It was a lacklustre week for the ASX200 last week, finishing down 0.12%, as RBA governor Michele Bullock reaffirmed that inflation will remain a challenge for the Central Bank.

Only three sectors finished in the green, with Energy leading the way up just over 2% as WTI oil climbed for the week back to $75 a barrel.

In the US, the S&P500 notched four straight weeks of gains. All 11 sectors finished in the green for the second week in a row, the first time in three years. Elsewhere, Sam Altman returned to OpenAI as CEO with a new board after a drama-filled week that saw him hired by Microsoft (MSFT) for less than a week. The good news for Microsoft is that they will now have better governance over the ChatGPT creator.

3 things that happened last week:

- Origin Energy steals the limelight

Origin Energy (ORG) stole the show on the ASX200 last week in what was a quiet week of trade. The energy giant was set to see shareholders vote on a $20 billion takeover offer from the Brookfield consortium on Tuesday, but it was delayed following an alternative proposal.

It’s been a good year for Origin Energy, up 11% and outperforming the ASX200. The news saw shares rise modestly last week, but there are still doubts that the deal will get over the line. Its biggest shareholder, AustralianSuper, reiterated it will vote against the Brookfield bid. However, the new offer may hold a clause allowing institutional shareholders to re-invest in the business after completion.

- Nvidia Smashes earnings expectations

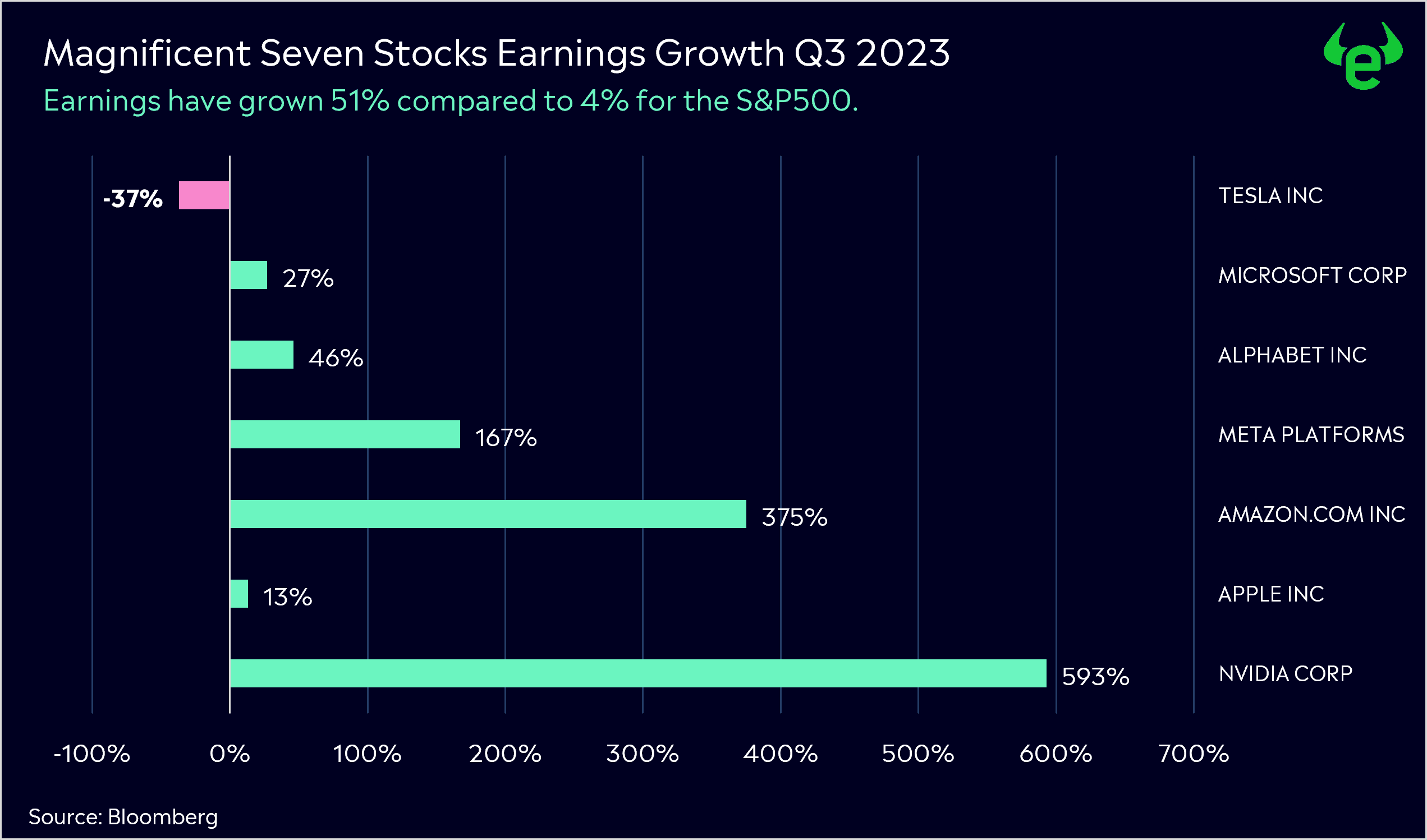

It was another blowout quarter from Nvidia (NVDA) in Q3, as the world’s most valuable chip maker topped expectations across the board.

There was simply no margin for error heading into these results, with shares gaining more than 240% year to date and expectations sky-high, but Nvidia delivered. Revenue grew by 200% year over year, whilst earnings jumped a massive 593%. When you’re expected to be great, you need to be exemplary, and that’s what Nvidia keeps doing.

Jensen Huang and the team at Nvidia are hitting home run after home run for investors right now. AI isn’t just Wall Street hype but, clearly, a revolutionary technology that is making Nvidia serious money.

- A winner and loser last week from the S&P/ASX200

It was a great week for miner Bellevue Gold (BGL) gaining 10.65%. Bellevue held its AGM last week, and clearly, investors were excited about what’s ahead, whilst the gold price jumped over 1% for the week.

Unfortunately for Healius (HLS) shareholders, it was a torrid week, with shares tumbling -23.5%. It follows the healthcare company completing the institutional component of a heavily discounted entitlement offer at a 35% discount of where it was trading last week.

3 things to watch for the week ahead:

1. AU Retail Sales

On Tuesday, the latest retail sales figure will be delivered. As always, retail sales is a key data point on the RBA’s list and often provides valuable foresight for the direction of interest rates. A resilient consumer this year has seen spending hold up well, despite consumer surveys telling us that households are increasingly pessimistic.

With retail spending still high, the fear is that this will continue to feed inflation, the very challenge the RBA is trying to combat. If households continue to splash cash, it gives the RBA headroom to hike rates further should they feel necessary. With RBA Governor Michele Bullock maintaining a relatively wary tone in her most recent address, a buoyant set of retail figures on Tuesday could mean a further hawkish tone from the RBA. However, next week’s figures may show the signs of a spending slowdown, with a contraction of 0.3% expected. This will be a step in the right direction and good news locally. Retail sales numbers may be skewed in the months ahead with seasonal spending, but a contraction next week would be well welcomed by investors.

2. AU Monthly CPI

After Michele Bullock’s aforementioned hawkish tone throughout the week, it’s fitting that on Wednesday, the monthly CPI reading is released. The RBA Governor expressed her concerns this week that the inflation challenge is “increasingly homegrown and demand-driven”, showing there is still work to do locally.

It’s worth noting that, whilst other Central Banks are ending their tightening cycles, Australia seems far from a conclusion. The key for other nations has been higher interest rates.

The BOE sits at 5.25%, and the Fed sits at 5.25-5.5%, both just under 100bps higher than the RBA’s cash rate. Clearly, the board feels there is more work to be done on inflation – and that could therefore mean the cash rate has higher to go.

The good news is that the CPI indicator is expected to ease next week to 5.3% from 5.6% in September. This is a welcome prediction for many, given other deciding factors, such as unemployment and retail sales, remain stubborn.

3. Black Friday and Cyber Monday

Originally an American tradition, Black Friday sales have well and truly ingrained themselves in the Australian calendar. Today’s deals are more than a one-day event, however, with the more e-commerce-focused Cyber Monday bookending this weekend and plenty of retailers extending their deals into next week to drive as much pre-Christmas foot traffic as possible.

According to retail groups, the annual sales event is set to eclipse the once-unbeatable Boxing Day sales phenomenon. With consumer habits now well and truly adjusted to go all-in on a late November splurge, retailers now see little choice but to participate or risk missing out on one of the biggest consumer events of the year.

While the true impact won’t show up in next week’s retail sales figures, December results will likely indicate a jump in spending over November, something that may well be a key factor in driving ongoing rate rises into the new year.

For more news on financial markets, listen to Digest and Invest by eToro:

*All data accurate as of 27/11//2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.