It was a positive week for global markets, with all major indices gaining for the week, with Europe leading the charge, as the Euro Stoxx 50 gained around 3.5%. The ASX200 had a solid week, gaining 1%, with 7 sectors in the green and materials doing the heavy lifting.

Retailers reported mixed results in a first look at their health ahead of the key spending period, and all gave a cautious outlook of the US consumer. Target (TGT) saw double-digit gains this week despite sales declining, while Walmart (WMT) dropped after its sales grew year-over-year.

Chinese stocks saw some positivity last week despite a sharp sell-off on Friday. Better-than-expected economic news in retail sales and upbeat earnings results from JD.com (JD.US) buoyed sentiment. However, the news that Alibaba (BABA) is scrapping its cloud unit spinoff plans sent shares plummeting for the week.

3 things that happened last week:

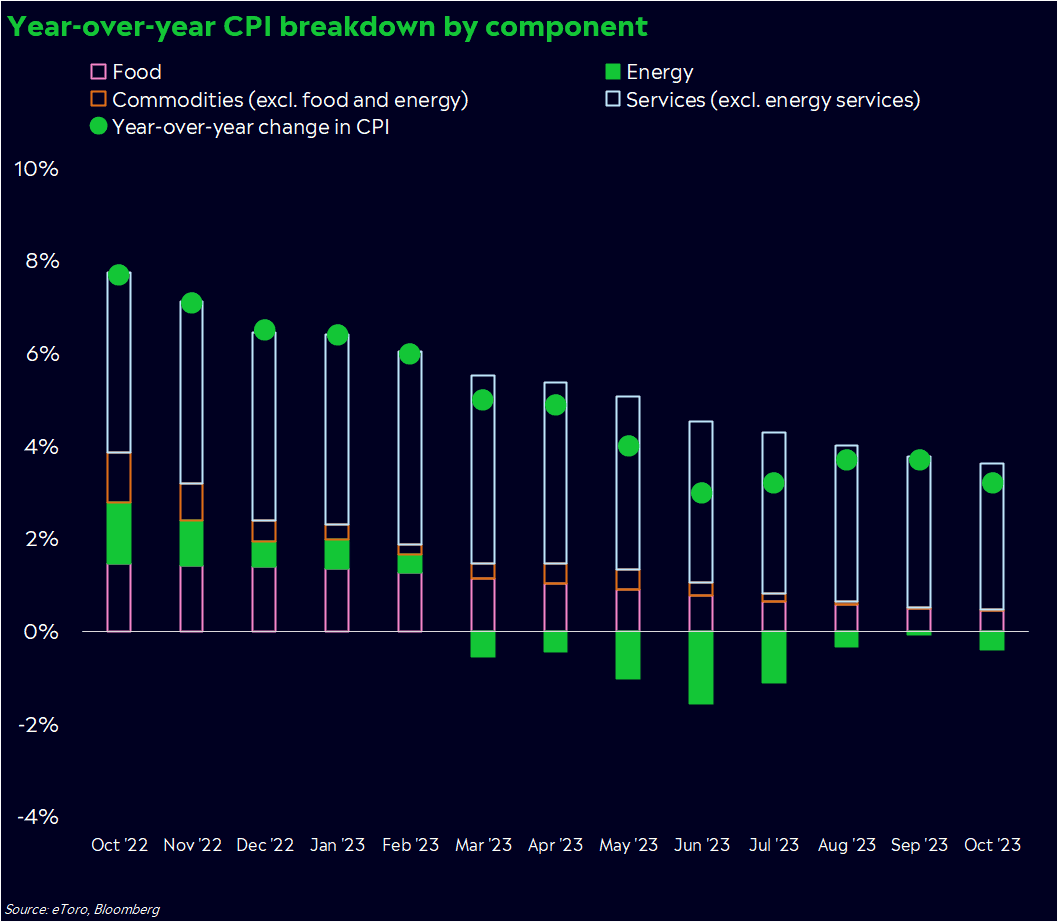

1. US Inflation cooler than expected

Last week saw good news on the inflation fight, as US CPI showed further signs of easing. Both headline and core inflation fell from the month prior, sending the S&P500 higher. Higher oil prices in recent months had stalled progress on inflation, but with oil prices now reversing, inflation is starting to trend lower once again.

Whilst the Fed continues to keep a hawkish tone for the time being, most measures of inflation are moving down over time, and that should encourage the Fed to tread carefully. The good news for investors is that markets are now pricing in rate cuts as early as May 2024.

2. Australian Employment stays resilient

Last week’s employment reading won’t be what Michele Bullock wanted to see and shows the RBA won’t have a quiet few months ahead. Although this reading doesn’t tip the dial towards an additional rate hike before Christmas, it does mean that the RBA will remain hawkish into next year.

The Australian economy added 55k jobs, well ahead of the 24k expected by markets. Unemployment picked up marginally to 3.7%, but it has remained in the range of 3.5%-3.7% throughout 2023.

The RBA is the odd one out from global central banks right now, with the Federal Reserve potentially set to start cutting rates as early as May. Unfortunately for investors locally, the lingering expectation that the RBA will hike again isn’t set to dissipate anytime soon.

3. A winner and loser last week from the S&P/ASX200

Elders (ELD) stole the show last week, with shares gaining +19%. The agribusiness gained after reporting full-year earnings; although earnings declined year-over-year, the result was much better than feared.

It was a torrid week for TPG Telecom (TPG) as shares sunk 13% after news the telco giant had ceased discussions with Vocus Group over the sale of some company assets.

For more from markets last week, check out the latest Market Bites podcast:

3 things to watch for the week ahead:

1. Michelle Bullock Speech & RBA Minutes

On Tuesday, the RBA Monetary Policy meeting minutes will be released against the backdrop of the ASIC Annual Forum, where RBA Governor Michelle Bullock is scheduled to address the crowd.

The meeting minutes will give some good insight into the central bank’s decision to raise the cash rate by 25bps, particularly given it was such a live meeting. However the bigger picture sentiment will tell us what we already know; while other central banks increasingly head towards a softer tone, Australia is far from out of the woods – and the RBA’s hawkish bias will likely stay intact for now.

At the forum, investors will still be looking for any hits of doveish sentiment from Bullock, similar to what we saw in the statement following the decision. It’s highly unlikely they will get that, though, with last week’s unemployment and wage figures causing further headaches for Bullock and the board heading into the year’s end.

Unfortunately, anyone hoping for the 28th of November’s retail figures indicating the economy is cooling may have their hopes dashed – and a December rate pause will not signal the hike cycle is over, especially once retail figures drop in January following both the Christmas and Black Friday flurry.

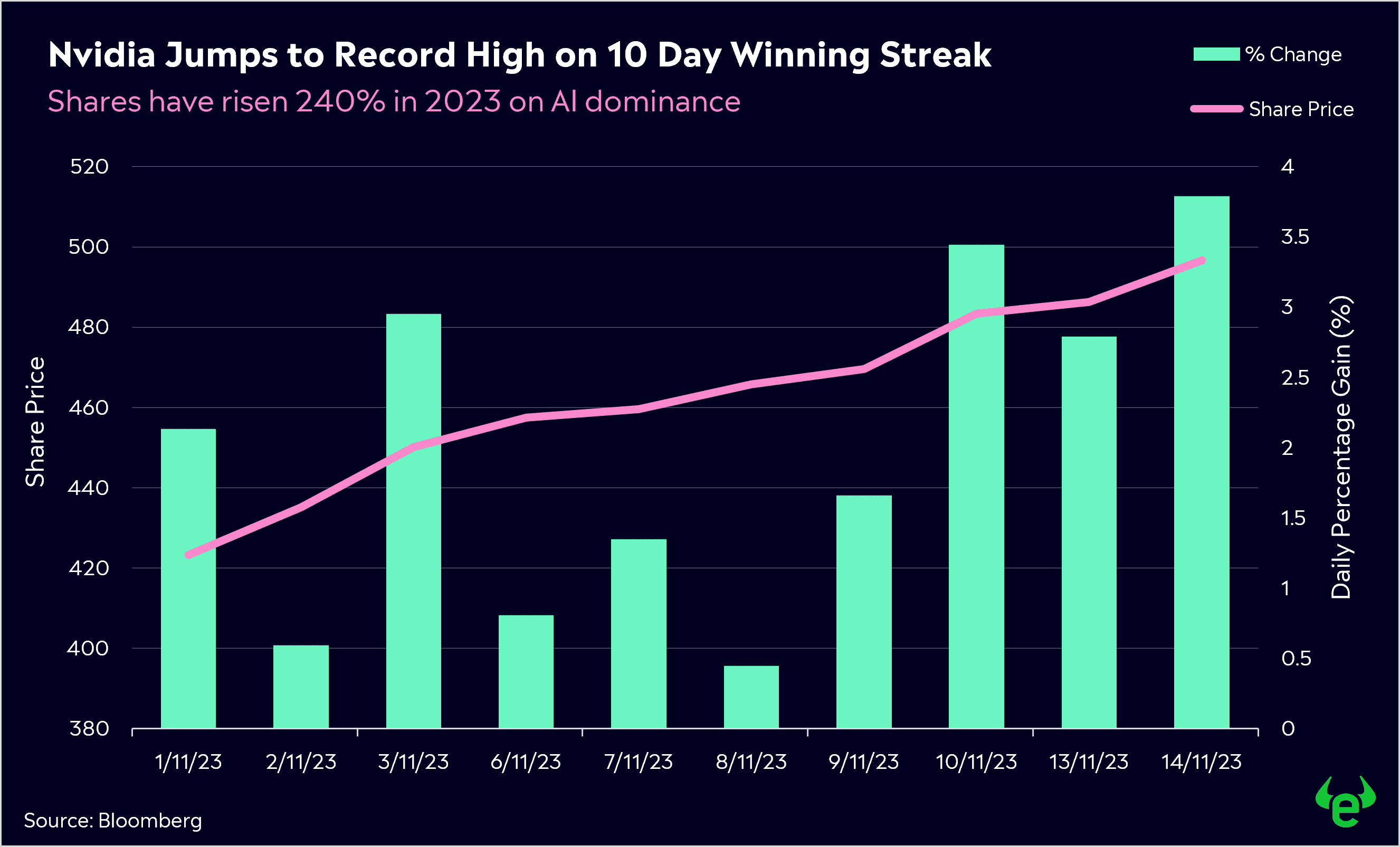

2. Nvidia Earnings Preview

NVIDIA (NVDA) investors will be gearing up for what is likely to be an impressive set of earnings on Tuesday, US time. NVIDIA more than delivered in Q2 with eye-watering results, along with a solid forecast for the upcoming quarter, guiding for revenue of US$16 billion, well above estimates of US$12.6 billion.

Even with the Magnificent Seven going in hard on AI, NVIDIA is still leading the pack when it comes to converting hype into profit. Earnings are expected to rise by just under 500% this week, putting AI monetisation front and centre.

The stock has continued to perform impressively, sitting near record highs after gaining 240% this year. Recently, shares experienced a 10-day winning streak in November, following a dip in October. The good news for AI investors broadly is that demand is set to stay high, with use cases exploding and businesses continuing to spend big.

3. A wealth of Materials AGM’s (Annual General Meetings)

This week will be a huge one for the materials sector, with a whole host of miners delivering AGM’s. The two big names worth watching are Pilbara Minerals (PLS) and Core Lithium (CXO). Both stocks have had a miserable 12 months as Lithium prices continue to free-fall. Worse still, Core Lithium has seen shares plummet by 75% in that time, so this is a key AGM to reassure investors of what’s ahead.

Elsewhere, we have updates from gold miners Bellevue (BGL) and Evolution Mining (EVN). Both these stocks have performed in stark contrast to the lithium names, gaining more than 40% each in the last 12 months. This is thanks in part to the recent rally in Gold prices, as geopolitical tensions cause uncertainty across global markets and central banks buy gold at record levels.

AGMs are an important time for shareholders and the business itself. A poor AGM can impact investor confidence, but a solid AGM can drive positive investor sentiment. It’s a great time for investors to get a sense of if the business is delivering and what’s ahead. With lithium’s slump largely driven by slow demand against a glut of supply, material investors will be hoping for strong indications of increased lithium demand in the tech and hardware sector going into 2024.

*All data accurate as of 20/11//2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.