The ASX200 finished modestly higher last week, led by healthcare stocks that jumped by 1.8%, while energy and materials shares fell. Rio Tinto’s return to the M&A market was the news of last week after its deal to buy Arcadium Lithium for $6.7 billion. It marks a clear step back toward acquisitive growth, and we may see other rivals follow suit in the not-too-distant future.

The S&P500 closed the week with its 45th record high of the year after big banks rallied following solid results. JPMorgan reported a gain in net interest income while raising its forecast on the expectation that interest rates will continue to fall. Tesla shares fell 8.8% following its Robotaxi day, while Uber and Lyft jumped by over 9.5%.

3 things that happened last week:

- Aussie retail investors buying the dip with Crowdstrike and Nike

Aussie retail investors bought up CrowdStrike, Nike and Intel shares as their prices plunged while continuing to back AI stocks in Q3, according to the latest quarterly stocks data from trading and investing platform eToro. The highest riser of Q3 in Australia was Crowdstrike, with a notable 77 per cent increase in holders on eToro compared to the end of Q2. Investors took the opportunity to buy the dip, as the cybersecurity firm’s share price fell over 40 per cent in July after a faulty update caused a mass computer outage, which affected both Australian and global businesses.

- US Inflation rises slightly more than expected

US inflation rose more than forecast in September, showing that the final hurdle on inflation will prove to be tricky, particularly while balancing the labour market at the same time. US core CPI came in hotter than the analysts’ consensus at 0.3% m/m (3.3% y/y) and US initial jobless claims jumped higher to 258k.

This data only amplifies the debate over whether the Fed will opt for a 25bps cut in November or even keep rates on hold. The Fed’s Raphael Bostic said he’s open to skipping a cut, but three Fed presidents shrugged off the higher-than-expected CPI print, suggesting the central bank can continue easing.

- A winner and loser last week from the S&P/ASX200

It’s not surprising that Arcadium Lithium was the winner last week. Shares lifted over 34%, pulling some miners higher, while other producers, like Pilbara Minerals, fell.

Neuren Pharmaceuticals shares fell 8.87% after investors took profits following a positive FDA update the week prior.

3 things to watch for the week ahead:

- Netflix Earnings

Netflix is the first tech name to announce earnings this Thursday. The streaming giant logged optimistic Q2 results, surpassing analyst expectations and touting a 17% YoY increase and approximately eight million new subscribers. As we look forward to this week’s earnings announcement, the overall brand sentiment is positive, and Netflix may have regained its spark.

The company is taking measures to address password sharing and is also successfully attracting a more price-sensitive customer base with its ad-supported tier, which has reportedly already grown by 34% compared to the previous year. However, this is also the first full quarter of earnings to reflect Netflix’s price rises for Aussie customers, which were announced at the end of May and raised concerns that many would cancel their subscriptions due to cost-of-living pressures.

Last year, the streaming wars seemed to hit its peak as entertainment giants jockeyed to tighten user-side freedoms and optimise profitability amid writer and actor strikes. With the dust settled, Netflix appears to have come out as the winner, holding onto its impressive lead across both user share and share price. The catch, as always, is that maintaining viewership requires staying desirable to subscribers – and with both Amazon Prime and Disney+ gearing up for a strong 2025, Netflix is going to need more than another season of Squid Game to keep its users’ hands off the remote.

Luckily, the business has a solid runway for growth ahead, with its solid original content and partnerships with the WWE and NFL providing opportunities for expansion in its ad business. The market expects earnings of USD$5.12 on revenue of $9.7 billion while adding 4.37 million new subscribers.

2. AU Unemployment

On Thursday, we’ll get the latest updates on Australia’s labour market. The unemployment rate remains one of the trickiest pieces of the RBA’s inflation puzzle, remaining firmly stuck around the 4.2% mark for the last five months. This has been excruciating for those desperately hoping for a rate cut, given the RBA has made clear their target unemployment range is above 4.25%.

That upward pressure may be on its way, however. Fresh data from the HR platform Deel last week indicated that 70% of Australian businesses intend to pursue cost-cutting measures. About 45 per cent of respondents were considering salary cuts and 41 per cent were planning on laying off staff.

Seek’s latest employment report also revealed job ads on the platform decreased in August by 13.0% YoY, reflecting a more difficult job market.

Obviously, these insights are not going to translate into a miracle boost this time around – but it’s an indication that our presently stubborn unemployment rate could be due for a shake-up in the coming months.

For now, though, Michele Bullock’s hawkish tone has really pushed back rate cut expectations, with market pricing not even fully pricing a cut by February next year. If this week’s data suggest more strength in the labour market while inflation persists, then that first cut could be pushed back even further.

3. Rio Tinto’s Deal for Arcadium

In case you missed it, Rio Tinto successfully snapped up Arcadium Lithium for AU$9.9b last week, its biggest deal in over 17 years. This acquisition has been a long time coming and markets responded accordingly, with a handsome jump in lithium stocks and Arcadium being the best performer of the week.

The cash deal means Rio is effectively the first of the major diversified miners to claim a major lithium business. This major leap is a sign that the lithium industry’s extended stock downturn due to a cooling electric vehicle market could be near its end. After almost two years of the lithium winter, we could be moving to a lithium spring. The move from Rio signals a renewed interest in securing long-term lithium supplies, especially as the race to decarbonise intensifies.

This isn’t Rio’s first foray into lithium – it has been a partial producer since the ‘90s – but this represents the first time the mining giant will be able to produce the material at scale.So far, competitors such as BHP have been unenthused by lithium but if Rio starts to see positive results from Arcadium, we will likely see similar acquisitions across the industry.

Of course, Arcadium isn’t a dime-a-dozen lithium biz. Its lithium filtration technologies are highly sophisticated and through this acquisition, Rio Tinto now leaps into the fray with other advanced lithium-producing competitors like Exxon Mobil and Sunresin who have invested heavily in direct lithium extraction (DLE), a process poised to rapidly advance the profitability of lithium mining over the next decade.

As Rio Tinto sharpens its focus on lithium, the entire sector could experience renewed interest. It could increase the likelihood of more mergers and acquisitions, potentially placing other ASX miners in the spotlight as a future target or partner for larger players seeking exposure to lithium. We’re seeing big names with big balance sheets come to the table at a time when the valuations of these global miners are more attractive, given their significant drawdowns.

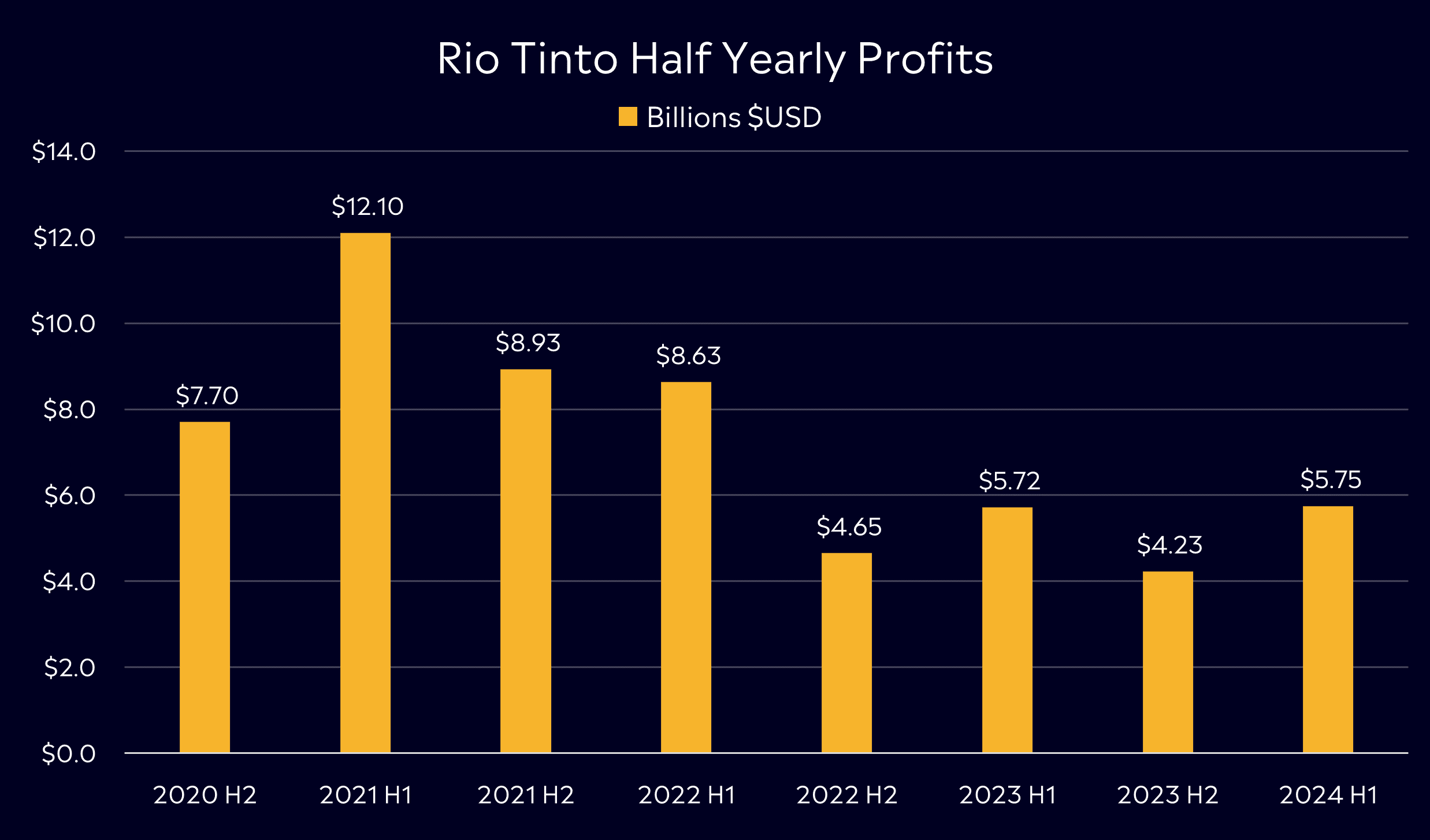

Rio Tinto has had a mixed performance this year, and eToro’s latest Top Stocks data indicates that Aussie investors are favouring other local miners such as Core Lithium, BHP, and Pilbara Minerals – all of which had notable QoQ increases in holders. However, this acquisition may change investors’ preferences in Rio’s favour as we head into the fourth quarter.

Rio Tinto will be releasing its third quarter update this Wednesday and markets are anticipating a pretty positive outlook across most of its other material production report. A solid update, along with this strategic acquisition, could set Rio Tinto up for a very strong 2025.

*All data accurate as of 14/10/2024. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.