It looks set to be a more positive week on the local market, with ASX futures pointing towards a 1% gain at the open today after falling by more than 2% last week. This follows a strong tailwind from US markets on Friday, with the Nasdaq gaining more than 2% and a tentative agreement to raise the US debt ceiling. The AI-fueled tech rally of last week should allow tech, the best-performing sector this year, to continue its strong performance.

The tentative agreement will take away some uncertainty for investors, and that will improve sentiment, helping to drive equities higher. However, investors hoping for a large, sustained rally may be disappointed. The Nasdaq rose 3.5% last week to its highest level since August, meaning much of the good news may already be priced in. We are already seeing that initial relief, but US PCE on Friday showed inflationary pressures had picked up, leaving markets to price in a 65% chance of another hike from the Federal Reserve for its June meeting, a stark contrast to the 17% chance last week, which may spoil the party. US markets are also closed until Tuesday.

3 things that happened last week:

1. Retail sales remain flat as consumers feel the pinch

Consumer spending is slowing as household budgets are squeezed under the strain of eleven hikes from the RBA, with retail sales remaining flat in April. Consumers have remained resilient for a long time, but cracks are starting to show. This flat retail sales reading is somewhat surprising however, given the increase in net overseas migration to Australia. This will be data that the Reserve Bank welcomes as it looks to slow consumption, and this slowdown in retail trade is likely to continue from here. If the RBA continues to see data moving in the right direction, the current 3.85% cash rate could be the peak. With unemployment and retail sales both now coming in weaker than expected, the chance of another pause in this hiking cycle is probable. However, inflation data handed down next week will be another crucial piece of the puzzle; a lower-than-expected reading there should solidify the likelihood of rates staying on hold.

2. Nvidia reports earnings beat and blowout guidance

There was little to no room for error for Nvidia (NVDA) this quarter, and they got the memo. Strength from Q1 earnings came from Data Center revenue, which saw a 14% jump, helping to offset further weakness in its gaming segment. In addition, net income surpassed expectations by almost 20%, further underscoring its robust performance. Nvidia shares have climbed by more than 150% in 2023 thanks to investors’ excitement surrounding AI, and the chip maker’s forecast for the second quarter shows that their business will continue to thrive as they power artificial intelligence software. The main takeaway, though, was its blowout guidance. Nvidia said it expects revenue of USD$11 billion in Q2, surpassing analyst estimates of USD$7.18 billion.

3. A winner and loser last week from the S&P/ASX200

Tech continued to dominate proceedings on the ASX last week, following a strong lead from US tech. Technology One (TNE) stole the headlines with solid half-yearly results. Strong top and bottom line growth helped shares gain 10% for the week.

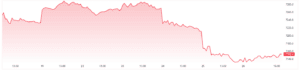

It was a disappointing week for Fisher & Paykel (FPH) shareholders, with shares falling by more than 11%. The healthcare business fell sharply for the week after its full-year results showed a sharp decline in earnings.

3 things to watch for the week ahead:

1. Australian CPI Monthly

It’s a big week on the economic front in Australia this week, with key inflation data being handed down (31st May). Investors’ focus will be on a fifth consecutive decline in monthly inflation after peaking at 8.4% in December. The latest reading showed that inflation had slowed to 6.3% as the RBA raised rates to their highest level for a decade. However, that decline, along with the quarterly reading of 7%, wasn’t enough for the RBA as they hiked rates again in May to 3.85%. Core inflation for both the monthly and quarterly reading came in below expectations, and this will be one of the areas the RBA will be looking at to see clear signs of a slowdown. This inflation data will be the key data point if the Reserve Bank is to keep rates on hold at its June meeting. The RBA will have welcomed employment and wages data coming in weaker than expected earlier in May as well as lower than expected retail sales last week. Another decline in inflation will show that the RBA’s massive tightening cycle is having the desired effect, and the Reserve Bank can keep rates on hold to allow the lag of its 12 rate rises to have the full impact. However, investors shouldn’t get ahead of themselves with Governor Philip Lowe continuing to re-emphasise that further rate hikes may be ahead.

2. Qantas Airways Investor Day

This week (30th May), Qantas (QAN) is hosting its first Investor Day since 2019, where investors will be looking for an update on the group’s strategy and what’s next for the airliner after what looks set to be their best fiscal year on record. Investors will be hoping for some reassurance that this stellar performance can continue as Alan Joyce hands the reins over to Vanessa Hudson later this year after 15 years at the helm. The good news for shareholders is the last time Qantas held its Investor Day, the market liked what it heard and shares jumped by 5% in the days after the event. Qantas announced last week it was on track to hand down a full-year profit of $2.5 billion thanks to soaring demand, falling fuel prices and higher airfares which we should hear more about this week. Investors should also watch out for any hints at a return of its dividend that stopped once the pandemic hit. Given Qantas is on track to record its most profitable year ever, it would be a surprise not to see a return of the dividend when it hands down its full-year results later in the year. The day may also be a valuable opportunity for Qantas to give investors a better understanding of how they plan to improve relations between passengers and unions and keep growing competition from the likes of Virgin Australia at bay.

3.Salesforce Earnings

Salesforce (CRM) investors will be hoping for another inspired earnings result when it reports FQ2 earnings this week (1st June). Following its FQ1 earnings in March, shares soared by 11.5% after beating expectations across the board and raising its guidance for the full year. It’s been a ‘better than feared’ earnings season for US tech stocks this quarter, with some big surprises and solid results. The focus this quarter will be on the software companies’ progress as they pivot from sales growth to profitability and how well management is executing this directional shift. Margins will also be on watch after announcing its restructuring plan in January, which included a 10% cut to its workforce as they look to drive efficiency. Corporate spending across big tech peers remained resilient in the quarter, with Microsoft (MSFT), Alphabet (GOOG) and HubSpot (HUBS) all reporting better-than-expected results, which should spell good news for Salesforce heading into the report. As has been the focal point for most companies this earnings season, plenty of attention will be on AI, which Salesforce has been investing heavily in since 2016. Expectations are for Salesforce to report earnings of USD$1.37 a share on sales of USD$8 billion.

*All data accurate as of 29/05/2023. Data Source: Bloomberg and eToro

Disclaimer:

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.