficult road ahead as electric vehicle sales seem to be dropping in key markets.

The deflationary pressures are undeniable and China CPI data from previous months has come in well below forecasts. Domestic demand is also struggling and once again, the pressure is on for the government to do more to inspire greater domestic spending and stoke the nation’s flailing property market.

Meanwhile, in the US, a September rate cut is basically assured, and it’s expected that August’s CPI data will reflect ongoing deflation. The Fed’s confidence in its tightening cycle seems to have been justified as inflation crawls back to the 2% annual goal. As is the case here and in the UK, there are concerns in the US that an unexpected jump in unemployment could now trigger a recession, especially given the sudden reduction of roles across the education and construction sectors – but it remains to be seen how alarmed markets should be at that prospect just yet.

3. AI in Australia

Markets went wild after last week’s announcement that US investment management company Blackstone had agreed to acquire Australian data centre specialist AirTrunk for $24bn. The monumental agreement has injected fresh energy into Australia’s tech and innovation space, particularly in data centres and AI, where AirTrunk has been investing a significant proportion of its attention.

Although Australia isn’t well known for tech stocks, there are a few AI stocks in Australia that investors can look to. These include companies NextDC, Megaport and Goodman Group, to name just a few. NextDC is increasingly involved in supporting AI workloads and providing the high-performance infrastructure needed for AI applications as the technology revolution continues to boom. While Megaport offers a platform that allows businesses to connect their IT infrastructure to various cloud service providers, data centres, and other networks around the world.

What’s clear is that the demand for AI is not slowing down. There is a trillion-dollar opportunity for businesses across the globe. AI will drive companies’ bottom lines through more efficient processes or increased spending on the technology. Meta, Microsoft and Alphabet are all growing their capital expenditures and directing that capital to AI, therefore, the opportunity for businesses involved with AI remains high.

*All data accurate as of 09/09/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.