Global markets remained skittish last week as investors continued to climb the wall of worry. The ASX did offer some surprising reprieve on Friday, gaining for the day but still finishing down more than 1% for the week. It was a similar story in the US, but with more pain as the S&P500 fell 2.53% for the week, sliding into correction territory after falling 10% from the indices’ 52-week high back in July. Recent losses put a bigger emphasis on what is a busy week ahead, with the Federal Reserve rate decision on Thursday (AEST AM), huge earnings from the likes of Apple and AMD, as well as retail sales in Aus today.

3 things that happened last week:

1. Australian Inflation comes in hot

Last week’s hot inflation data set the scene for the RBA to hike interest rates again in November. Both headline (5.4%) and trimmed (5.2%) CPI for the quarter rose more than expected, giving the RBA an unwanted headache. Automotive fuel saw the most significant price rise, up by 7.2% for the quarter. With geopolitical tensions still rife, higher oil prices are a double market threat: a growing consumer tax and a hit to the lower inflation narrative. This print, alongside a labour market that remains extremely tight, piles the pressure on the RBA to put its foot back on the gas and hike interest rates again. Markets now see more than a 70% chance the RBA hikes by the end of 2023.

2. Microsoft shows signs of monetising AI

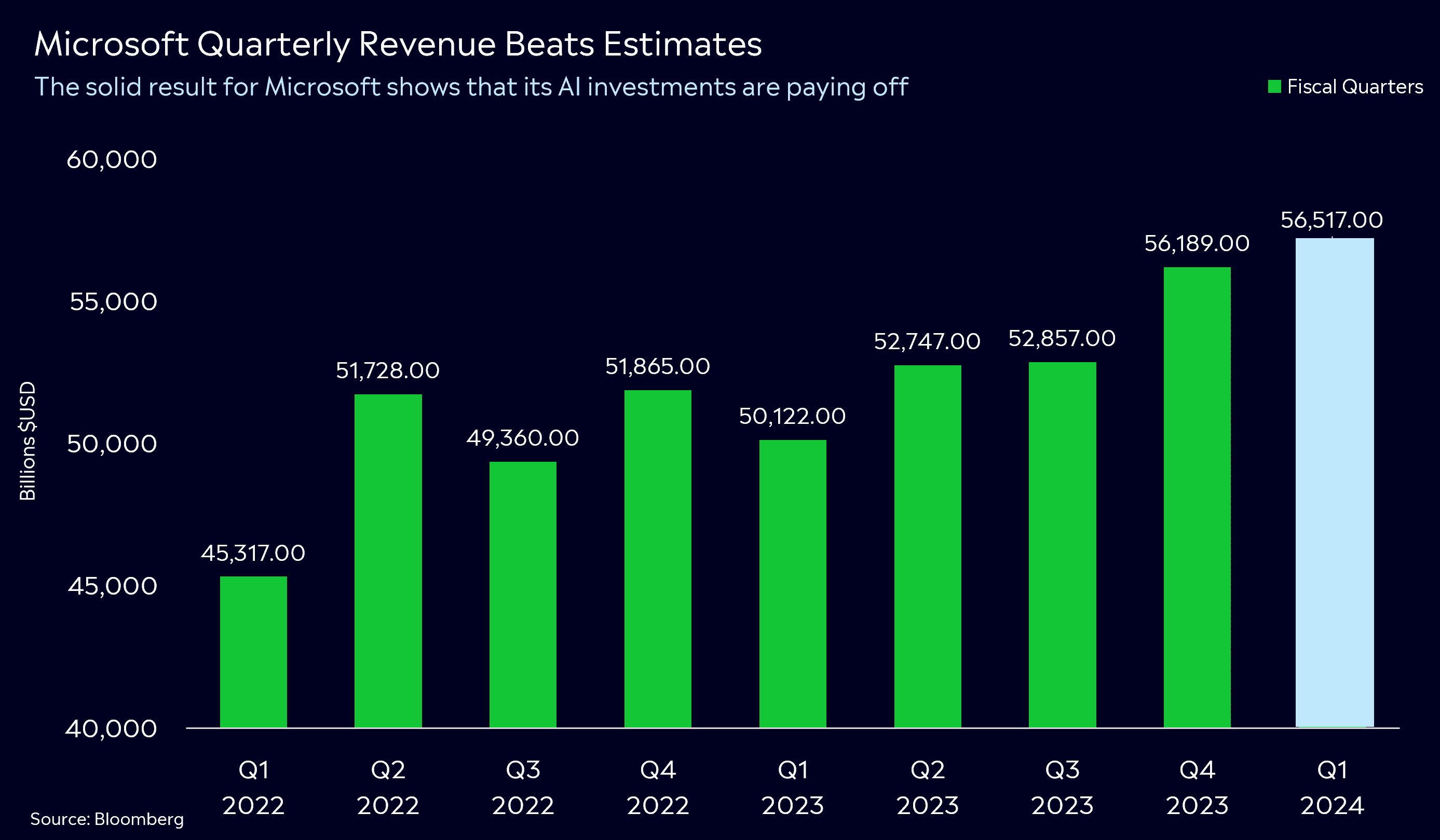

With expectations high heading into this earnings result, Microsoft needed to deliver – and deliver it did. The tech giant reported a stellar set of results, with revenue, earnings and cloud all beating estimates. Revenue came in at US$56.52 billion, well above Wall Street estimates of US$54.52 billion, while earnings of US$2.99 also exceeded expectations of US$2.65. This solid result for Microsoft shows that its AI investments are paying off and aren’t simply underpinned by hype. The huge beat on revenue is a clear indication of Microsoft monetising AI – something the market was longing for, and stamping its mark as a clear leader in the AI race. The focal point of the report was the 29% growth from Azure cloud, showing enterprises’ continued transition and reliance on the cloud.

3. A winner and loser last week from the S&P/ASX200

Lynas Rare Earths enjoyed a strong week, climbing by +13.2%. The miner reported that its subsidiary in Malaysia had been issued an operating license.

With global tech in reverse last week, Megaport felt the full force of the sell-off falling by 17.4%. That, combined with an update from the business, which showed disappointing customer growth, saw investors hitting sell.

3 things to watch for the week ahead:

1. Australian Retail Sales the next key puzzle piece for the RBA

Updates from local retailers last week indicate fairly conclusively that Aussie consumers are slowing their spending considerably. Big hitters such as JB-HiFi and Harvey Norman both reported a decline in sales during FYQ1, following a fairly successful year for both of the shopping centre giants. Overall, retail sales have held up relatively robustly in 2023 and this week markets expect to see retail sales rise by 0.8% month on month. If retail sales continue to follow the trends observed this year, we may see September’s figures come in above the predicted figure of 0.8%.

After last week’s hot inflation reading, another solid print from retail sales would almost certainly solidify the prospect of the RBA hiking rates on Melbourne Cup day. Importantly, this will be the last and key data point the Reserve Bank gets before its November meeting.

2. Apple investors hoping for strong earnings

Overall, this has been a mixed week for tech earnings. Companies are clearly being rewarded for beating expectations but punished for anything less than perfect results.

The release of the new iPhone may come at a great time, and investors will want to understand the level of consumer demand for the new models. AI will also be in focus again (as it is across all major names in tech) but so far, Apple has kept its AI cards close to its chest. With companies now beginning to report success with their AI ventures, investors will want to hear more details from Apple.

Services revenue will also be back in focus, given this is Apple’s fastest-growing segment. However, with decade-high interest rates and slowing consumer spending, any weakness in revenue growth wouldn’t be a surprise.

Apple shares have had a good year, and are up 30% YTD but are trading well below their highs of the year after recent weakness. Market consensus is earnings of US$1.39 and revenue of US$89.31 billion.

For all the latest this earnings season, make sure to listen to the Market Bites podcast on Digest & Invest by eToro:

3. US Fed under the microscope

Staying with the US, Q3 2023 GDP results beat expectations on the back of strong consumer spending last week, indicating that the US economy remains resilient and likely means it can handle further hikes should the Fed decide it’s necessary.

The Fed kept rates on hold in September after hiking interest rates to 5.25%–5.50% at the July 2023 meeting. Last week’s Core PCE inflation showed further signs of easing, with another low reading at 3.7%. This reinforces the case for the Fed to stay on pause this week when it meets to make a call on the Federal funds rate on Thursday. However, even though rates may stay on hold, it may continue to drive the ‘higher for longer’ narrative.

Despite recent good economic news, US shares remained in reverse as tech shares continue to be sold off – even amidst decent – if not mixed – results from the likes of Microsoft, Amazon, Meta and Alphabet. Geopolitical tensions also remain a concern, with the prospect of easing tensions seemingly still a while off, putting investors into ‘risk-off’ mode.