The ASX200 rose by 0.2% last week, bucking the trend of US markets that declined for the second consecutive week. It’s a big week on the corporate front in Australia, with names such as CSL, Transurban, Mirvac, Telstra and Allkem all reporting. US earnings season is beginning to wind down, but there is still a focus on American retailers in the week ahead. Target, Walmart, and Home Depot are some of the key names in the sector slated to report this week in what has been a better-than-expected reporting season.

3 things that happened last week:

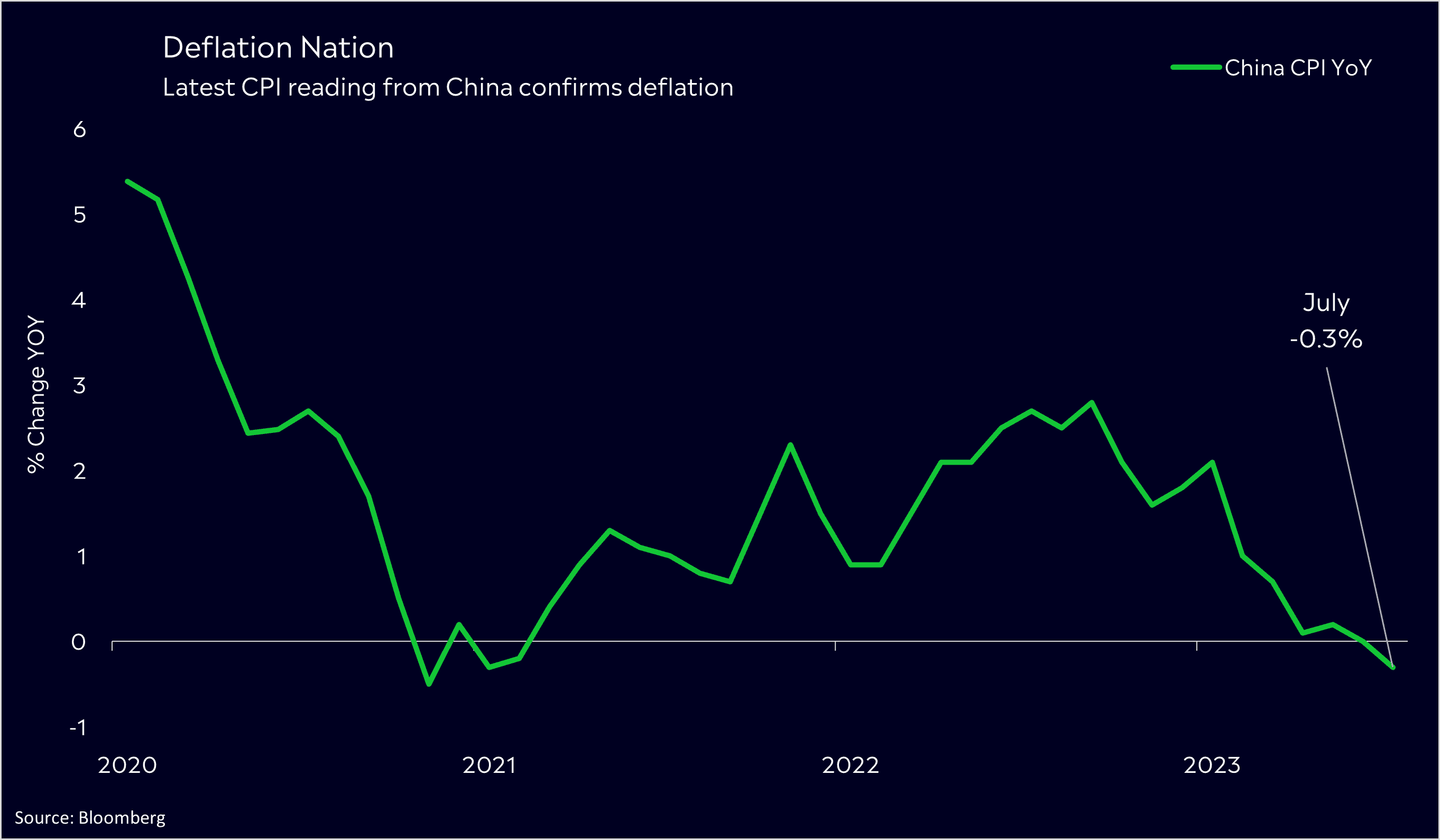

1. China sees deflation as demand slumps

China’s economy showed further signs of weakening last week as consumer and producer prices declined in July. The region is now experiencing deflation, with subdued consumer spending, a property slump, and falling demand. This reading, alongside falling trade data, puts more pressure on the PBOC to stimulate the economy. The silver lining to this bad news is that this might be enough to prompt a response from policymakers in China. More meaningful support is key for keeping China on track for its 5% growth this year. The worry for investors is that the effect of deflation in the world’s second-largest economy has global repercussions. Close to home, Australian miners could see some hardship if a period of deflation prolongs, given it would drive China’s demand for raw materials down, amongst other areas such as energy and even Australian-grown produce.

2. AGL Earnings mixed but guidance calls for soaring profits

AGL’s net loss for the full year widened more than expected to $1.26 billion due to the impact of impairments against its power plants that were closed in order to speed up their decarbonisation transition. The good news for investors is that the current fiscal year will paint a much prettier picture.AGL’s underlying profit for the full year, which excludes the impairment, came in above market expectations, rising by 25% year-over-year to $281 million. The energy giant also reaffirmed its underlying profit guidance for FY24, which could see profits more than double, projected to land between $580 to $780 million. Whilst the rising cost of energy is putting a strain on consumers in Australia, AGL’s profit forecast shows that it’s benefitting the business and investors alike. Shares are up more than 40% so far in 2023 and forecasted profits are set to soar. If fulfilled, those profits will aid AGL’s energy transition that, in turn, should help energy prices to fall. The headline loss may capture the market’s attention today, given it was larger than expected and the strong forecast was baked into the share price.

3. A winner and loser last week from the S&P/ASX200

Boral shares soared by 14% last week and took the crown of the best-performing ASX200 stock for the week, thanks to a solid set of full-year results. Revenue for FY23 jumped by 17% whilst net profit quadrupled to $142 million.

It was a tough week for tech giant Block, as shares fell by 13%. Its Q2 earnings update disappointed markets despite a beat on estimates, with gross profit growth continuing to slow.

3 things to watch for the week ahead:

1. Reporting season moves into full swing

It’s a big week on the reporting season calendar this week, with CSL, Telstra, JB-Hi Fi and Transurban, to name just a few, all releasing full-year results. The ASX200 has taken results well so far, gaining 0.2% last week despite US equities moving into reverse after their huge gains this year. CSL will be the focal point of the week but consumer discretionary stocks such as JB Hi-Fi will be under the spotlight. Retail sales have contracted for three straight months as consumption continues to fall under the RBA’s most aggressive tightening cycle for decades. Looking to CSL, the healthcare giant has already revised its guidance for FY23, citing currency headwinds, and downgraded its FY24 forecast. The company has felt the full force of that downgrade, with shares tumbling by 12% in the last three months to AU$265, making the healthcare sector the worst-performing ASX200 sector in that time. Investors will be hoping for an upside surprise to CSL’s results rather than any further weakness in earnings, margins or its FY24 forecast. The silver lining is that often, low expectations can lead to upside surprises.

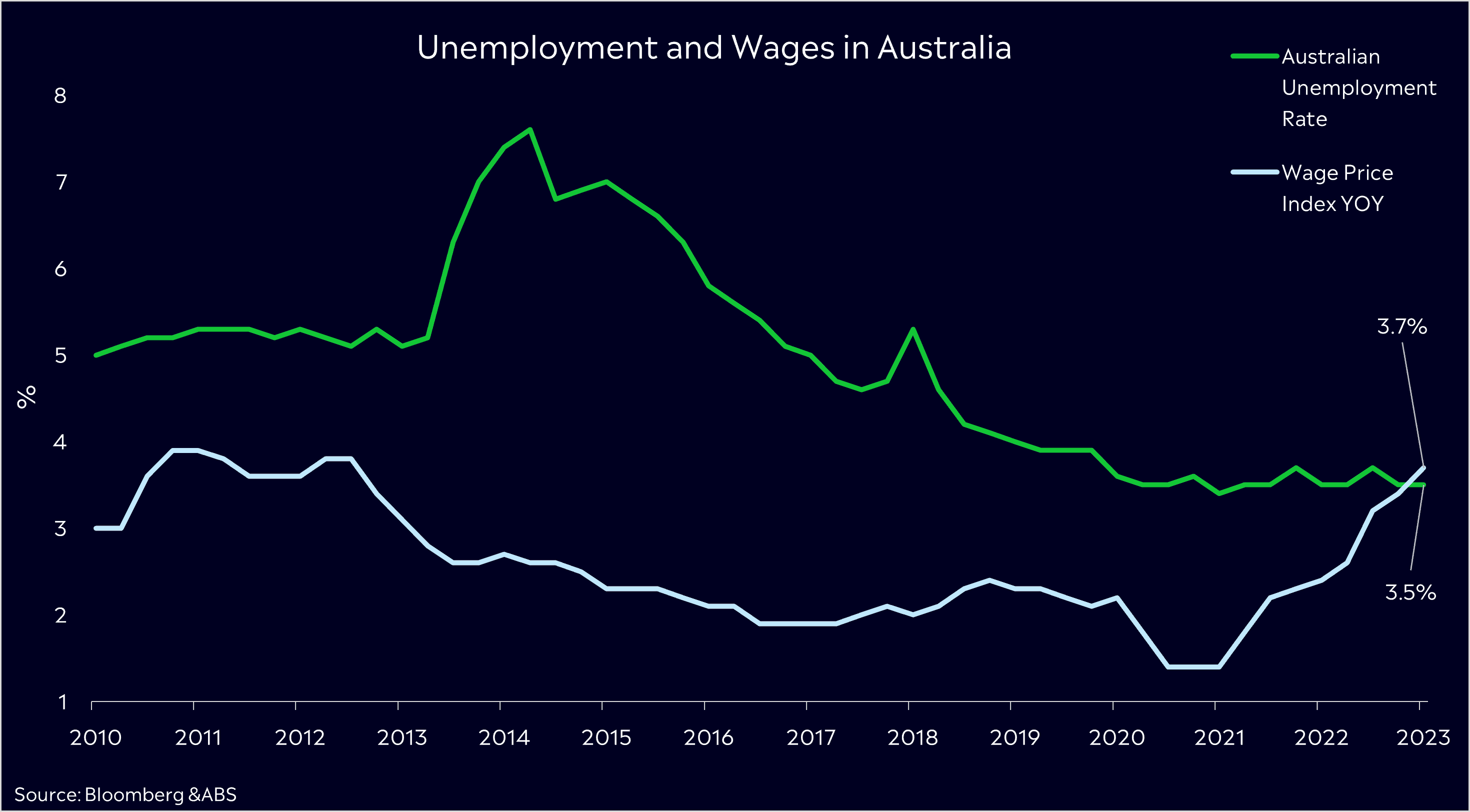

2. Australian Unemployment and Wages

Reporting season has taken investors’ minds off macro for a short period, but this week sees another reading on Australian employment, which is a crucial data point for Philip Lowe and the Reserve Bank. The unemployment rate is set to stay near decade lows at 3.5%, with 3.4% being the all-time low recorded in October last year. The worry for the RBA is that the labour market in Australia remains tight, and the new jobs being added are full-time positions, meaning higher wages. This week also sees the quarterly reading of the Wage Price Index, which has remained on an upward trajectory since the pandemic low and is set to rise again this week to 3.8%. With a tight labour market and wages that don’t seem to be slowing, inflation may begin to prove stickier than the RBA is anticipating, especially in services. Investors will be looking to see unemployment picking up and wages cooling this week, as this will be a key element in ensuring that we have seen the last hike from the Reserve Bank.

*Wages data released 17/05/2023 (The Wage Price Index measures changes in the price of labour, unaffected by compositional shifts in the labour force, hours worked or employee characteristics)

*Wages data released 17/05/2023 (The Wage Price Index measures changes in the price of labour, unaffected by compositional shifts in the labour force, hours worked or employee characteristics)

3. Tencent Q2 Earnings

Tencent is set to report Q2 earnings this week, and with deflation confirmed in China last week, the outlook for Chinese equities remains sour. The silver lining is that the deflation reading, alongside weaker-than-expected imports and exports, may prompt Chinese officials to act. More meaningful support from China in the coming days and weeks would be met with market optimism. The economic struggles will remain a drag on sales growth in the second half of the year for Tencent, but Q2 earnings may offer some short-term positivity driven by a rebound in gaming and advertising revenue. The good news long term is that the crackdown from regulators in the region on Chinese tech is seemingly over, and those regulators seem more accommodating towards gaming after years of tough treatment towards developers shaved significant value off the sector. Although Baidu appears to have stolen the show in the AI race over in China, Tencent will likely provide updates on its AI plays, which should spark investor interest. But, if China’s economy continues to weaken, technology companies like Tencent will find it tough to see decent growth.

*All data accurate as of 14/08/2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.